[ad_1]

gorodenkoff/iStock via Getty Images

Company Overview

Karooooo Ltd. (NASDAQ:KARO) is a full-fledged smart mobility platform for online automobiles that was initially launched in South Africa to assist with the recovery of stolen vehicles. With its Software-as-a-Service [SaaS] architecture, Karooooo maximises the value of data collected from tracking and monitoring mobile assets.

From the initial idea to the final product, KARO has full creative and operational control over its intelligent hardware, platforms, software, and support for its customers. The system acts as the central nervous system for a fleet of connected vehicles, allowing managers to keep tabs on every vehicle in the fleet from one convenient location. When it comes to helping their customers, KARO says their product excels in the areas of effectiveness, productivity, longevity, and regulation compliance.

We know that the digitally transform business does not happen overnight. So we partner with our customers to take them through different stages of building their business.

Zak Calisto, CEO

Company Presentation

The company operates in South Africa, the rest of Africa, Europe, Asia/Pacific/Middle East/USA, and the United States. Africa-Other consists of Mozambique, Tanzania, Kenya, Namibia, Nigeria, Botswana, Malawi, Rwanda, Eswatini, and Zimbabwe. European Union’s Europe section consists of Portugal, Poland, and Spain. The Asia-Pacific, Middle East, and USA region consists of Singapore, Thailand, the Philippines, Hong Kong, Malaysia, Indonesia, the United Arab Emirates [UAE], New Zealand, and the United States. On May 19, 2018, the Singaporean company officially opened for business.

Company Presentation

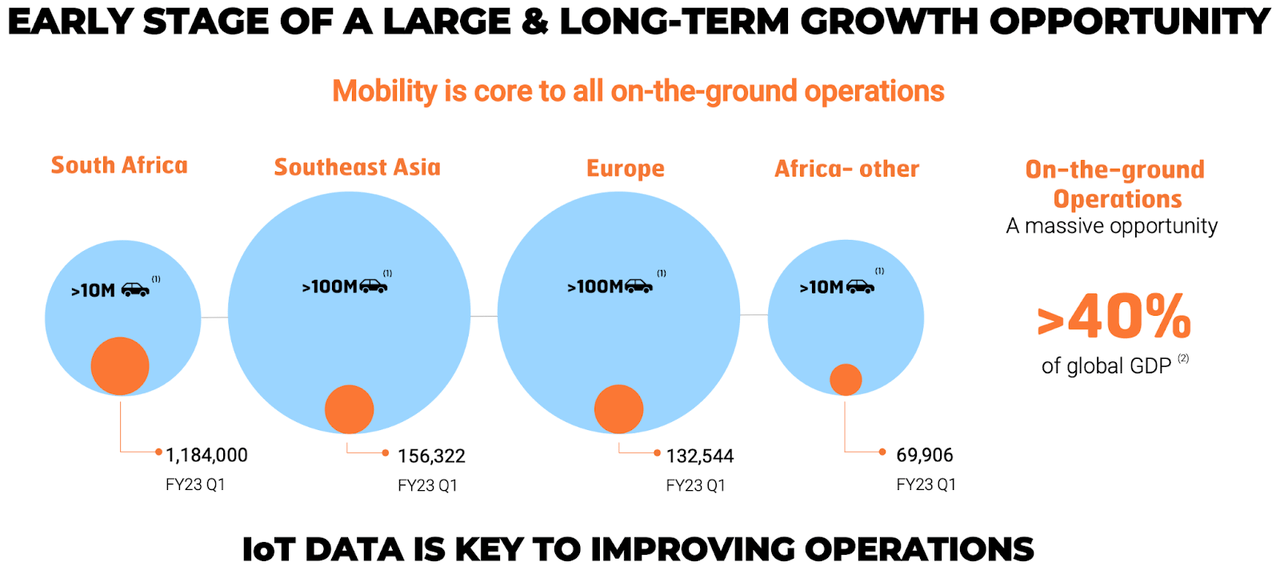

There is a large total addressable market opportunity for Karooooo, as they are a frontrunner in this industry. Considering the company’s significant growth potential, it’s easy to see why the CEO is so confident in their future capabilities. Management is always trying out new ideas and methods. The company, according to CEO Zak Calisto, is interested in more than just connected cars. Carzuka, its new line of business, is an online marketplace for buying and selling automobiles that will revolutionise the used-car market by facilitating the marketing, purchasing, selling, financing, and insuring of automobiles with complete telemetry data.

Company Presentation

Karo is in a unique position due to the nature of the software that the business operates, which allows Karo to see and analyse billions of data points on a multitude of industries. This information and knowledge can prove to be vital to the continued growth of Karo.

We have a very diverse customer base, ranging from consumers to small, medium, large enterprises. We understand that all these businesses are very different, given that they operate in different industries with different types of active vehicles at 3 different operations… And given that all the data that we collect through the app on different industries and there are billions of data points we collect on a monthly basis. This allows us to take knowledge to give business intelligence reports that learnings that we’ve had from one country or one industry and help assist other companies, and it’s been able to gather all this data and to understand that every customer is his own challenges. And putting this all together is really what we do to be able to help our customers digitally transform their operations.

Zak Calisto, CEO

Company Presentation

Financial State Of The Company

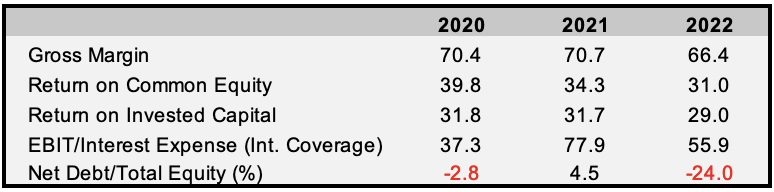

Despite a healthy operating margin, Karo hasn’t been able to return to the 70% gross profit margins it enjoyed before inflation was re-inflationary. To weather the inflationary storm, however, Karo has kept an exponential return on invested capital throughout this time. Debt reduction efforts have continued apace under management, resulting in -$33.43 million net debt as of the start of the fiscal year 2022.

FactSet, Author’s Work

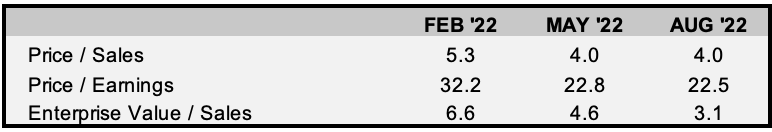

In 2022, Karo’s stock price has fallen in tandem with the market. Because of this decline, valuation multiples for Karo are once again in line with the company’s actual growth prospects. A newfound emphasis on supply chain management is likely to cement Karo’s position as a market leader if the company is successful in further increasing their significance to the day-to-day processes of major institutions and SMBs.

FactSet, Author’s Work

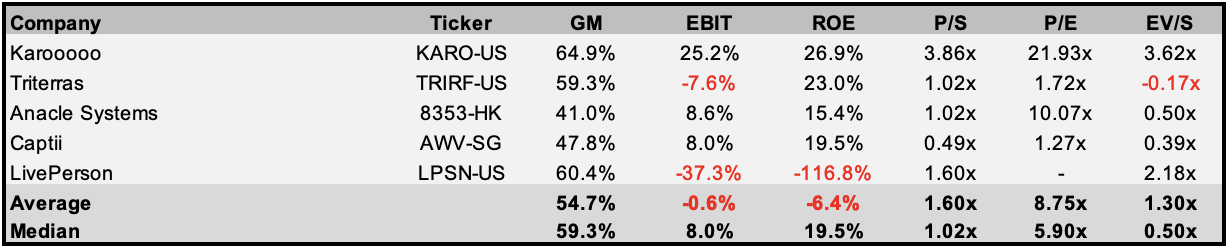

Karo exhibits a significant premium to the median price and EV multiple compared to many of its software service provider peers. The growth curve and the business model are additional contexts in which this must be viewed. As can be seen in the table below, Karo has the largest gross income and operating margins compared to its competitors. This, along with a significant premium in ROE and ROIC, justifies the high valuation.

FactSet, Author’s Work

Final Thoughts

Karo exhibits the characteristics of a company that is on pace for continued growth in the long term. Karo can be viewed as a thematic play on the continued growth in supply chain management expenditure due to COVID. The financial state of the balance sheet and the resilience in ROE and ROIC are significant pillars in risk reduction. Karo is a long term buy for us and does exhibit a medium level of risk that is attributed to failure to materialise the relationships and data collected on these companies and industries.

[ad_2]

Source link