The Maker token, MKR, has managed to interrupt the $1,500 degree with a pointy 15% rally as on-chain information reveals MKR has seen excessive deal with exercise not too long ago.

Maker Has Outperformed Prime Cash With 15% Rally In Previous Week

Whereas giants like Bitcoin have struggled not too long ago, MKR has confirmed to be completely different because the coin has noticed a formidable run of bullish momentum. Following the most recent leg up within the asset’s rally, it has surged previous the $1,500 degree, a feat it hasn’t replicated since Could 2022, nearly a 12 months and a half in the past now.

Associated Studying: Bitcoin Bearish Sign: Lengthy-Time period Holders Deposit To Exchanges

The beneath chart reveals what the asset’s latest rally has appeared like:

The worth of the cryptocurrency has sharply gone up in latest days | Supply: MKRUSD on TradingView

Out of the highest 100 cryptocurrencies by market cap, solely Chainlink (LINK) and Curve (CRV) have seen higher returns than Maker’s 15% features through the previous week.

Even these two property haven’t seen bullish momentum as constant as MKR previously month, although, as MKR’s very good 42% earnings within the interval notably outshine theirs.

Maker Energetic Addresses Have Hit A ten-Week Excessive

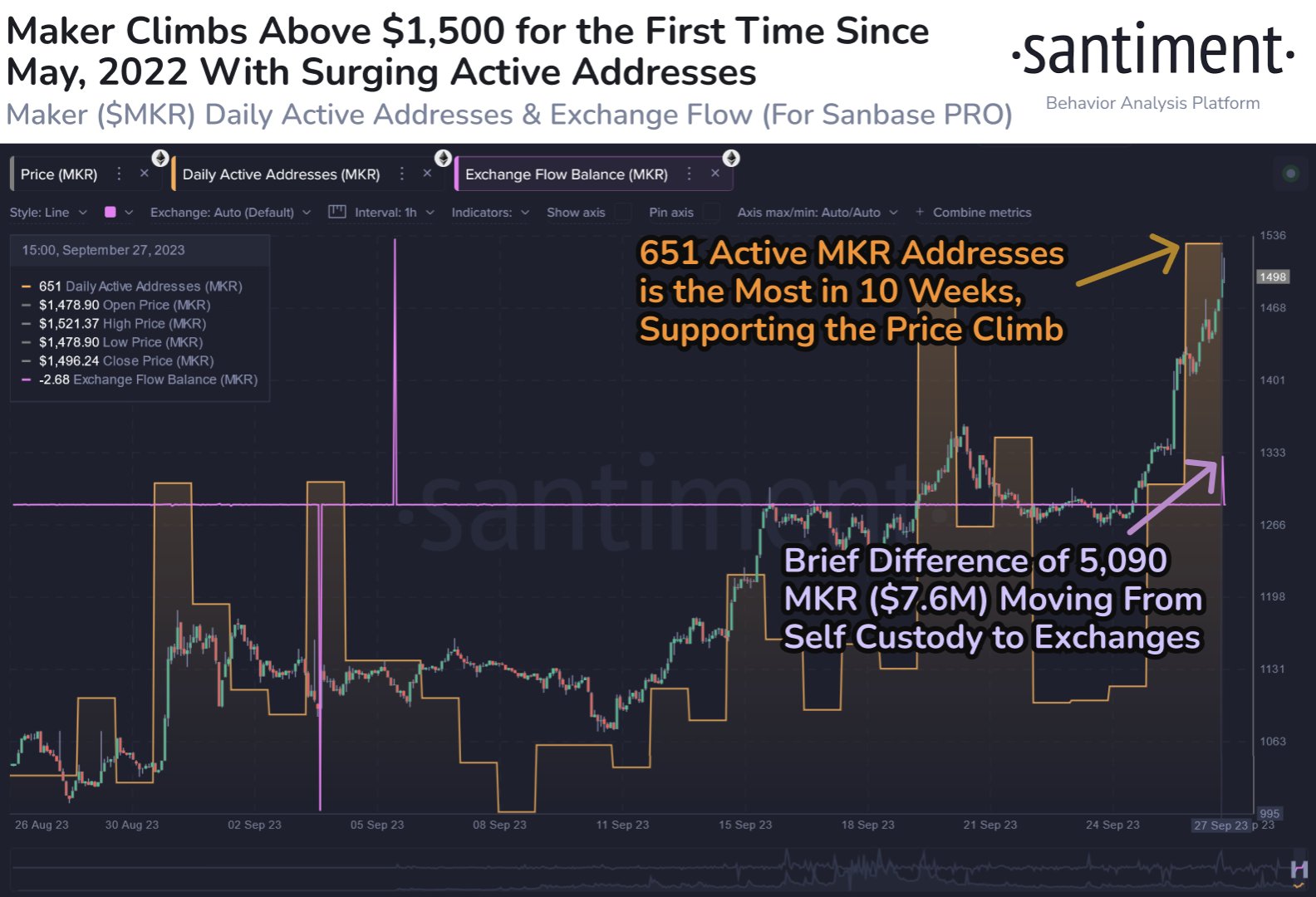

Based on information from the on-chain analytics agency Santiment, this sharp run in MKR has come alongside a surge within the cryptocurrency’s “lively addresses” metric.

This indicator retains observe of the day by day whole variety of distinctive Maker addresses which might be participating in some type of transaction exercise on the blockchain. This metric’s worth can merely be checked out as the quantity of site visitors that the community is receiving each day.

When the indicator has excessive values, it signifies that a lot of customers are taking part within the buying and selling exercise of the asset. Such a development implies that curiosity within the coin is excessive presently.

Now, here’s a chart that reveals how the lively addresses metric has modified for MKR through the previous month:

Appears to be like like the worth of the indicator has shot up over the previous few days | Supply: Santiment no X

From the graph, it’s seen that the Maker lively addresses have climbed up alongside the rally within the asset’s value. After the most recent improve within the indicator, its worth has hit 651, which is the very best noticed in round 10 weeks.

Usually, for any surge to be sustainable, it requires continued participation from a considerable amount of merchants. Rallies that aren’t accompanied by a enough rise in consumer exercise often run out of steam earlier than lengthy.

For the reason that newest Maker surge has seen an growing variety of addresses turning into lively, indicators might be trying good for its sustainability. As the worth continues its run, although, some buyers is likely to be tempted to reap the excessive earnings that they’ve amassed.

In the identical chart, Santiment has additionally connected the info for the trade netflow, which reveals that some inflows of $7.6 million simply have occurred in direction of centralized trade platforms, implying that profit-taking could already be starting.

This can be a comparatively modest quantity, however the analytics agency warns that inflows could be one thing to be cautious about, as they may lead in direction of not less than a short lived prime within the value.

Featured picture from Shutterstock.com, charts from TradingView.com, Santiment.web