To start with a reminder: US and Canadian money markets might be closed in the present day due to the Labour Day celebration, clearly leading to diminished flows this afternoon. Going again in chronological order, APAC is led by the superb efficiency of the China50 and particularly Hong Kong the place a surge on actual property shares helped the indices so as to add 2.5% and 1.8% respectively. This comes after embattled Nation Backyard reportedly gained approval to increase funds for an onshore Personal Bond and is now up 7.9% (simply out the wire they’re making an attempt to get financing in Malaysian Ringgit); the general Mainland Properties Index is +7.32%. This week there might be essential knowledge from this hemisphere with the RBA price resolution and the Chinese language commerce steadiness.

Friday’s NFP determine was barely higher than anticipated (+187k vs +170k anticipated) however on the identical time the earlier two readings had been revised downwards by 100k, whereas the unemployment price surprisingly jumped to 3.8% (3.5% anticipated) additionally on account of a rise in labour drive participation (62.8% vs 62.6%). There are extra individuals searching for employment and that is most likely one of many components that led to a fractional lower in Common Hourly Earnings. General, we emerge from the week with the impression that the labour market is lastly beginning to decelerate.

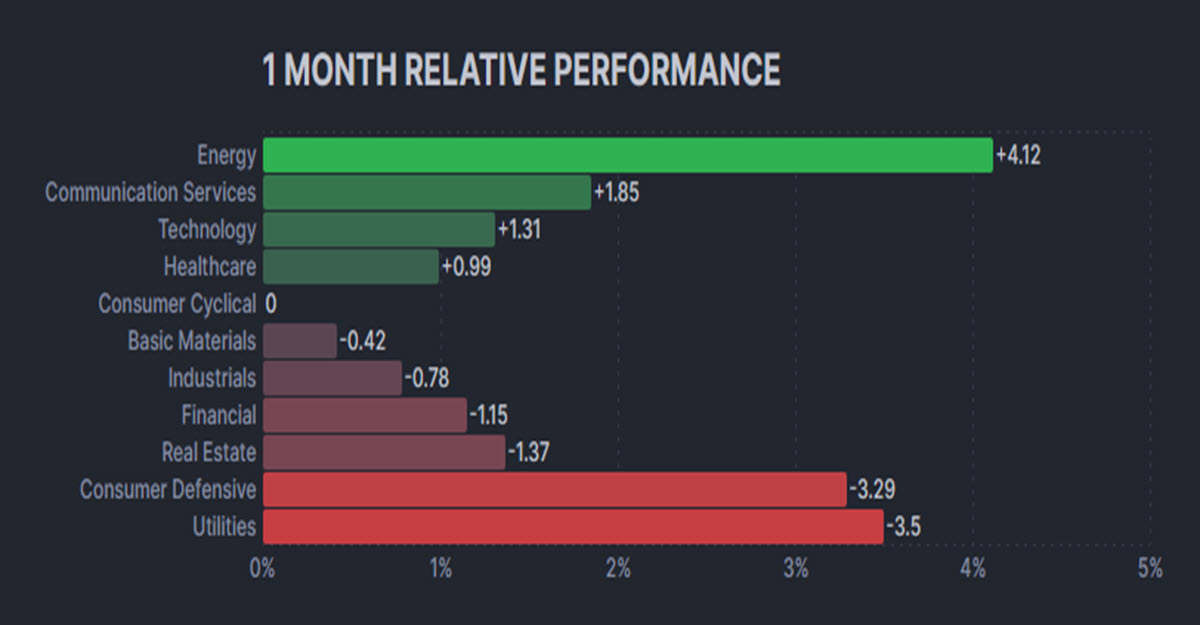

Relative Performances by Sector, August

Yields and USD reacted by plummeting shortly after the information, earlier than completely reverting the transfer and ending the day up; the long-end has skilled the heavier promoting stress, ensuing within the curve steepening.

Crude oil soared once more (+2.30%) with the EIA and API knowledge exhibiting appreciable stress on shares through the week most likely as a result of impact of a number of months of manufacturing cuts. On the identical time, Copper hit $390 earlier than sellers emerged, including to its 6.50% rally since mid August on respectable Chinese language Manufacturing knowledge.

-

FX – USDIndex recovered 104 (104.09 now), EURUSD turned under 1.08 (1.07865, GBPUSD simply north of 1.26 (1.2609). USDJPY sits above 146 as soon as once more, USDCNH 7.2667.

-

Shares – US30 closed larger on Friday and notched its finest week since July. US500 +0.2%, US100 -0.02% however nonetheless up +3.67% on the week. In Europe GER40 closed -0.6%, CAC40 – 0.29%.

-

Commodities – USOil is digesting final Friday’s rally, now -0.61% at $85.48, the unfold in opposition to UKOil has decreased to $2.97. Copper flat at $385 after sellers emerged at $390 on Friday.

-

Gold – nonetheless hovering round $1940, XAG pulled again powerfully from $25 ($24.18 now).

LATER TODAY: German Commerce Steadiness, Switzerland GDP, EU Sentix confidence, ECB’s Lagarde speech

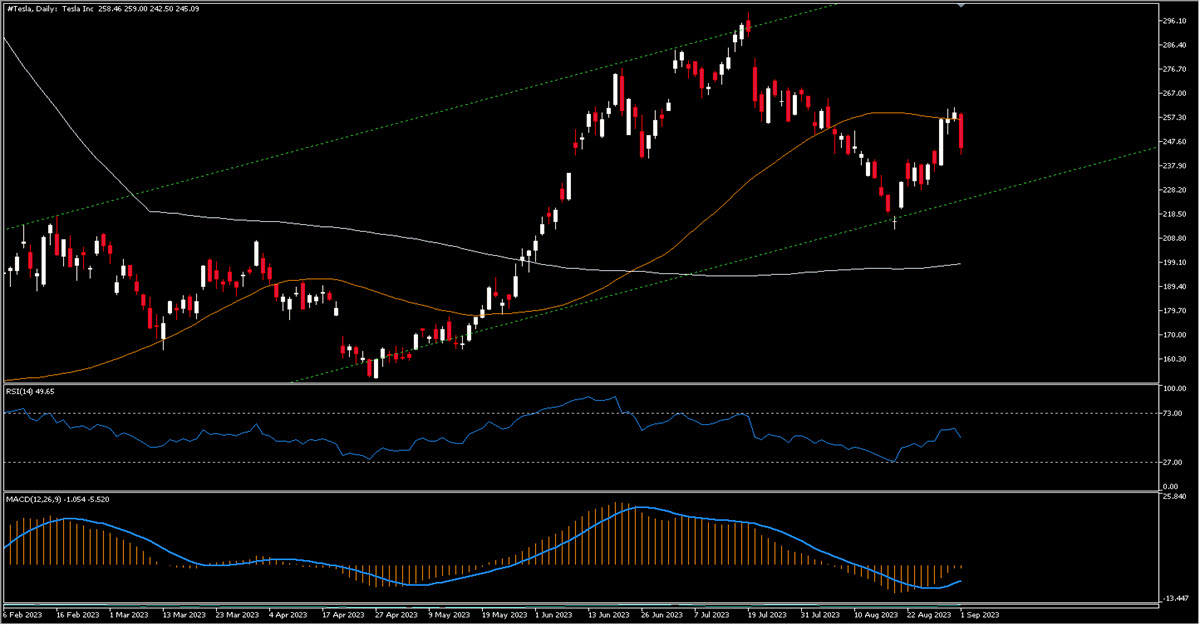

INTERESTING MOVER: TESLA -5.06% at $245.01 after reducing the US costs of its Mannequin S and X for the seventh time in 2023, now $30k and $40k respectively cheaper than originally of the yr. The worth was rejected by the 50MA and the MACD is unfavourable.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a common advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.