[ad_1]

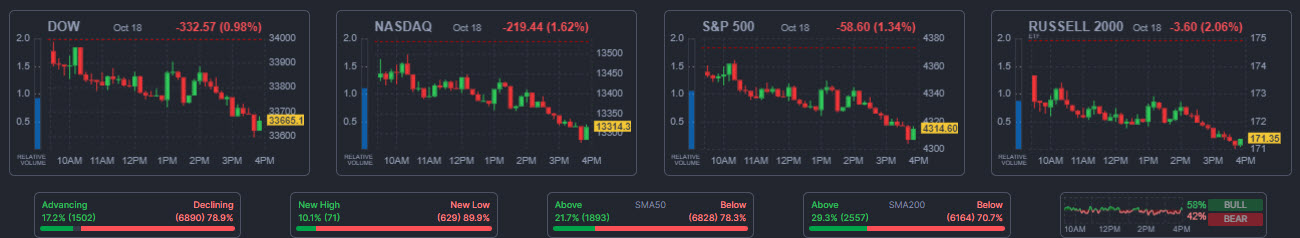

World inventory markets skilled a decline resulting from elevated volatility ensuing from escalating tensions within the Center East, compounded by Fed Powell’s assertion which added to the environment of threat aversion. Longer dated yields have climbed once more whereas the brief finish sustains a few of its bid as curve steepening trades take maintain. Powell commented that the economic system stays resilient as a result of charges haven’t been excessive sufficient for lengthy sufficient, suggesting the hawkish stance might be maintained. In China, efforts to inject extra money into the economic system would possibly present help, particularly because the nation’s shares had erased all features from their important reopening rally late final yr. China’s economic system has confronted challenges this yr, together with decreased demand and a downturn within the property market.

- USDIndex reverted on EU open from 106.25 to beneath 106. The VIX prolonged above 20 breaking 4-month highs.

- Additional argument for the doves on the ECB & BOE: GfK client confidence & retail gross sales declined within the UK. The weaker than anticipated quantity provides to indicators that the economic system is cooling, which is including to arguments towards one other charge hike from the BOE whilst inflation stays excessive. In Germany, the producer costs declined and costs for client items dropped for a second month. The latter possible displays waning demand, which is placing stress on costs.

- Gold and Oil costs continued to climb amid issues a few potential floor invasion of Gaza by Israel, which may set off a broader battle within the Center East. Gold breached 1984, turning the eye to April’s highs. USOIL prolonged to $89.20.

- BTCUSD is about to see its greatest weekly achieve since June. Presently at 29200.

Attention-grabbing Mover: US500 (-3.50%) in a unload for a 4th day in a row, with speedy help ranges at 4265, 4230 and 4200.

Attention-grabbing Mover: US500 (-3.50%) in a unload for a 4th day in a row, with speedy help ranges at 4265, 4230 and 4200.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is supplied as a common advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or must be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link