Friday:

Monday:

Over the weekend, our coated three key ratios to assist decipher the market motion and the prevailing macro theme for the economic system.

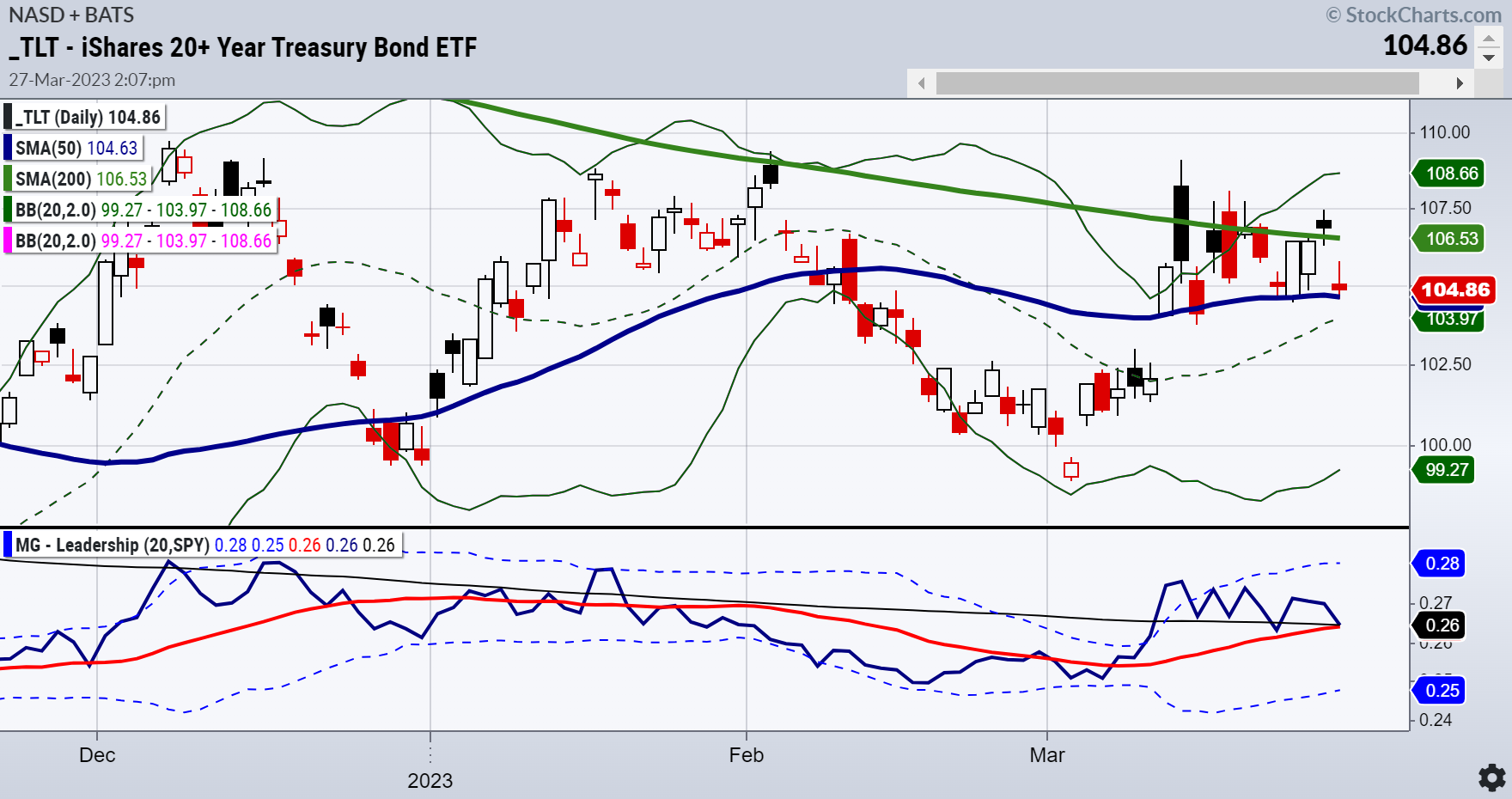

We began with the one between lengthy bonds () and the (). All final week, lengthy bonds outperformed the SPY with requires recession.

This week to date, bond yields have risen to three.5%. Whereas declined a bit together with semiconductors, was up $70 a barrel, and grains and sugar costs rose.

Wanting on the TLT: SPY Monday, TLTs are acting on par with SPY. Recession fears over, hiya stagflation?

Then, as if to assist the stagflation idea with yields rising and the indices in a buying and selling vary, continues to outperform .

Though silver costs additionally fell, the ratio between silver and gold entered the “inflation fear” zone.

For the third ratio, we proceed to have a look at the for clues. The greenback usually goes up when rates of interest do.

But the greenback declined towards the euro, now at 1.07. So we now have yields rising, silver outperforming, and the greenback declining.

Our Small Cap All-Stars Mannequin had the perfect every day returns Monday after the financial institution points started with excellent news.

The () may see an extra bounce from right here. But stays caught in a buying and selling vary.

A minimum of we’re not seeing IWM head into recession territory. The great information is that the market is optimistic about avoiding recession.

The unhealthy information is that the market has not but handled the opportunity of stagflation. After which there may be .

A observe on Bitcoin from Holden:

The almost certainly situation from right here is that we’ll see Bitcoin go sideways for a short time on this new vary till a brand new piece of main information comes out to pressure a break by some means. Within the occasion of a breakdown from right here, we’d anticipate BTC to seek out assist across the $25,000 degree, whereas the clear goal from right here is to take out the psychological $30,000 degree on a every day closing foundation.

ETF Abstract

- S&P 500 (SPY) Must clear 400 and maintain 390

- Russell 2000 (IWM) 170 held-so possibly the ratios are implying no recession after all-180 resistance

- Dow (DIA) 325 cleared now wants to carry

- Nasdaq (QQQ) 305 assist 320 resistance

- Regional banks (KRE) Each day up reversal. Weekly extra contained in the vary of the final 2 weeks

- Semiconductors (SMH) Observe by on that key reversal w/ 250 assist

- Transportation (IYT) 219 is a degree that has been like a yo-yo worth

- Biotechnology (IBB) Held key assist at 125 area-127.50 resistance

- Retail (XRT) Granny held 60-still within the game-especially since that’s the January calendar vary low