[ad_1]

Pgiam/iStock through Getty Pictures

Advertising and marketing automation firm, Klaviyo, Inc. (NYSE:KVYO), earned a first-day valuation of $9.2 billion, after going public this week. Klaviyo is a part of a brand new technology of corporations advancing applied sciences that search to automate work. In an period through which automation is changing into more and more vital, traders and the media have paid a substantial amount of consideration to corporations resembling Klaviyo. It’s no coincidence that it was one of many stars of the brand new IPO season, going public in the identical weeks as Instacart (CART), and Arm (ARM). But, though the agency has grown, it has to date did not earn a revenue, and an examination of its valuation exhibits that lots of its value relies on the belief of progress. This could give traders pause to assume.

The Enterprise Mannequin

Steve Jobs appreciated to explain the pc because the “bicycle of the thoughts”, increasing human capability, quite than changing people. The triumph of the pc gave approach to the Age of Software program, and this in flip is now giving approach to a special type of revolution: the automation of labor by way of clever purposes. AI is consuming the world. Equally, evangelists will argue that the impact of automation will likely be to boost human functionality, quite than substitute people, that fears of automation taking jobs fall into the “lump of labor fallacy”, and that, though complete lessons of jobs could disappear, new lessons of jobs will take their place, within the course of, enriching society.

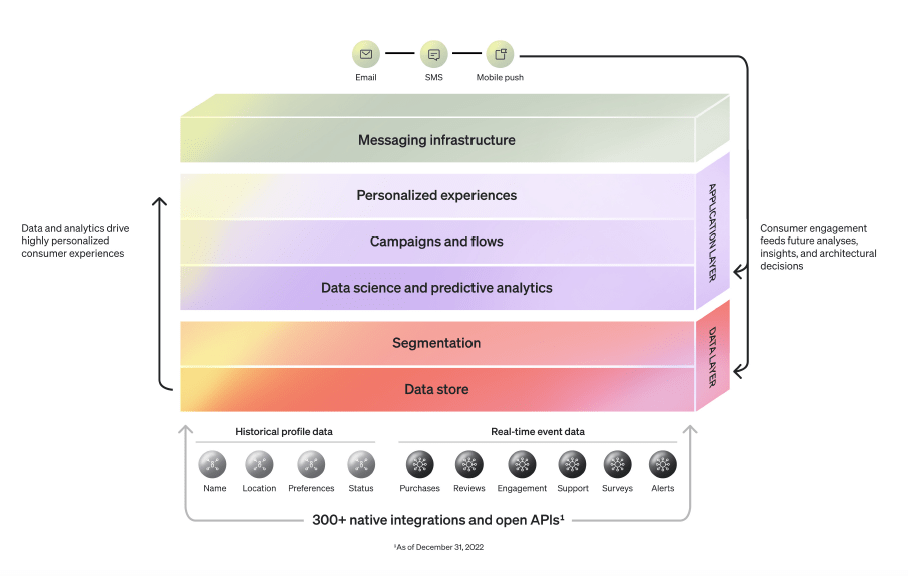

Klaviyo is a part of this new wave of automation. From a jobs-to-be-done perspective, Klaviyo seeks to assist companies enrich their buyer experiences throughout all their digital channels, whereas additionally serving to clients work by way of the AI age at a time through which third celebration knowledge is changing into much less accessible; and first-party knowledge has change into extra complicated and fewer usable. Klaviyo does this by granting subscribers entry to its SaaS platform, with its proprietary knowledge, so that every enterprise can plug in its knowledge, have it analyzed and used to make predictions that can be utilized to ship out extremely personalised messages throughout the companies numerous digital channels, enrich buyer experiences, assess buyer engagement and measure things like “Klaviyo Attributed Worth” (KAV), ie, the time-weighted income influence of messages delivered. The corporate believes that automating advertising and marketing is barely a ‘first use case” and that its software program could be prolonged to different use instances.

Supply: Klaviyo, Inc. S-1/A submitting

Klaviyo generates extra KAV for its customers than it takes when it comes to income, in that sense, exists as a platform within the Invoice Gates sense, the identical approach that Home windows is a platform, quite than within the two-sided platform sense that has change into extra standard. In 2022, the agency had generated $37 billion of KAV, towards $473 million in income. The median time to earn that KAV was 30 days, and for these clients with an annual recurring income (ARR) of greater than $50,000, KAV was generated in beneath 9 weeks.

The character of the platform signifies that the extra clients use the software program, extra buyer profiles are uploaded (6.9 billion as of June 30 this 12 months), the extra knowledge there may be, the higher the inferences, and the extra worth is generated for customers. As clients take pleasure in extra KAV, they convey extra of their enterprise to the corporate. The agency has efficiently employed this “land-and-expand technique”, attaining a web retention price (NRR) of 119% as of June 30, 2023. In line with the Bessemer Enterprise Companions “State of the Cloud 2023”, an NRR of 110-119% is “higher”, whereas the “greatest” NRR is 120% and above. The common NRR within the final 10 quarters was 118.3%. With an 88% dollar-based gross income retention price (GRR), the agency’s retention of its clients is actually very excessive.

That Klaviyo is ready to assist its clients obtain their jobs-to-be-done is evident: as Clayton Christensen stated, if a product will get the job finished, you’ll be able to cost cash for it. The query is, can Klaviyo cost sufficient to be worthwhile? Tech corporations are likely to deal with the dimensions of the chance -Klaviyo says its complete world addressable market is $68 billion-, however these figures are extremely topic to error, and even when true, the dimensions of the market isn’t as vital as Klaviyo’s capacity to show a revenue.

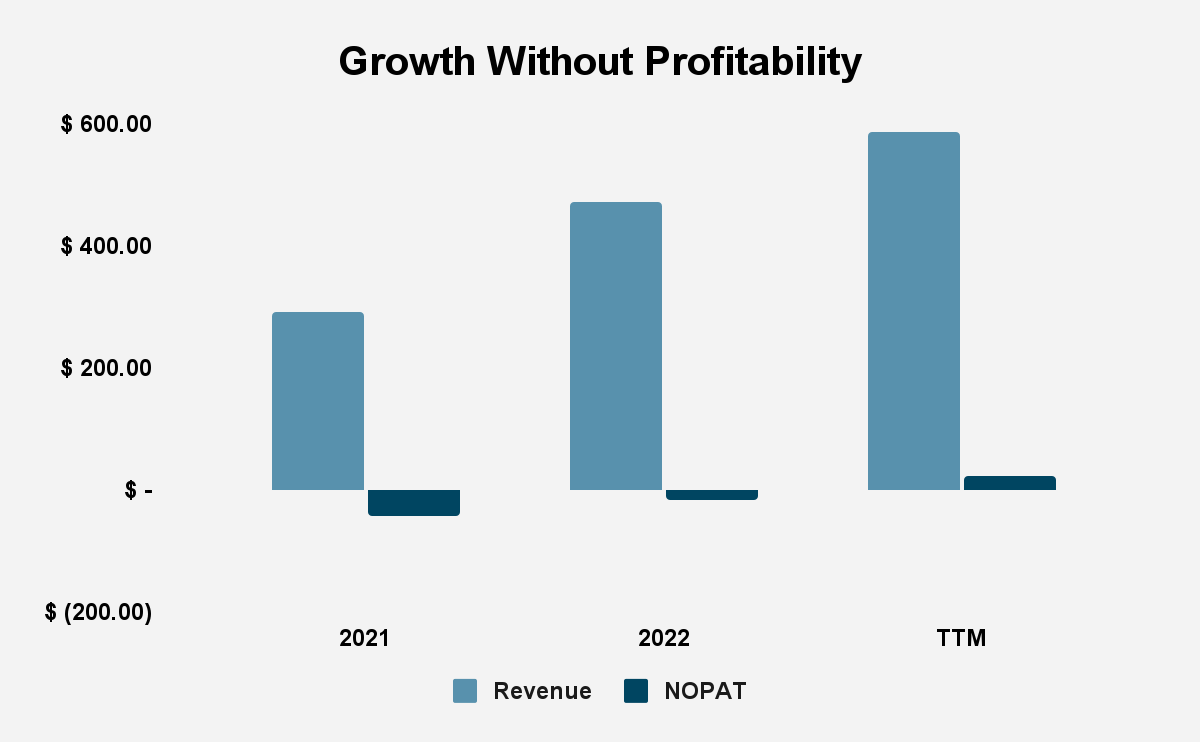

Development With out Revenue

GAAP earnings are clearly problematic, and the type of different earnings that Klaviyo advances are deeply flawed. Stripping away non-operating and non-recurring components to find out web working revenue after taxes (NOPAT), offers us a more true sense of the agency’s profitability. Klaviyo’s NOPAT has risen from -$43.62 million in 2021 to -$17.32 million in 2022. Estimating NOPAT for the trailing twelve months (TTM) interval through the use of a 2-year common for working money taxes, offers us a TTM revenue of $22.11 million, pushed purely by tax results.

|

NOPAT |

|||

|

Financial Class (Values in 1000’s besides per share quantities) |

2021 |

2022 |

LTM |

|

Income |

$ 290.64 |

$ 472.75 |

$ 585.08 |

|

Working Bills |

|||

|

Value of income |

$ 84.70 |

$ 128.03 |

$ 144.00 |

|

Gross Revenue |

$ 205.94 |

$ 344.72 |

$ 441.08 |

|

Gross Margin |

70.86% |

72.92% |

75.39% |

|

Analysis and improvement |

$ 65.60 |

$ 104.08 |

$ 126.90 |

|

Promoting and advertising and marketing |

$ 156.34 |

$ 213.85 |

$ 245.90 |

|

Normal and administrative |

$ 63.24 |

$ 81.83 |

$ 90.12 |

|

Whole Working Expense |

$ 369.87 |

$ 527.78 |

$ 606.92 |

|

Whole Hidden Non-Working Expense, Internet |

$ – |

$ – |

$ 7.37 |

|

Hidden Whole Restructuring Bills, Internet |

$ – |

$ – |

$ 7.37 |

|

$ – |

$ – |

$ 7.37 |

|

|

$ – |

$ – |

$ 0.01 |

|

|

$ – |

$ – |

$ – |

|

|

Hidden International Foreign money Bills, Internet |

$ – |

$ – |

$ – |

|

Hidden Different Actual Property Owned Bills, Internet |

$ – |

$ – |

$ – |

|

Hidden Acquisition and Merger Bills, Internet |

$ – |

$ – |

$ – |

|

Hidden Authorized, Regulatory, and Insurance coverage Bills, Internet |

$ – |

$ – |

$ – |

|

Hidden By-product Associated Bills, Internet |

$ – |

$ – |

$ – |

|

Hidden Different Financing Bills, Internet |

$ – |

$ – |

$ – |

|

Hidden Different Non-Recurring Bills, Internet |

$ – |

$ – |

$ – |

|

Hidden Recurring Pension Bills, Internet |

$ – |

$ – |

$ – |

|

Hidden Non-Recurring Pension Bills, Internet |

$ – |

$ – |

$ – |

|

Hidden Firm Outlined Different Bills, Internet |

$ – |

$ – |

$ – |

|

Adjusted Whole Working Bills |

$ 369.87 |

$ 527.78 |

$ 599.55 |

|

Adjusted EBIT/EBT |

$ (79.23) |

$ (55.04) |

$ (14.47) |

|

Adjusted EBITA/EBTA |

$ (79.23) |

$ (55.04) |

$ (14.47) |

|

Curiosity for PV of Working Leases |

$ 3.25 |

$ 3.03 |

$ 3.05 |

|

Core Earnings, or Internet Working Revenue Earlier than Tax (NOPBT) |

$ (75.99) |

$ (52.01) |

$ (11.42) |

|

Working money taxes |

$ (32.37) |

$ (34.69) |

$ (33.53) |

|

NOPAT |

$ (43.62) |

$ (17.32) |

$ 22.11 |

Supply: Creator Calculations

Given the challenges of estimating tax charges of corporations of which we’ve restricted knowledge, not an excessive amount of must be fabricated from the TTM NOPAT and extra consideration must be paid to the core earnings pattern. Core earnings, or web working taxes earlier than revenue (NOPBT), do present an upward trajectory for earnings, with core earnings rising from -$75.99 million in 2021, to -$52.01 million in 2022, to -$11.42 million within the TTM interval.

Supply: Firm Filings; Creator Calculations

With rising profitability, returns on invested capital (ROIC) have additionally risen, from -48% in 2021 to round -15% in 2022. Taking with a big pinch of salt our estimation of TTM NOPAT, ROIC within the TTM interval is round 20%.

Valuation

Given the uncertainty across the future tax place of the corporate, I suggest a really conservative approach of taking a look at its worth, stripped from any tax influence. The reader is inspired to take a look at alternative routes of resolving the issue. Ranging from core earnings, we will create a easy mannequin of the agency’s zero-growth worth, which supplies us a pessimistic evaluation of what the worth of the enterprise is. In that state of affairs, the zero-growth worth per share of the agency is $8.93 per share. That is an attention-grabbing train, though this conclusion is determined by the low cost worth you utilize, whether or not you utilize a goal price, as I’ve finished, WACC, as is the style, or APV or another method, and likewise on the way you worth the agency’s worker inventory choices (ESO). What the reader will come away with is a way of simply how a lot of the inventory value is pushed by expectations of Klaviyo’s progress prospects, quite than on the core earnings of the enterprise.

|

Zero-Development Worth |

|||

|

2021 |

2022 |

TTM |

|

|

Core earnings |

$ (75.99) |

$ (52.01) |

$ (11.42) |

|

Discounted worth |

8.00% |

8.00% |

8.00% |

|

NOPAT/Low cost worth |

$ (949.84) |

$ (650.08) |

$ (142.80) |

|

Adjusted complete debt (together with off-balance sheet debt) |

$ 65.47 |

$ 62.41 |

$ 62.41 |

|

Extra money |

$ 313.38 |

$ 362.59 |

$ 409.88 |

|

Unconsolidated Subsidiary Property |

$ – |

$ – |

|

|

Internet Property from Discontinued operations |

$ – |

$ – |

|

|

Worth of Excellent Worker inventory choice liabilities |

$ 33.10 |

$ 33.17 |

$ 33.20 |

|

Beneath (Over) funded Pensions |

$ – |

$ – |

$ – |

|

Most well-liked inventory |

$ – |

$ – |

$ – |

|

Minority pursuits |

$ – |

$ – |

$ – |

|

Internet deferred compensation property |

$ – |

$ – |

$ – |

|

Internet deferred tax property |

$ – |

$ – |

$ – |

|

Zero-Development Worth |

$ (735.03) |

$ (383.07) |

$ 171.47 |

|

Value to-date per share |

$ 33.70 |

$ 33.70 |

$ 33.70 |

|

Excellent shares |

$ 19.20 |

$ 19.20 |

$ 19.20 |

|

ZGV per share |

$ (38.28) |

$ (19.95) |

$ 8.93 |

Supply: Creator Calculations

Conclusion

Klaviyo is a part of a brand new wave within the transformation of the character of labor: the automation of labor. The agency seeks to automate advertising and marketing and transfer from there to different use instances. Regardless of the thrill of the sector, it’s price noting that the underlying enterprise has to date did not generate any income. Certainly, considering by way of how the agency is valued exhibits simply how a lot of its value relies on the belief of progress. If that progress fails to materialize, the value has a steep fall forward of it.

[ad_2]

Source link