Thomas Demarczyk/E+ through Getty Photographs

It has been a busy Q3 to date for the dear metals sector, with two sizeable acquisitions by First Majestic Silver Corp. (AG) and Gold Fields Restricted (GFI). In the meantime, we have seen a number of financial research launched by builders and producers, highlighting strong mission economics even at comparatively conservative metals value assumptions. One firm that just lately launched a much-awaited PEA was Kinross Gold Company (NYSE:KGC) at its Nice Bear Challenge in Canada, and it is also simply come off reporting vital margin growth in H1-24 with possible even stronger H2-24 monetary outcomes on deck.

On this replace, we’ll dig into the corporate’s Q2 24 outcomes, current developments, and the way Kinross’ valuation stacks up relative to friends after a 12 months of outperformance.

Bald Mountain Mine – Kinross Gold Video, Jeff Dow Pictures

All figures are in United States {Dollars} until in any other case famous. G/T = grams per tonne (of gold or silver). GEOs = gold-equivalent ounces. AISC refers to all-in sustaining prices. LOMP = lifetime of mine plan.

Q2 Manufacturing & Gross sales

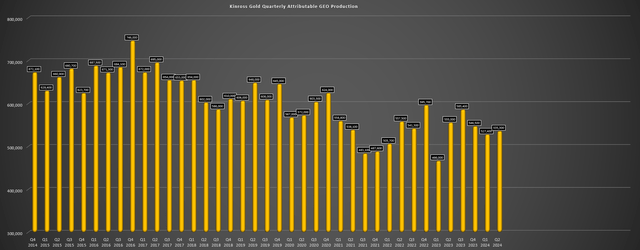

Kinross launched its Q2-24 leads to late July, reporting quarterly manufacturing of ~535,300 GEOs, a 4% decline from the year-ago interval. The corporate’s decrease manufacturing was associated to a pointy decline in output at Paracatu, its #2 asset by scale, partially offset by larger manufacturing from its Nevada mines and a slight improve in output at Tasiast. Thankfully, decrease manufacturing was greater than offset by a file common realized gold value of $2,342/oz. This allowed Kinross to take pleasure in a 12% improve in quarterly income to ~$1.22 billion, a 14% improve in working money circulate to ~$604 million, and a marginal improve in adjusted earnings ($174.7 million vs. $167.6 million or US$0.14 vs. $0.14 on a per share foundation). Let’s dig into the outcomes a bit of nearer:

Kinross Quarterly GEO Manufacturing – Firm Filings, Creator’s Chart

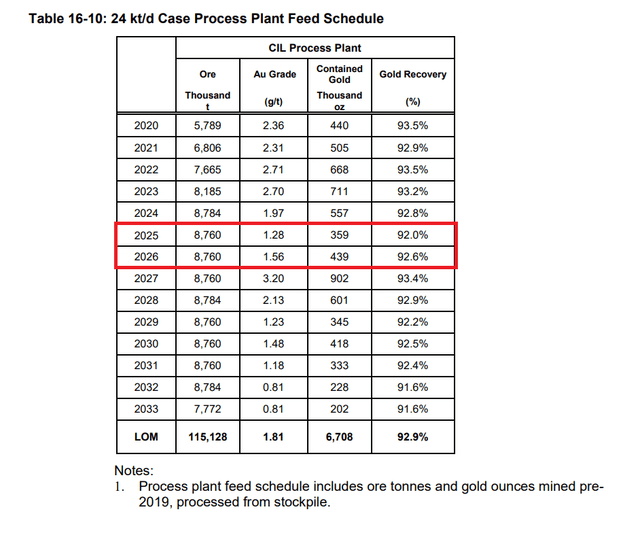

Beginning with Kinross’ largest and highest-margin operation, Tasiast produced ~161,600 ounces vs. ~157,800 ounces on the again of upper throughput associated to its 24k Enlargement (Q2-24: 2.16 million tonnes processed at 2.7 G/T of gold. The upper manufacturing was regardless of lapping tough year-over-year comps from a grade standpoint (Q2-23: 3.25 G/T of gold), and helped to take care of the operation’s strong value profile of $656/ozproduction value of gross sales vs. $652/ozin Q2-23). That stated, we’re prone to see a dip in grades and recoveries in 2025/2026 in line with the 2019 TR, pointing to larger unit prices at this asset subsequent 12 months.

Tasiast Operations – Google Earth Tasiast Grade Profile – 2019 TR

Shifting over to Paracatu, Kinross noticed a 21% decline in manufacturing year-over-year, with manufacturing value of gross sales rising to $1,039/ozvs. $825/ozwithin the year-ago interval. The decrease manufacturing was largely attributable to lapping tough year-over-year comparisons, with the mine delivering a large quarter in Q2-23 with ~164,200 ounces produced. Kinross famous that the decrease grades in Q2-24 (0.35 G/T of gold vs. 0.42 G/T of gold in Q2-23) have been associated to the mining sequence and shifting by way of lower-grade parts of the pit. On a constructive observe, grades are anticipated to select up by the top of this 12 months and the asset stays on monitor to satisfy steerage of 510,000 ounces with over 258,000 ounces produced year-to-date.

Fort Knox Operations – Firm Web site

Taking a look at Kinross’ Alaska operations, Fort Knox loved barely larger manufacturing year-over-year albeit at larger unit ($1,345/ozvs. $1,146/oz), producing ~69,900 ounces vs. ~69,400 ounces within the year-ago interval. Nonetheless, we should always see a fabric improve in manufacturing to 400,000+ ounces subsequent 12 months with the good thing about higher-grade ore from Manh Choh (70% Kinross-owned) which poured its first gold in July and carries a lot larger grades at 7.9 G/T of gold.

As for Kinross’ Nevada operations, the corporate had a greater quarter year-over-year with a mixed manufacturing of ~107,700 ounces (Q2-23: ~96,800 ounces) from its Bald Mountain and Spherical Mountain mines. Lastly, La Coipa could have seen decrease manufacturing year-over-year at ~65,900 ounces (Q2-23: ~66,700 ounces) on the again of decrease throughput and decrease silver grades/recoveries. Regardless of the marginally decrease output year-over-year, La Coipa continued to contribute significant low-cost ounces and Kinross famous that mill upkeep is underway to work on enhancing plant reliability.

La Coipa Mine – Firm Video

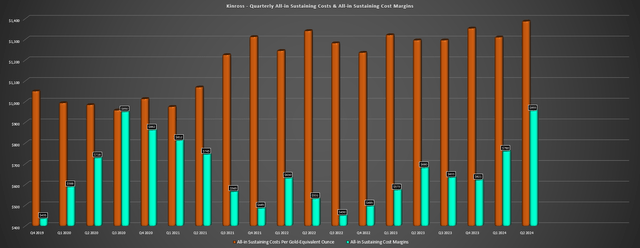

Prices & Margins

Shifting over to prices and margins, Kinross reported larger unit prices in Q2-24 on a year-over-year foundation, reporting all-in sustaining prices [AISC] of $1,387/ozvs. $1,296/ozwithin the year-ago interval. The corporate referred to as out larger contractor and labor prices at Fort Knox (Alaska), with larger royalties. We additionally noticed an influence from fewer ounces bought and better G&A, partially offset by barely decrease sustaining capital ($116.5 million vs. $148.6 million), with a lot decrease sustaining spend at La Coipa, Bald Mountain, and Spherical Mountain.

Thankfully, the upper gold value picked up all of the slack to offset the 7% improve in prices, with Kinross’ AISC margins leaping 40% to $955/oz (40.8%) vs. $680/oz (34.4%) within the year-ago interval.

Kinross Quarterly AISC & AISC Margins – Firm Filings, Creator’s Chart

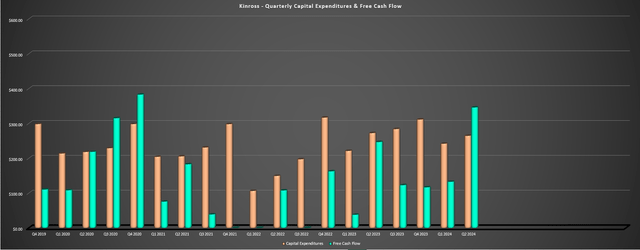

Given the numerous enchancment in margins and barely decrease attributable capex within the interval, free money circulate surged 34% to $345.9 million, up from $258.3 million in Q2-23. This has helped Kinross to proceed paying off debt with $200 million in debt repaid, and its internet debt place lowered to ~$1.55 billion, with $480 million in money and money equivalents at quarter-end.

Kinross Quarterly Attributable Capex & Free Money Movement – Firm Filings, Creator’s Chart

Latest Developments

Eagle Mine Incident & Kinross’ Heap-Leach Services

Given the 2 tragic heap-leach failures this 12 months, some buyers is likely to be a bit of nervous about proudly owning Kinross’ inventory with a number of heap-leach operations in its portfolio. Nonetheless, Kinross said in its name that’s fairly assured within the integrity of those belongings, as identified under. Two advantages embrace superior topography for Bald and Spherical Mountain with them not constructed on hillsides or valley fills and the truth that Fort Knox and Bald Mountain are run-of-mine operations, with further commentary under:

We’re assured within the high quality and security of our heap leach amenities for a number of causes. First off, our amenities are primarily run-of-mine heap leach pads, which means they’ve bigger rocks and crushed heap leach pads, which considerably reduces the chance of liquefaction and will increase the structural stability of the pads. The one heap leach we’ve with crushing is Spherical Mountain, the place we’re solely crushing a portion of the ore we’re inserting on the pads. So general, we nonetheless have bigger rock sizing and a totally crushed pad.

Second, topography. Each Spherical and Bald Mountain are constructed on comparatively stage floor quite than hillsides or valley fills, rising their stability. Fort Knox is our solely valley-fill heap leach operation. And once more, the 2 pads there are 100% run-of-mine ore. Lastly, it is usually value noting that the embedment of the toe of the valley pads at Fort Knox is designed, engineered, operated, and monitored as dams primarily based on state regulation in Alaska, which ensures robust governance on building and stability.

– Kinross Gold Q2-24 Convention Name (emphasis added).

Capital Allocation

Shifting to capital allocation, Kinross famous that its focus continues to be on its time period mortgage due in March 2025. It additional famous that it’s not pressured to do any M&A however that it will contemplate one thing if it made sense. Given the inventory’s robust foreign money and comparatively flat manufacturing profile searching to the top of the last decade, I actually would not rule out an acquisition. Nonetheless, Kinross has a strong pipeline with optionality in Lobo-Marte, a mission that is coming collectively properly at Curlew, Spherical Mountain Section X wanting higher with every set of recent drill outcomes, and naturally, the huge Nice Bear Challenge in Purple Lake, Ontario. It might doubtlessly start industrial manufacturing by H2-2030.

“I imply we’re in nice form with our natural portfolio. We have plenty of alternatives inside our portfolio that we will activate and we will likely be trying to additional advance research and economics. In order that’s one bit of excellent information. The portfolio itself. We have a wonderful stability sheet. We’re actually not underneath any stress to do something in that regard.

So after we take into consideration M&A, it is actually while you use the phrase opportunistic, it is the place might we see worth, the place can we add worth? And once more, I might say we’ve a really robust technical acumen. We will convey that technical acumen to bear to assist flip issues round to assist enhance. We even have a wonderful stability sheet. And so we will convey capital to the equation. So not underneath any stress, if one thing got here alongside that made sense the place we thought we might create worth for our shareholders, we might take a look at it.”

– Kinross Gold Q2-24 Convention Name.

Spherical Mountain

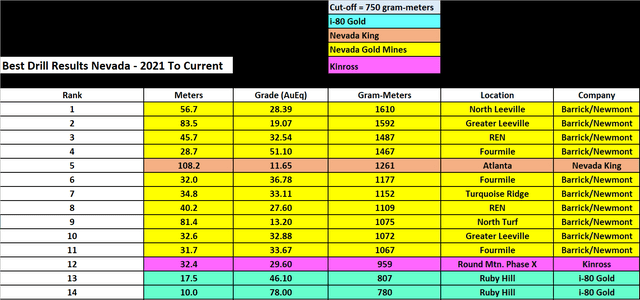

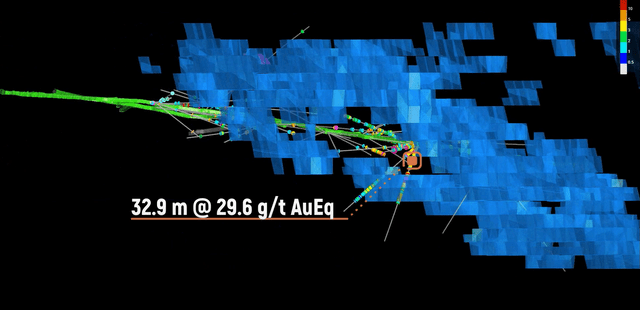

Taking a short have a look at Spherical Mountain, Kinross famous that 2.2 kilometers of growth had been accomplished on its exploration decline and that Section S stays on plan, with stripping underway and manufacturing anticipated subsequent 12 months. Nonetheless, the true spotlight from the quarter at Spherical Mountain was a particularly spectacular intercept of 32.4 meters at 29.6 G/T of gold, making it a top-12 intercept drilled in Nevada over the previous 4 years on a gram-meter foundation. An animation is proven under along with the most effective intercepts over the previous a number of years in Nevada. This clearly is a really strong intercept outdoors the primary exploration goal and effectively above common grades at Section X to this point.

Kinross had the next to say, which may be very encouraging and suggests the potential for this to be a significant contributor as soon as totally developed with bulk mining potential:

“These outcomes display the potential for growth of the first useful resource goal and are anticipated to help excessive productiveness bulk mining.”

– Kinross Gold, Q2-24 Convention Name (emphasis added).

Finest Drill Leads to Nevada (Gold-Equal Grade) – 2021 to Present Spherical Mountain Section X – Firm Video

Nice Bear

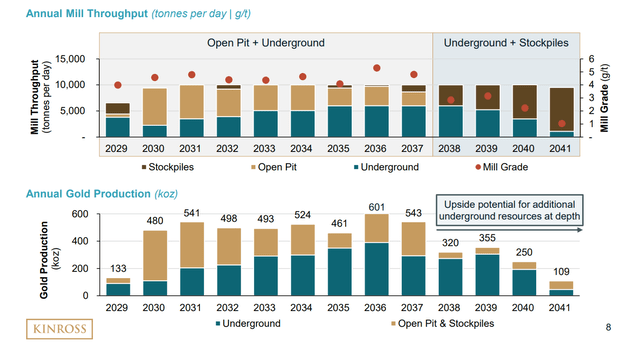

Lastly, shifting over to the most important information of Q3, Kinross launched a Preliminary Financial Evaluation [PEA] for its Nice Bear Challenge in Ontario, Canada. The outcomes of this examine actually delivered with the examine envisioning an open-pit and underground operation that may run concurrently that would produce ~430,000 ounces each year on common with manufacturing of ~518,000 ounces each year in its first eight years. Notably, that is anticipated to be achieved with a really modest throughput and general footprint of 10,000 tonnes per day, lending to its industry-leading open-pit grades of ~3.0 G/T of gold and common feed grade of three.87 G/T of gold (open-pit and underground).

Kinross famous that it selected a modest plant measurement to keep away from over-sizing the mill for an underground-only state of affairs within the latter portion of the mine life. It additionally shared that the mission is kind of straight-forward with a high-grade open pit at a 6.7/1.0 strip, clear metallurgy with no deleterious parts primarily based on work to this point, and underground mining using long-hole open stoping with paste backfill and cemented backfill.

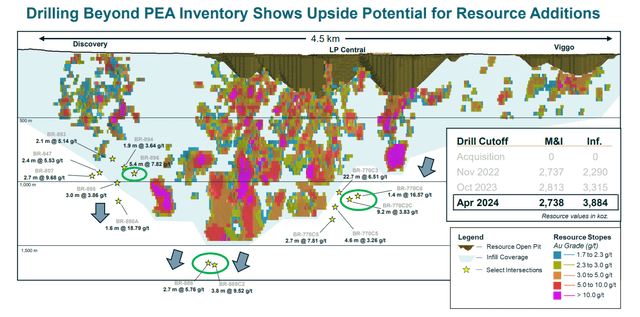

Because it stands, first stope manufacturing is predicted in 2029 topic to permits, and we noticed a slight bump within the general useful resource to ~6.6 million ounces of gold (~42% measured and indicated). Nonetheless, I finally wouldn’t be stunned to see this asset develop to 10-13 million ounces of assets and help a 7.5+ million ounce reserve base or 16 years at 460,000+ ounces each year on common as soon as optimized.

Nice Bear Challenge Mill Throughput & Potential Annual Manufacturing Profile – Kinross Gold Web site

Digging into the economics a bit of nearer, Kinross had initially said in 2021 on the time of its acquisition that it noticed an upside to get preliminary capex underneath the $1.0 billion determine, however capex did are available in fairly a bit larger at ~$1.43 billion ($1,181 million upfront building capital and $248 million of capitalized mine growth). And even when we apply a 20% improve to preliminary capex for conservatism as main building is unlikely to start out for at the very least three years and a 5% improve to estimated capitalized mine growth, upfront capex would nonetheless are available in at ~$1.67 billion.

It is a very manageable capex invoice for Kinross to cowl, with it producing ~$700 million in free money circulate each year. That is even utilizing conservative gold value assumptions (~$2,300/oz) and the current gold value energy serving to the corporate to quickly de-lever forward effectively upfront of main building. Lastly, wanting on the Nice Bear Challenge’s anticipated value profile and IRR, the asset is predicted to take pleasure in industry-leading LOM AISC under $850/oz ($1,000/ozif baking in conservatism provided that we’re at the very least six years from industrial manufacturing) and a 24% IRR at $1,900/ozgold and an NPV (5%) of $1.9 billion.

If we improve the gold value outlook to $2,150/ozto nonetheless be conservative however above what’s a far too low base case of $1,900/ozgold and bake in further conservatism on prices and capex, Nice Bear’s NPV (5%) is available in nearer to ~$2.3 billion at $2,150/oz. That is effectively above ~$1.46 billion paid for the asset. Nonetheless, as highlighted under, we proceed to see phenomenal grades at a number of zones outdoors present assets and at depth, with the deepest gap to this point hitting 3.8 meters at 9.52 G/T of gold. Therefore, as famous beforehand, I might not be stunned to see mine life extension and better annual manufacturing (~460,000? vs. 431,000 ounces) by the point this asset begins manufacturing on a post-2028 examine with the mine plan optimized and a a lot bigger useful resource.

Nice Bear Drill Highlights – Firm Web site

Lastly, it’s value declaring that Kinross plans to construct a state-of-the-art facility with a desulfurization flotation circuit to take away sulfides and render tailings non-acid producing. It additionally plans to make use of in-pit tailings, pulling ahead mining on the a lot smaller Viggo Pit. This actually contributed to the upper capex, however makes for a lower-risk operation from an environmental standpoint on the territories of the Lac Seul and Wabauskang First Nations companions.

General, I used to be anticipating a minimal $2.2 billion NPV (5%) at Nice Bear, so this didn’t make a lot of a distinction when it comes to my valuation.

Valuation

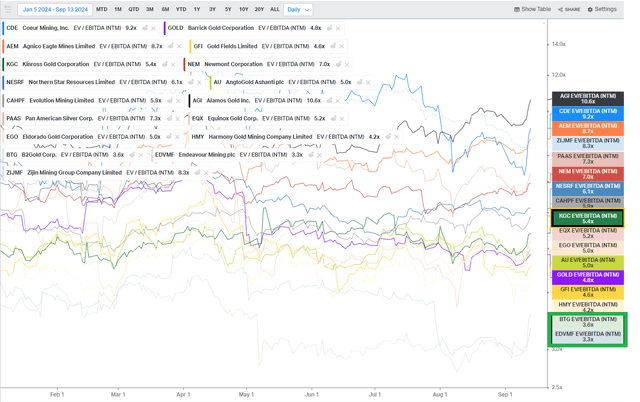

Primarily based on ~1,235 million shares and a share value of US$9.70, Kinross trades at a market cap of ~$12.0 billion and an enterprise worth of ~$13.6 billion. This continues to go away Kinross in the course of the pack from an EV/EBITDA a number of standpoint vs. its million-ounce producer friends. It’s pricier than these with African publicity that proceed to commerce at extraordinarily engaging multiples, however a deserved low cost to the biggest gold producer sector-wide given Kinross’ inferior scale and diversification.

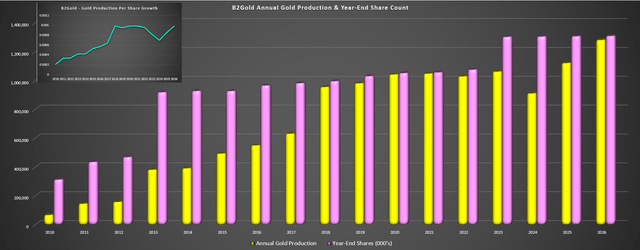

And as I famous in my earlier replace in July, I proceed to see B2Gold Corp. (BTG) because the way more engaging choice. It’s buying and selling at its lowest a number of in years with a much more supportive sentiment backdrop for larger costs (B2Gold is arguably as hated as Kinross was when it made a serious backside in 2022) and trades at lower than 5x FY2026 EV/FCF estimates vs. Kinross Gold at over 14x FY2026 EV/FCF estimates at present.

Kinross Gold July 2022 Replace – Searching for Alpha PRO Kinross Gold EV/EBITDA A number of vs. Friends – Koyfin

So, what’s a good worth for the inventory?

Utilizing what I consider to be truthful multiples of 1.1x P/NAV and eight.0x FY2025 P/CF estimates and a 65/35 weighting to P/NAV vs. P/CF, I see an up to date truthful worth for Kinross of US$9.60. This factors to zero upside from present ranges, suggesting that Kinross is extra reliant on larger gold costs than its friends, with it already having re-rated considerably over the previous couple of years. Clearly, I might be fallacious. The inventory might proceed to development larger if the gold value stays above $2,500/ozor continues to soften up. Nonetheless, I do not see any technique to justify paying up for the inventory at present ranges. That is very true contemplating vital relative worth alternatives elsewhere. These embrace B2Gold at simply over one-fourth of Kinross’ enterprise worth with a much better monitor file of per share progress, a superior progress profile within the 2024-2026 interval and the Fekola worries just lately being lifted.

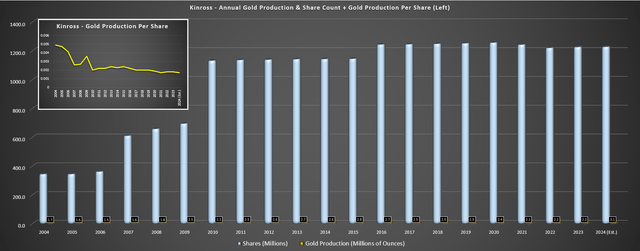

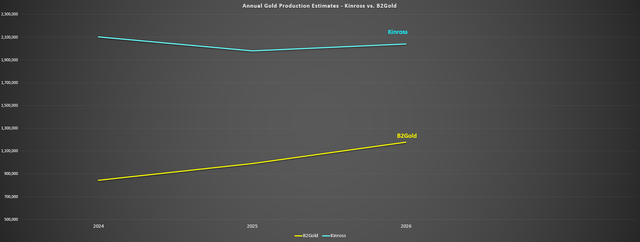

Kinross Annual Gold Manufacturing Per Share – Firm Filings, Creator’s Chart & Estimates B2Gold Annual Gold Manufacturing & Share Rely + Gold Manufacturing Per Share – Firm Filings, Creator’s Chart & Estimates Kinross vs. B2Gold Estimated Manufacturing Profile (2024-2026) – Firm FIlings, Creator’s Chart & Estimates

Technical Image & Abstract

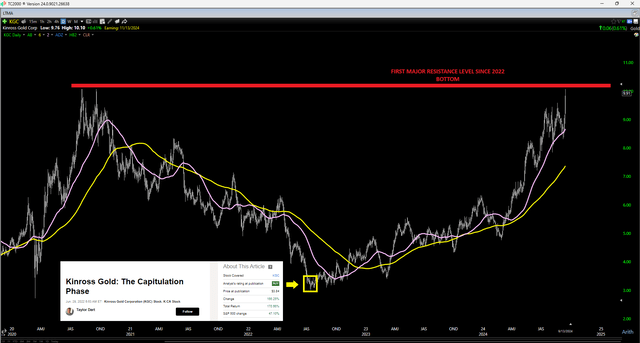

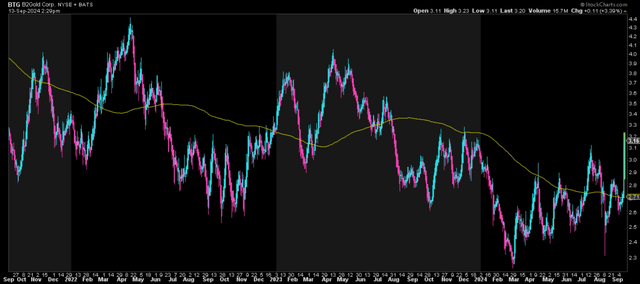

As for the technical image, B2Gold and Kinross couldn’t be extra dissimilar. In Kinross’ case, the inventory is tagging its first key resistance stage close to US$10.00 after making a serious rounded backside two years in the past close to US$3.00 per share. In the meantime, B2Gold is simply rising from a 9-month base and has lastly hopped again above its 200-day shifting common, suggesting a superior reward/danger outlook for BTG vs. KGC from each a technical and valuation standpoint.

Kinross Gold 2022 Backside & Purchase Ranking, Weekly Chart – Worden, Searching for Alpha Premium/PRO BTG Every day Chart – StockCharts.com

Kinross has actually outperformed year-to-date, however it’s now turn out to be a momentum play, not a price play, which is okay, however it does carry larger danger. In my opinion, I believe the far superior setup is momentum and worth. That is the case for names like B2Gold at present, which is lastly again above a rising 200-day shifting common and trades on the lowest FY2026 EV/FCF a number of amongst its million-ounce producer friends.

To summarize, I proceed to see Kinross Gold Company as one of many least engaging methods to place capital to work within the sector at present, with its strong operational momentum and an improved pipeline already largely priced into the inventory. Therefore, if I have been trying to put capital to work within the sector, two concepts that I see as superior setups can be B2Gold within the mid-cap area and Vox Royalty Corp. (VOXR) within the smaller-cap area.