[ad_1]

Japanese Yen, USD/JPY, US Greenback, BoJ, Ueda, Intervention, JGB, Yields, – Speaking Factors

- USD/JPY recoiled decrease on Monday after remarks from BoJ Governor Ueda

- The BoJ may be prepping the marketplace for coverage changes additional down the monitor

- The yield unfold between JGBs and Treasuries may be price watching

Advisable by Daniel McCarthy

Buying and selling Foreign exchange Information: The Technique

The Japanese Yen has had a wild begin to the week after feedback from Financial institution of Japan Governor (BoJ) Kazuo Ueda opened the door to hypothesis for the tip of its unfavourable rate of interest coverage (NIRP).

In early Asian commerce on Monday morning, USD/JPY retreated from its 10-month peak of 147.87. It traded all the way down to 146.67 earlier than steadying towards 147. At present’s low was simply above Friday’s low of 146.59.

The Yomiuri Shimbun newspaper is reporting that Ueda san could tilt financial coverage if wages and costs rise, citing that there are numerous choices.

He made it clear that any coverage adjustment might be depending on circumstance by saying, “Now we have a wide range of choices if financial and worth circumstances flip upward.”

Nevertheless, the market might need received forward of itself in searching for tightening from the BoJ. Ueda additionally remarked, “There’s nonetheless some method to go earlier than the worth goal will be realized. We are going to proceed our persistent financial easing coverage.”

The BoJ has a coverage price of -0.10% and is sustaining yield curve management (YCC) by concentrating on a band of +/- 0.50% round zero for Japanese Authorities Bonds (JGBs) out to 10 years.

The financial institution has grow to be versatile on YCC implementation, lately permitting the 10-year Japanese Authorities Bond (JGB) to yield above 0.50%. It traded at 0.70% at the moment, its highest return in nearly 10 years.

The unfold between JGBs and Treasury yields may be price listening to as there has historically been a powerful correlation to USD/JPY. The subsequent few periods may even see some volatility on this a part of the market.

USD/JPY AND YIELD SPREAD BETWEEN 10-YEAR TREASURIES AND JGBS

Chart created in TradingView

Governor Ueda’s feedback observe some comfortable jawboning final week from Masato Kanda, Japan’s Vice Minister of Finance for Worldwide Affairs and BoJ board member Hajime Takata.

It may be affordable to anticipate extra remarks from Japanese officers if USD/JPY makes one other transfer to the topside.

The market is mostly not anticipating bodily intervention till the worth strikes towards 152.00, if in any respect. The November 2022 excessive was 151.95.

To be taught extra about commerce USD/JPY, click on on the banner under.

Advisable by Daniel McCarthy

The way to Commerce USD/JPY

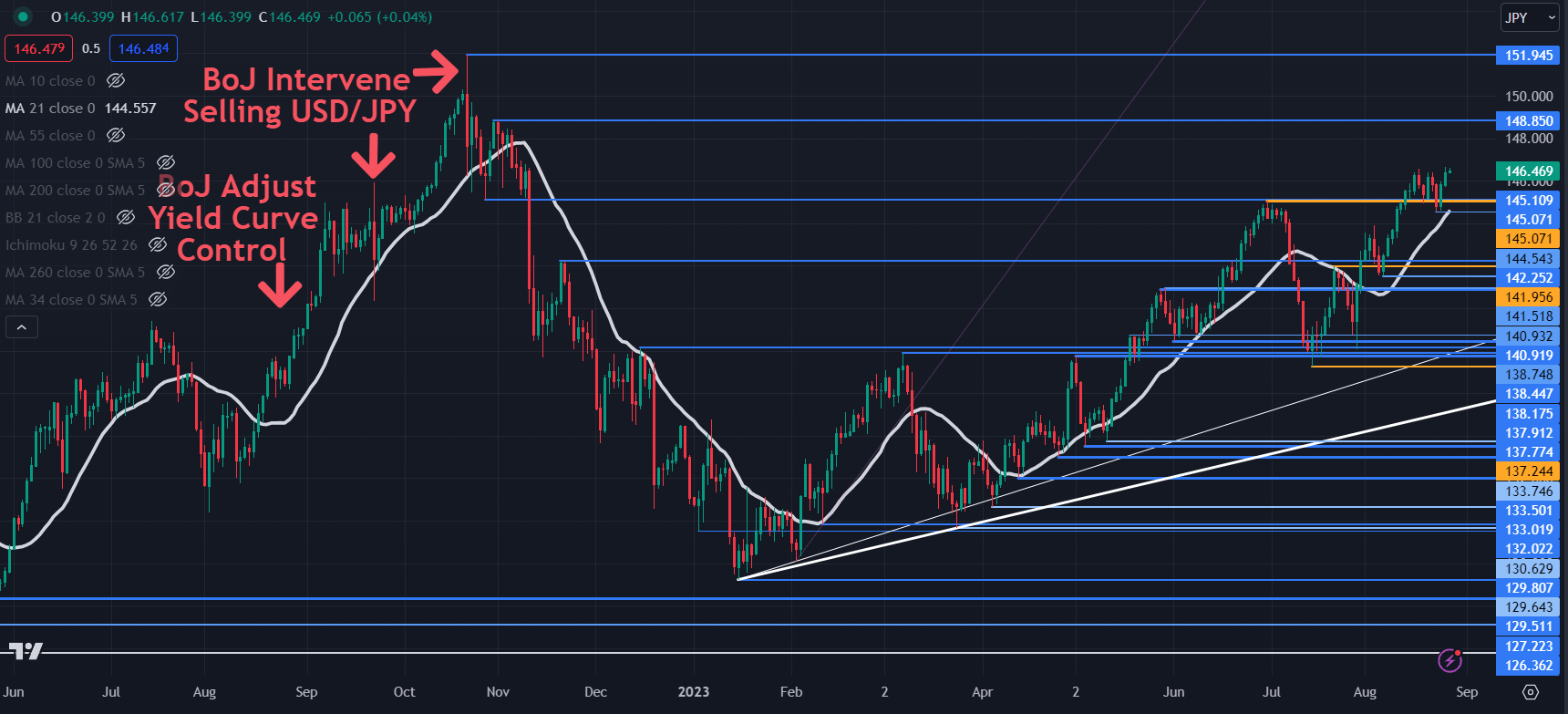

USD/JPY TECHNICAL ANALYSIS SNAPSHOT

USD/JPY made a 10-month excessive final Tuesday earlier than consolidating in a 146.59 – 147.87 vary. A breakout on both aspect of the vary may see momentum evolve in that path.

If a bullish run emerges, resistance may be on the prior peaks of 148.85 and 151.95.

On the draw back, help could lie on the breakpoints within the 145.05 – 145.10 space forward of the prior lows close to 144.50 and 141.50.

The 34-day Easy Shifting Common (SMA) can be close to 144.80 and will lend help.

Chart created in TradingView

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX staff

Subscribe to E-newsletter

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the feedback part under or @DanMcCathyFX on Twitter

[ad_2]

Source link