[ad_1]

The main focus remained on the Center East and the Israel-Hamas struggle. Makes an attempt to include the hostilities and forestall the battle from escalating all through the area supplied some assist for danger urge for food to start out the week. The VIX slipped to 17.45 after surging to 19.45 to finish final week. Fed’s Harker says Fed shouldn’t be contemplating extra charge will increase. Expectations for extra good earnings outcomes additionally boosted Wall Avenue, as did some softening within the US Greenback, whilst Treasury yields climbed.

New Zealand inflation slowed greater than economists anticipated in Q3, including to indicators that the RBNZ has come to the top of its tightening cycle. The annual inflation charge fell to five.6%, a 2-year low, from 6% within the second quarter, Statistics New Zealand stated Tuesday in Wellington.

- Decreased demand for haven belongings – Oil & Treasuries fall as efforts to ease battle intensify with Biden’s go to in Israel. President Joe Biden will journey to Israel tomorrow, in a go to designed to sign US solidarity with its closest Center East ally and assist stop the battle from engulfing the area.

- Closing Hours for Nation Backyard as it’s on the point of a doable offshore default. This might spotlight the depth of the arrogance disaster gripping the sector.

- USDIndex dipped to 105.95 and GBPUSD didn’t cross 1.2200.

- Morgan Stanley’s Michael Wilson: A rally within the USA500 within the fourth quarter of 2023 “is extra probably than not”.

- Shares: Boosted by Fed Harker dovish feedback, the AI euphoria and expectations that the FED is not going to increase rates of interest additional and hypothesis of an excellent earnings season.

- USOIL reversed to $85 and Gold dropped again to $1912 on the again of heightened danger aversion towards the background of escalating tensions within the Center East.

- BTCUSD settled at 28200. A quick 10% surge in Bitcoin yesterday gave merchants a glimpse into the doable influence of a looming the US SEC choice on whether or not to permit exchange-traded funds investing instantly within the token.

- As we speak: Earnings stories from Goldman Sachs & Financial institution of America. US Retail Gross sales and Canadian CPI.

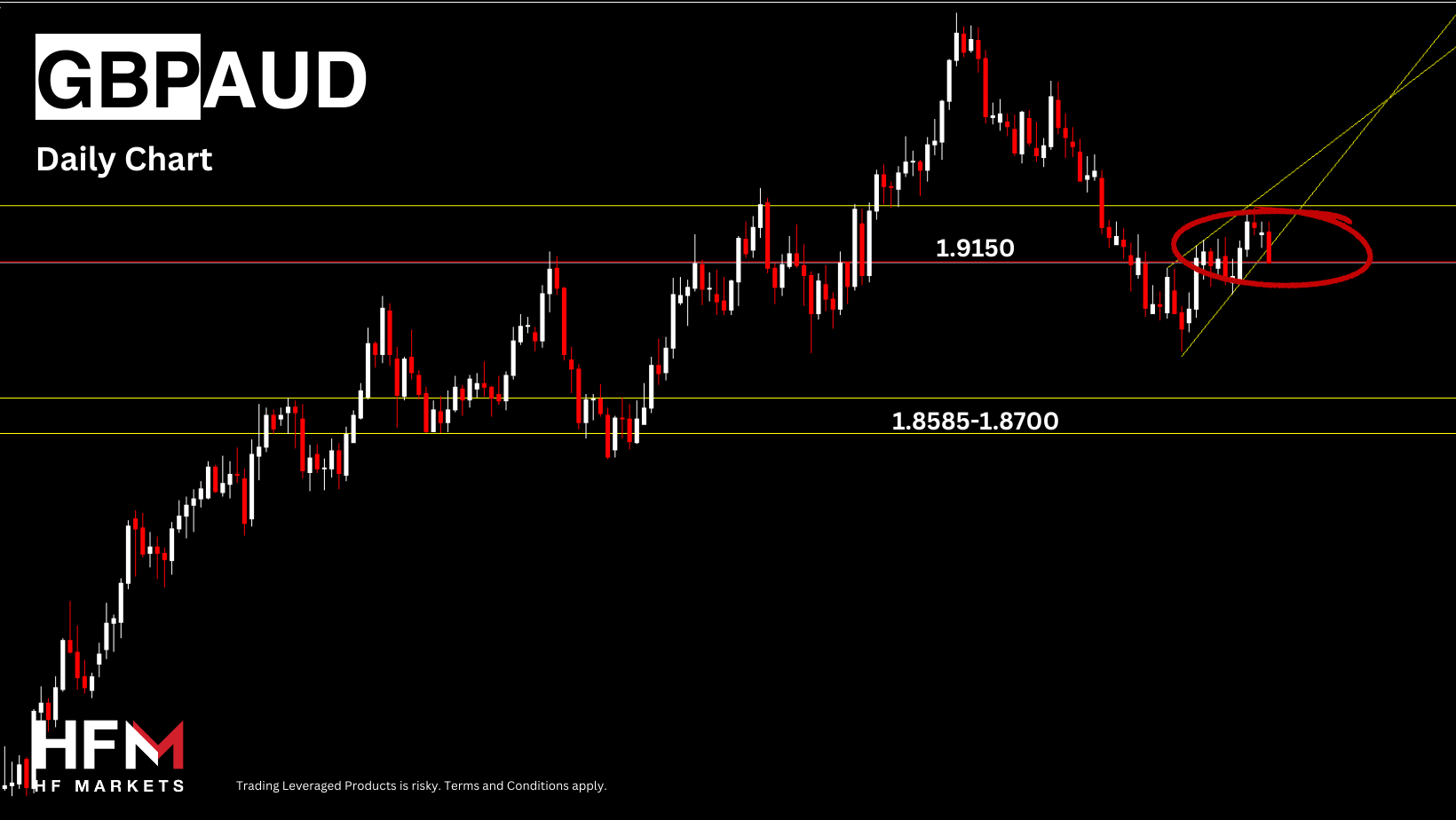

Attention-grabbing Mover: GBPAUD (-0.56%) broke 1.9150, which coincides with breakout of ascending triangleand Might-June Resistance. This might be a doable Head and Shoulder formation.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is supplied as a common advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or needs to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link