[ad_1]

There have been no surprises from the FOMC. As universally anticipated, the Fed elevated the funds fee 25 bps to a 5.25% to five.50% band. That is the best since early 2001. Wall Road was combined all session. The US30 was up for a thirteenth consecutive session, the most effective streak since January 1987. A achieve as we speak can be an all-time report going all the way in which again to June 1897. The coverage assertion and Chair Powell’s press convention didn’t present a transparent fee path into the tip of the yr, however careworn that the choice might be depending on upcoming information, of which there are two extra CPI studies and two extra payroll studies to be assessed.

ECB Preview: the ECB is broadly anticipated to ship one other 25 foundation level hike as we speak, whereas preserving all choices open for September. This can imply the presser ought to be a tad extra dovish than in June, when Lagarde successfully dedicated to additional tightening this month. Nevertheless, whereas there are actually extra indicators that earlier fee hikes are feeding by the system, and that core is plateauing, inflation stays far above the ECB’s goal and preserving all choices on the desk for September additionally signifies that additional tightening after the summer time break stays a chance.

- FX – The USDIndex sagged modestly to 100.40, down from the week’s excessive at 101.37. USDJPY broke the 140 low, reflecting merchants’ unease forward of the Financial institution of Japan assembly Friday that some assume will embody a coverage change. GBP spiked to 1.2984 and EUR at 1.1127.

- Shares – The US30 closed with 0.23% good points and fractional losses within the US500 and US100 as buyers additionally monitored varied earnings outcomes. The GER40 gapped as much as 16,194 because the German GfK shopper confidence resumes uptrend. #Meta advertisements income rebounded and regardless of the metaverse associated rising prices. #Samsung studies 95% drop in revenue, expects demand to get better.

- Commodities – USOil regular at 3-day territory.

- Gold – prolonged to $1982.

At this time: ECB Charge Determination and Press Convention, US Sturdy items and GDP. Earnings: McDonald’s, Mastercard, Intel, AbbVie, Shell, Comcast and so forth.

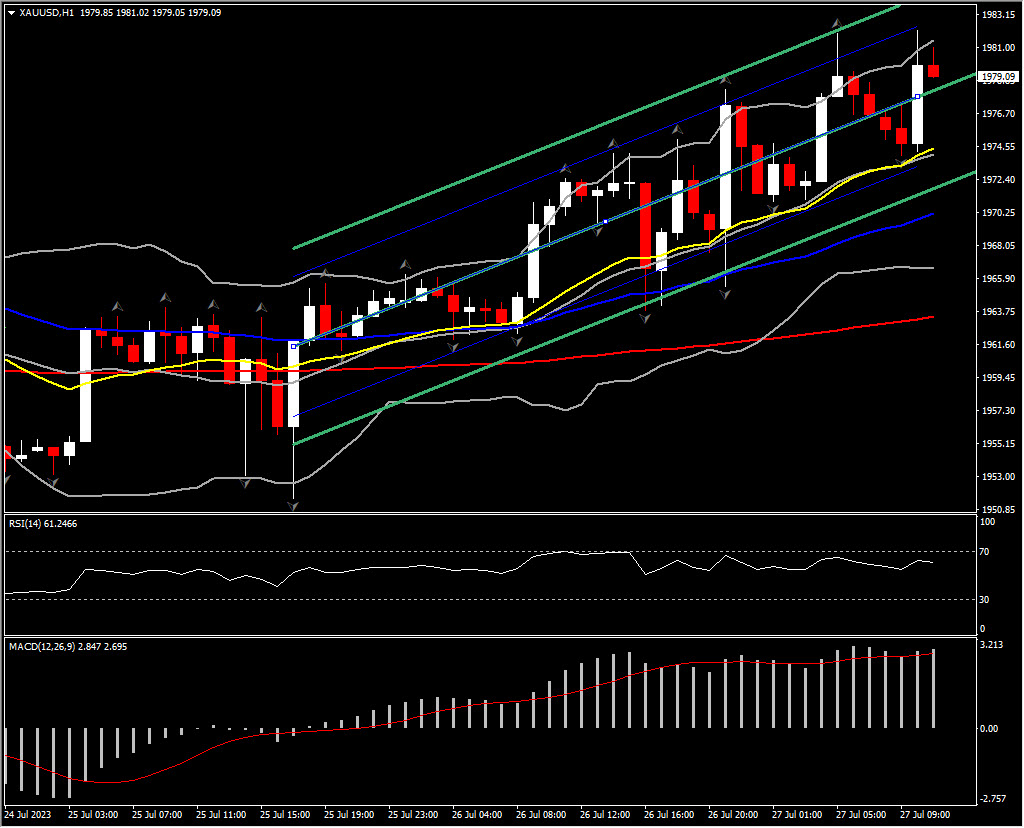

Greatest Mover: (@6:30 GMT) XAUUSD (-0.64%) topped at $1982 with RSI and MACD positively configured whereas ATR(H1) is at 4.28 and ATR(D) is at 16.55.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is supplied as a basic advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link