Earlier this week, Amazon.com (NASDAQ:) unveiled plans to separate its inventory for the primary time in additional than 20 years. The transfer will enhance the corporate’s excellent shares in a 20-to-1 ratio, making the inventory value extra enticing for traders who had been uncomfortable shopping for a inventory with a four-digit worth.

After the cut up announcement on Wednesday, Amazon soared as a lot as 11% within the after-hours buying and selling. Nevertheless, it gave again a few of these features amid a broad market selloff, closing Thursday at $2,936.57, up greater than 4,000% since its final inventory cut up in September 1999.

The Seattle-based e-commerce large, in an emailed assertion, stated the cut up goals at giving workers “extra flexibility in how they handle their fairness” and making the inventory “extra accessible” for common traders. Amazon’s cut up requires shareholder approval and would take impact in June if cleared.

Technically talking, inventory splits don’t change the worth of an organization or its traders’ holdings. Nevertheless, this technique reduces the worth of particular person shares, which may make a inventory extra accessible to a broad vary of traders, particularly when the worth of shares reaches a degree deemed too excessive for small traders.

Amazon’s cut up choice, following comparable strikes final 12 months by Apple (NASDAQ:) and Tesla (NASDAQ:), additionally illustrates the rising affect of retail traders available on the market the place massive institutional traders have taken a again seat for the reason that COVID-19 pandemic.

That stated, traders shouldn’t make their funding choices primarily based on inventory splits. As an alternative, the corporate’s enterprise fundamentals and its valuation matter essentially the most. On that account, Amazon inventory is an effective purchase, in our view.

Highly effective Momentum

Amazon inventory has turn out to be fairly enticing after dropping 1 / 4 of its worth since final July when it hit a document excessive. The downward transfer began as the large warned about the price pressures within the post-pandemic atmosphere, spurred by supply-side hurdles, labor provide shortages, and elevated freight and transport prices.

However whereas the present atmosphere doesn’t look too favorable for Amazon’s e-commerce enterprise, traders shouldn’t ignore the highly effective momentum within the firm’s different models, together with its promoting phase and features from Amazon Internet Companies (AWS), the corporate’s cloud unit.

Gross sales for the cloud unit, which presents clients server capability and software program instruments and generates a good portion of the corporate’s working revenue, have been exhibiting large development. Within the earlier quarter, this diversification in gross sales helped Amazon when cloud-computing and promoting companies mixed made up greater than the decline in on-line retailer gross sales. Consequently, the corporate posted a blockbuster .

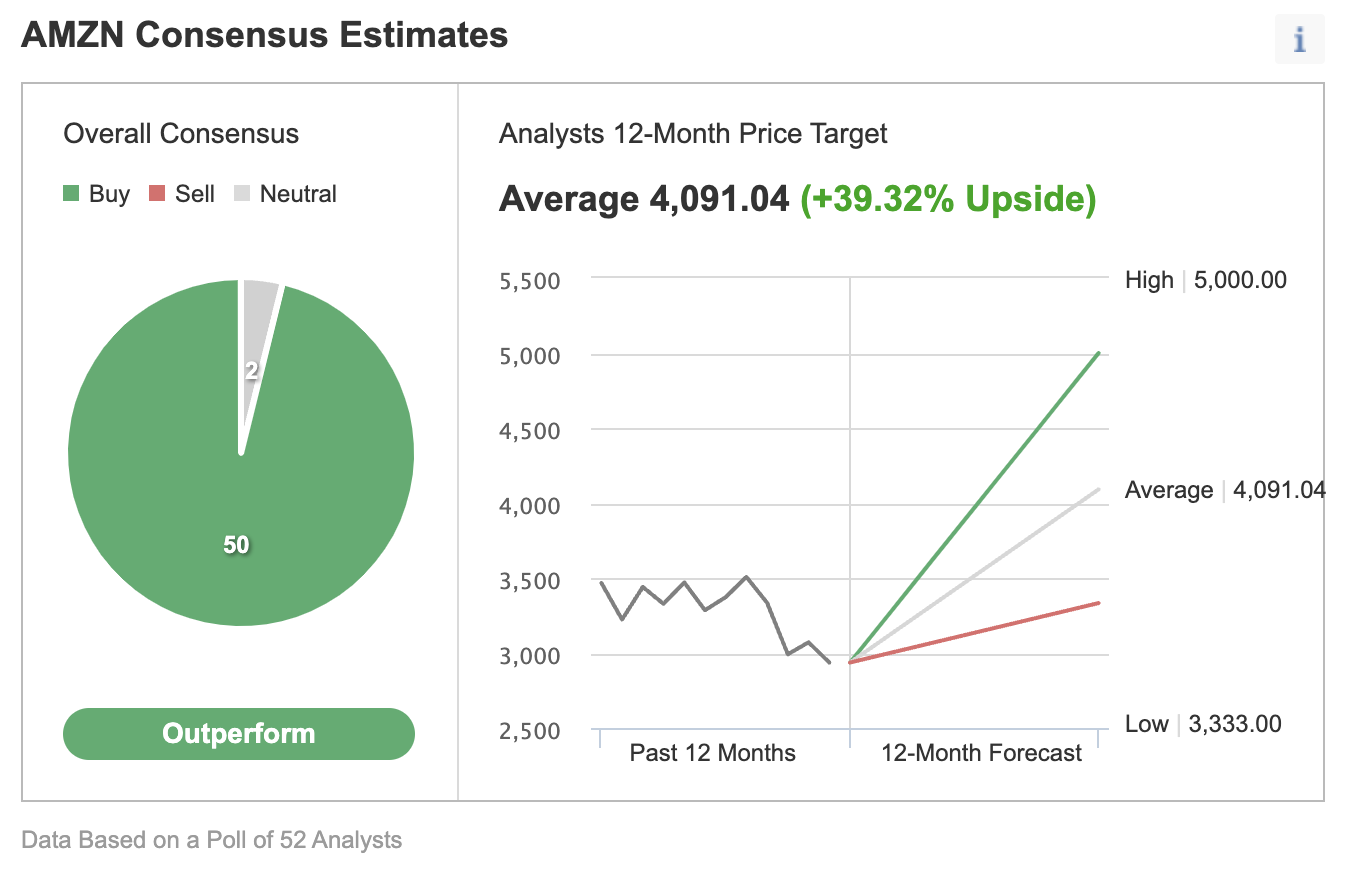

This power in Amazon’s development outlook is the principle cause that analysts overwhelmingly assist shopping for the inventory on these ranges. In an Investing.com survey of 52 analysts, 50 have an “outperform” ranking on the inventory with a 12-month consensus value goal that suggests about 39.3% upside.

Supply: Investing.com

Barclays, this week reiterated Amazon as chubby, saying the corporate will revise its earnings outlook. Its notice stated:

“Retail margins are beginning to present stabilization in 2022 and continued combine shift to higher-margin enterprise models like AWS and Advertisements, we see upward estimate revisions as probably this 12 months.”

Financial institution of America, in a current notice, named Amazon its high choose for 2022, saying that the retail behemoth ought to take pleasure in a “vital” growth in revenue margins from 2023 to 2025, helped by its cloud, promoting, and third-party market.

Backside Line

Amazon’s inventory cut up choice will broaden the corporate’s enchantment amongst retail traders who’re extra actively concerned in buying and selling within the post-pandemic atmosphere. As well as, Amazon has a major upside because of development momentum in its cloud and different models.