Most Learn: US Greenback’s Outlook Brightens; Setups on EUR/USD, USD/JPY, GBP/USD

The attract of following the group is powerful in relation to buying and selling monetary belongings – shopping for when the market is gripped by euphoria and promoting when panic takes maintain. But, skilled merchants acknowledge the potential hidden inside contrarian approaches. Instruments like IG consumer sentiment supply a invaluable peek into the market’s collective temper, probably revealing moments the place extreme bullishness or bearishness may foreshadow a reversal.

In fact, contrarian indicators aren’t foolproof. They develop into strongest when built-in right into a well-rounded buying and selling technique. By thoughtfully mixing contrarian observations with technical and elementary analyses, merchants acquire a richer understanding of the forces at play – dynamics that almost all may overlook. Let’s discover this idea by inspecting IG consumer sentiment and its potential affect on silver, NZD/USD and EUR/CHF.

For an intensive evaluation of gold and silver’s medium-term prospects, obtain our complimentary Q2 buying and selling forecast now!

Beneficial by Diego Colman

Get Your Free Gold Forecast

Silver Forecast – Market Sentiment

IG information reveals a bullish tilt in sentiment in the direction of silver, with 72.58% of merchants at present net-long, leading to a long-to-short ratio of two.65 to 1. Nonetheless, this bullishness has decreased in comparison with yesterday (down 3.75%) and final week (down 9.32%).

Our method typically incorporates a contrarian perspective. Whereas the prevalent bullishness may sign potential weak point in silver costs, the latest lower in net-long positions introduces a level of uncertainty. This shift suggests a attainable reversal to the upside could also be within the playing cards, regardless of the general net-long positioning.

Necessary Notice: These blended indicators spotlight the need of mixing contrarian insights with technical and elementary evaluation for a extra complete understanding of market dynamics.

Annoyed by buying and selling setbacks? Take cost and elevate your technique with our information, “Traits of Profitable Merchants.” Unlock important methods to avoid frequent pitfalls and dear missteps.

Beneficial by Diego Colman

Traits of Profitable Merchants

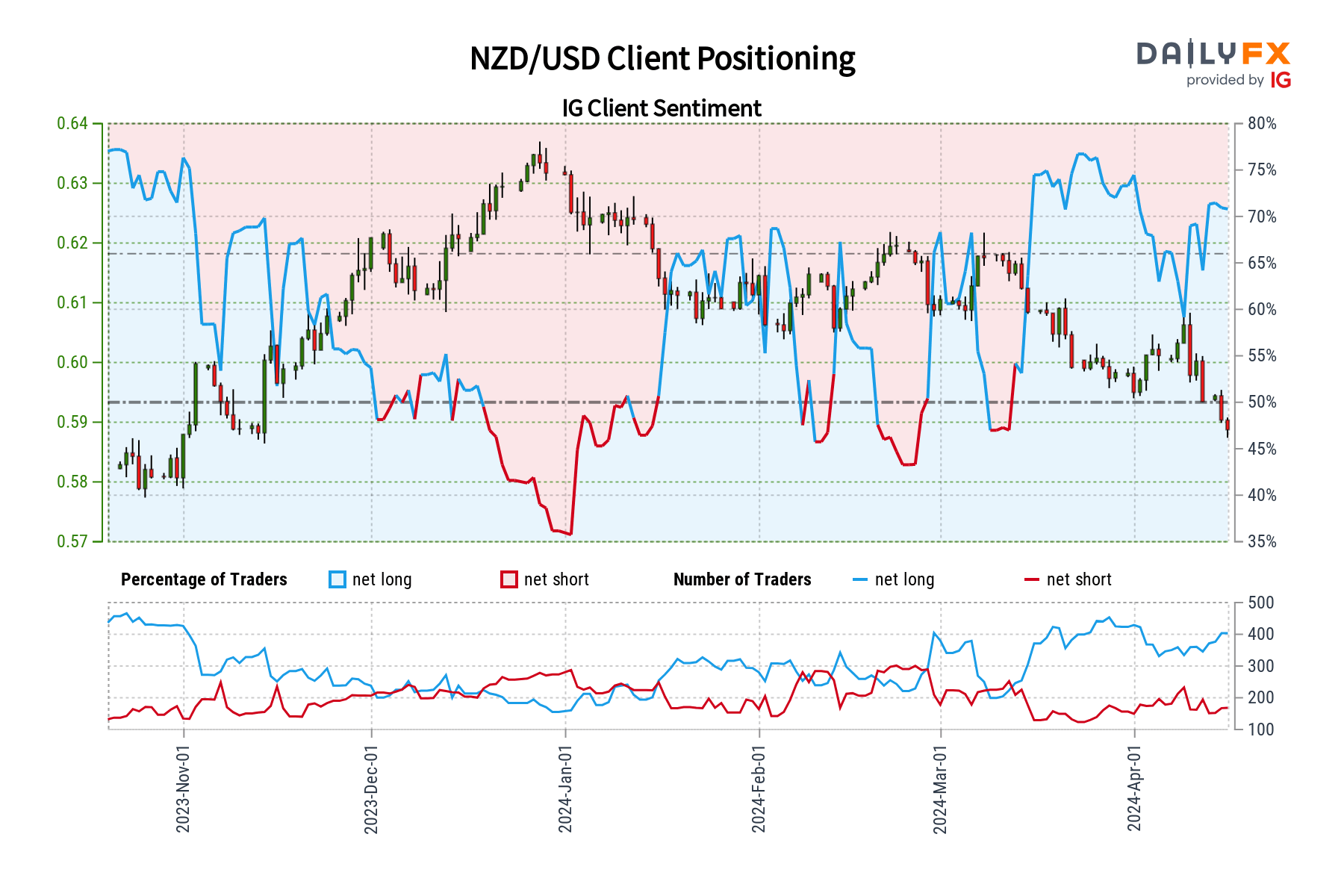

NZD/USD Forecast – Market Sentiment

IG information signifies a powerful bullish bias in the direction of NZD/USD amongst retail merchants, with 72.35% of shoppers at present holding net-long positions. This interprets to a long-to-short ratio of two.62 to 1. The variety of internet patrons has risen considerably since yesterday (up 7.22%) and in comparison with final week (up 11.23%).

Our buying and selling technique typically leans in the direction of taking a contrarian perspective. The widespread bullishness on NZD/USD suggests the pair could have room to weaken additional over the approaching days. The continuing improve in net-long positions strengthens this bearish contrarian outlook.

Necessary observe: Whereas contrarian indicators present invaluable insights, they’re handiest when mixed with technical and elementary evaluation. All the time conduct a radical market evaluation earlier than making any buying and selling choices.

Fascinated by studying how retail positioning can supply clues about EUR/CHF’s directional bias? Our sentiment information incorporates invaluable insights into market psychology as a pattern indicator. Get it now!

| Change in | Longs | Shorts | OI |

| Day by day | 6% | 2% | 4% |

| Weekly | 8% | -20% | -6% |

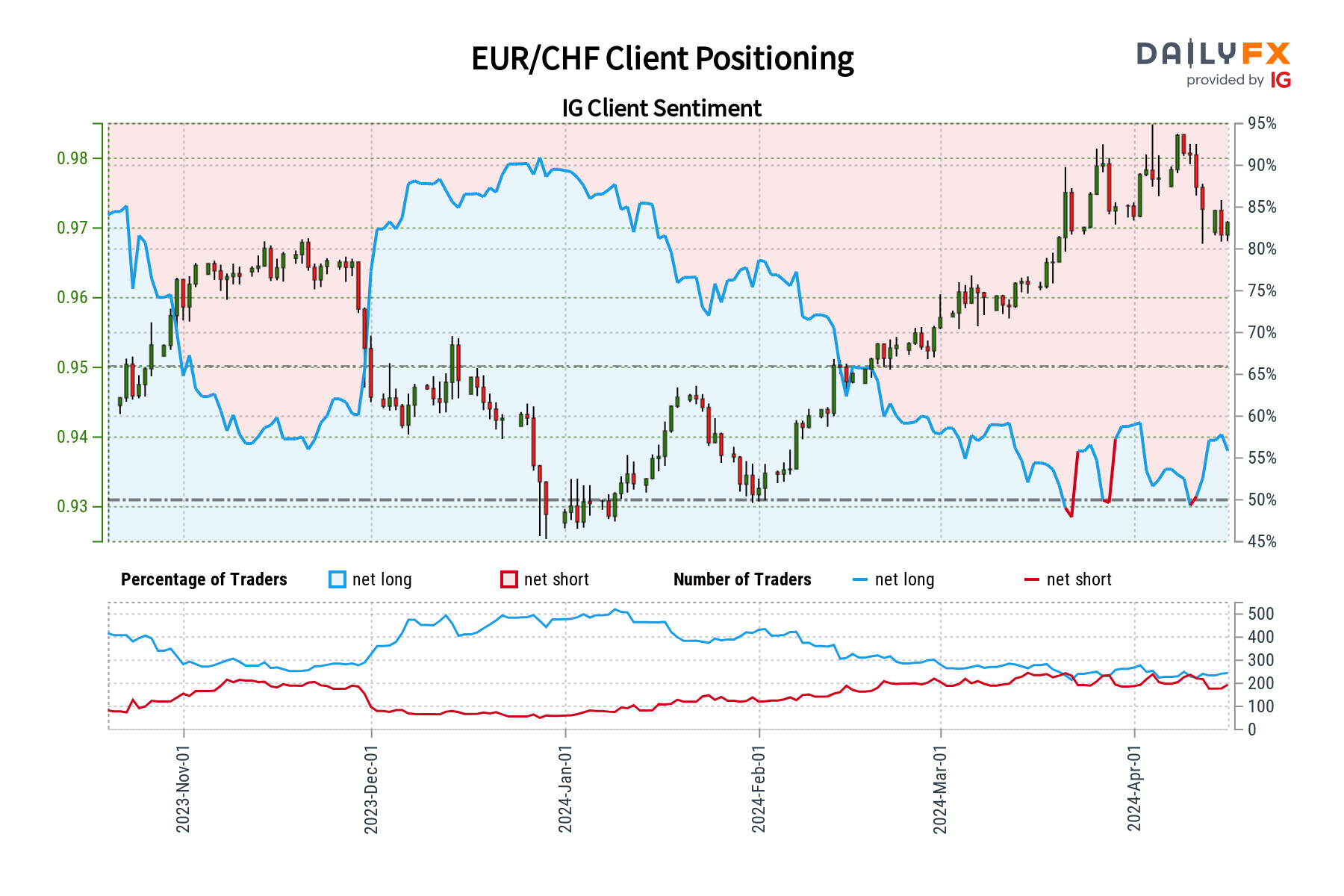

EUR/CHF Forecast – Market Sentiment

As per the newest information from IG, 55.76% of shoppers are bullish on EUR/CHF, indicating a long-to-short ratio of 1.26 to 1. Merchants sustaining net-long positions have risen by 8.33% since yesterday and by 4.66% from final week, whereas shoppers with bearish wagers have dropped by 1.01% in comparison with the earlier session and by 17.99% relative to seven days in the past.

We regularly undertake a contrarian method to market sentiment. The present predominance of net-long merchants suggests a possible additional decline for EUR/CHF within the brief time period. The rising variety of patrons in comparison with each yesterday and final week, alongside latest adjustments in positioning, strengthens our bearish contrarian buying and selling outlook on EUR/CHF.

Necessary Notice: Do not forget that contrarian indicators supply only one piece of the buying and selling puzzle. Combine them with thorough technical and elementary evaluation for a extra complete decision-making course of.