[ad_1]

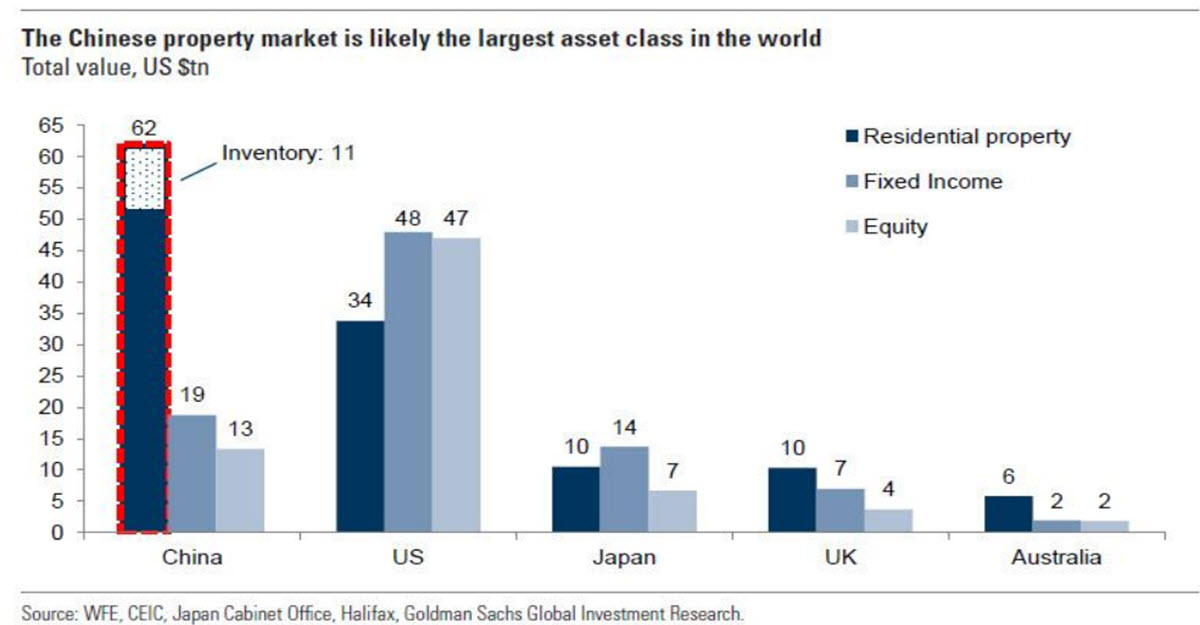

Let’s begin with the info that simply got here out this morning: Within the UK we had some good surprises, with GDP (+0.2% q/q vs flat exp., +0.4% y/y vs +0.2% exp.), industrial and manufacturing manufacturing beating throughout the board. The Pound is up and the most effective performer among the many majors, however the AUD isn’t doing too badly both, after RBA’s Governor Lowe reiterated his dedication to carry inflation to three.25% by the top of 2024. Yesterday’s CPI information despatched the markets on a rollercoaster trip: massive day by day swings within the indices which, after rising round 1%, closed on the day’s lows. The USD recovered heavy losses and above all of the crushing efficiency towards the JPY helped it get better 90 cents after falling as little as 101.62 (USDX). The Japanese forex is on the lows of the yr and near what previously has been an intervention zone. Extra bother from Asia the place it’s rumoured that the developer big Nation Backyard will ask for a debt restructuring within the coming weeks, making it the largest disaster because the not so distant days of Evergrande. The central authorities is claimed to shift $139 bln of troubled debt to provinces. CHINA50 -1.88%.

- FX – USDIndex little modified this morning at 102.35, USDJPY 144.78, lower than 30 pips away from this yr’s highs. CABLE up above 1.27 after the info, EURUSD shy of 1.10.

- Shares – US indices closed the day flat after rising as a lot as 1% earlier. Futures are flat. US500 and US100 are set for the 2nd week of losses in a row. GER40 failed to remain above 16k, CAC above 7.4k. CHINA50 – 2.88%.

- Commodities – Some revenue taking over USOil after it nearly touched $85, again at $82.4 now. Copper down roughly -7% in AUG, $373.25 now.

- Gold – Down near July’s lows, buying and selling at $1916.25, XAG -4.34% up to now this week.

As we speak: US PPI and Michigan Client Confidence.

GBPUSD, H1

Fascinating FX Mover: GBPUSD (+0.29%) spiked 40 pips after the GDP information, consolidating above 1.27 now, 1.2711 final. Holding above the 1.2675 assist zone, under the quick time period trendline.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a basic advertising communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or ought to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link