[ad_1]

Marko Geber

JOYY Inc. (NASDAQ:YY) operates a number one international on-line social leisure platform, providing customers a novel expertise throughout numerous video-based classes, comparable to stay streaming, short-form video, and video communication. With its common month-to-month lively customers of greater than 280 million, the corporate supplies participating and engaging content material to viewers.

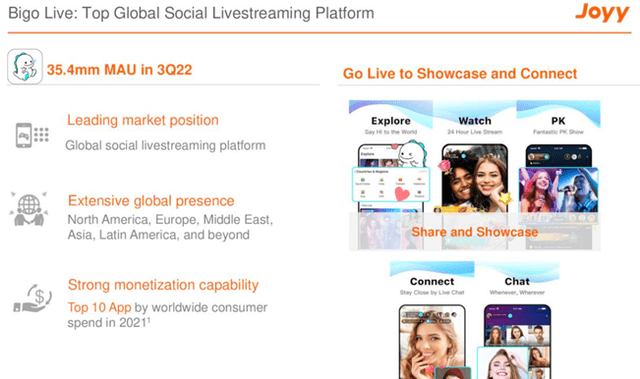

Bigo platform (buyers relation )

Since its inception in 2005, the corporate has expanded its enterprise attain globally by means of its vibrant video-based social leisure platforms. In 2019, JOYY acquired Bigo, and since then Bigo has improved considerably and produce substantial income for the corporate.

Within the final 12 months, the corporate offered one in every of its video-based live-streaming platforms YY Reside to Baidu for the combination value of $3.6 billion. Because of this, the corporate has vital money reserves.

The inventory has dropped over 74% since its excessive in 2021 and is presently buying and selling at simply $35 per share, dropping from round $135 per share. The corporate has turn into considerably undervalued and supplies monumental upside potential.

Historic efficiency

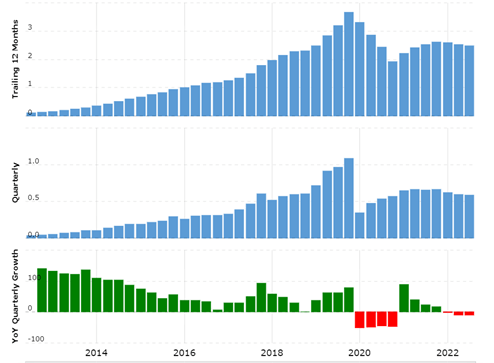

income development (macrotrends.internet )

Within the final ten years, income development has been considerably engaging; it has grown from $131 million in 2012 to over $2.6 billion by 2021. Additionally, internet earnings rose significantly over the interval, reaching about $531 million by 2019. Nonetheless, on account of numerous setbacks that the enterprise has been dealing with, income has dropped considerably, and internet earnings have turned unfavourable. Notice that the excellent share depend has elevated from 30 million to about 72 million; though the corporate has began spending on buybacks, the ensuing impact of share dilution is substantial.

Moreover, the corporate has a considerably robust monetary place; the full worth of the steadiness sheet has reached $9.3 billion and has been rising constantly. It needs to be appreciated that the enterprise has grown with none main reliance on debt. Additionally, the corporate ends the quarter with over $5 billion in present property and appreciable long-term investments, which supplies the enterprise mannequin vital stability.

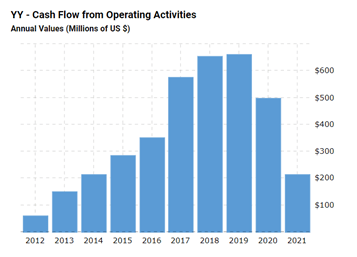

money move from operations (macrotrends.internet )

Over the interval, JOYY has generated vital money move from operations, which exhibits that the enterprise mannequin is strong and sound.

Margin of security

The corporate has over $5 billion in liquid property with significantly low debt. Whereas the full market capitalization is round $2.5 billion. Plainly the inventory has been buying and selling for simply 0.5 occasions its liquid property; this value level provides vital safety from everlasting capital loss and supplies an enormous margin of security.

Threat components

Contemplate that latest profitability is attributed to funding achieve. The working efficiency nonetheless stays subdued, and if the situation lasts longer, the corporate may face a big drop in profitability. Additionally, the corporate has been dealing with powerful competitors from its opponents, which could put substantial strain on its margins.

From the problems talked about above, the inventory value could be affected significantly, however its robust monetary place together with low valuation, present the inventory with a big margin of security.

Current growth

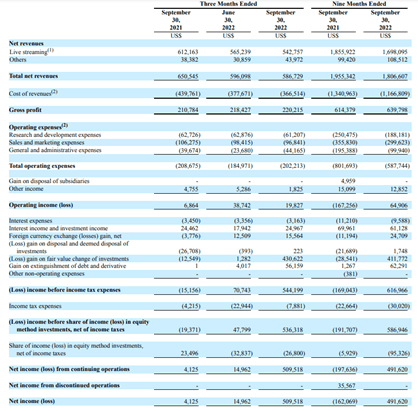

Quarterly outcomes (Quarterly reviews)

Within the latest quarter, complete income decreased from $650 million in the identical quarter final 12 months to about $586 million, ensuing from low streaming income. Additionally, the online earnings have reached $540 million from a internet loss within the final 12 months; a considerable rise in profitability is attributed to vital achieve on honest worth change of investments.

The corporate’s efficiency within the final 9 months reveals the identical image, the place income has seen a substantial decline. Nevertheless it needs to be appreciated that the administration has been specializing in share buybacks because the inventory value has dropped.

For the reason that first half of 2021, now we have been comprehensively and constantly reviewing the price buildings and administration processes of our core companies. On the identical time, we undertook a collection of operational changes to boost product synergies, enhance operational effectivity, and finally make sure the well being and sustainability of our enterprise.

Notice {that a} vital quantity of income comes from Bigo live-streaming platform; the corporate has been specializing in numerous strategic initiatives to drive enterprise development. Because of this, Bigo stay’s MAU has elevated by over 13% and reached a traditionally excessive stage.

The backdrop that JOYY has been dealing with is primarily attributed to adversarial financial circumstances and a recessionary atmosphere, however I consider because the financial sentiments begin stabilizing, the corporate may regain its incomes energy again.

We’ll proceed to domesticate various premium content material, innovate interactive product options, and arrange actions tailor-made to native markets. These initiatives will additional enhance our consumer expertise and finally, facilitate the expansion of our consumer neighborhood and monetization, 2 components that correlate positively with consumer satisfaction over time. As well as, our diversified operations throughout quite a lot of areas, together with North America, Europe, the Center East, and Southeast Asia, have given us higher total flexibility and allowed us to mitigate the dangers that come up from counting on any single market.

The administration has been specializing in enhancing buyer expertise, which is able to strengthen the enterprise mannequin and drive income within the upcoming years. Additionally, Bigo stay is increasing its footprints in numerous high-potential markets; the corporate has a big alternative to develop internationally.

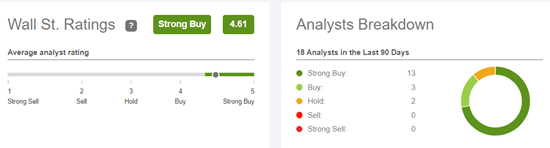

rankings (in search of alpha)

At present, the corporate has been buying and selling for $2.5 billion, whereas it produced over $485 million in 2019 (pre-covid), which provides it a price-to-earnings ratio of 5, which appears significantly engaging as in comparison with historic valuation. Additionally, the corporate has over $5 billion in present property and over $1 billion in investments, which provides it a substantial security margin. Subsequently, I assign purchase rankings to the inventory.

[ad_2]

Source link