Shutthiphong Chandaeng

I had first beneficial Klaviyo because the advertising and marketing automation guru in December 2023, and proceed to charge it a purchase. I’m summarizing the principle causes for getting the inventory from the earlier article right here:

- The energy of its built-in information platform, combining buyer and advertising and marketing information.

- Shopify’s stake and strategic partnerships, which helps Klaviyo’s income development.

- A really cheap valuation at 8x gross sales with 30% development, in comparison with greater rival HubSpot’s (HUBS) 12x gross sales with 20% development.

- Robust aggressive benefits over plain vanilla e mail advertising and marketing suppliers with no complete information platform with a number of further options and choices.

- Whilst a excessive development income story, that they had a powerful emphasis on profitability and money circulate technology, with adjusted working margins of 11% and money circulate of 16%.

I’m re-iterating my purchase suggestion, This autumn-2023 earnings got here in barely above expectations, with good steerage, which confirms my thesis that Klaviyo continues to have the aggressive benefits listed above, and can proceed to develop revenues with a powerful emphasis on money technology as properly.

The earnings name revealed additional aggressive benefits of autonomous AI, a foray out of their consolation zone of e-commerce, and a spotlight and push in direction of greater purchasers needing extra advertising and marketing spend – options I’d like to focus on on this article.

This autumn-2023 and 2023 earnings inform story

Klaviyo (NYSE:KVYO) reported earnings final night, 02/27/2024, and so they had been on course with good steerage as properly for Q1-24 and FY2024. Let’s take a better look.

Klaviyo’s This autumn-2023 Earnings (Klaviyo, Searching for Alpha, Fountainhead)

Klaviyo’s 4th quarter efficiency was uniformly good, as we see from the desk above.

This autumn Income elevated 39% YoY, beating estimates by 5.4Mn or 2.7%, and full yr 2023 revenues elevated 48% to $698Mn.

This autumn non-GAAP EPS of $0.08 additionally beat estimates by a penny or 13% and full yr non-GAAP EPS got here in constructive at $0.36.

Gross income improved sooner, growing to $157Mn or 45% and full yr gross improved to 520Mn or 51%. Gross margins improved 400 foundation factors in This autumn and 200 foundation factors for the total yr.

With working leveraging kicking in, adjusted working margins changed into the inexperienced, bettering 1,700 foundation factors to 11% for the yr. Klaviyo’s founders have a historical past of bootstrapping, and clearly they didn’t let a lot go to waste. Free money circulate additionally improved considerably by 66% for the quarter to $35Mn and by a whopping $152Mn in 2023 to a constructive $110Mn or 16% of gross sales.

These are actually good numbers and for a fledgling <$1Bn firm, lower than one yr publish IPO is pretty outstanding.

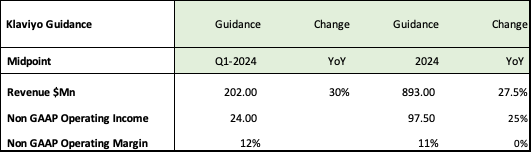

Klaviyo 2024 Steering (Searching for Alpha, Klaviyo, Fountainhead)

As we see above, steerage was additionally fairly good, with Q1 revenues rising 30% and full yr revenues anticipated to develop 27.5%. My very own estimates had a 30% Q1-growth as properly and a barely greater 28% development to $895Mn for the total yr. These are very cheap numbers and ensure their development trajectory.

Klaviyo’s non-GAAP working income will not be anticipated to develop as quick with solely 25% development, with margins remaining flat at 11% for 2024 due to greater gross sales and advertising and marketing spending.

Key takeaways from This autumn-2024 earnings name:

Tackling new anti-spam guidelines

The brand new anti-spam guidelines haven’t harm them thus far, and from the seems to be of it Klaviyo appears to be utilizing it to their benefit – as a promoting level to make their clients compliant.

As CEO and Co-founder Andrew Bialecki mentioned on the earnings name, emphasis mine.

For instance, one of many necessities is one-click unsubscribe, which we constructed into our product in January, so it’s a frictionless expertise for our clients. To offer you want a few information factors, we measure unsubscribe charges from e mail, and we’ve seen that enhance by solely 0.007%, so actually small quantity. On the patron facet, we’re additionally watching that as properly, and to date, we haven’t seen any adjustments in client conduct. After which we additionally look ahead to issues like spam charges. And whereas we don’t have good visibility into that, once we discuss to clients anecdotally, we’re not listening to of any broad adjustments within the stories of SpamPort.

The CEO emphasised that they had been really succeeding of their aim to have their clients do even much less work – as a lot of the spam compliance was being taken care of by the platform and that finally much less spam delivered to the shopper by means of a greater product with greater customized gross sales messages and fewer noise would really lead to higher revenues.

Capturing good clients

In keeping with their earnings name, Klaviyo captured 8 of the Numerator prime 10 fastest-growing CPG manufacturers and seven of Retail Dive’s prime 8 DC manufacturers. There was a aware and targeted accepted to seize bigger clients, and that cohort >$50,000 in annual income grew the quickest at 80%. And the important thing differentiating technique in profitable these clients is providing tech stack consolidation to make higher use of all their information. For example, the CEO talked about.

Throughout the quarter, we noticed a European Wax Facilities consolidate their SMS channel with their current Klaviyo e mail subscription. They’re now in a position to create unified buyer journeys throughout e mail and SMS from advertising and marketing and buyer outreach to appointment reminders and updates.

Going past e-commerce

Klaviyo’s energy is in e-commerce. E mail and SMS advertising and marketing is a cornerstone of e-commerce advertising and marketing and Klaviyo is seeing some success by getting out of its pure habitat and getting clients in new verticals. Including F45 Coaching, a health middle with 1,800 places, was a excessive level in This autumn and proof of their capability to scale past retail e-commerce. Once more, it’s the platform strategy that appears to be a key differentiator.

Synthetic Intelligence, AI, at scale for actionable options

Klaviyo took pains to handle why AI wouldn’t be only a buzz phrase. They’ve been utilizing machine studying in all elements of their enterprise; predictive AI for sending the best message on the proper time, generative AI for content material creation and what they’re calling autonomous AI for an entire seamless/friction much less technique of buyer outreach and conversion. In Andrew Bialecki’s phrases, from the This autumn-2024 earnings name, emphasis mine.

It’s not nearly AI that makes messages extra private and saves you time, it’s about empowering you to generate and refine revenue-driving concepts effortlessly. Think about a platform that not solely creates tailor-made experiences for every particular person client, however repeatedly study and adapt, refining methods for the perfect final result in a fraction of the time.

The model who will win received’t simply be utilizing one sort of synthetic intelligence. They’ll be utilizing predictive, generative and autonomous AI to avoid wasting time, executing at this time’s imaginative and prescient and constructing tomorrow’s technique.

A number of examples – a buyer Proozy, with manufacturers like Oakley and Reebok, saved 45 minutes a day in topic line creation and their SMS unsubscribe charge dropped by 20%. One other, Aura Frames saved 10 hours per week consolidating their information underneath one roof.

Progress and different working metrics stay glorious

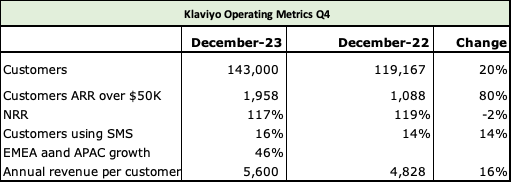

Klaviyo Working Metrics (Searching for Alpha, Klaviyo, Fountainhead)

Buyer additions got here in at 20%, a quantity that was questioned by analysts as a attainable signal of slowdown, however it’s the identical charge of development as Q3. Prospects with ARR (Annual Recurring Income) grew 80% to 1,958 clients – that’s their focus space, however Greenback Based mostly NRR (Web Retention Income) dropped 2% to 117% from 119% – administration is assured of 115% NRR wanting ahead, and so they haven’t gone beneath this charge for about 10 quarters now. There have been enhancements in SMS utilization, one other precedence with 14% development. The ARPC, (Annual Income Per Buyer) elevated 16% to five,600 one other signal of bettering fortunes. The expansion in ARPC is essential, because the unit economics of huge clients utilizing extra options on their platform is far more worthwhile in the long term.

Spend extra to earn extra, and share value be dammed.

Maybe not in these phrases, however administration did reiterate their concentrate on investing in advertising and marketing spend. From Klaviyo’s CFO, Amanda Whalen, on the earnings name, emphasis mine.

Gross sales and advertising and marketing expense was $77.3 million or 38% of income for the quarter. As we mentioned final quarter, areas we’re investing in embrace advertising and marketing program spend and gross sales headcount to develop our capability.

A few of our investments within the mid-market take a bit longer to yield than SMB investments that drive sturdy total ROI.

Based mostly on the timing of those investments, we count on to see some deleverage year-over-year in working margin within the first half of the yr as we front-load investments. We count on extra leverage within the latter a part of the yr as we head into our seasonally sturdy fourth quarter. We measure our gross sales cycles in weeks, not in months. And so these investments are likely to have a fairly good payback interval as they ramp up.

There might be quick time period ache for long run acquire, and I like their candor, focus and conviction in spending for the best causes. When your goal buyer is bigger, you want extra boots on the bottom, your gross sales cycles get longer although they’re in weeks and never months in Klaviyo’s case. They’re making ready properly for his or her greatest season, the Cyber Monday, Thanksgiving weekend, which has the utmost impression on their gross sales.

Reiterating purchase – the valuation and funding thesis stay intact

I purchased a pleasant chunk of shares on Friday morning between $26 and $27, taking full benefit of a really opportune drop.

And as I discussed in my final article, Klaviyo is in an enviable place for a startup because it doesn’t have to decide on between development and profitability with 16% of free money circulate technology, and about $739Mn money on its stability sheet. It’s frugal from its bootstrapping roots and spends money correctly. The 8-10% drop publish earnings due to working margins getting hit as a result of spending for 2 quarters is brief time period, weak conduct from the market and a godsend to choose up shares on a budget.

Long run, I’m very comfy with Searching for Alpha’s consensus and my estimates for income development from 2023 to 2026 of $698Mn to $1.4Bn or a CAGR of 26%. Administration guided to $893Mn for 2024, which is 27.5% greater and given the additional advertising and marketing spend in Q1 and Q2, and concentrate on bigger clients, that is probably a conservative estimate. Given the 20% buyer additions in 2023, and 16% greater Annual Income Per Buyer, the income estimates for 2025 and 2026 at $1.13Bn and $1.4Bn are additionally probably conservative; Klaviyo can obtain the identical development in 2025 and 2026 with 15% new clients and a ten% enhance in Annual Income Per Buyer. Their greenback based mostly NRR hasn’t crossed beneath 115% within the final 10 quarters, so I’m assured that these numbers are cheap and conservative.

At a Market Cap of $7.26Bn, that’s simply 8x 2024 gross sales of $893Mn, dropping to simply 5x 2026 gross sales of $1.4Bn. It is a cut price for a 26% grower with adjusted working margins of 11% and free money circulate margin of 16%. I consider that past 2026, Klaviyo ought to proceed to develop revenues within the low to mid-twenties and may get a gross sales a number of of no less than 8X $1.4Bn, resulting in a market cap of $11.2Bn. Closest competitor Hubspot has a income a number of of 13X with development of 18%, so I do consider Klaviyo is relatively a a lot better cut price. These projections are according to my earlier projections as properly. There are different catalysts that would assist development, in the event that they proceed to execute past e-commerce, or enhance their Web Retention Price, or enhance the variety of buyer utilizing their SMS characteristic, which continues to be very low at 16% of their buyer base. Apart from, they haven’t monetized the AI options that they spoke about, one thing I might be carefully monitoring sooner or later. The principle dangers for Klaviyo could be a) development deceleration, on condition that that is primarily a income development story, and b) I might even be carefully checking for anti-spam measures and see if that’s curbing their attain and enterprise mannequin.

Along with all causes summarized at first of this text, I additional consider that the upper advertising and marketing spend, the concentrate on bigger clients, the automated AI emphasis, and the virtues of an built-in platform are all good causes to purchase the inventory.