[ad_1]

Japanese Yen Costs, Charts, and Evaluation

- USD/JPY stays close to multi-decade excessive regardless of official warning.

- US NFPs might immediate BoJ intervention.

Obtain our Complimentary Japanese Yen Q2 technical and Elementary Forecasts beneath:

Really helpful by Nick Cawley

Get Your Free JPY Forecast

The Japanese Yen picked up a small bid in early European commerce after PM Kishida warned fx markets that officers will take applicable motion if there are any additional ‘extreme fx strikes.’ In what’s a verbal warning to Yen speculators, PM Kishida outlined how extreme volatility and disorderly FX strikes might harm monetary stability and the Japanese economic system and received’t be tolerated. Verbal intervention by both the federal government or the BoJ is seen as a precursor to official intervention to maneuver the extent of the Japanese Yen.

Financial institution of Japan (BoJ) – International Trade Market Intervention

Friday’s early warning comes a number of hours earlier than the newest US Jobs Report (NFPs), a intently watched launch that may have an effect on the worth of the US greenback. This month’s report comes on the heels of some hawkish commentary from Fed policymaker Neel Kashkari who mentioned on Thursday that if US inflation stays sticky, then charge cuts this 12 months might not be wanted. Monetary markets are nonetheless penciling in three 25-basis level cuts in 2024, however any indicators of a robust labor market in at this time’s NFP launch might change this forecast.

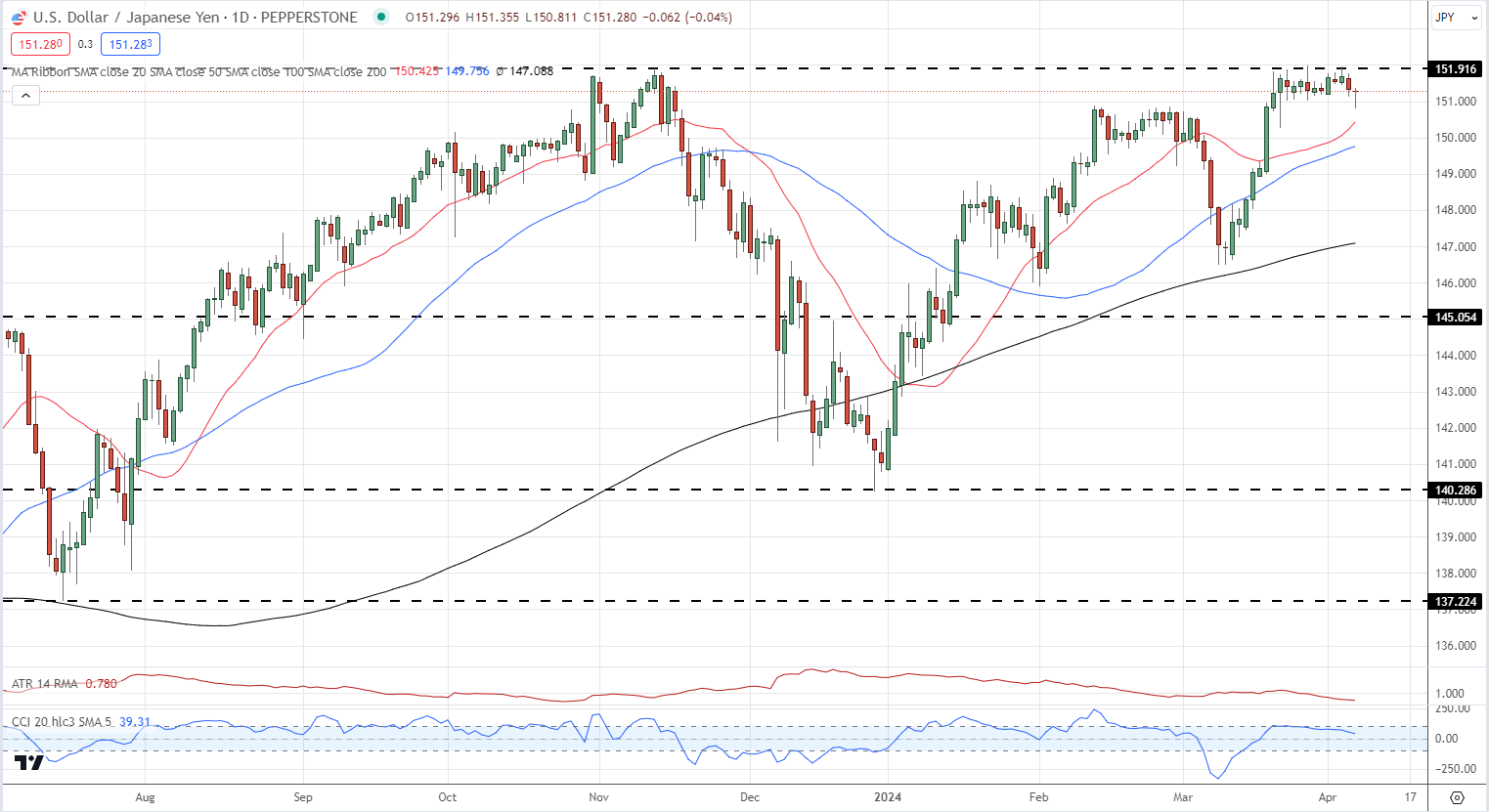

USD/JPY has ticked decrease post-official commentary however stays inside touching distance of a multi-decade excessive across the 152 stage. The technical outlook for USD/JPY stays optimistic with a break above 152 opening the way in which for additional positive factors. The basic outlook nonetheless means that any additional transfer increased won’t be tolerated, leaving the market in limbo. Right this moment’s US Jobs Report and any additional official Japanese commentary, or intervention, might see the pair transfer sharply, a technique or one other.

USD/JPY Every day Value Chart

Retail dealer knowledge exhibits 14.69% of USD/JPY merchants are net-long with the ratio of merchants quick to lengthy at 5.81 to 1.The variety of merchants net-long is 17.67% decrease than yesterday and 5.51% decrease than final week, whereas the variety of merchants net-short is 6.00% decrease than yesterday and a couple of.79% decrease than final week.

We sometimes take a contrarian view to crowd sentiment, and the actual fact merchants are net-short suggests USD/JPY costs might proceed to rise.

Obtain the Newest IG Sentiment Report back to see how every day/weekly sentiment adjustments can have an effect on USD/JPY value outlook

| Change in | Longs | Shorts | OI |

| Every day | -16% | -5% | -7% |

| Weekly | -3% | -2% | -2% |

What’s your view on the Japanese Yen – bullish or bearish?? You possibly can tell us by way of the shape on the finish of this piece or contact the creator by way of Twitter @nickcawley1.

[ad_2]

Source link