[ad_1]

Futures are marginally larger this morning after US100 and US500 snapped a 4 day adverse streak yesterday with the tech heavy index posting its greatest advance of the month (+1.65%) boosted by Tesla and Nvidia‘s performances. The chip maker rose 8.47% after being upgraded by HSBC (goal worth $780) and solely 2 days earlier than the much-anticipated earnings report that can come out Wednesday after the bell once we’ll discover out whether or not the corporate’s income forecast – which was 50% larger than Wall Avenue estimates – will come to fruition. The Tech rally held regardless of yields on US Treasuries spiking once more with the 10Y closing at 4.342% – its highest degree since November 2007 – the 2Y buying and selling above 5% and 10Y actual charges shortly hitting 2%. Sometimes larger charges are adverse for tech and development shares as they have an effect on their future flows low cost (regardless of of their price of financing) however this was not the case yesterday. On the inventory aspect, Softbank’s chip unit ARM is ready to record at Nasdaq, turning into the largest IPO of 2023. Additionally, Zoom shares climbed round 4% after the shut after reporting earnings that beat expectations.

- FX – USDIndex is buying and selling at 103.04 proper now (-0.16%), EURUSD is north of 1.09 (1.0918, +0.21%) and buying and selling between its 50 and 200 MAs as CABLE is doing (1.2784). USDJPY is pulling again (145.89) after having touched 146.50 in a single day.

- Shares – US and EU Futures marginally larger (+0.07% US30/+0.15% US100/+0.16% GER40); JPN225 rose 0.9% on tech energy whereas China slipped on Miners weak point.

- Commodities – USOil -0.15% at $80.76 after having pulled again from $82.44 yesterday; Copper is catching a bid (+0.7% at $374.5) as are different metals (Palladium +0.62%, Platinum +0.82%).

- Gold – Shy of $1900 regardless of larger charges.

In the present day: EU present account, Richmond Fed Index, speeches from Fed’s Barkin, Bowman & Goolsbee.

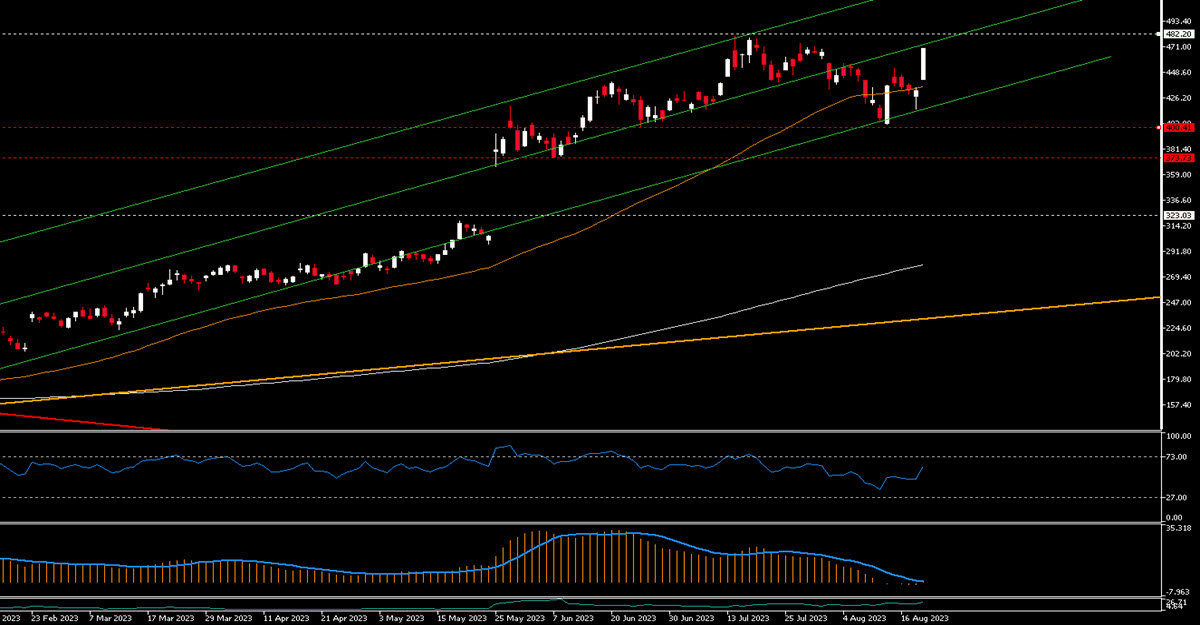

Attention-grabbing Mover: Nvidia rose 8.47% to $469.67, leaping above its 50-day MA and placing its current highs ($480) in sight. Appears to have discovered help on the decrease certain of a particularly steep channel; RSI heading larger and never overbought.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a normal advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or needs to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link