[ad_1]

S&P 500 AND NASDAQ 100 OUTLOOK: SLIGHTLY BEARISH

- The S&P 500 and Nasdaq 100 completed the week decrease after the Federal Reserve indicated that its terminal price shall be larger than beforehand anticipated

- Inflation shall be an important value motion catalyst subsequent week

- For market sentiment to enhance, CPI knowledge should present a significant slowdown in value pressures

Really helpful by Diego Colman

Get Your Free Equities Forecast

Most Learn: USD Snaps Again on NFP After Fed-Fueled Rally: EUR/USD, GBP/USD

The S&P 500 and Nasdaq 100 suffered steep losses this week after the Federal Reserve delivered one other 75 basis-point hike at its November assembly. Nonetheless, this determination, which was totally discounted, was not the principle bearish catalyst: verbal steerage was. Whereas the central financial institution signaled that it might downshift the tempo of tightening sooner or later sooner or later, it additionally acknowledged that it’s too untimely to speak a couple of “pause” and that the final word degree of rates of interest shall be larger than anticipated attributable to persistently elevated inflation.

Powell’s hawkish message spooked merchants, main them to reprice larger the trail of financial coverage, as mirrored within the chart beneath, exhibiting an implied terminal price on Fed funds futures of round 5.1% by the center of subsequent 12 months, up from 4.85% on Monday. This aggressive roadmap is prone to reinforce recession dangers and undermine equities, even when the FOMC strikes to a slower cycle to higher assess the cumulative results of its previous actions contemplating the lag of coverage transmission.

IMPLIED YIELD FOR 2023 FED FUTURES

Supply: TradingView

The newest U.S. employment report confirmed that policymakers have extra work to do to chill the economic system of their quest to tame inflation by way of demand destruction. In October, U.S. employers added 261,000 payrolls versus 200,000 anticipated, an indication that hiring stays extraordinarily resilient regardless of quite a few headwinds. A good labor market ought to bolster family spending whereas stopping wage pressures from easing materially, a state of affairs that can complicate the combat to revive value stability.

In any case, we’ll know extra about inflation subsequent week, after the U.S. Bureau of Labor Statistics releases final month’s knowledge on Thursday morning. That mentioned, headline CPI is forecast to have risen 0.7% on a seasonally adjusted foundation, with the annual price seen easing to eight.0% from 8.2% in September. For its half, the core gauge is predicted to clock in at 0.4% m-o-m and 6.5% y-o-y.

For the temper to enhance and for consumers to return, the CPI outturn should shock to the draw back in a cloth approach. Outcomes which might be in-line with or above estimates ought to maintain sentiment depressed, paving the way in which for extra losses for each the S&P 500 and Nasdaq 100. On this sense, the very near-term outlook for shares hinges on the inflation report, however over a medium-term horizon, the underlying bias remains to be destructive.

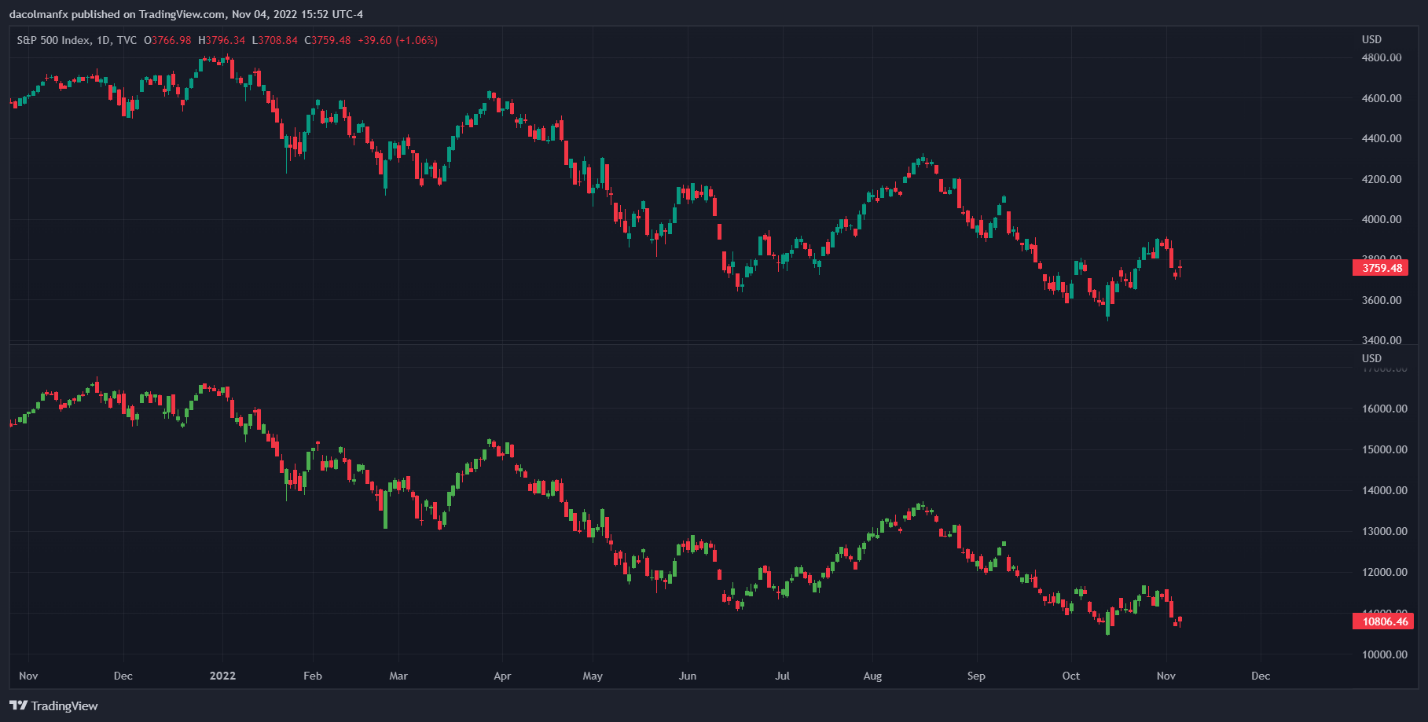

S&P 500 and Nasdaq 100 Every day Chart

S&P 500 Chart Ready Utilizing TradingView

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX staff

Subscribe to Publication

EDUCATION TOOLS FOR TRADERS

- Are you simply getting began? Obtain the learners’ information for FX merchants

- Would you prefer to know extra about your buying and selling character? Take the DailyFX quiz and discover out

- IG’s shopper positioning knowledge gives useful data on market sentiment. Get your free information on how you can use this highly effective buying and selling indicator right here.

—Written by Diego Colman, Market Strategist for DailyFX

[ad_2]

Source link