[ad_1]

“Revenue margins are in all probability probably the most mean-reverting collection in finance. And if revenue margins don’t mean-revert, then one thing has gone badly fallacious with capitalism.” – Jeremy Grantham

Whereas there are actually many complaints that “capitalism” is damaged, such isn’t the case. Sure, there are issues with financial inequalities, nearly all of which might be immediately traced to financial and financial insurance policies and an increase in “corporatism.” Nevertheless, that could be a dialogue for one more article.

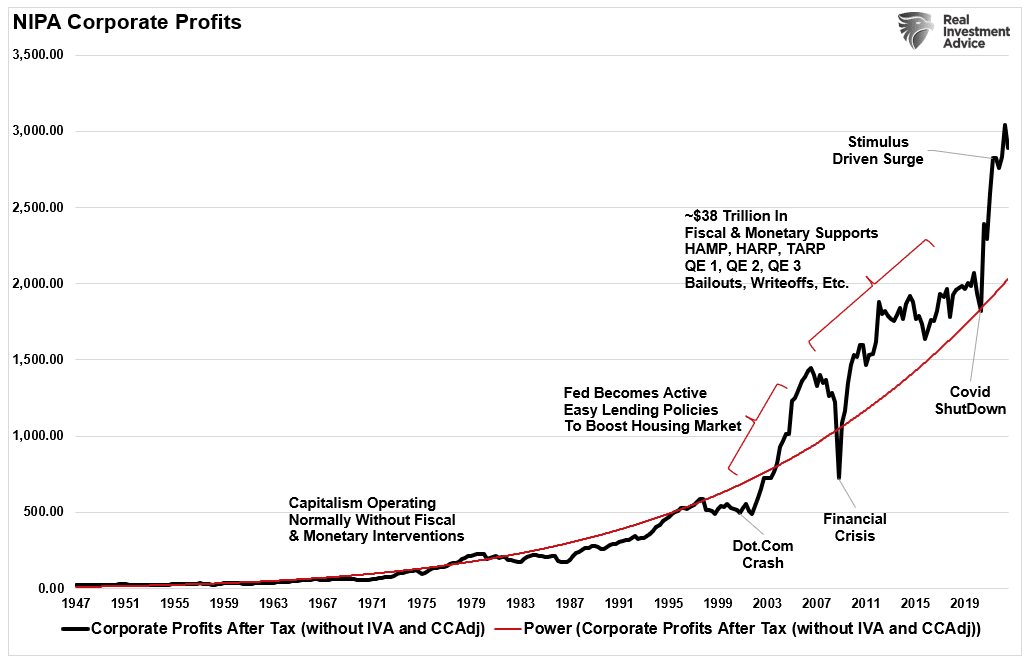

Within the economic system right this moment, capitalism is alive and effectively. The rationale we all know this is because of each the surge in inflation and company profitability since 2020. If “capitalism” was damaged, because the economic system was flooded with $5 trillion in fiscal stimulus, inflation wouldn’t have resulted. To wit:

“The next financial illustration exhibits such taught in each ‘Econ 101’ class. Unsurprisingly, inflation is the consequence if provide is restricted and demand will increase by offering ‘stimulus’ checks.”

With the economic system shut down and an inorganic surge in demand on account of “free cash,” the promoting costs of a restricted provide of products rose. The essential financial perform of provide and demand proves capitalism is functioning correctly. Moreover, as proven, company income surged with labor prices significantly diminished because of the shutdown and better costs on account of artificially stimulated demand.

“Notably, this has nothing to do with big firms making the most of shoppers. It’s simply the financial consequence of ‘an excessive amount of cash chasing too few items.”’ – RIA

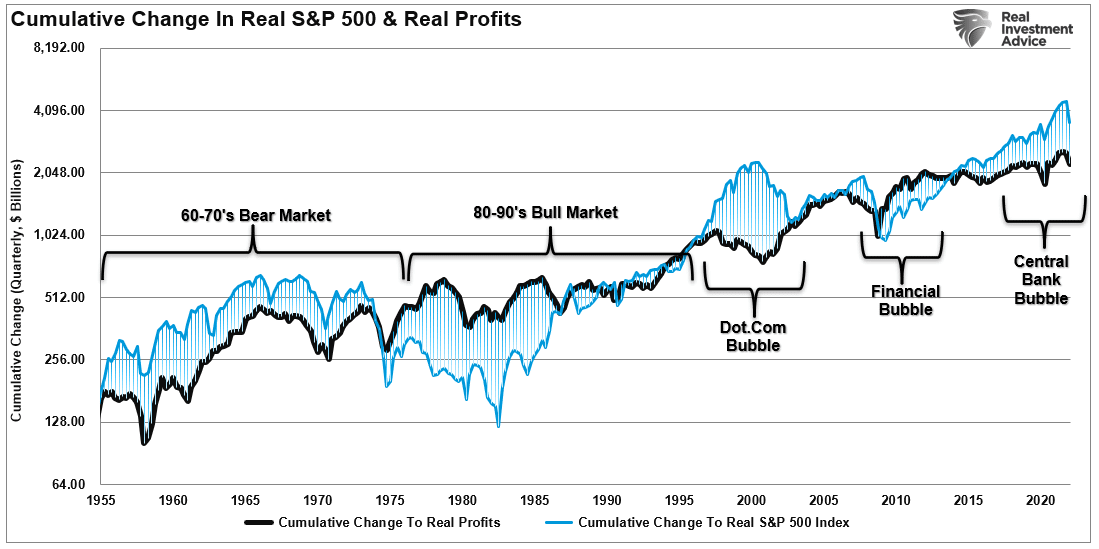

Lastly, if “capitalism was damaged,” as many recommend, inventory market costs wouldn’t have chased greater company income. In a capitalistic market atmosphere, buyers ought to place the next valuation on corporations with elevated income. Such is exactly what we noticed in 2020 and 2021 as buyers started to overpay for present income. As is at all times the case, “greed” is a byproduct of capitalism.

Nevertheless, company income should additionally fall if capitalism has not develop into damaged.

What Are You Going to Do for Me Now

Let’s revisit how we bought that large surge in company income.

- Shut down the economic system main to an enormous surge in .

- Begin sending $5 trillion in financial stimulus on to households.

- Have the lower rates of interest to zero.

- Start probably the most aggressive Quantitative Easing program in historical past.

- Put moratoriums on numerous debt obligations giving households extra discretionary financial savings to spend.

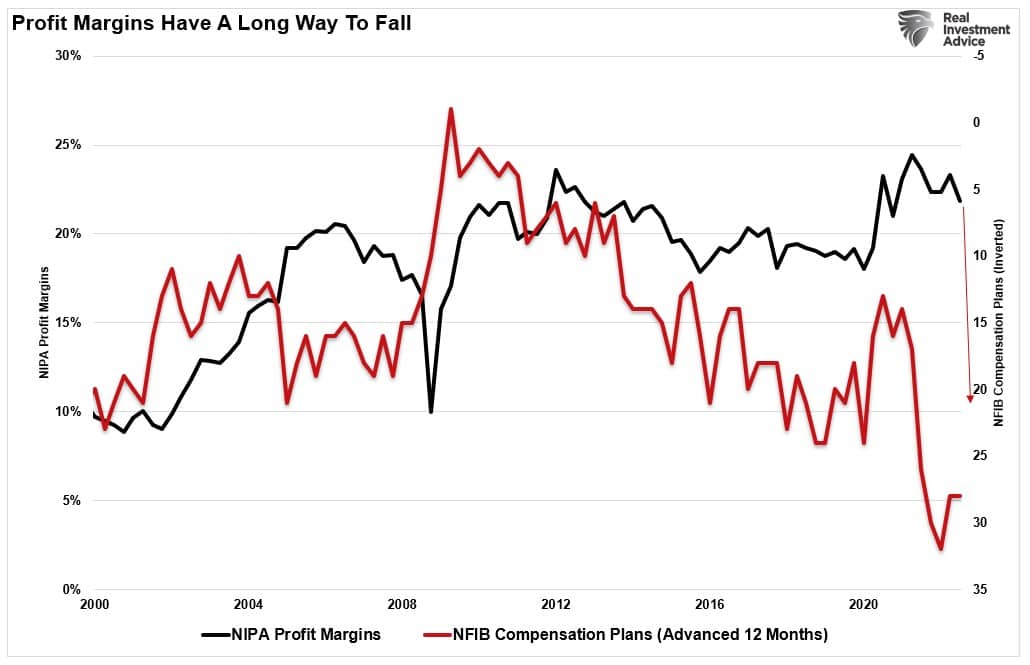

Not surprisingly, with sharply diminished and households flush with money to spend and nothing else to do, mixed with a listing shortfall to satisfy demand, the consequence was a pointy enhance in profitability. The info from the confirms that as labor prices proceed to rise, company income will fall.

“This factors to economy-wide revenue margins persevering with to fall – doubtlessly fairly sharply – by the 12 months.” – Simon White from Bloomberg

So, suppose the mixture of a shuttered economic system, no provide, and big rounds of fiscal stimulus bought us right here. What’s going to be the catalyst to assist document income sooner or later?

Over the subsequent few years, the atmosphere appears to be like markedly completely different than previously.

- The economic system is returning to a sluggish development atmosphere with a danger of recession.

- Inflation is falling, that means much less pricing energy for companies.

- No synthetic stimulus to assist demand.

- Over the past two years, the pull ahead of consumption will now drag on future demand.

- Rates of interest are considerably greater, impacting consumption.

- Customers have sharply diminished financial savings and better debt.

- Earlier stock droughts are actually surpluses.

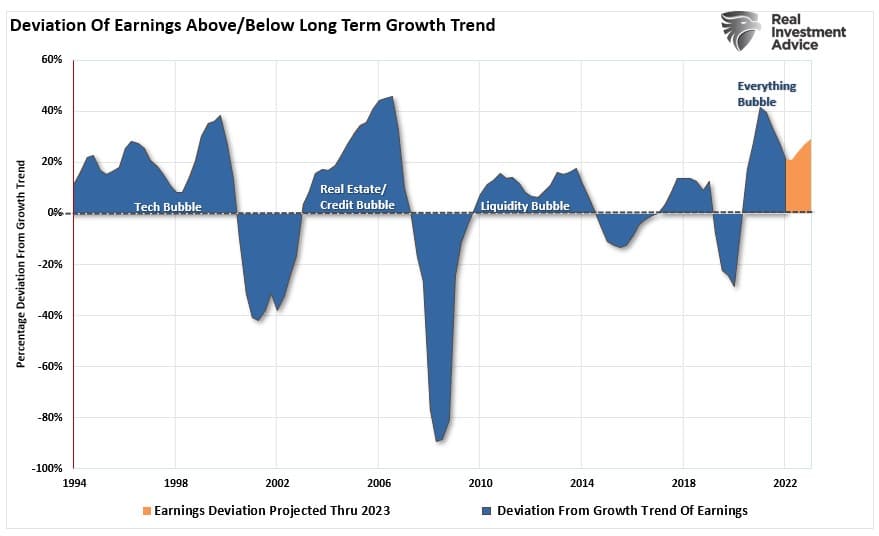

If you happen to agree with that premise, you could agree that “capitalism HAS NOT develop into damaged.” Due to this fact, company income, and by extension earnings, should revert to accommodate slower financial development. The present near-record deviation of company earnings from the long-term exponential development development stays problematic for bullish buyers at the moment.

Capitalism Stays Indifferent

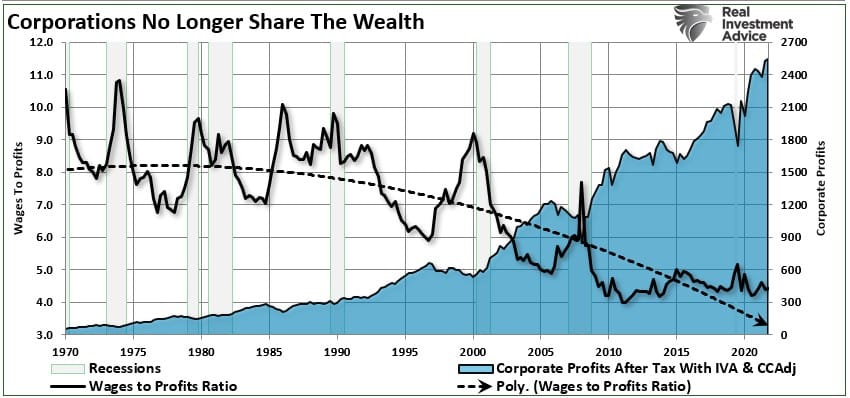

It’s actually comprehensible why individuals assume capitalism has develop into damaged. They really feel unfairly handled because the labor suppliers to the capital suppliers. The chart beneath of income to wages makes the argument.

Nevertheless, the very definition of capitalism is that chart:

“Capitalism is an financial system by which non-public people or companies personal capital items. On the identical time, enterprise house owners (capitalists) make use of employees (labor) who solely obtain wages; labor doesn’t personal the technique of manufacturing however solely makes use of them on behalf of the house owners of capital.” – Investopedia

In different phrases, if you’re feeling slighted by the present economic system, then you may have three decisions:

- Be a laborer, or

- Develop into a supplier of the technique of manufacturing, or

- Spend money on public corporations by the inventory market

The issue is that company profitability and the market stay indifferent from the underlying economic system because of the large interventions during the last decade. Such makes ahead returns on offering the technique of manufacturing and market investments extra problematic.

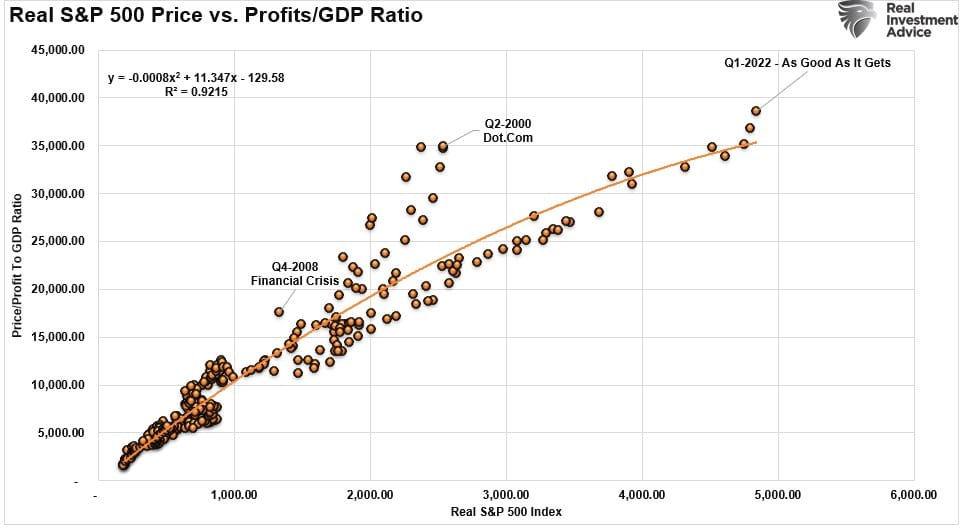

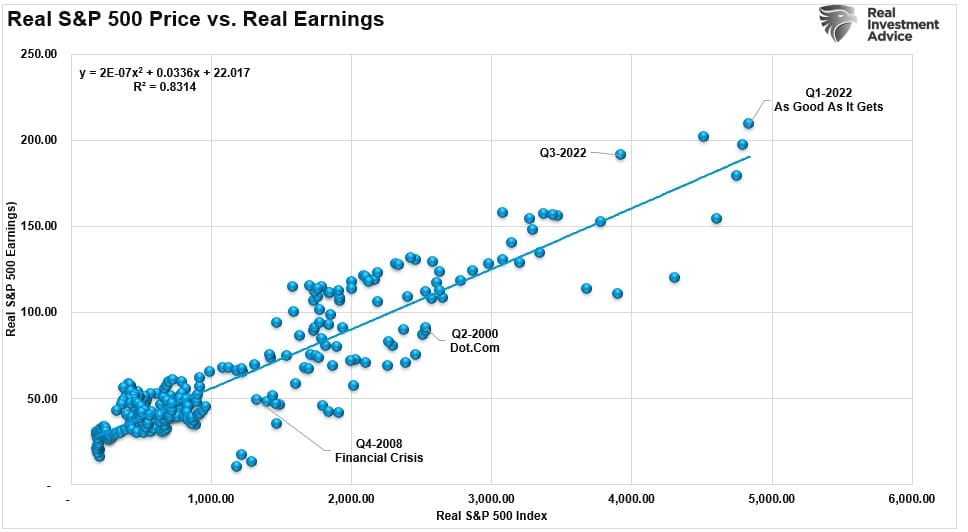

Traditionally, such deviations don’t work out effectively for overly “bullish” buyers. The correlation is extra evident when trying on the market versus the ratio of to . Why income? As a result of for IRS tax functions, firms report “income,” that are a lot much less topic to manipulation than “earnings.”

With correlations at 90%, the connection between financial development, earnings, and company income ought to be evident. Therefore, neither ought to the eventual reversion in each collection. At the moment, the index is buying and selling effectively above its historic development in earnings. As company income decline, the present earnings estimates may also lower.

No. Capitalism has not develop into damaged. Nevertheless, the detachment of the inventory market from underlying profitability ensures poor future outcomes for buyers. However, as has at all times been the case, Wall Road is at all times late in catching up with financial realities.

Such is especially the case of surging shares in opposition to a weakening economic system, diminished international liquidity, and rising inflation. Whereas buyers cling to the “hope” the Fed has every part underneath management, there may be greater than an affordable probability they don’t.

[ad_2]

Source link