[ad_1]

Michael Nagle

Thesis

On this article, I’ll conduct a comparability amongst JPMorgan Chase & Co. (JPM), Financial institution of America Company (BAC), and Wells Fargo & Firm (WFC). The valuation of the three largest U.S. banks reveals that JPMorgan is poised to outperform the opposite two, boasting a good value per share of roughly $314.74. This determine represents an 85% enhance from the present inventory value of $170. The mannequin suggests a future value for JPMorgan at $545.20, translating into a powerful annual return of 44.1%.

Conversely, the opposite two banks, based mostly on their respective valuations, are deemed pretty valued. Financial institution of America might doubtlessly yield annual returns of 20.6%, whereas Wells Fargo would possibly ship 18.3%. Given these issues, I advocate for a “sturdy purchase” score on JPMorgan, whereas suggesting a “purchase” for the others.

Overview

Enterprise

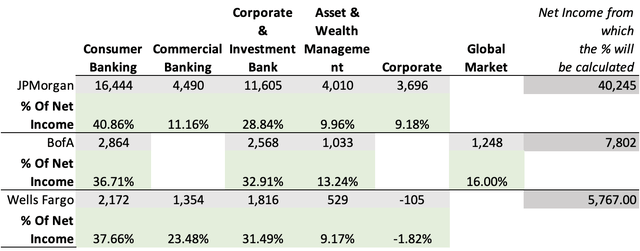

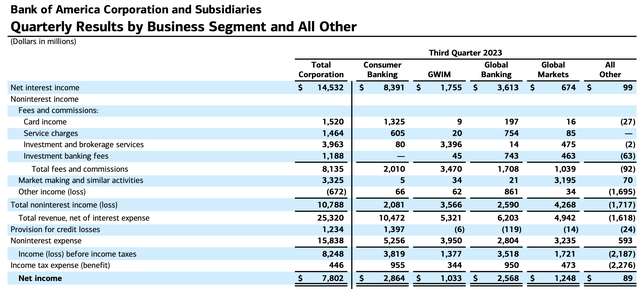

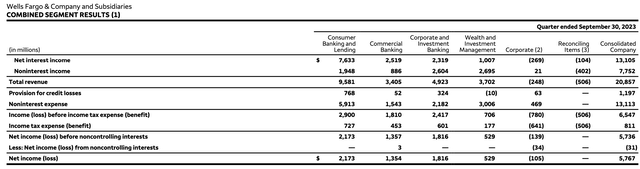

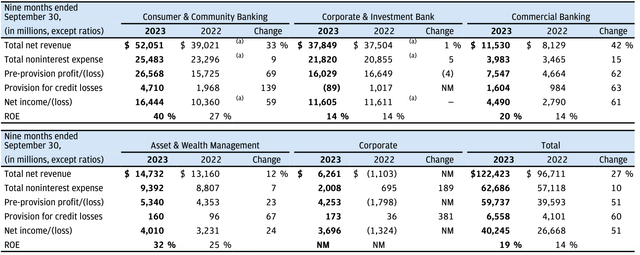

As evident from the desk beneath, JPMorgan emerges as essentially the most reliant on Client Banking, contributing 40.88% of its internet revenue from these operations. In distinction, BofA and Wells Fargo exhibit a larger dependence on Company & Funding Banking, with percentages of 32.91% and 31.49%, respectively. Wells Fargo stands out as essentially the most depending on Business Banking, deriving 23.48% of its internet revenue from this sector. Moreover, within the realm of Asset & Wealth Administration, BofA takes the lead, accounting for 13.24% of its internet revenue.

In case you are questioning why JPMorgan’s base internet revenue surpasses that of the opposite two, it is as a result of JPM’s base internet revenue displays the 9-month ended interval, as disclosed in its Q3 2023 earnings. In distinction, the figures for the opposite two banks characterize solely the three months ended.

Writer’s Calculations BofA Q3 2023 Earnings Launch Wells Fargo Q3 2023 Earnings Launch JPMorgan Q3 2023 Earnings Launch

Market

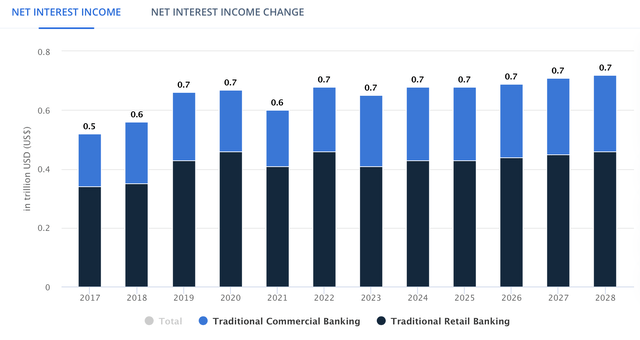

The US conventional banking market, comprising business banking and retail banking, is anticipated to expertise a internet curiosity revenue development of 1.44% from 2024 to 2028. Concurrently, world funding banking income is projected to develop at a CAGR of 1.40% throughout the identical interval. These sectors characterize the slowest-growing markets inside the banking business, largely attributed to the maturity of the finance business and minimal differentiation elements.

Regardless of the general sluggish development in these segments, JPMorgan holds a strategic benefit. The financial institution stands out by providing a few of the hottest bank cards, together with the Chase Sapphire Reserve, the Enterprise Ink, and the Chase Freedom.

Web Curiosity Earnings of the U.S. Conventional Banking Market (Statista) Income of the Worldwide Funding Banking market (Statista)

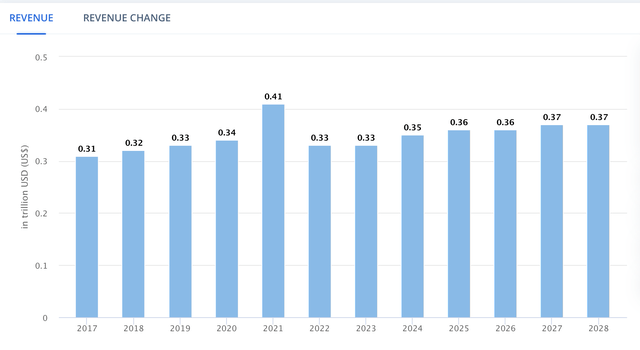

Turning to different sectors, Worldwide Asset Administration is poised for a extra respectable development fee of 4.40% from 2022 to 2027. Nevertheless, essentially the most dynamic market associated to the three banks is World Wealth Administration, projected to attain a powerful 5.90% income development from 2024 to 2027. This signifies a extra sturdy development potential in these areas in comparison with the comparatively slower-growing conventional and funding banking segments.

Income of the World Asset Administration market (Statista)

Financials

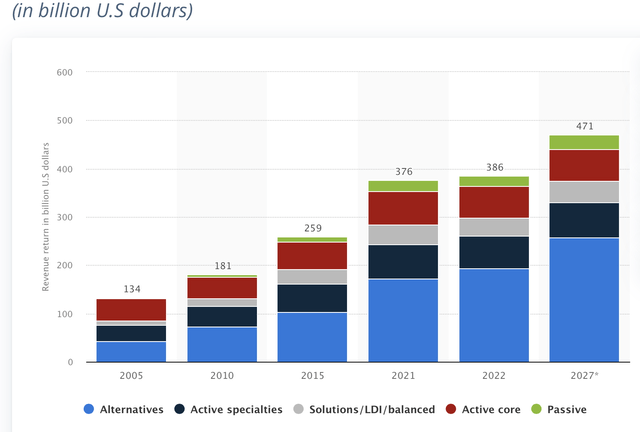

Relating to the revenue assertion, JPMorgan takes the lead within the annual development fee. Over the interval 2017-2023 TTM, JPMorgan has exhibited sturdy income development, averaging an annual fee of 8.39%, outpacing BofA with 2.60% and Wells Fargo with -1.84%. Notably, JPMorgan boasts the best income among the many three banks, reaching $142.4 billion.

Moreover, JPMorgan has demonstrated superior efficiency in internet revenue development throughout the identical interval. With an annual internet revenue development of 18.28%, JPMorgan considerably outperforms BofA’s 11.22% and surpasses the stagnant development of Wells Fargo at -2.88%.

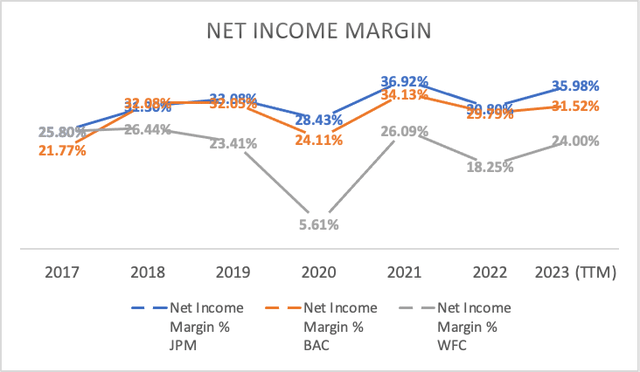

Regarding internet revenue margin, JPMorgan carefully aligns with BofA, as JPMorgan’s margin stands at 35.98% in comparison with BofA’s 31.52%. Nevertheless, Wells Fargo lags significantly behind with a margin of 24%.

Writer’s Calculations Writer’s Calculations

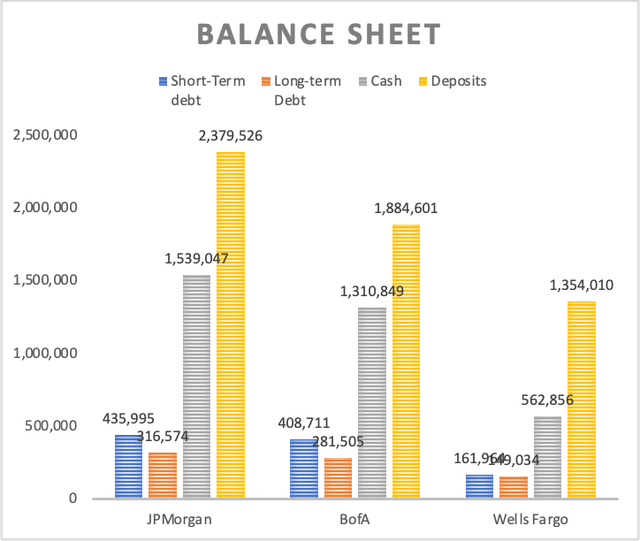

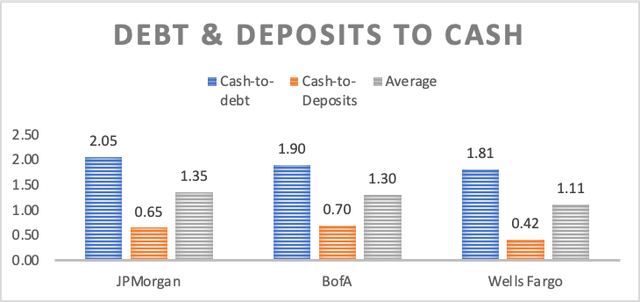

Turning to the stability sheet, it turns into evident that every one three banks at the moment boast sturdy monetary well being, particularly when evaluating it to their whole debt. On this regard, JPMorgan holds 2.05 instances more money than whole debt, whereas BofA follows carefully with a ratio of 1.90, and Wells Fargo stands at 1.81. Nevertheless, when assessing the state of affairs in relation to deposits, BofA stands out by overlaying roughly 70% of them with their money and equivalents. JPMorgan secures the second place with 65%, whereas Wells Fargo trails behind at 42%.

In an total analysis utilizing a composite rating derived from these two key metrics, JPMorgan emerges on the forefront with a rating of 1.35, carefully trailed by BofA at 1.30. Wells Fargo, although sustaining a stable place, lags with a rating of 1.11. Nonetheless, it is necessary to notice that every one three are formidable, extremely liquid banking giants, well-equipped to climate any potential banking panics.

Writer’s Calculations Writer’s Calculations

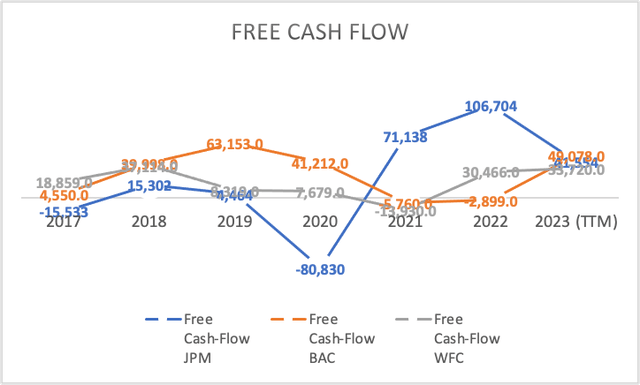

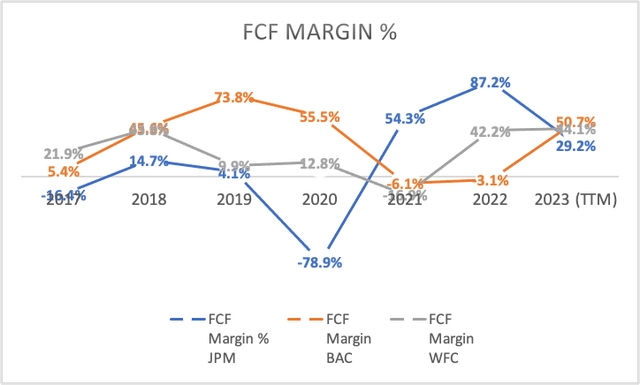

Lastly, turning our consideration to free money movement, Financial institution of America (BofA) takes the lead with a powerful $49 billion, adopted by JPMorgan (JPM) with $41 billion, and Wells Fargo with $33 billion. Analyzing the free money movement margin reveals that BofA is at the moment within the lead with 50.7%, adopted by Wells Fargo at 44.1%, whereas JPM lags considerably with 29.2%.

This disparity can be evident when taking a look at historic knowledge, significantly the typical free money movement margin in the course of the interval 2017-2023 TTM. BofA and Wells Fargo maintained common FCF margins of 31.68% and 22.54%, respectively, throughout this era, whereas JPM reported a decrease common of 13.47%. This underscores the constant power of BofA in producing free money movement in comparison with each JPM and Wells Fargo.

Writer’s Calculations Writer’s Calculations

In abstract, JPMorgan stands out because the financial institution with essentially the most promising development prospects. It’s a sturdy and wholesome establishment, though not surpassing the monetary well being of Financial institution of America (BofA), which not solely displays higher free money flows but additionally boasts a superior stability sheet. Nevertheless, BofA faces the problem of much less optimistic development prospects.

However, Wells Fargo emerges because the outlier or “black sheep” on this comparability. The financial institution, marred by varied scandals and working below asset limitations, faces constraints in its development potential in comparison with JPMorgan. Whereas its stability sheet stays stable, it would not fairly measure as much as the monetary power of each JPMorgan and BofA.

Valuation

On this valuation part, I’ll make use of three distinct residual earnings fashions for the banks mentioned on this article. The idea tables firstly of every subsection within the valuation part will probably be populated utilizing varied sources of knowledge.

Moreover, the CAPM tables, utilized to calculate the Required Charges of Returns, will probably be offered. The betas of the shares are sourced from MarketWatch and stand at 1.21 for BofA, 1.22 for Wells Fargo, and 1.1 for JPMorgan.

The method of figuring out internet working property concerned subtracting money reserves from whole property, adopted by subtracting whole deposits. The latter serves because the working liabilities within the formulation, whereas all money reserves are labeled as non-operating property on this calculation. This classification is rooted within the notion that money, in my thought course of, is a product of the ebook of loans (thought-about working property) originated from deposits (deemed working liabilities).

Wall Road Prep Wall Road Prep

Moreover, the ebook worth was computed utilizing a margin linked to income, achieved by dividing the 2023 TTM ebook worth by the 2023 TTM income. This complete method goals to supply an intensive and correct evaluation of the valuation course of.

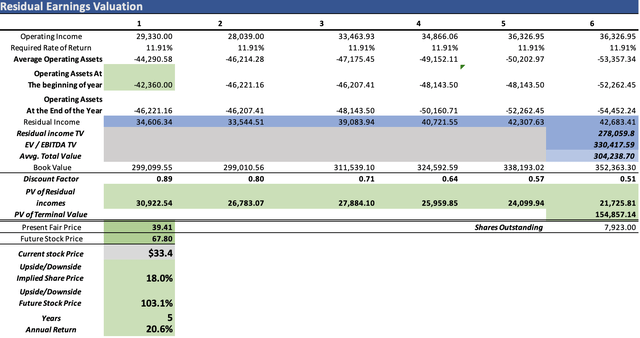

Financial institution of America Company

Commencing with the preliminary financial institution, Financial institution of America, beneath is the belief desk. It is value noting that this is identical desk utilized for calculating Weighted Common Value of Capital [WAAC] in Discounted Money Circulation [DCF] fashions. Nevertheless, as this can be a Residual Earnings mannequin, the main focus will shift to calculating a Capital Asset Pricing Mannequin (CAPM), derived from beta, the risk-free fee, and the typical market return.

| TABLE OF ASSUMPTIONS | |

| (Present knowledge) | |

| Fairness Worth | 258,667.00 |

| Debt Worth | 690,216.00 |

| Value of Debt | 1.22% |

| Tax Price | 8.56% |

| 10y Treasury | 3.80% |

| Beta | 1.22 |

| Market Return | 10.50% |

| Value of Fairness | 11.97% |

| Web Earnings | 30,503.00 |

| Curiosity | 8,433.84 |

| Tax | 2,612.00 |

| D&A | 1,954.00 |

| Ebitda | 43,502.84 |

| D&A Margin | 2.02% |

| Curiosity Expense Margin | 8.72% |

| Income | 96,772.0 |

| CAPM | |

| Threat-Free Price | 3.80% |

| Beta | 1.22 |

| Market Threat Premium | 6.650% |

| Required Price of Return | 11.913% |

Displayed within the desk are the variables for the terminal worth, with the expansion fee derived from the ahead GAAP EPS development fee accessible within the “development” tab of In search of Alpha for the inventory ticker BAC, comparable to Financial institution of America.

| Terminal Worth Calculation | |

| Assumptions | |

| CAPM | 11.91% |

| Progress Price | -2.98% |

| EV / EBITDA | 6.53 |

Subsequent, the desk facilitates the calculation of internet working property and ebook worth all through the projection, using the method beforehand talked about. Financial institution of America’s whole property at the moment stand at $3.15 trillion, with whole investments totaling $1.31 trillion and deposits amounting to $1.88 trillion.

| Working Belongings | -42,360.0 |

| E-book worth | 287,062.0 |

| Working Belongings / Income | -45.84% |

| E-book Worth / Income | 296.64% |

Shifting ahead, the next desk outlines income and working revenue projections. Though D&A and curiosity bills are included within the desk, they aren’t utilized within the mannequin. For income, estimates for FY2023 and FY2024 are chosen at $100.83 billion and $100.8 billion, respectively. Working revenue is then calculated utilizing the EPS estimates for FY2023 and FY2024, that are $3.41 and $3.26, respectively. This determine is then multiplied by widespread shares excellent to acquire internet revenue, and taxes are added to that internet revenue to derive working revenue.

| Income | Working Earnings | Plus D&A | Plus Curiosity | |

| 2023 | $100,830.0 | $29,330.0 | $31,365.94 | $40,153.44 |

| 2024 | $100,800.0 | $28,039.0 | $30,074.33 | $38,859.22 |

| 2025 | $105,023.5 | $33,463.9 | $35,584.54 | $44,737.52 |

| 2026 | $109,424.0 | $34,866.1 | $37,075.53 | $46,612.02 |

| 2027 | $114,008.9 | $36,327.0 | $38,628.99 | $48,565.06 |

| 2028 | $118,785.8 | $37,849.1 | $40,247.55 | $50,599.94 |

| ^Remaining EBITA^ |

Writer’s Calculation

Based on my mannequin, Financial institution of America is deemed undervalued by roughly 18%, suggesting a good value per share of round $39.41. Furthermore, the mannequin signifies that by 2028, the inventory is projected to succeed in a value of $67.80, translating into annual returns of 20.6%, a commendable determine.

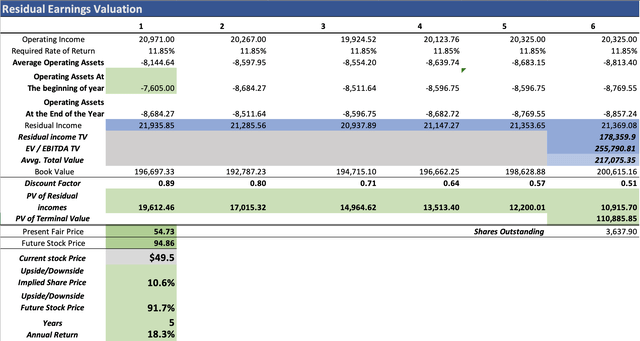

Wells Fargo & Co.

For the upcoming evaluation targeted on Wells Fargo, I’ll undertake a technique much like the one beforehand detailed. Introduced beneath is the excellent set of assumptions and pivotal tables important for computing income and working revenue targets, together with the CAPM.

| TABLE OF ASSUMPTIONS | |

| (Present knowledge) | |

| Fairness Worth | 161,696.00 |

| Debt Worth | 310,998.00 |

| Value of Debt | 2.20% |

| Tax Price | 13.70% |

| 10y Treasury | 3.80% |

| Beta | 1.21 |

| Market Return | 10.50% |

| Value of Fairness | 11.91% |

| Web Earnings | 18,356.00 |

| Curiosity | 6,832.73 |

| Tax | 2,514.00 |

| D&A | 6,014.00 |

| Ebitda | 33,716.73 |

| D&A Margin | 7.86% |

| Curiosity Expense Margin | 8.93% |

| Income | 76,492.0 |

The ahead GAAP EPS development fee for Wells Fargo accessible in In search of Alpha is -0.12%.

| Terminal Worth Calculation | |

| Assumptions | |

| CAPM | 11.85% |

| Progress Price | -0.12% |

| EV / EBITDA | 7.38 |

| CAPM | |

| Threat-Free Price | 3.80% |

| Beta | 1.21 |

| Market Threat Premium | 6.650% |

| Required Price of Return | 11.847% |

Moreover, the desk facilitates the intricate calculation of internet working property and ebook worth all through the projection, leveraging the beforehand talked about course of. Wells Fargo’s current whole property quantity to $1.9 trillion, with whole investments reaching $562.85 billion, and deposits totaling $1.35 trillion.

| Working Belongings | -7,605.0 |

| E-book worth | 182,373.0 |

| Working Belongings / Income | -10.53% |

| E-book Worth / Income | 238.42% |

| Income | Working Earnings | Plus D&A | Plus Curiosity | |

| 2023 | $82,500.0 | $20,971.0 | $27,457.36 | $34,826.77 |

| 2024 | $80,860.0 | $20,267.0 | $26,624.42 | $33,847.33 |

| 2025 | $81,668.6 | $19,924.5 | $26,345.52 | $33,640.66 |

| 2026 | $82,485.3 | $20,123.8 | $26,608.97 | $33,977.06 |

| 2027 | $83,310.1 | $20,325.0 | $26,875.06 | $34,316.83 |

| 2028 | $84,143.2 | $20,528.3 | $27,143.81 | $34,660.00 |

| ^Remaining EBITA^ |

Writer’s Calculation

As depicted, the mannequin advocates for a good valuation of $54.73 for Wells Fargo, signifying an undervaluation of 10.6% compared to the present inventory value. Peering into the longer term, the mannequin anticipates a potential value of $94.86 by 2028, translating into annual returns of 18.3% all through that yr. This projection underscores a promising development trajectory for Wells Fargo, as envisaged by the mannequin.

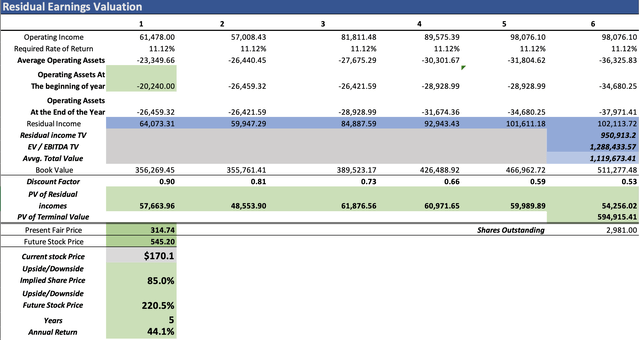

JPMorgan Chase & Co.

| TABLE OF ASSUMPTIONS | |

| (Present knowledge) | |

| Fairness Worth | 289,967.00 |

| Debt Worth | 752,569.00 |

| Value of Debt | 1.30% |

| Tax Price | 23.94% |

| 10y Treasury | 3.80% |

| Beta | 1.1 |

| Market Return | 10.50% |

| Value of Fairness | 11.17% |

| Web Earnings | 51,253.00 |

| Curiosity | 9,778.91 |

| Tax | 12,270.00 |

| D&A | 5,846.00 |

| Ebitda | 79,147.91 |

| D&A Margin | 4.10% |

| Curiosity Expense Margin | 6.87% |

| Income | 142,431.0 |

The ahead GAAP EPS development fee accessible at In search of Alpha for JPMorgan is 0.34%.

| Terminal Worth Calculation | |

| Assumptions | |

| CAPM | 11.12% |

| Progress Price | 0.34% |

| EV / EBITDA | 9.72 |

| CAPM | |

| Threat-Free Price | 3.80% |

| Beta | 1.1 |

| Market Threat Premium | 6.650% |

| Required Price of Return | 11.115% |

Furthermore, the desk is instrumental in calculating internet working property and ebook worth all through the projection, using the beforehand talked about course of. Presently, JPMorgan’s whole property quantity to $3.89 trillion, with whole investments totaling $1.5 trillion, and deposits reaching $2.37 trillion.

| Working Belongings | -20,240.0 |

| E-book worth | 317,371.0 |

| Working Belongings / Income | -16.55% |

| E-book Worth / Income | 222.82% |

| Income | Working Earnings | Plus D&A | Plus Curiosity | |

| 2023 | $159,888.0 | $61,478.0 | $68,040.51 | $79,017.97 |

| 2024 | $159,660.0 | $57,008.4 | $63,561.58 | $74,523.39 |

| 2025 | $174,811.7 | $81,811.5 | $88,986.53 | $100,988.61 |

| 2026 | $191,401.4 | $89,575.4 | $97,431.36 | $110,572.43 |

| 2027 | $209,565.4 | $98,076.1 | $106,677.59 | $121,065.75 |

| 2028 | $229,453.1 | $107,383.5 | $116,801.30 | $132,554.89 |

|

^Remaining EBITA^ |

Writer’s Calculation

The excellent analysis locations JPMorgan on the forefront among the many three banks, boasting superior development prospects and the perfect total rating when evaluating its debt and deposits to money. Based on the mannequin, the inventory could possibly be undervalued by a powerful 85%, suggesting a good value of round $314.74. Waiting for 2028, the mannequin tasks a future value of $545.20, translating into extraordinary annual returns of 44.1%.

Whereas this determine could initially appear excessive, I shared the identical skepticism when the mannequin generated this outcome. Subsequently, in my quest for validation, I sought out different articles on In search of Alpha overlaying JPMorgan. Curiously, I found articles with targets round $240. Nevertheless, it is essential to notice that these targets lined a shorter projection interval of three years, whereas my evaluation spans 6 years. Consequently, the prolonged projection horizon ends in extra residual earnings to low cost, contributing to a better inventory truthful value.

Lastly, making an attempt to mission every of the financial institution’s operations by the market development fee of their respective market is inconsequential. Within the occasion of a downturn, comparable to in funding banking, all three banks can be equally affected, and the identical situation would apply to client banking, moreover, as beforehand mentioned, the banks have a really comparable dependence on all of the segments they function which might trigger them to yield comparable truthful costs.

In conclusion, all three banks current a promising upside with commendable annual returns. Nonetheless, JPMorgan stands out with extraordinary returns and a considerable upside. Consequently, JPMorgan is unequivocally designated as a “sturdy purchase,” whereas Financial institution of America and Wells Fargo could possibly be labeled as a “purchase.” This distinction is derived from the superior prospects projected for JPMorgan in comparison with the opposite two banks.

Dangers to Thesis

The first dangers related to this thesis revolve round well-established challenges inside the banking business, the foremost being the perennial risk of financial institution runs. As exemplified within the 2008 monetary disaster, giant banks are extra vulnerable to mismanagement, typically counting on the expectation of being rescued. Sadly, this rescue focus tends to prioritize saving the financial institution over safeguarding shareholders, doubtlessly resulting in vital losses for buyers.

A second important threat stems from the saturation of the market. The current surge in deposit development skilled by main banks is, partially, a consequence of people fleeing from smaller lenders following the financial institution panic in March 2023. Nevertheless, this momentum could also be fleeting, and there’s a chance that depositors might revert to smaller establishments providing extra engaging rates of interest in a high-interest fee surroundings.

The ultimate recognized threat pertains to a broader market downturn, which might considerably diminish the income of Asset & Wealth Administration. This income mannequin depends on a fee tied to AUM. Due to this fact, if the valuation of those AUM diminishes throughout a market downturn, the related fee would characterize a lowered financial worth.

Understanding and mitigating these dangers is essential for a complete analysis of the thesis, as every poses distinct challenges to the sustained success and profitability of the banking business within the outlined context.

Conclusion

In conclusion, the excellent evaluation of JPMorgan, Financial institution of America, and Wells Fargo underscores distinct trajectories inside the banking sector. JPMorgan emerges because the standout performer, exhibiting superior development prospects and a powerful total rating, positioning it as a “sturdy purchase.” The mannequin suggests an undervaluation of round 85%, with a good value projection of roughly $314.74 and an formidable future goal of $545.20 by 2028, translating into outstanding annual returns of 44.1%. Whereas these figures could seem formidable, the prolonged projection interval contributes to this optimistic outlook, making JPMorgan an distinctive funding proposition.

However, BofA and Wells Fargo, whereas providing first rate upsides and commendable annual returns, fall barely behind JPMorgan by way of development potential. With a good value of $39.41, BofA is classed as a “purchase,” projecting an annual return of 20.6%. Wells Fargo, valued at $54.73, additionally receives a “purchase” score, with an anticipated annual return of 18.3% by 2028. These rankings and targets mirror a nuanced understanding of every financial institution’s strengths, weaknesses, and market situations, offering buyers with a well-informed foundation for decision-making in navigating the dynamic panorama of the banking business.

[ad_2]

Source link