[ad_1]

A lot stronger than anticipated retail gross sales was the primary headline and offered a short spark to Treasury bears. The longer-term Treasury yields hit their highest stage this 12 months, i.e. 10-year US Treasury rose to 4.22%, its highest stage since November 2022. There was additionally some offset from disappointing drops within the Empire State index and the NAHB housing index. The Fed’s Kashkari mentioned he isn’t able to say the Fed is completed. Asian and European bourses misplaced floor on the worrisome progress outlook. China’s new house costs fell for the primary time this 12 months in July. The PBOC unexpectedly reduce key coverage charges for the second time in three months on Tuesday, whereas the RBNZ left the OCR unchanged at 5.50% as anticipated however signaled the chance of one other attainable hike to tame inflation. In Europe, stubbornly excessive UK core inflation strengthened bets of one other fee hike from the BoE, whereas German ZEW confidence beat which supported the potential for added ECB hikes which weighed on Europe bonds.

UK: CPI a tad increased than anticipated. Extra importantly core failed to say no barely, as most had anticipated. As an alternative, the core quantity remained regular at 6.9%. On condition that it’s vacation season that might be notably noticeable for a lot of and will underpin inflation expectations, even when headline inflation dropped -0.4% m/m in July. A difficult state of affairs for the BoE, however after yesterday’s increased than anticipated wage quantity, the higher-than-expected core studying specifically will possible gas fee hike expectations additional.

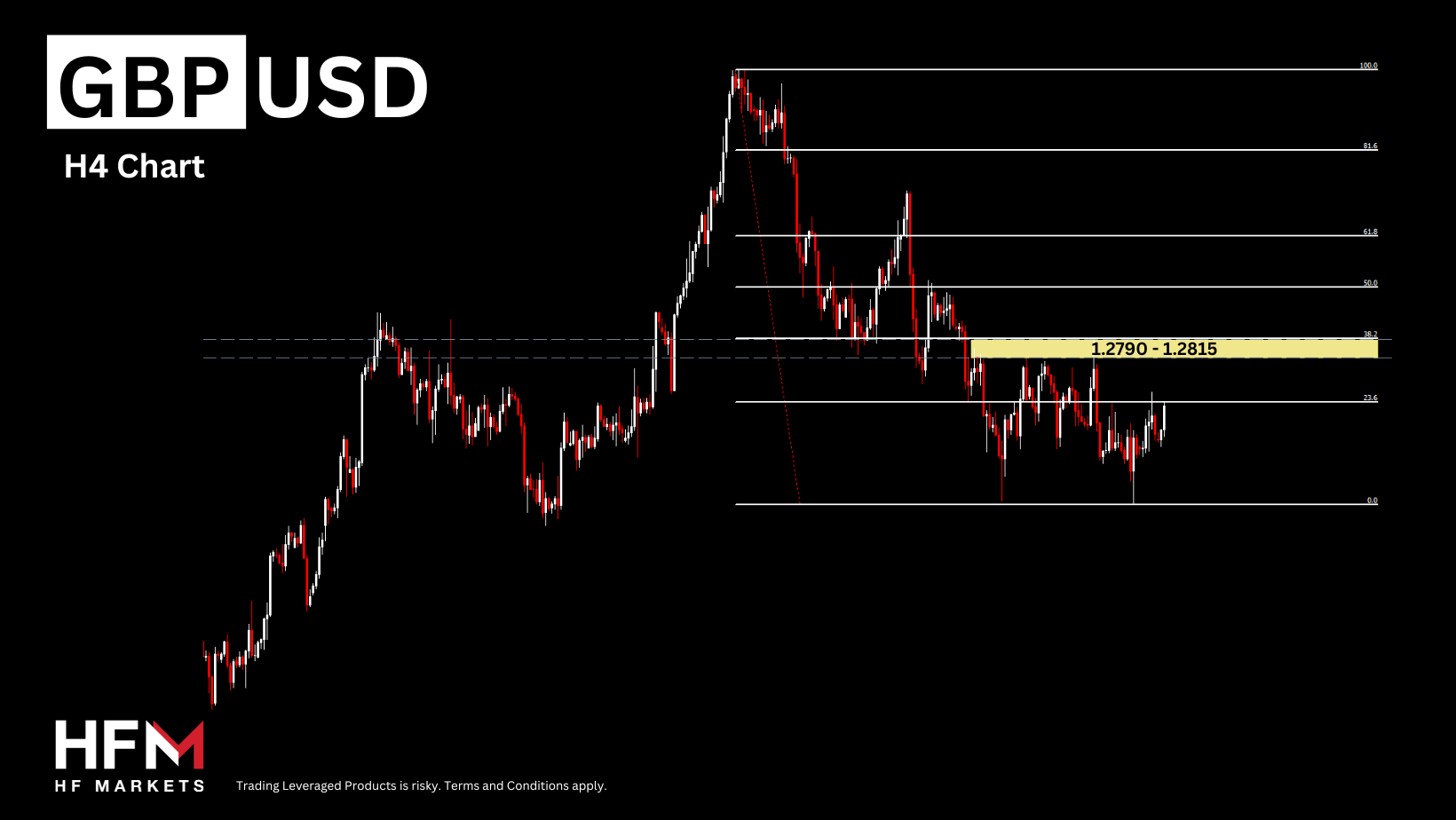

- FX – USDIndex hovered both facet of 103.000. EURUSD regular under 1.0930, Cable jumped to 1.2738 from 1.2685.

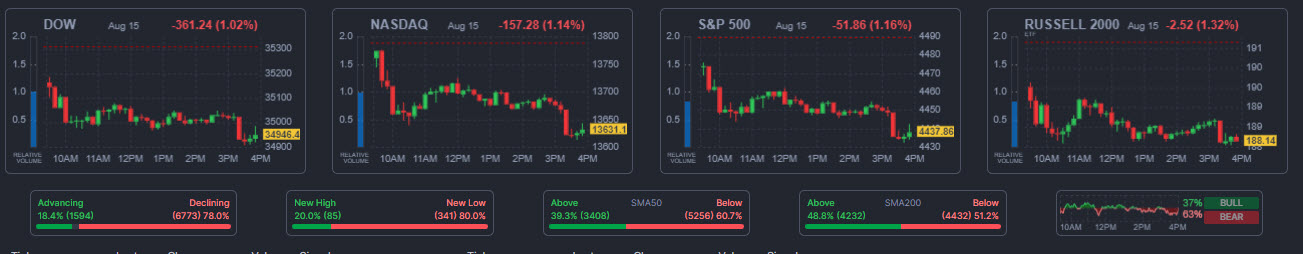

- Shares – Wall Road was principally within the crimson however promoting intensified into the shut to depart the main indexes extra deeply within the crimson with the US100 and US500 off -1.14% and -1.16%, respectively and the US30 off -1.02%. JPN225 fell 1.5%.

- Residence Depot kicked off retail earnings week by beating estimates however warned of “continued stress” on shoppers, as the corporate mentioned clients are pulling again on home-renovation initiatives.

- Intel Corp will drop its $5.4 billion deal to accumulate Israeli contract chipmaker Tower Semiconductor Ltd as soon as their contract expires in a while Tuesday with out regulatory approval from China.

- Most financial institution shares fell Tuesday. Fitch advised CNBC that the company was contemplating reducing a number of financial institution scores. The Financial institution of America fell probably the most, off 3.2%. M&T Financial institution was down 4.2%. Western Alliance and Comerica fell 4% and 4.5%, respectively.

- Commodities – USOil dropped to $80.06 as China jitters weigh on the demand outlook, which outweighed declining US stockpiles.

- Gold – is hovering at $1,900.

Right now: US housing begins, constructing permits, and industrial manufacturing, Fed minutes and earnings from Goal, TJX, Cisco Techniques, Synopsys.

Greatest FX Mover: GBPUSD (+0.26%) spiked to 1.2736 put up UK inflation information, with 1.2750 the subsequent resistance stage. A break would open the door to the 1.28 space.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or must be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link