Currently, now we have turn into greater than used to speaking about inflation, rates of interest, central banks. There may be a number of uncertainty about these matters, partly as a result of most lively buyers haven’t skilled related conditions of their lives (such because the inflation shock of the Seventies).

This indecision might be clearly seen within the lengthy finish of the fastened earnings curves the place the 10y Bund is buying and selling not removed from final autumn’s ranges and the 10y US Treasury has been in a good vary since at the very least March.

And such an indecisive behaviour is much more noticeable amongst currencies the place the USD has not made a lot progress because the starting of the 12 months and has traded all through the spring between 101 and 102.5, precisely the place it was in January. Once you suppose that there are such a lot of different elements to contemplate within the value of a foreign money, like commerce/price range balances, GDP development, or the impression of a regional banking disaster or of the US debt ceiling, it’s not a foul thought to depend on value motion evaluation to scrub up among the noise from too many inputs.

The USD stopped weakening on the finish of January/starting of February after a decline in costs that took the index from 114.74 in September 2022 to the 100.50 / 101.00 space; and now it appears to be making an attempt to lift its head once more.

At first it was the power in opposition to some Asian currencies such because the CNH or the JPY: in each circumstances, a trendline had already been damaged in mid-April, bringing the Renminbi again near 7.00, whereas the USDJPY retested the above-mentioned break earlier than shifting increased.

USDJPY, Each day

Then, previously few days, an rising foreign money cross like USDZAR broke strongly off its 2022 highs and marked new ATH (additionally as a result of inner points which we are going to look at sooner or later). Possibly all these pairs and crosses had been canaries within the mine?

Then, previously few days, an rising foreign money cross like USDZAR broke strongly off its 2022 highs and marked new ATH (additionally as a result of inner points which we are going to look at sooner or later). Possibly all these pairs and crosses had been canaries within the mine?

USDZAR, Each day

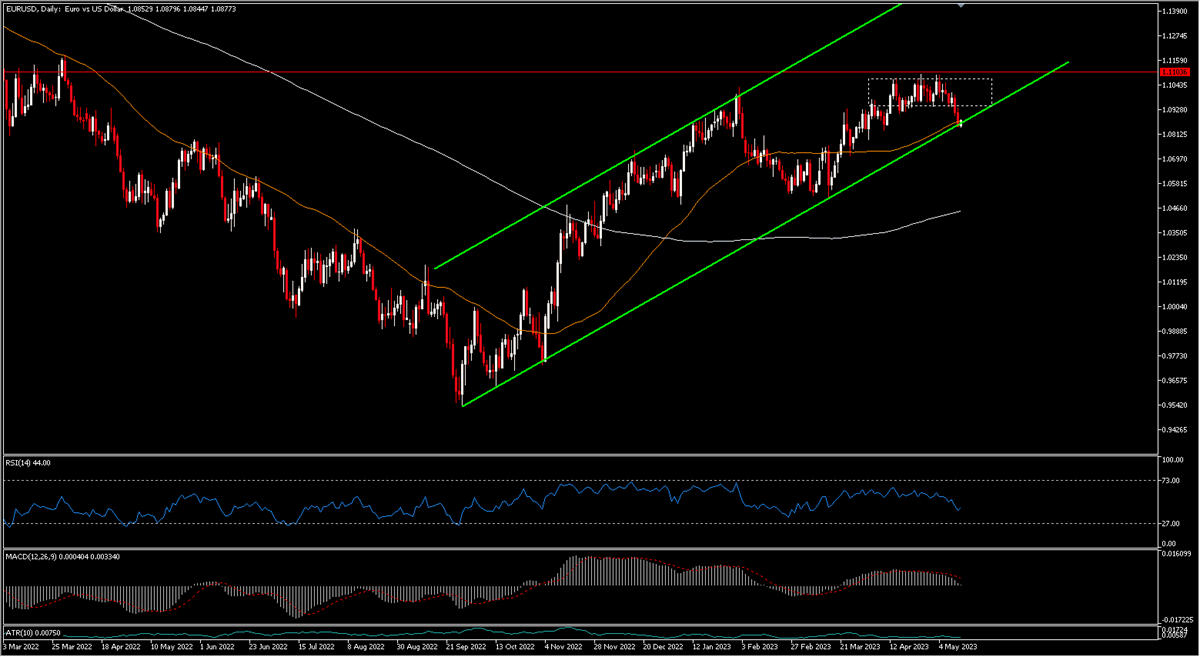

Clearly, a USD Index constant motion couldn’t occur with out this additionally occurring on a very powerful currencies that make up the basket of the USD index such because the Euro (which is price about 60%) or the GBP. Nicely, in the previous few days we’re experiencing this type of actions: the Cable fell 1.77% in 3 days after being rejected by a doable long run trendline within the 1.2675 space. EURUSD fell greater than 1% between Thursday and Friday and is simply now testing the bullish channel which originated in Oct2022.

EURUSD Each day

It goes with out saying that these actions have been mirrored within the USD Index which is simply now testing the downtrend of the final 8 months. It’s now the time to carefully comply with the buck value motion and discover out if we’re near a pattern change – or not.

USD Index, Each day

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a normal advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or must be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.