[ad_1]

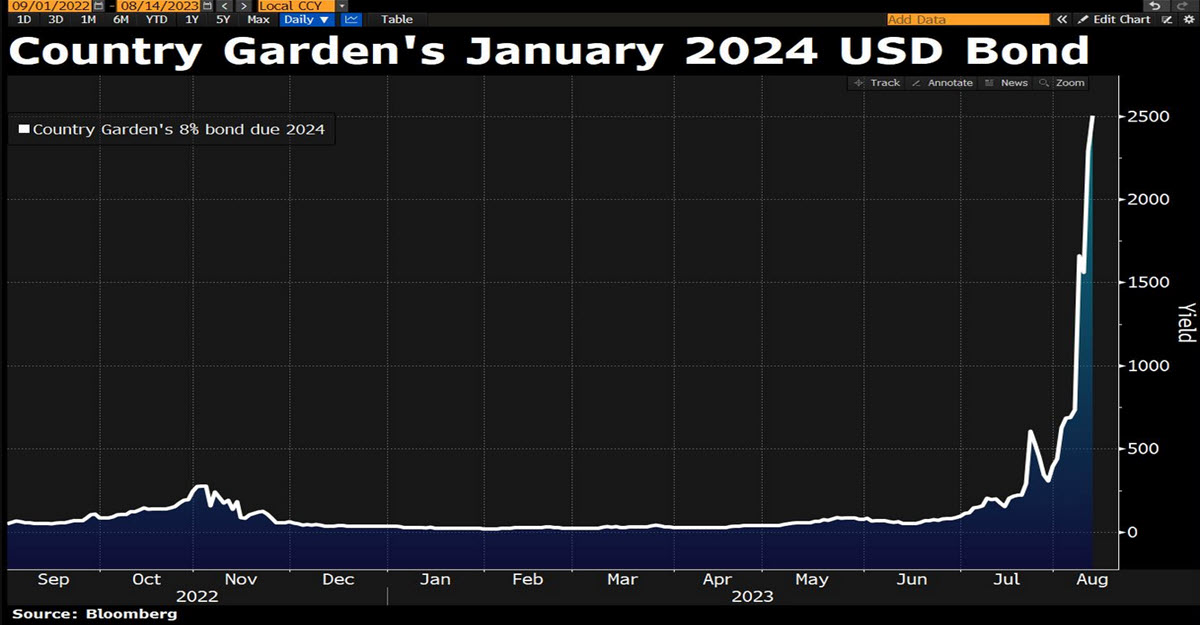

Asia is in dire straits: CHINA50 and HK are down greater than 2% as issues with developer Nation Backyard intensify and the inventory is down virtually -15% at its lows after suspending buying and selling on 11 onshore bonds. Its issuance dated 01/2024 has fallen as little as 9 cents, indicating a yield of 2500%: a chapter now appears inevitable, it stays to be seen how a lot the system will be capable of sterilise it. The USDCNH at the moment trades at 7.2757, what can be the very best settlement of the yr. However it’s not the one one: the USDJPY touched 145.20, a brand new one-year low for the yen. Final yr above 146, the BOJ’s financial defence with open market interventions had begun and plenty of merchants anticipate one thing related this yr.

Again within the West, a higher-than-expected PPI determine favoured one other purple day for the US indices from which solely the US30 was saved: that’s two weeks in a row of declines for each the US500 and US100. Do not forget that producer costs transfer forward of client ones. In the meantime, the USD continues to rise for the fourth week in a row and so does the Crude, up for 7 weeks in a row: the power sector is now one of the best performer and has largely overtaken know-how in short-term efficiency. Charges are on the rise once more with the 2y at 4.90% and the 10y at 4.17%.

- FX – USDIndex up for weeks in a row buying and selling at 102.80 now, approaching the channel down and the 200MA; each EURUSD and CABLE are -0.10% (1.0938, 1.2681) and appear to be shut to interrupt down their 10 months lengthy uptrends.

- Shares – US futures are -0.2% this morning, JPN225 -1.44%, AUS200 -0.87%, DAX -0.4% and clearly buying and selling under its 50MA (as US100 is).

- Commodities –USOil -0.96% at $82.24, UKOil -0.93% at $85.58, one other purple day for Copper ($370).

- Gold – Down at $1913 as yield are rising.

At present: No knowledge until tonight when Japanese GDP, RBA minutes and Chinese language Retail Gross sales + Industrial Manufacturing will hit the tape.

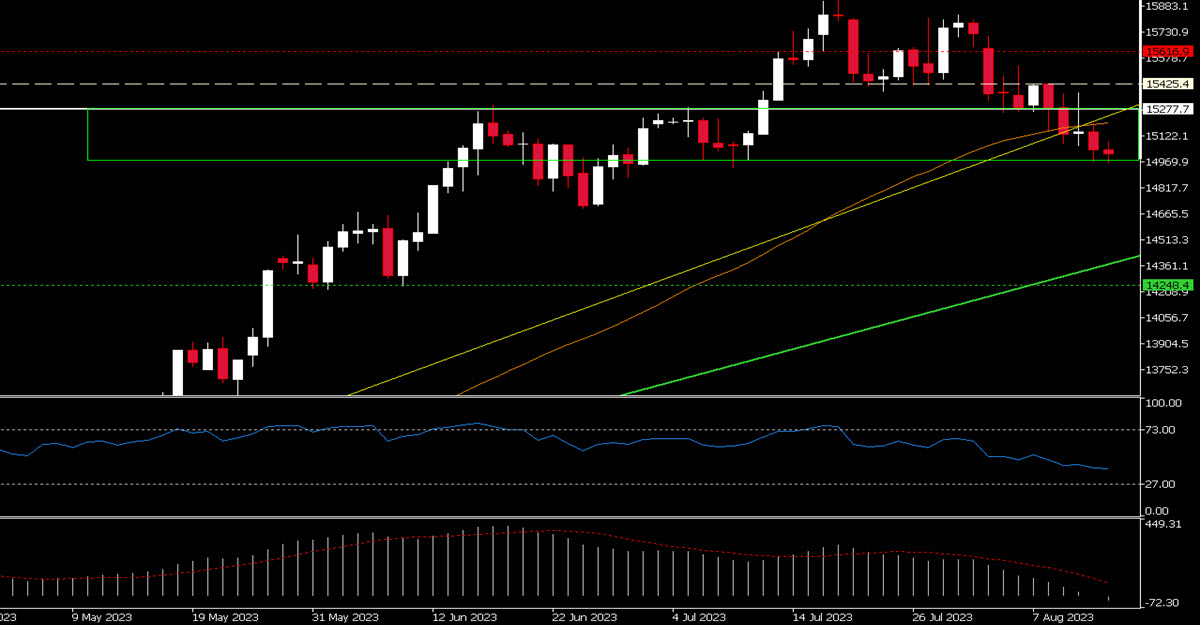

Attention-grabbing Mover: US100 (0.15%) is buying and selling under its 50MA and have damaged the primary steepest (yellow) trendline. 14935 space is now a weak static help.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or must be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link