[ad_1]

Financial Indicators & Central Banks:

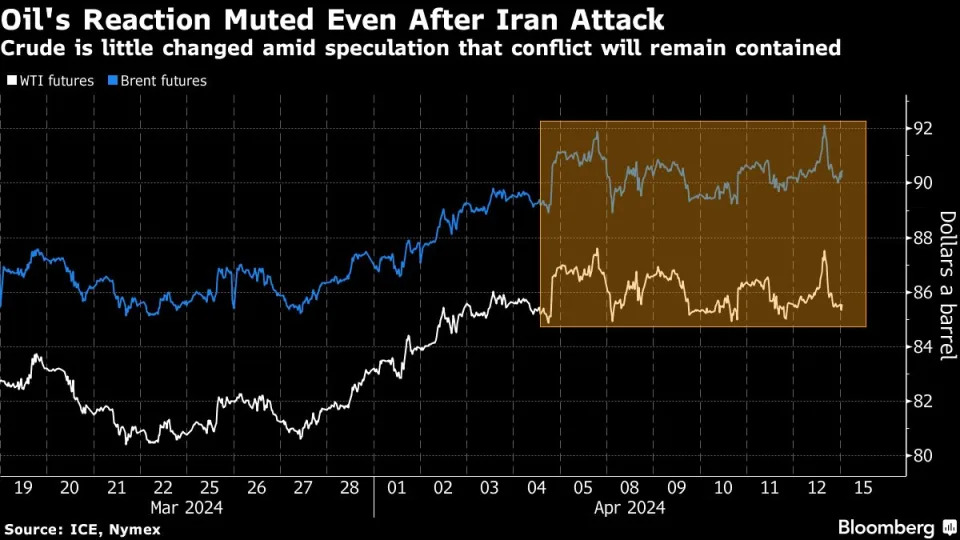

- Markets weigh threat of retaliation cycle in Center East. Initially the retaliatory strike from Iran on Israel fostered a haven bid, into bonds, gold and different haven belongings, because it threatens a wider regional battle.

- Nevertheless, this morning, Oil and Asian fairness markets have been muted as merchants shrugged off fears of a struggle escalation within the Center East. Iran mentioned “the matter will be deemed concluded”, and President Joe Biden has referred to as on Israel to train restraint following Iran’s drone and missile strike, as a part of Washington’s efforts to ease tensions within the Center East and reduce the chance of a widespread regional battle.

- New US and UK sanctions banned deliveries of Russian provides, i.e. key industrial metals, produced after midnight on Friday. Aluminum jumped 9.4%, nickel rose 8.8%, suggesting brokers are bracing for main provide chain disruption.

Monetary Markets Efficiency:

- The USDIndex fell again from highs over 106 to at present 105.70.

- The Yen dip in opposition to USD to 153.85.

- USOIL settled decrease at 84.50 per barrel and Gold is buying and selling beneath session highs at at present $2357.92 per ounce.

- Copper, extra liquid and pushed by the worldwide economic system over current weeks, was extra subdued this morning. At the moment at $4.3180.

Market Traits:

- Asian inventory markets traded blended, however European and US futures are barely larger after a tricky session on Friday and yields have picked up.

- Mainland China bourses outperformed in a single day, after Beijing supplied renewed regulatory assist. The PBOC in the meantime left the 1-year MLF charge unchanged, whereas as soon as once more draining funds from the system.

- Nikkei slipped 1% to 39,114.19.

- On Friday, NASDAQ slumped -1.62% to 16,175, unwinding most of Thursday’s 1.68% bounce to a brand new all-time excessive at 16,442. The S&P500 fell -1.46% and the Dow dropped 1.24%. Declines have been broadbased with all 11 sectors of the S&P ending within the crimson.

- JPMorgan Chase sank 6.5% regardless of reporting stronger revenue in Q1. The nation’s largest financial institution gave a forecast for a key supply of earnings this 12 months that fell beneath Wall Avenue’s estimate, calling for less than modest progress.

- Apple shipments drop by 10% in Q1.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or ought to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link