OlekStock/iStock through Getty Photographs

Introduction

I’ve written seven articles on SA about vanadium mining firm Largo (NASDAQ:LGO) (TSX:LGO:CA) to this point, the most recent of which was in March 2023 after I stated that the 12 months appeared to be beginning sturdy because of excessive vanadium pentoxide (V2O5) costs and that the corporate may very well be again within the black quickly.

Effectively, I believe that the Q1 2023 monetary outcomes have been underwhelming, and I discover it disappointing that the corporate revised its manufacturing, gross sales, and price steerage for the complete 12 months attributable to heavy rains. As well as, international vanadium costs have been sliding since early March and I believe that there may very well be additional decreases within the coming months attributable to slowing international metal output. In view of this, I am chopping my ranking on the inventory to carry. Let’s assessment.

Overview of the current developments

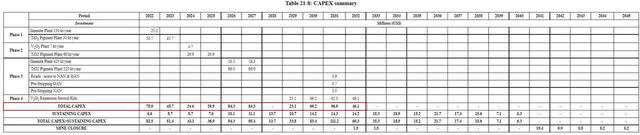

In case you are not aware of Largo or my earlier protection, here is a brief description of the enterprise. The corporate owns the Maracas Menchen vanadium mine in Brazil which accounts for about 7% of world vanadium provide with a nameplate capability of 13,200 tonnes. The mine employs 379 folks and it has a reserve lifetime of 20 years. Largo can be setting up an ilmenite focus plant there with a manufacturing capability of 150,000 tonnes that’s anticipated to be commissioned in Q2 2023. Industrial manufacturing is forecast to be reached within the second half of the 12 months and the corporate is evaluating the potential to provide titanium dioxide pigment as a attainable follow-on product. In 2021, Largo launched an up to date lifetime of mine plan for Maracas Menchen that confirmed an after-tax web current worth (NPV) of $2 billion at round $8 per pound for almost all of the mine life. Nonetheless, low vanadium costs may put the corporate in a tricky spot as the whole CAPEX (together with a titanium dioxide pigment plant) was forecast at over $350 million by 2027.

Largo

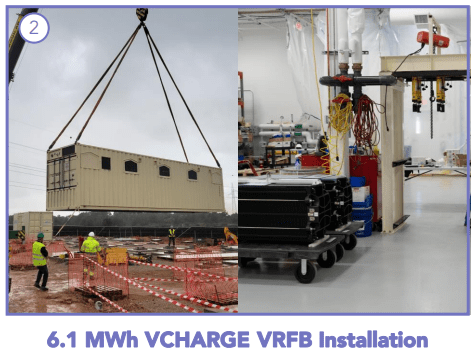

Apart from Maracas Menchen, Largo has a bodily vanadium holding arm named Largo Bodily Vanadium Corp (OTCPK:VANAF) (VAND:CA) which is listed on the TSX Enterprise Change that has a market capitalization of C$32.1 million ($23.6 million) as of the time of writing. Largo’s 65.7% stake within the firm is thus valued at C$21.1 million ($15.5 million). As well as, Largo has a clear power subsidiary referred to as Largo Clear Vitality which is targeted on vanadium redox move battery (VRFB) options. The latter has a battery manufacturing facility in Wilmington, Massachusetts, and is constructing a 6.1 MW vanadium battery for a buyer in Spain which is predicted to be delivered in Q3 2023.

Largo

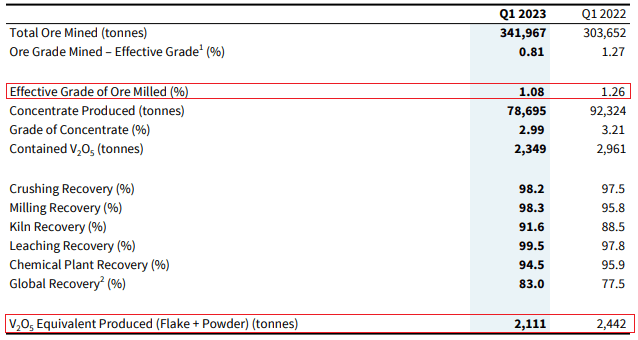

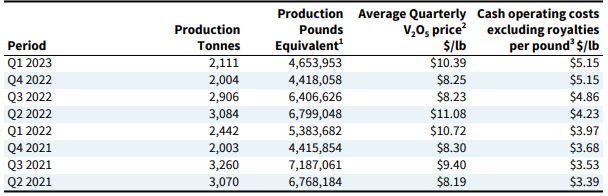

Turning our consideration to the Q1 2023 manufacturing and monetary outcomes, V2O5 output declined by 13.6% 12 months on 12 months attributable to decreased huge ore stock following heavy rainfall in December 2022 and early 2023. As you may see from the desk under, the efficient grade of ore milled in the course of the interval was 14.2% decrease in comparison with a 12 months earlier. But, the manufacturing was within the higher vary of the manufacturing steerage of 1,900-2,200 tonnes for the quarter.

Largo

The decrease grades and a shutdown of the processing plant in January for the completion of deliberate upkeep and refractory refurbishment within the kiln pushed up money working prices excluding royalties to $5.15 per pound. Evidently Q2 is beginning on a weak notice as April manufacturing was simply 676 tonnes (see web page 7 right here).

Largo

Nonetheless, gross sales of V2O5 equal rose by 27.6% to 2,849 tonnes as logistical challenges eased and Largo expects to see additional enchancment within the coming months. In April, the corporate offered a complete of 1,101 tonnes of V2O5 equal.

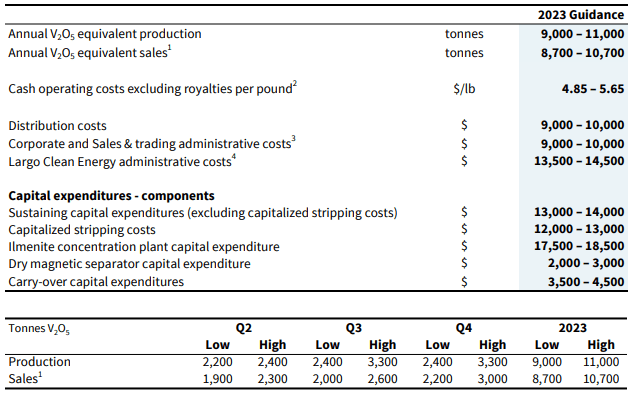

Nonetheless, the heavy rains in December and early 2023 have led to a delay within the infill drilling marketing campaign for the 12 months and Largo has revised its manufacturing, gross sales, and price steerage. The manufacturing steerage was reduce to 9,000 – 11,000 tonnes from 11,000 – 12,000 tonnes of V2O5 equal, the gross sales steerage was downgraded to eight,700 – 10,700 tonnes from 10,300 – 11,300 tonnes; and the steerage for money working price excluding royalties per pound offered was revised to $4.85 – 5.65 from $4.85 – 5.25. Evidently Q2 will likely be notably weak.

Largo

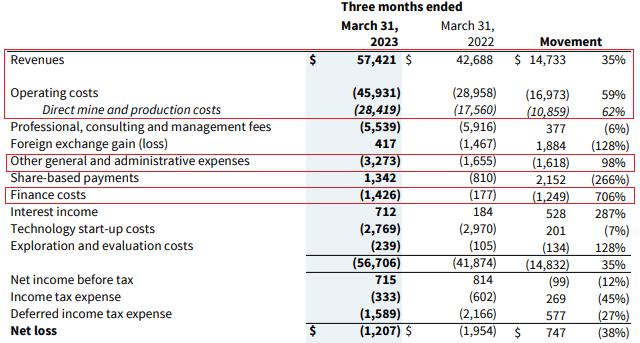

Trying on the monetary outcomes for Q1 2023, Largo remained within the crimson as sturdy gross sales could not offset the a lot increased direct mine and manufacturing prices attributable to low ore availability. As well as, different common and administrative bills soared attributable to increased depreciation within the company section attributable to software program merchandise whereas the finance prices rose attributable to the next debt load and preliminary financing charges on new debt services.

Largo

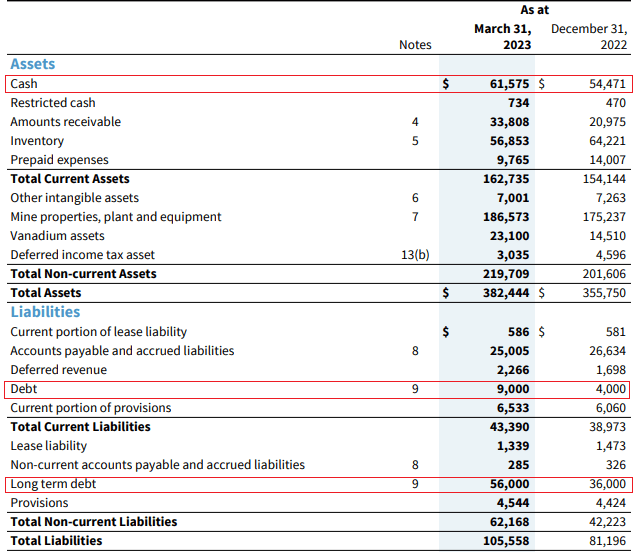

Turning our consideration to the steadiness sheet, Largo had a web debt of $3.4 million as of March 2023 which represents a major enhance in comparison with December as the corporate turned to loans to finance $23.4 million of CAPEX in Q1 2023.

Largo

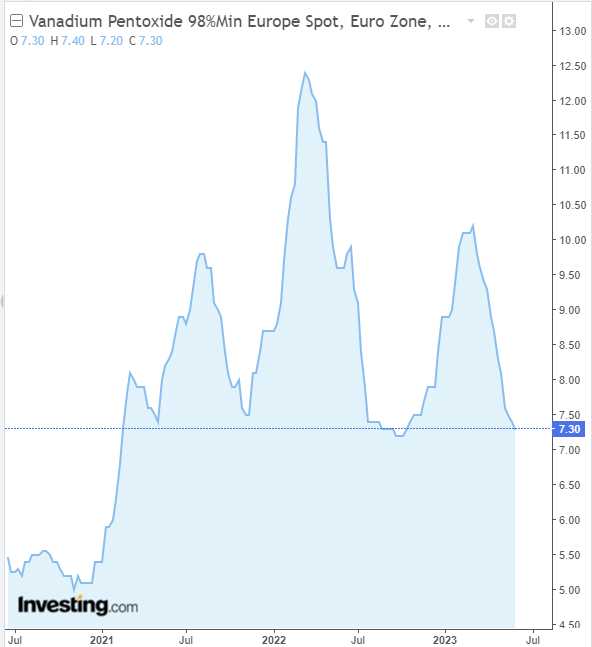

Taking a look at what to anticipate sooner or later, I am involved that the online loss and web debt may soar over the following a number of months as international vanadium costs are prone to proceed falling. You see, vanadium costs have been declining since March identical to with many different commodities attributable to international financial progress considerations.

Investing.com

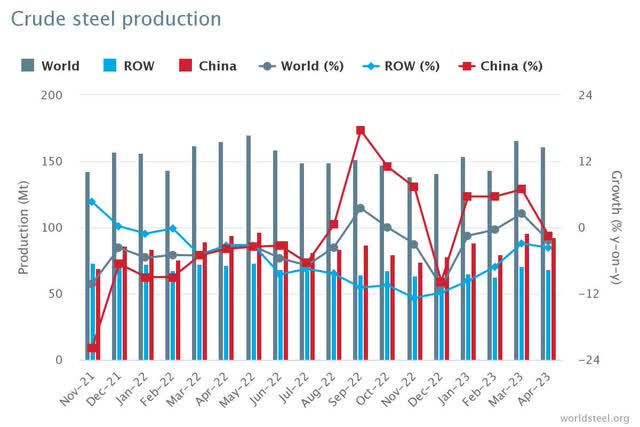

In April, international metal manufacturing started declining too and the metal trade accounts for simply over 90% of world vanadium demand. In keeping with knowledge from the World Metal Affiliation, crude metal manufacturing in its 63 member nations fell by 2.4% 12 months on 12 months to 161.4 million tonnes in April. The lower was pushed by China the place metal rebar costs in hit their lowest in three years because of low financial progress, notably within the property sector.

World Metal Affiliation

With no indicators that China’s financial progress and building exercise are possible to enhance within the close to future, I believe that it is possible that international metal output will proceed declining over the following a number of months which is prone to put additional downward strain on vanadium costs. In my opinion, V2O5 pentoxide costs in Europe may fall under $6 per pound by the tip of 2023 which might put severe strain on the monetary outcomes of Largo over the following few quarters.

Investor takeaway

The Maracas Menchen mine has an NPV of $2 billion based on the 2021 lifetime of mine plan which is over 7 occasions increased than Largo’s market capitalization as of the time of writing. Nonetheless, the corporate has been within the crimson for 3 consecutive quarters and it seems to be that the following few quarters are prone to be difficult as falling international metal output places strain on vanadium costs. In my opinion, that is the fallacious time to open a place and I am altering my stance on the corporate to impartial.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.