JAPANESE YEN FORECAST

- The Japanese yen depreciates sharply in opposition to the U.S. greenback and the euro after the Financial institution of Japan maintains its coverage of unfavorable charges and solely modestly tweaks its yield curve management program

- Japan’s Ministry of Finance says it has not intervened within the FX market just lately

- This piece examines the essential technical ranges for USD/JPY and EUR/JPY to watch within the upcoming buying and selling classes

Most Learn: British Pound – GBP/USD and EUR/GBP Technical Outlooks

The Japanese yen suffered giant losses in opposition to the U.S. greenback and euro on Tuesday following Financial institution of Japan’s financial coverage announcement. In early afternoon buying and selling in New York, USD/JPY was up about 1.5% to 151.35, a degree it had not reached since October final yr. In the meantime, EUR/JPY was up round 1.2%, breaking above the 160.00 threshold and hitting its highest mark in 15 years.

The BoJ maintained its benchmark fee unchanged at -0.10% and tweaked its yield curve management program, indicating that it will take a extra versatile strategy to controlling long-term charges. Below the brand new scheme, the establishment would permit the 10-year authorities bond yield to rise above 1.0%, characterizing this degree as a reference level slightly than a inflexible cap as beforehand thought of.

In case you are puzzled by buying and selling losses, obtain our information to the “Traits of Profitable Merchants” and learn to overcome the widespread pitfalls that may result in missteps.

Really useful by Diego Colman

Traits of Profitable Merchants

Whereas the BoJ’s motion is a step within the route of dismantling its controversial accommodative place of the previous decade, the measure didn’t reside as much as expectations after a media leak on Monday prompt that the establishment, below Kazuo Ueda’s management, was ready to implement a extra substantial and significant change to its present technique.

The yen’s drop was worsened by information that the Ministry of Finance had stayed out of FX markets just lately. Merchants believed that the federal government had taken measures to help the forex earlier this month, however official information contradicts this declare. Because of this the excessive volatility skilled a number of weeks in the past, when USD/JPY broke above 150.00, was most likely the results of buying and selling algorithms.

With the BoJ not but able to exit its ultra-dovish stance altogether and the Japanese authorities not doing a lot to include FX weak spot, rampant speculative exercise might preserve driving USD/JPY and EUR/JPY larger within the close to time period. This might imply recent multi-year highs for each pairs heading into November.

For a complete view of the Japanese yen’s elementary and technical outlook, be certain that to obtain our free This autumn buying and selling forecast at this time.

Really useful by Diego Colman

The right way to Commerce USD/JPY

USD/JPY TECHNICAL ANALYSIS

USD/JPY broke out on the topside, clearing the 151.00 deal with on Tuesday hitting its highest degree in additional than 12 months. With bullish momentum on its aspect, the pair might quickly problem a key ceiling at 151.95, which corresponds to final yr’s peak. On additional energy, the main target shifts to channel resistance at 152.85.

On the flip aspect, if the bears return and set off a pullback, preliminary technical help turns into seen at 150.95. Breaching this ground might entice new sellers to enter the market, setting the stage for a retracement in the direction of 148.90. Under this space, merchants’ consideration turns to the psychological 148.00 deal with, adopted by 146.00.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Utilizing TradingView

Discover the impression of crowd mentality on FX buying and selling dynamics. Obtain our sentiment information to grasp how market positioning can provide clues about EUR/JPY’s trajectory.

| Change in | Longs | Shorts | OI |

| Each day | -21% | 13% | 6% |

| Weekly | -27% | 6% | -1% |

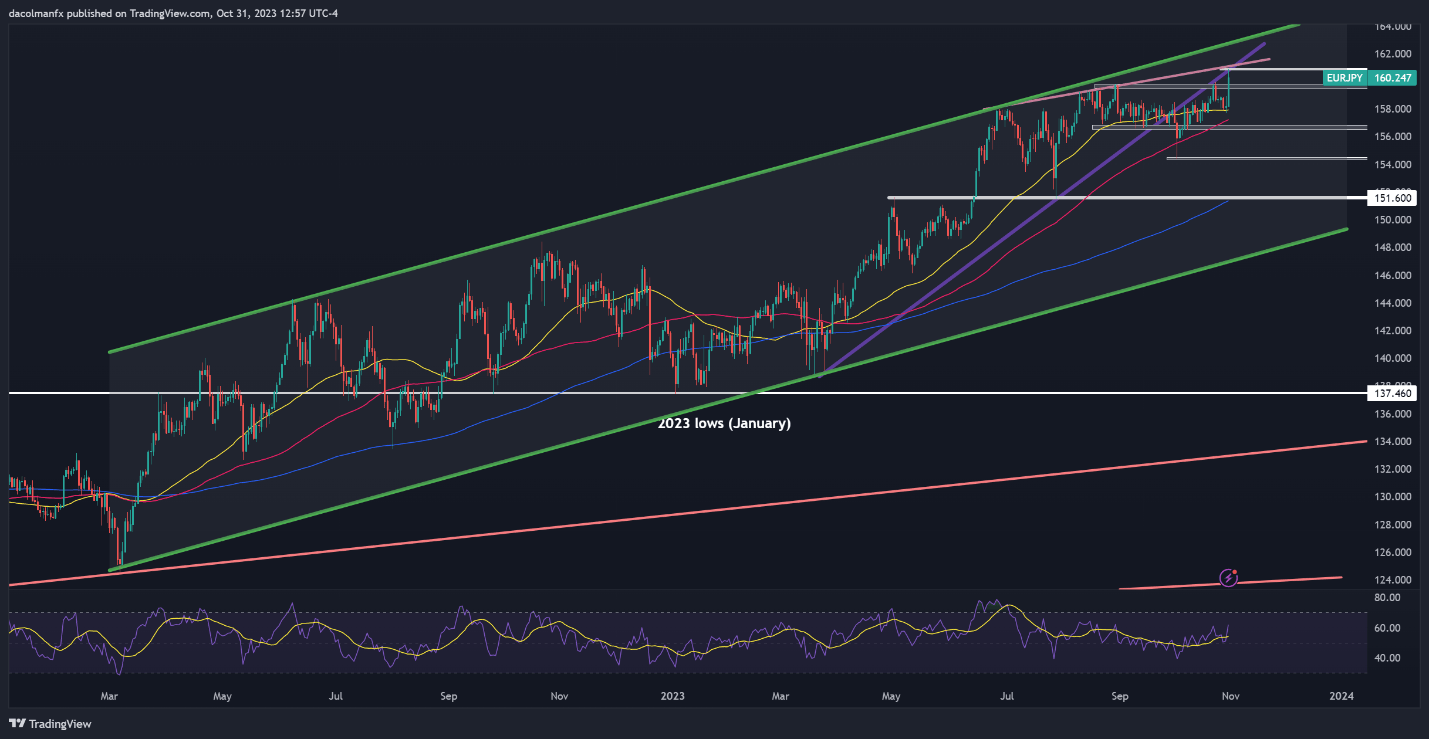

EUR/JPY TECHNICAL ANALYSIS

EUR/JPY additionally blasted larger on Tuesday, capturing its strongest degree in 15 years. Regardless of this outsize rally, the pair didn’t clear trendline resistance at 161.00. For clues on the outlook, this technical zone ought to be watched fastidiously within the coming days, taking into consideration {that a} breakout might spark a transfer in the direction of 162.80.

Within the surprising occasion that sellers regain management of the market, help may be noticed at 159.70. Under this space, the main target shifts to 156.65 and 154.50 thereafter.

EUR/JPY TECHNICAL CHART

EUR/JPY Chart Created Utilizing TradingView