[ad_1]

In a single day RBA left charges unchanged at 4.1% in opposition to expectations: current CPI and PPI information – a lot weaker than anticipated – will need to have weighed on the choice even when the financial institution acknowledged that ”additional financial coverage tightening could also be required” and considers that inflation ”is to return to the goal vary of 2-3% by late 2025”. Consider the tight native labour market. We had extra unhealthy information from China the place Caixin Manufacturing shrank to contraction territory in July (49.2) and home gross sales figures reported the most important dip in a 12 months. No less than HSBC reported an 89% rise in pre-tax revenue and is up 1.8% in HK. 10y JGB are nonetheless discovering a backside at 0.60%, Yen is tumbling and the Japanese Minister of Finance Suzuki is again to the rhetoric of ”carefully monitoring the market”. US markets have been up once more yesterday and US500 has not had a >1% drop in 41 days now; Russell 2000 has been the month-to-month finest performer testifying to how the rally is now not pushed solely by Tech mega-caps however its breadth is broadening. That is the busiest week of the earnings season and after greater than 160 corporations included within the US500 have already reported, immediately we await Merck, Pfizer, Caterpillar, Norwegian, AMD and lots of extra.

US500, 5 minutes, Intraday Shorts protecting on the shut?

- FX – USDIndex is up 0.15% to 101.77, AUDUSD fell 0.74% after RBA resolution (0.6668) giving up simply a few of yesterday’s positive aspects, EURUSD is simply shy of 1.10, Cable down 0.1% to 1.2820. USDJPY eyes 143.

- Shares – US and EU futures are barely crimson, -0.1% on common. Dax has been buying and selling above its earlier ATH seen in June for a few days now. Nikkei up 0.65% on weak JPY.

- Commodities – USOil extends its rally, trades at $81.52 now. Corn, Wheat fractionally up after a 5 day shedding streak, Copper reacts to $400 however is surprisingly edging larger on a 2 month perspective.

- Gold – buying and selling at $1959 this morning, XAG at $24.85.

At the moment: Germany, Europe unemployment, US Canada – Spain – Italy – France – Germany Manufacturing PMI, API weekly Crude Oil Inventory. EARNINGS: Uber, Pfizer, Caterpillar, Norwegian BFO; AMD, Starbucks, MicroStrategy, Pinterest, ATC.

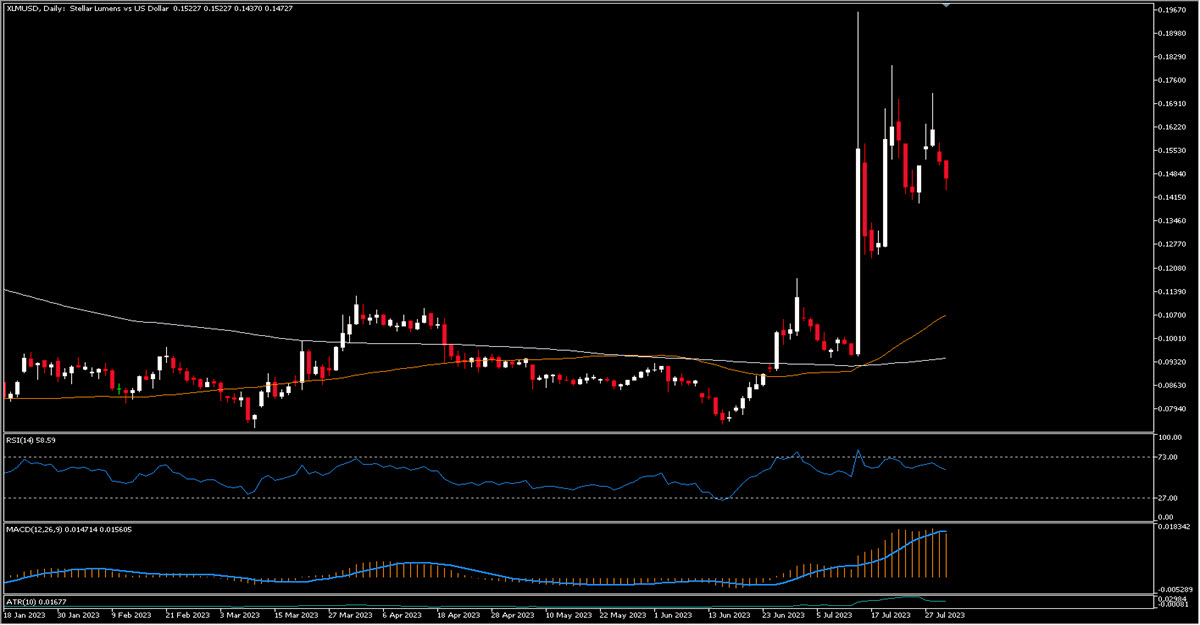

Largest Mover: (@6:30 GMT) XLMUSD (-3.67%) buying and selling at $0.1468 and consolidating inside a triangle after the current rally. MACD histogram simply crossed to the draw back, RSI negatively sloped.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a common advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or ought to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link