This yr’s rebound in asset costs world wide means that investor sentiment is shifting to risk-on after a yr of enjoying protection. Attempting to divine the long run for pricing is all the time precarious, particularly within the close to time period. However there’s no cost for proxies of key market tendencies by varied ETF pairs. As we’ll see, sure slices of markets are predicting a brand new bull run, but it surely’s nonetheless early to ring the all-clear sign, in line with a broad measure of US shares relative to US bonds, which is arguably a extra dependable indicator. However let’s begin with the sizzle.

The poster boy for the current change in threat urge for food is captured by the current spike within the ratio between high-beta US shares () and their counterpart by way of low-volatility shares (). The important thing query: Will this gauge of sentiment maintain on to its newest acquire and keep an upside bias?

Excessive Beta S&P 500 vs Low Quantity S&P 500 Shares

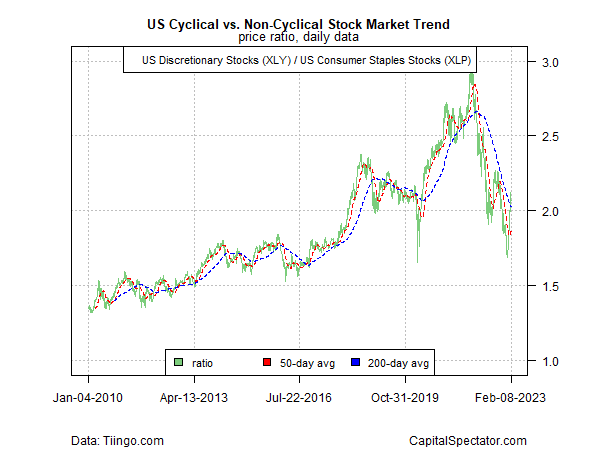

One other solution to gauge the urge for food for threat sentiment is by monitoring how discretionary client shares () carry out relative to their extra defensive counterparts by way of client staples (). Right here, too, a sentiment change is seen, however the shift is weaker in contrast with excessive beta/low vol.

US Cyclical vs Non.Cyclical Inventory Market Development

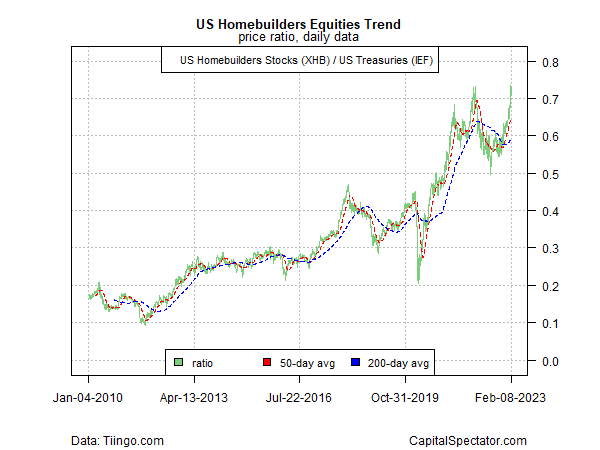

In contrast, a proxy for the housing outlook seems to be purple sizzling, primarily based on homebuilder shares () relative to the US Treasuries (). It’s debatable if this slice of the market is getting forward of itself, however to the extent, it is a main indicator for financial exercise, it’s screaming that it’s off to the races as soon as extra.

US Homebuilders Equities Development – Value Ratio Each day Knowledge

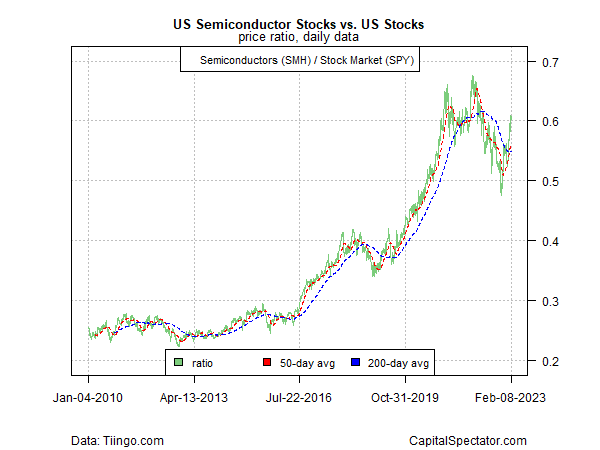

One other proxy for the enterprise cycle and demand for threat property is the ratio between semiconductor shares () and the broad equities market (). The idea right here is that semis are extremely delicate to the enterprise cycle and due to this fact provide early alerts for main turning factors in financial exercise. On that foundation, there’s a transparent change underway.

US Semiconductor Shares vs US Shares Each day Knowledge

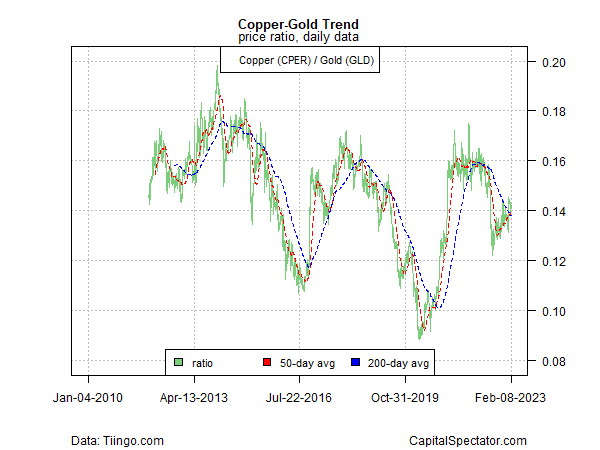

Turning to commodities, the ratio of United States Copper Index Fund (NYSE:) to SPDR Gold Shares (NYSE:) costs signifies a modest enchancment in threat urge for food however way more cautiously than the indications by way of equities proven above. The thought right here is that demand tends to rise and fall with financial exercise vs. gold’s conventional position as a have in instances of turmoil.

Copper-Gold Development Each day Knowledge

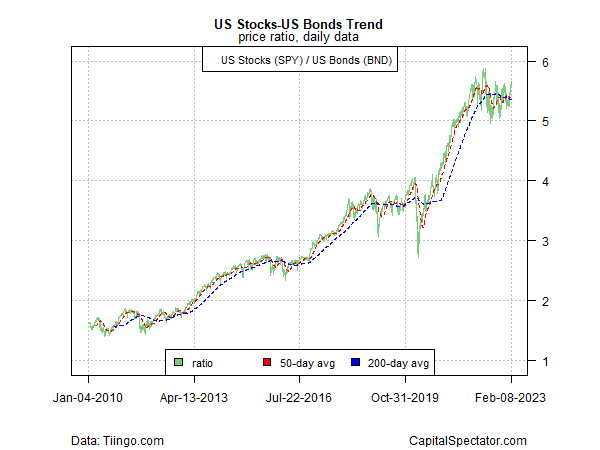

Lastly, take into account broad measures of US shares (SPY) vs. US bonds (), which is arguably the first estimate of the group’s market sentiment. On this entrance, the pattern stays uneven and caught in a holding sample. In impact, this indicator is advising {that a} wait-and-see technique remains to be warranted.

US Shares – US Bonds Development Each day Knowledge