- Greenback pauses slide as jobs and inflation information awaited

- Yen pulls again however hawkish BoJ alerts maintain it elevated

- Wall Road awaits Nvidia (NASDAQ:), oil retreats on demand worries

Greenback Awaits Key Knowledge for Path

The prolonged its hunch in opposition to all its main friends on Wednesday, as within the absence of any top-tier information and surprising headlines, buyers continued to digest Powell’s dovish stance at .

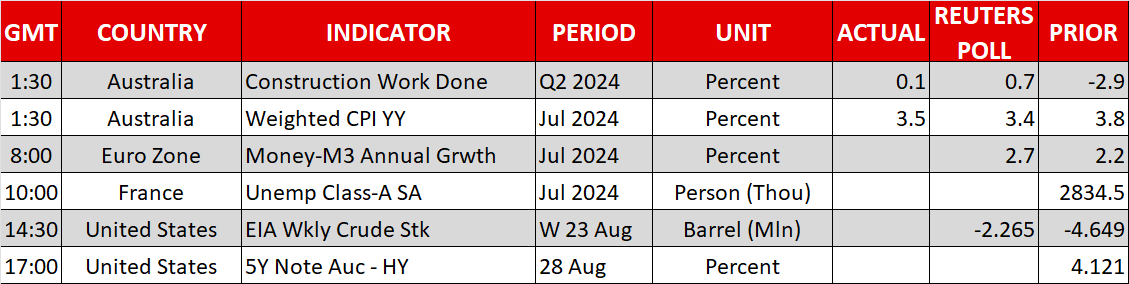

Nevertheless, at this time, the greenback is in a restoration mode, maybe as brief sellers are liquidating their positions forward of essential releases tomorrow and Friday.

Allowing for that Powell careworn the significance of the labor market, tomorrow’s could appeal to extra consideration than ordinary, whereas on Friday, the value index, the Fed’s favourite inflation gauge, is because of be launched.

Following Powell’s remarks, extra market members have been satisfied that the Fed could proceed with a 50bps reduce in September, with the chance for such motion at the moment resting at round 35%, and the full foundation factors price of reductions by December at round 103.

Due to this fact, information pointing to additional cooling of the labor market and extra softness in inflation might encourage buyers to additional decrease their implied fee path, one thing which is more likely to exert extra strain on Treasury yields and the US greenback.

Yen Carry Commerce Not the Favourite Sport in City

The currencies taking probably the most benefit of the greenback’s slide have been the risk-linked , , and , in addition to the . BoE Governor Bailey’s message that they don’t seem to be in a rush to chop rates of interest once more quickly can be including gas to the pound’s engines.

But, the will not be the sufferer it was throughout risk-on days. It managed to achieve some floor yesterday, implying that buyers stay hesitant to take one final trip with the beforehand overcrowded carry commerce.

Though it’s on the again foot at this time, hawkish remarks by BoJ policymakers are unlikely to permit huge promoting. Following Governor Ueda on Friday, Deputy Governor Himino mentioned at this time that they might proceed to boost rates of interest if inflation stayed on target.

This allowed merchants to proceed penciling in a robust 72% likelihood of one other 10bps hike by the BoJ this 12 months.

Fairness Merchants Lock Gaze on Nvidia

All three of Wall Road’s important indices closed yesterday’s session within the inexperienced. With recession fears abating, expectations of decrease rates of interest within the months to come back are cheered once more by fairness merchants.

The beneficial properties have been cautious although, as at this time, Nvidia is reporting its earnings after the closing bell. Nvidia’s outcomes observe current issues about spending will increase by different main gamers within the race to overcome the AI world, and thus, consideration could also be larger than ordinary.

Certainly, choices pricing means that merchants anticipate larger-than-usual post-earnings strikes, which implies that the broader market may expertise elevated volatility as Nvidia accounts for greater than a 3rd of the ’s beneficial properties this 12 months.

Oil Slips on Consumption Worries

costs have rebounded strongly these days on fears about potential provide losses from Libya, in addition to growing tensions within the Center East.

That mentioned, a three-day streak of beneficial properties ended yesterday because of issues about decrease refinery revenue margins after information confirmed that world consumption progress has been decrease than beforehand estimated this 12 months.

But, the continued battle between Israel and Hamas and the chance of greater than 1 million barrels per day of manufacturing being shut in Libya amid a political dispute, recommend that any setbacks in oil costs are more likely to keep restricted and short-lived.