[ad_1]

Japanese Yen Costs, Charts, and Evaluation

- Rising inflation and wage pressures seen.

- USD/JPY upside is proscribed.

Study Tips on how to Commerce USD/JPY with our Complimentary Information

Really useful by Nick Cawley

Tips on how to Commerce USD/JPY

In an interview with Reuters earlier at present, Japan’s Deputy Chief Cupboard Secretary Hideki Murai mentioned that early indicators of rising inflation and wages have been changing into evident within the financial system, boosting market hopes that an finish to Japan’s multi-decade period of ultra-loose financial coverage might quickly be coming to an finish.

“We have to revitalise the financial system by shifting away from one which prioritizes value cuts to at least one the place a constructive cycle of upper progress and wages kicks in,” Murai mentioned. “We’re regularly seeing such a constructive cycle fall into place.”

This constructive outlook follows on from latest commentary by Financial institution of Japan board member Hajime Takata who mentioned that the central financial institution’s purpose of sustainable 2% inflation is ‘lastly in sight’.

Japanese Yen Grabs a Bid, Emboldened by Financial institution of Japan Discuss

At present’s commentary shifted rate of interest hike hikes marginally however not sufficient to noticeably strengthen the Japanese Yen. In line with market possibilities, there’s now a 40% probability that the BoJ will hike charges at this month’s assembly, though June stays the most probably assembly for the central financial institution to take rates of interest out of destructive territory.

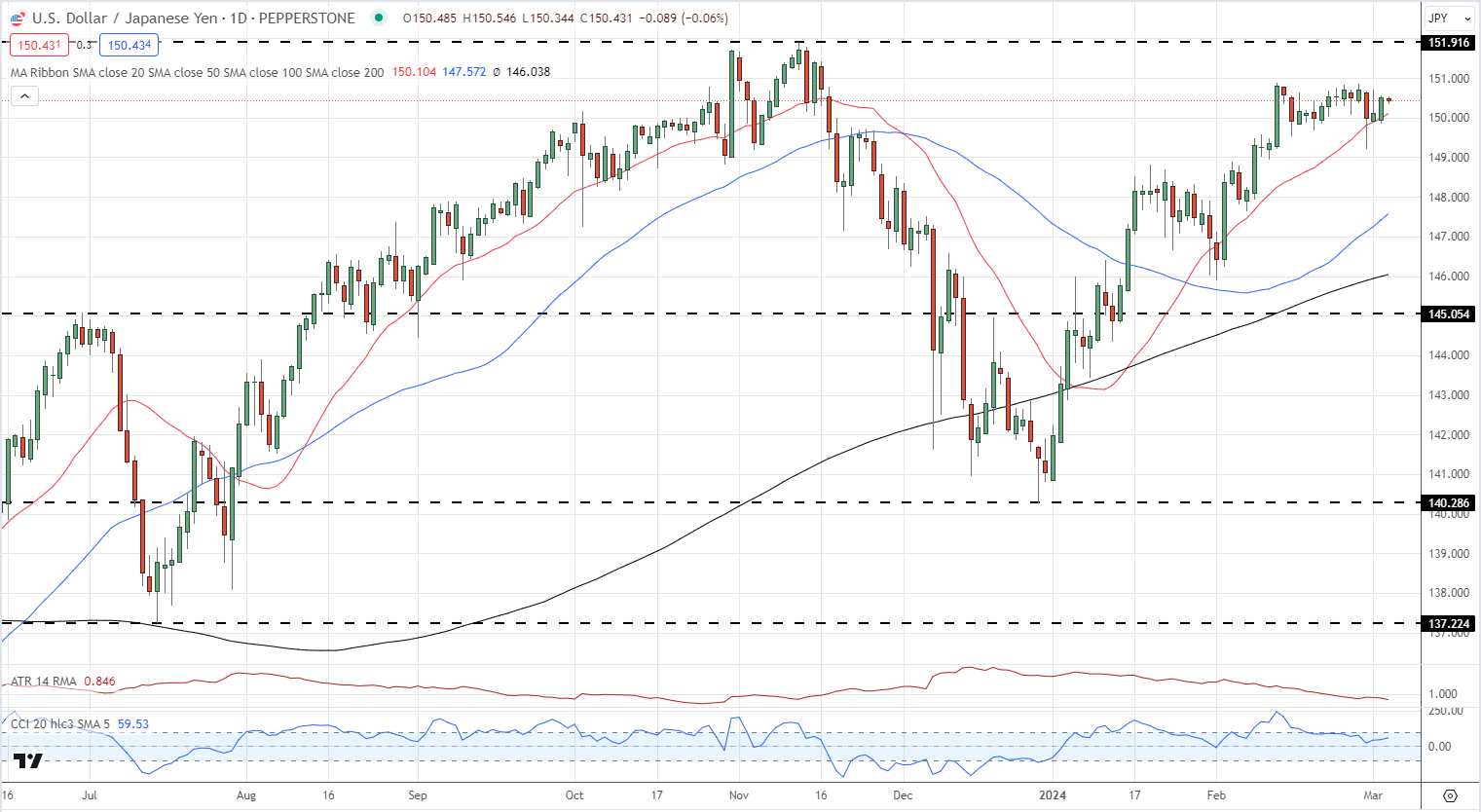

USD/JPY continues to commerce simply above the 150 stage though the pair are discovering it troublesome to maneuver greater. Additional upside is proscribed with the 151.90 multi-decade excessive a formidable stage of resistance to take out, particularly after the latest official commentary. The draw back appears to be like the trail of least resistance with a number of ranges of assist of prior swing lows and all three easy shifting averages earlier than the 145 space comes into view.

USD/JPY Each day Value Chart

Retail dealer information 21.93% of merchants are net-long with the ratio of merchants brief to lengthy at 3.56 to 1.The variety of merchants net-long is 3.12% greater than yesterday and 13.50% decrease than final week, whereas the variety of merchants net-short is 6.83% greater than yesterday and 6.43% greater than final week.

We sometimes take a contrarian view to crowd sentiment, and the actual fact merchants are net-short suggests USD/JPY costs might proceed to rise.

Obtain the Newest IG Sentiment Report back to see why every day/weekly adjustments have an effect on USD/JPY value outlook

| Change in | Longs | Shorts | OI |

| Each day | 2% | 4% | 4% |

| Weekly | -8% | 7% | 3% |

What’s your view on the Japanese Yen – bullish or bearish?? You may tell us through the shape on the finish of this piece or you’ll be able to contact the creator through Twitter @nickcawley1.

[ad_2]

Source link