[ad_1]

The financial system is starting to stall because the Fed has repeatedly elevated its low cost charge over the previous few months to combat inflation. As Jerome Powell put it, “We have now acquired to get inflation behind us,” even “if the possibilities of a mushy touchdown are more likely to diminish.”

Inflation did edge down final month and has probably peaked. Sadly, if it has peaked, it’s probably as a result of we’re on the sting of or in a recession. Mass layoffs have been introduced at a number of giant corporations (11,000 at Fb, 10,000 at Amazon, and so forth.), and new housing begins have plummeted.

A survey by the Nationwide Affiliation of Enterprise Economics discovered 72% of economists predict a recession in 2023 (and one with excessive unemployment, in contrast to the technical recession of Q1-Q2 2022), and the Bloomberg Economics mannequin places the chances at 100%.

So, we are able to count on comparatively excessive inflation and a recession in 2023 whereas rates of interest on the common 30-year mortgage have greater than doubled over the previous yr.

Whereas a housing crash like 2008 is extraordinarily unlikely, actual property costs have already began to say no (not less than month-over-month costs have), and evidently, this isn’t a very best market to be shopping for in.

And we should always keep in mind that traditionally talking, the Federal Reserve’s low cost charge as of this writing (4%) continues to be low by historic requirements.

U.S. Federal Funds Charge Over Time – Buying and selling Economics

However, housing costs have gone up considerably sooner than inflation. Invoice McBride at Calculated Danger has put collectively a “housing affordability index” that takes into consideration median revenue, housing worth, and rates of interest, and that is what it regarded like again in June.

This exhibits that housing is as unaffordable because it’s been since simply earlier than the Nice Recession, and that was again in July. It’s definitely gotten worse prior to now few months. However even nonetheless, affordability is best than it was again when Volker broke the again of inflation in 1982 by jacking rates of interest by the roof.

So how ought to buyers method this risky actual property market? Nicely, as I prefer to say, each market has pluses and minuses. In a purchaser’s market, it’s straightforward to purchase, not promote. In a vendor’s market, it’s straightforward to promote, not purchase. On this odd market, creativity could possibly be the important thing. However first, let’s have a look at the simple recommendation for flippers and householders.

Recommendation for Flippers and Wholesalers

Six months in the past, the market was on fireplace and assuming you possibly can discover a motivated vendor or value-add property, it wasn’t often powerful to search out an finish purchaser for it. That’s quickly beginning to shift. And it’s more likely to shift extra. For flippers who must rehab a property and gained’t probably listing it on the market once more for 2-6 months, you must assume the market will likely be worse than it’s now. It could be smart to cut back your most acceptable supply from 5-10% as a contingency.

Wholesalers want to comprehend they want a greater deal than prior to now to entice finish consumers. Along with reducing your gives, you must also think about asking for longer closing occasions, as it might take longer to search out one. And, after all, try to be sincere and open about what you’re doing with the vendor. Don’t faux you’re the tip purchaser.

Must Transfer? Lease Your House

Whether or not you’re a actual property investor or not, in the event you personal your house and want to maneuver for work or different causes, promoting your house is just not the best way to go.

As a substitute, it makes extra sense to hire out your present residence after which hire the place you’re shifting (assuming it doesn’t make sense or is unaffordable to purchase there).

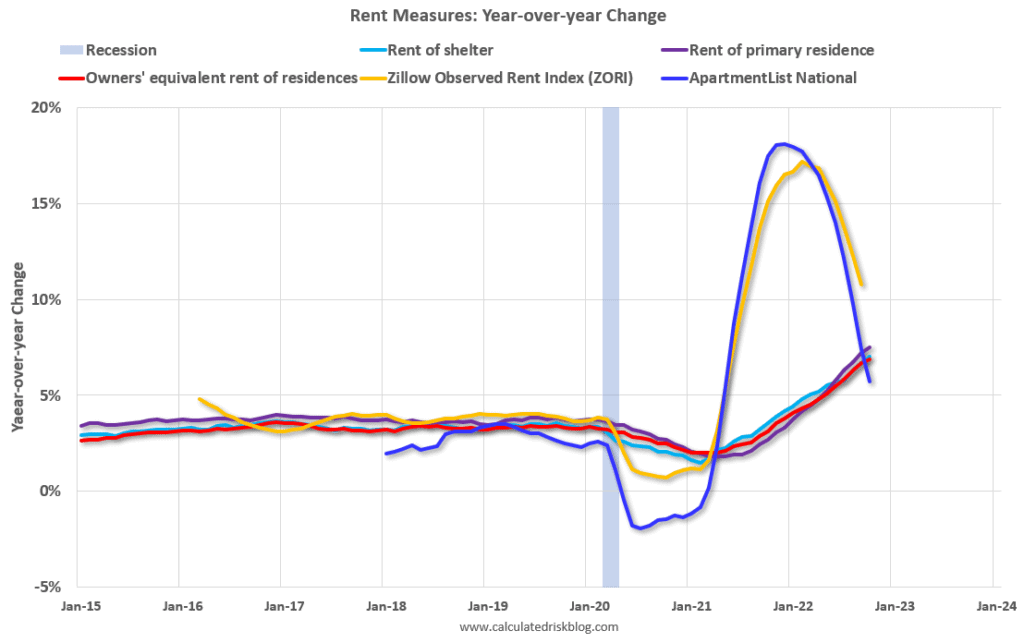

Lease costs throughout the nation are trending again down after skyrocketing in 2021. Certainly, the graph for hire costs is sort of the curler coaster:

Whereas this can make it much less worthwhile to hire out your present property, it would additionally make it rather more reasonably priced to discover a place to hire the place you’re going. And the advantages of holding actual property accrue over time, whereas renting is momentary.

Every time charges return down, you’ll be able to merely purchase a house the place you could have moved to. Though I do know, that makes for lots of shifting, and shifting sucks, it’s the value we pay for monetary freedom.

Topic To and Vendor Financing

The final time we had high-interest charges (and once more, they have been a lot greater than now) was within the Nineteen Seventies and early Eighties. And that was when vendor financing first grew to become fashionable. As rates of interest make conventional lending choices much less engaging, vendor financing can once more turn out to be a great tool.

Among the best teams to market to is these with none debt on their properties. About 37% of house owners don’t have any mortgage. For such homeowners, vendor financing at a decrease rate of interest could be an vital level of negotiation. Certainly, many such homeowners are older and would moderately have a stream of revenue than a lump sum.

Topic to offers is an much more engaging chance. Topic to means you purchase the property “topic to the present financing.” In different phrases, the vendor’s title stays on the mortgage, however the purchaser begins making the mortgage funds.

It needs to be famous that this technically triggers the due on sale clause in each financial institution’s mortgage paperwork. This is able to give the lender the best to foreclose, and whereas it’s uncommon they do that, it’s one thing you want to pay attention to.

The overwhelming majority of mortgages nowadays are fixed-rate, and most have been taken out between 2018 and early 2022 when charges have been very low. Being topic to one in all these low-interest loans is a gigantic boon. Bear in mind, an awesome deal could be made with phrases. It isn’t all concerning the worth.

One different level to be aware of right here is that the final time topic to offers was fashionable was shortly after the housing crash in 2008 when credit score markets have been tight. The benefit was predominantly that it allowed a purchaser to buy the property with out a lot money down or with out having to hunt a financial institution mortgage.

Right this moment, the benefit has to do with the rates of interest of the loans. Meaning most consumers will need to maintain these loans for a very long time and sure the period. The vendor will probably not be okay with this, particularly since being caught with a mortgage of their title may intervene with a future try to get a brand new mortgage on a special property. You have to be sincere and forthright about how lengthy you propose to carry the mortgage of their title and stick with your phrase.

Money Purchases and Companions

When rates of interest are excessive, money is king. After all, “have cash” isn’t significantly useful recommendation, as this tweet amusingly factors out:

However even in the event you don’t have cash, that doesn’t imply you’ll be able to’t purchase with money. Whereas non-public loans could have been one of the best ways to boost cash a couple of years in the past, partnerships could also be extra engaging now; i.e., you do the work and convey the deal, the companion brings the money, and also you cut up the deal. You’ll find such companions the identical manner you’ll discover non-public lenders.

For these, the pitch ought to embody a plan to refinance with a financial institution mortgage and repay a lot of the fairness companion’s funding at any time when charges come again down.

Shopping for Portfolios

This one is a little more speculative, however we’ve got seen a notable uptick within the variety of sellers liquidating portfolios of homes and small multifamilies. Certainly, we’ve got bought 4 such portfolios in 2022 alone and have type of made this our specialty.

From what I can inform, a mix of causes have led to this, which I imagine are:

- Many homeowners of portfolios (significantly between 5-30 models) couldn’t sustain with hire will increase over the previous few years and now have fairly under-rented portfolios, which they don’t need to cope with.

- On this interest-rate setting, it doesn’t make sense to refinance, and it might be tough and take a very long time to promote many scattered websites individually.

- The final problem of managing a gaggle of spread-out homes and small multifamily models.

I must also level out that they often promote these portfolios at important reductions. The 4 we purchased this yr have been, from my estimates, between 75%-80% of their worth.

If you’re pretty effectively established and may deal with low money circulation on a more recent buy for the speedy future whilst you get the rents up, this could possibly be a chance to discover.

Conclusion

It’s vital to keep in mind that each actual property market has its benefits and drawbacks. When it’s onerous to search out good offers, it’s often straightforward to promote. The identical goes for a market teetering on the sting of a recession with excessive inflation and high-interest charges.

You simply might need to be a bit extra inventive.

On The Market is offered by Fundrise

Fundrise is revolutionizing the way you put money into actual property.

With direct-access to high-quality actual property investments, Fundrise lets you construct, handle, and develop a portfolio on the contact of a button. Combining innovation with experience, Fundrise maximizes your long-term return potential and has rapidly turn out to be America’s largest direct-to-investor actual property investing platform.

Study extra about Fundrise

Observe By BiggerPockets: These are opinions written by the creator and don’t essentially characterize the opinions of BiggerPockets.

[ad_2]

Source link