Brent, WTI Oil Information and Evaluation

- Geopolitical uncertainty and provide issues have propped up oil

- Oil costs settle forward of technical space of confluence resistance

- WTI respects main long-term stage however geopolitical uncertainty stays

- The evaluation on this article makes use of chart patterns and key help and resistance ranges. For extra info go to our complete training library

Beneficial by Richard Snow

Get Your Free Oil Forecast

Exterior Elements have Propped up the Oil Market

Oil costs gathered upward momentum on the again of experiences of outages at Libya’s major oilfields – a significant supply of revenue for the internationally acknowledged authorities in Tripoli. The oilfields within the east of the nation are stated to be underneath the affect of Libyan navy chief Khalifa Haftar who opposes the Tripoli authorities. In line with Reuters, the Libyan authorities led by Prime Minister Abdulhamid al-Dbeibah is but to substantiate any disruptions, however clearly the specter of impacted oilfields has filtered into the market to buoy oil costs.

Such uncertainty round worldwide oil provide has been additional aided by the persevering with state of affairs within the Center East the place Israel and Iran-backed Hezbollah have launched missiles at each other. In line with Reuters, a high US normal stated on Monday that the hazard of broader conflict has subsided considerably however the lingering risk of an Iran strike on Israel stays a risk. As such, oil markets have been on edge which has been witnessed within the sharp rise within the oil worth.

Oil Costs Settle Forward of Technical Space of Confluence Resistance

Oil bulls have loved the latest leg greater, using worth motion from $75.70 a barrel to $81.56. Exterior elements resembling provide issues in Libya and the specter of escalations within the Center East offered a catalyst for lowly oil costs.

Nonetheless, immediately’s worth motion factors to a possible slowdown in upside momentum, because the commodity has fallen in need of the $82 mark – the prior swing excessive of $82.35 earlier this month. Oil has been on a broader downward development as international financial prospects stay constrained and estimates of oil demand progress have been revised decrease because of this.

$82.00 stays key to a bullish continuation, particularly given the very fact it coincides with each the 50 and 200-day easy transferring averages – offering confluence resistance. Within the occasion bulls can maintain the bullish transfer, $85 turns into the subsequent stage of resistance. Help stays at $77.00 with the RSI offering no explicit help because it trades round center floor (approaching neither overbought or oversold territory).

Brent Crude Oil Day by day Chart

Supply: TradingView, ready by Richard Snow

Beneficial by Richard Snow

Methods to Commerce Oil

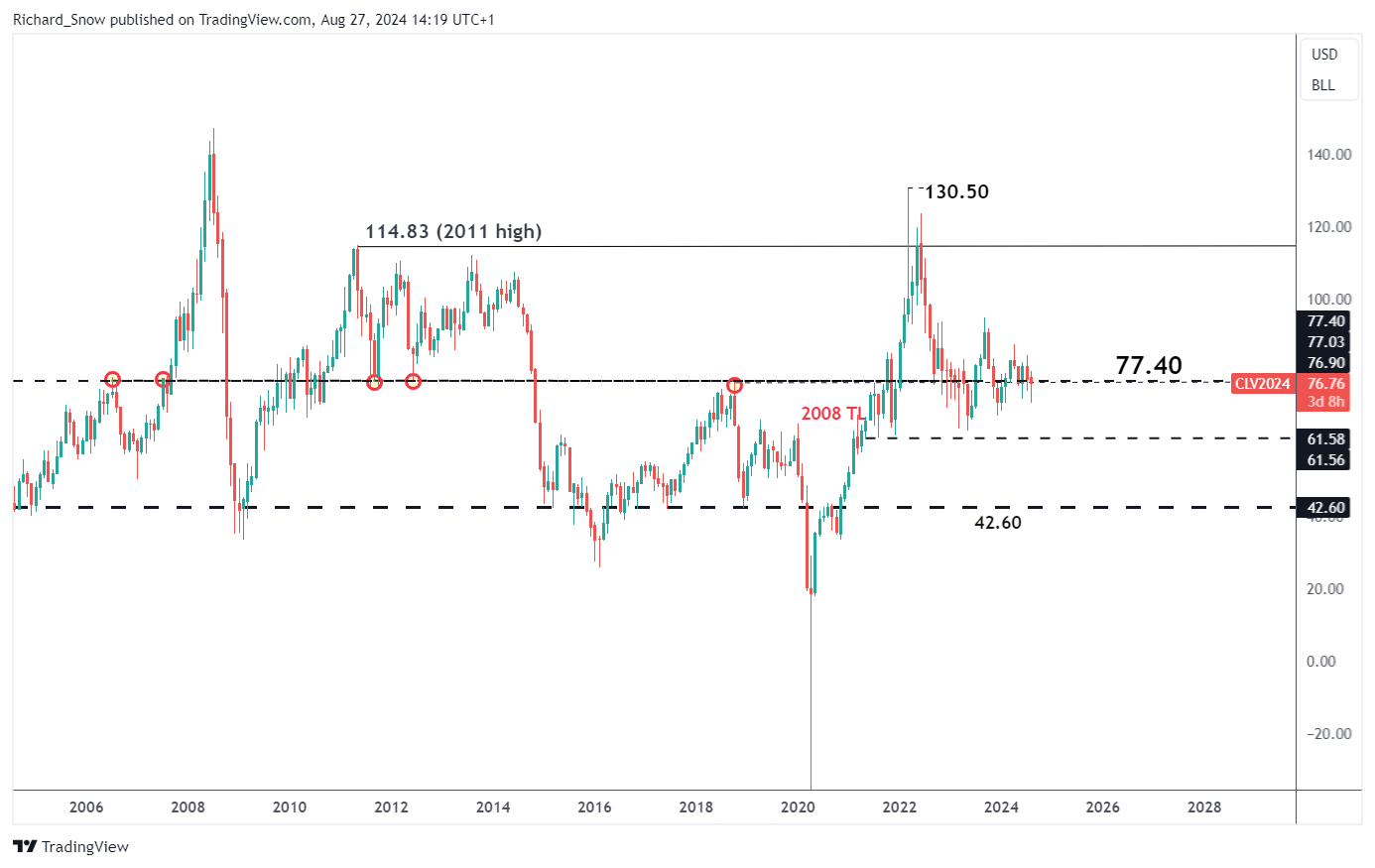

WTI crude oil trades in a similar way to Brent, rising over the three earlier buying and selling classes, solely to decelerate immediately, to this point. Resistance seems on the vital long-term stage of $77.40 which could be seen beneath. It acted as main help in 2011 and 2013, and a significant pivot level in 2018.

WTI Oil Month-to-month Chart

Supply: TradingView, ready by Richard Snow

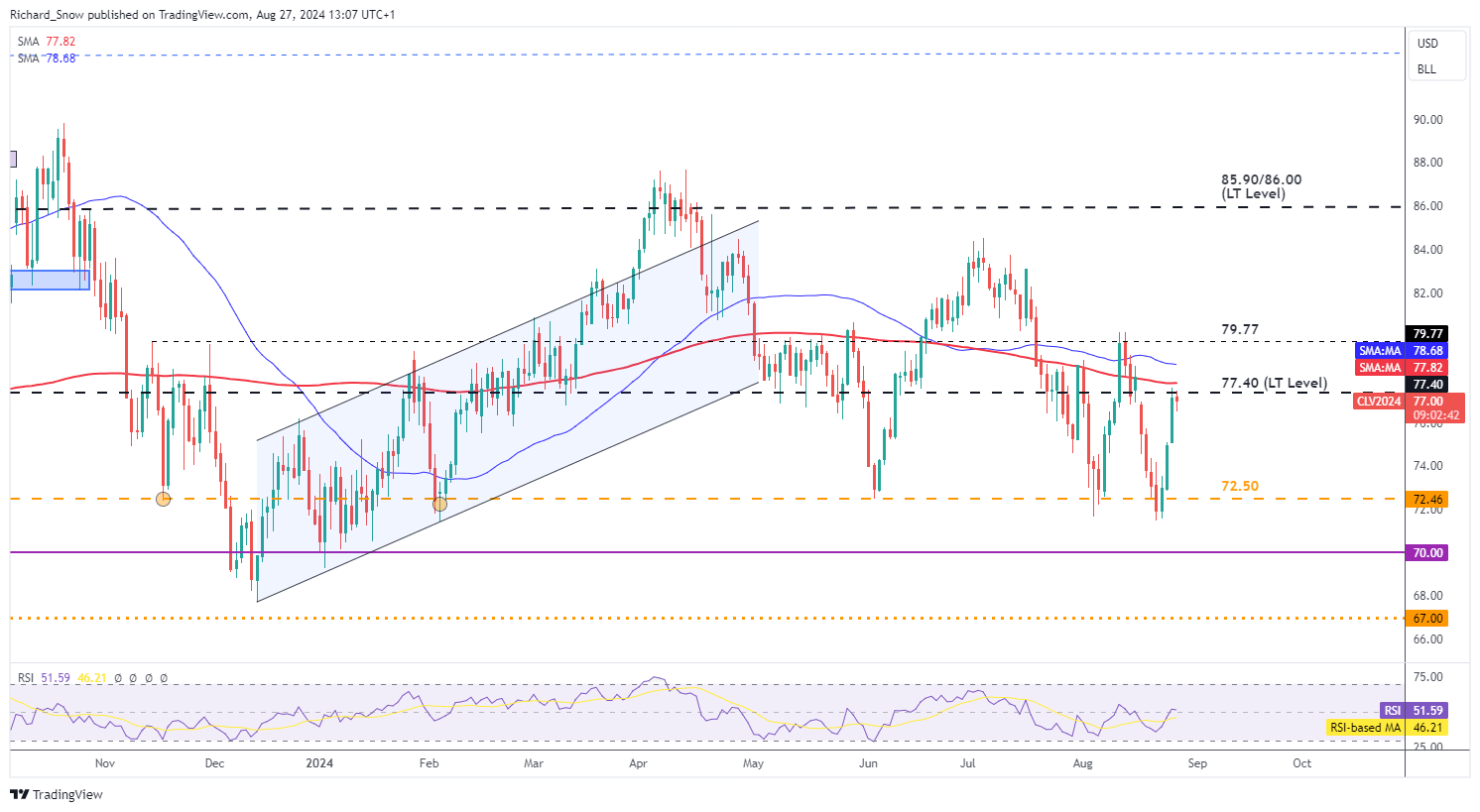

Rapid resistance stays at $77.40, adopted by the November and December 2023 highs round $79.77 which have additionally stored bulls at bay extra just lately. Help lies at $72.50.

WTI Oil Steady Futures (CL1!) Day by day Chart

Supply: TradingView, ready by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and observe Richard on Twitter: @RichardSnowFX