[ad_1]

Shares completed the day flat after a sizzling report despatched charges larger, and a cool report despatched charges again to flat. That left shares transferring sideways after a quick transfer larger within the noon and a decline into the shut.

So, in case you are counting, the completed the day beneath the 10-day exponential transferring common for the second day in a row. The final time was on February 21, adopted by a better hole after NVIDIA (NASDAQ:) reported outcomes.

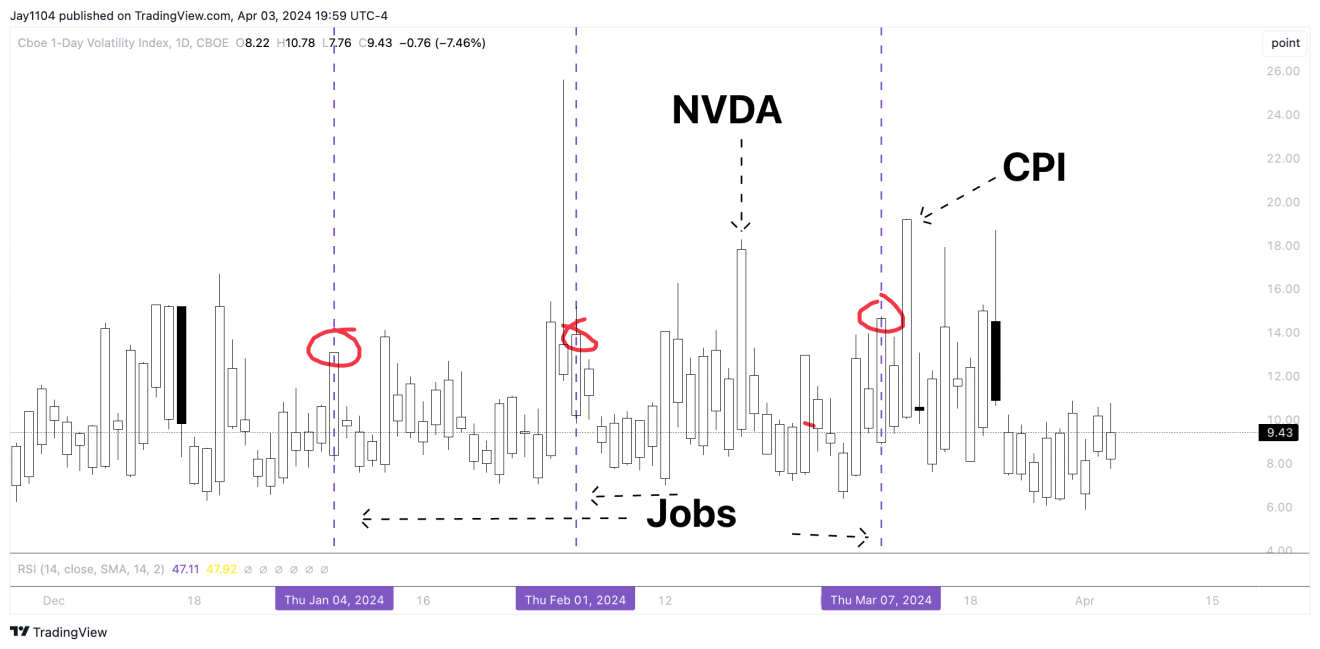

At the moment will probably be Job Stories Eve, which suggests we should watch the VIX1D intently to see how excessive it will get heading into the report on Friday morning. It doesn’t appear excessive sufficient to make a distinction proper now, however I might anticipate the 1-day rise in the present day; perhaps it even will get into the mid-teens.

The previous three stories have seen the VIX1D rise up to round 13 to 14, in comparison with the VIX1D reaching 18 earlier than the Nvidia report and 19 forward of the report. So, if the VIX1D stays in that 13 to 14 vary, it in all probability doesn’t end in a lot volatility crush on Friday.

In the meantime, costs surged yesterday and pushed larger above resistance at $4.15. It actually appears to be like like copper is in a restoration part at this level and has some room to run till it hits resistance at round $4.30.

additionally surged yesterday over resistance at $85.50, and if it might maintain these ranges and consolidate, it appears to be like as if it’s going to go larger and probably again into the 90s.

Given the positive aspects in copper and oil, I might assume that we might see charges rise and push larger. Yesterday, they tried to maneuver larger, after which they appeared to get nervous following the weaker-than-expected ISM report.

Nonetheless, the appears to be like like it’s consolidating simply above resistance at 4.35%. The cup and deal with sample means that the 10-year strikes larger to round 4.55%.

It appears fairly clear that inflationary threat belongings are rising. In some unspecified time in the future, this must catch as much as rates of interest, and charges must reply to the upper commodity costs and potential impacts on the inflationary outlook.

Unique Put up

[ad_2]

Source link