[ad_1]

Financial Indicators & Central Banks:

- China’s lending charges stay unchanged. That adopted the PBOC’s choice to keep borrowing prices earlier this month, which was one other disappointment that did little to spice up Chinese language inventory markets.

- Current knowledge displaying resilient US financial exercise has triggered a shift in expectations, with markets now predicting fee cuts to begin in Might as an alternative of March.

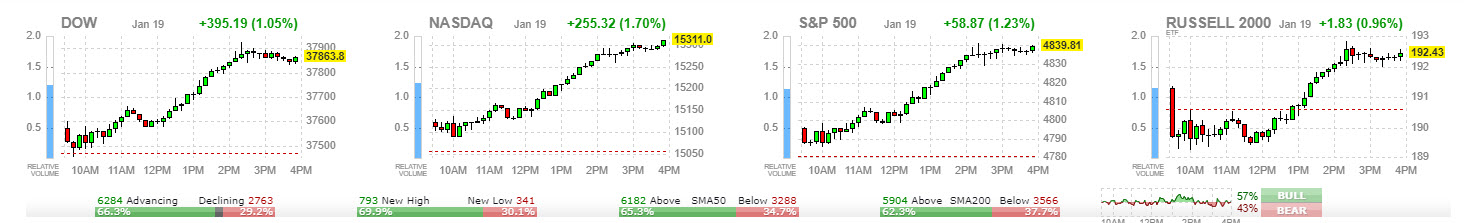

- European & US inventory futures maintain rising, extending the rally in world equities that pushed the US500, US100 and US30 to all-time highs. Optimism over anticipated Federal Reserve interest-rate cuts and the artificial-intelligence growth boosted Equities.

- Rate of interest futures point out a 100 foundation factors hole between market expectations and the Fed’s personal projections for year-end charges, contributing to the greenback’s struggles.

- In political information, Ron DeSantis withdraws from the US presidential race and endorses Republican front-runner Donald Trump forward of the New Hampshire major on Tuesday.

Market Traits:

- Chinese language markets underperformed once more at present towards their lowest stage in nearly twenty years. The Cling Seng plunged -2.8%, the CSI 300 -1.5%. Chinese language tech behemoths together with Meituan and Tencent Holdings Ltd. have been among the many greatest drags.

- JPN225 rallied to a recent 34-year peak at present (closed at 36,546.85) on weaker yen but in addition primarily because the US500’s record-high shut on Friday buoyed investor sentiment, regardless of continued indicators of overheating within the Asian market.

- DAX and FTSE 100 are up 0.9% and 0.5% respectively whereas Treasuries have pared in a single day beneficial properties, and the 10-year fee is now up 0.8 bp at 4.13%. The brief finish is underperforming in each the US and the EU.

Monetary Markets Efficiency:

- The USDIndex is struggling to increase above 103 resulting from uncertainties associated to central financial institution selections in Japan and Europe this week. EURUSD right down to 1.0890.

- USDJPY had a notable motion, bouncing from a 1-month low to a excessive, impacted by the Financial institution of Japan’s 2-day assembly and the expiry of a considerable amount of forex choices.

- Oil costs are down as OPEC member Libya restarted output at its largest discipline, bolstering world provides and overshadowing for now considerations about tensions within the Purple Sea that look set to proceed disrupting delivery.

- Key occasions for the week embody the primary estimate of US This autumn GDP, central financial institution conferences in Japan, Canada and Europe, South Korean financial output knowledge, and preliminary readings of buying managers’ surveys in Europe for 2024.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a normal advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link