[ad_1]

Article written by IG Senior Market Analyst Axel Rudolph

- FTSE 100 displays shorter-term draw back potential with the emergence of a ‘capturing star’ candlestick sample

- DAX cools after reaching a brand new all-time excessive final week even with the ECB mountaineering one other 25 bps

- S&P 500 to begin the week in a cautious temper after ‘triple witching’ on Friday

Following final week’s FTSE 100 failure to interrupt by its 7,655 to 7,679 resistance zone on a long-lasting foundation and Friday’s Taking pictures Star candlestick sample, the index seems to be short-term underneath strain, very like Asian markets in a single day which have been in a cautious temper.

A slip by the one-month tentative help line at 7,603 may put the 200-day easy transferring common (SMA) at 7,549 on the map, along with the early June low at 7,546.

The higher boundary of the close to one-month sideways buying and selling vary between the mid-Might low to late Might and present June highs at 7,655 to 7,688 represents key resistance.

Supply: IG

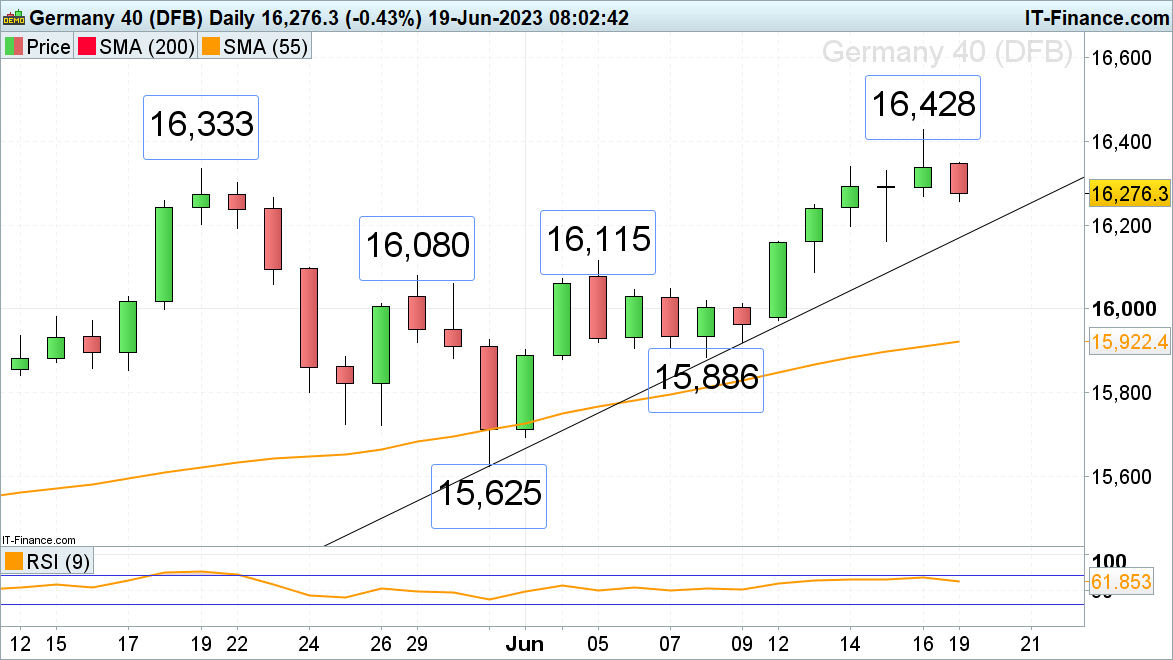

DAX 40 begins week on a extra cautious notice

The DAX 40 made a brand new all-time file excessive at 16,428 final week regardless of the European Central Financial institution (ECB) mountaineering its charges for an eight consecutive time to three.50% and sticking to its hawkish tone.

This week kicks off on a extra subdued notice with a retracement again in the direction of the one-month uptrend line at 16,169 presumably being witnessed, along with final Thursday’s low at 16,160.

Resistance will be noticed between final Wednesday’s excessive at 16,338 and this morning’s intraday excessive at 16,348.

Supply: IG

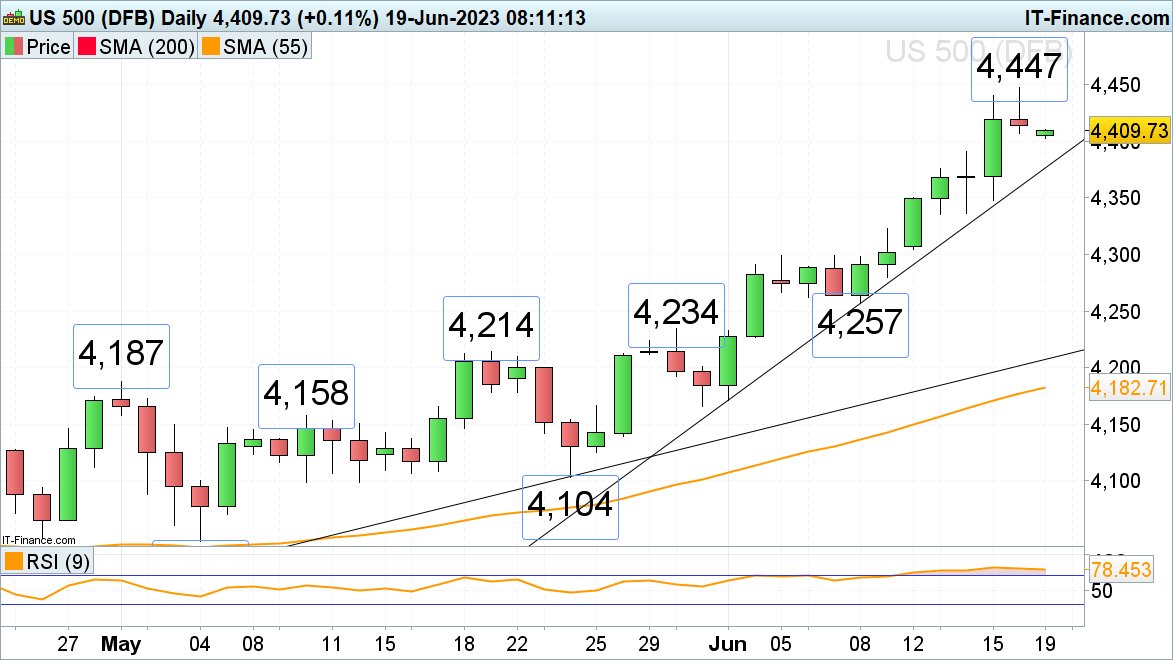

S&P 500 varieties minor prime

Final week the S&P 500 noticed its fifth consecutive week of upper costs with an acceleration to the upside taking it to a 14-month excessive at 4,447 on hopes that the Federal Reserve’s (Fed) “skip” of not mountaineering its charges in June may truly transform the lengthy awaited “pivot.”

Following in Asia’s footsteps, this week is prone to start on a extra cautious footing following Friday’s Triple Witching, the day at which inventory choices, inventory index futures and inventory index choices expire within the US.

Based on IG head of markets Europe Salah-Eddine Bouhmidi, since Q1 2000 the week(s) following Triple Witching on common are typically unfavourable ones.

This time spherical bulls additionally need to cope with opposite indicators such because the CNN Concern & Greed Index buying and selling in “excessive greed” territory and the put/name ratio at extraordinarily low ranges whereas the volatility VIX stays at pre-Covid ranges, all of which can level to a prime forming.

Potential slips could discover help across the minor psychological 4,400 mark and at Wednesday’s 4,391 excessive right this moment, under which the June help line will be noticed at 7,376.

The one resistance of notice to talk of is final week’s excessive at 4,447.

Supply: IG

[ad_2]

Source link