PM Pictures

Funding Thesis

In a decrease rate of interest atmosphere, dividend-paying shares usually carry out higher as buyers search increased yields than what fixed-income investments provide. With lowered attraction of bonds, these shares change into a horny different, driving their efficiency upward. Consequently, I imagine that decrease rates of interest will improve the efficiency of dividend-paying shares. This text will discover this dynamic additional, specializing in the ETF IGRO and associated macroeconomic components and why I imagine this ETF will outperform.

Fund Description and Efficiency

The fund goals to copy the efficiency of the Morningstar International ex-US Dividend Progress Index with 399 constituents. The ETF invests in securities with a historical past of uninterrupted dividend development and sustains that development (not less than 5 years of consecutive dividend development). The consensus earnings forecast should be constructive, and the forward-looking dividend payout ratio should be lower than 75%. The methodology thus ensures future dividend development.

Under is a abstract desk together with expense ratio and dividend frequency. Along with this, I’ve additionally offered the YTD value efficiency of 9.5%. This return is nice, however nonetheless decrease than the S&P 500 index value and complete return of 13% and 14.89%, respectively. I imagine that is attributed to decrease know-how sector allocation and ex-us nation factor.

Value Efficiency (Looking for Alpha)

Holdings and Sector Weights

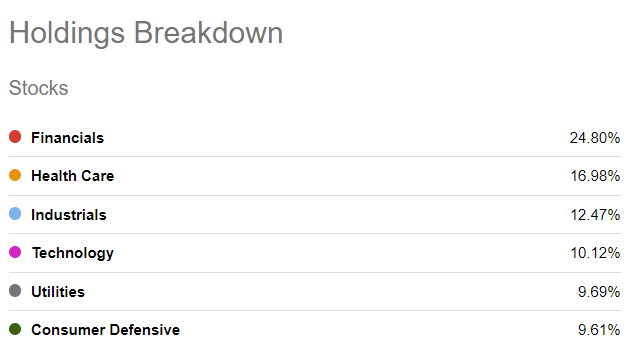

The highest three fund holdings of the 4, proven beneath, are healthcare shares and the second largest sector weight is healthcare at 16.98% with $134m of the $788m AUM invested on this sector.

Prime 4 fund holdings (Looking for Alpha) Sector Breakdown (Looking for Alpha)

The healthcare sector is taken into account a protected and regular funding throughout bear markets. It is considered a late-cycle defensive play as a result of it might assist shield a portfolio when the inventory market will get unstable. Here is why:

Important Providers: Irrespective of how the financial system is doing, individuals nonetheless want medical care, medicines, and different well being providers.

Steady Earnings: These corporations usually have dependable earnings and money move, which is interesting to buyers on the lookout for security throughout robust market occasions.

Dividend Funds: Common dividend funds, make them engaging to buyers who need regular revenue, particularly when investments equivalent to bond yields are dropping worth.

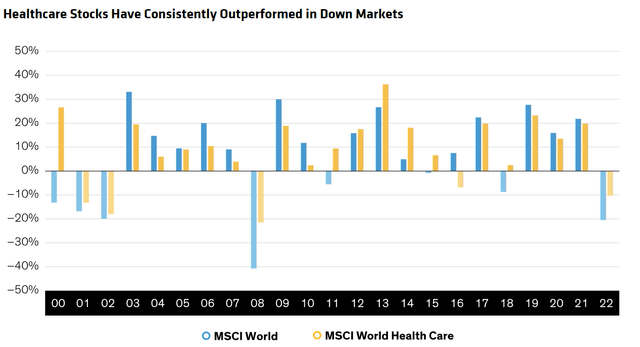

If we evaluate a healthcare index to a typical vanilla world index, it’s simple to see how defensive healthcare investments are helpful. For instance, in 2008 and 2022, the MSCI World Healthcare Index fell by half of what the MSCI World Index dropped by. This reveals how healthcare retains up its pattern of decreasing draw back threat. The truth is, since 2000, healthcare has outperformed the market each time world equities have gone down.

Healthcare vs World Index (Alliance Bernstein)

Macro Backdrop

Dividend shares are inclined to carry out properly during times of macroeconomic volatility and authorities charge cuts, as buyers search alternate options to bonds for yield appreciation. Whereas dividend funds could develop extra slowly than a inventory’s capital appreciation, buyers can depend on rising dividend yields to reinforce returns over time. The facility of compounding, particularly when reinvesting dividends, can flip this right into a extremely profitable technique.

Traditionally, when the Federal Reserve begins slicing rates of interest, corporations that proceed to boost their dividends have usually outperformed different shares. In distinction, during times of excessive rates of interest, buyers usually favor different short-term income-generating belongings with minimal threat. As an illustration, following the inflation surge largely triggered by the invasion of Ukraine, which led to vital value will increase in on a regular basis shopper items, Chair Powell was compelled to implement a collection of consecutive charge hikes to counteract the inflation influence (primary economics which I cannot focus on on this article). This resulted within the yield on the 10-year Treasury climbed from 1.72% to five%. Throughout this time, cash market funds noticed a 21% enhance in AUM as buyers gravitated towards high-yielding money equivalents with little to no threat, usually on the expense of dividend shares, which confronted strain on their valuations.

Provided that dividends contribute considerably to complete returns, buyers may think about specializing in shares that enhance their dividends when the Fed lowers charges, particularly if revenue is a precedence. Moreover, dividend-paying corporations have traditionally acted as a hedge in opposition to market uncertainty, as administration is usually cautious about altering payout ratios. This stability turns into much more interesting throughout occasions of heightened financial and political uncertainty.

Such corporations are sometimes often called “dividend aristocrats” because the methodology for such indices solely contains companies which have elevated their dividends for 25 consecutive years or extra. A latest examine by Ed Clissold and Thanh Nguyen of Ned Davis Analysis presents empirical proof supporting this. They found that, on common, dividend-paying shares are inclined to outperform non-payers beginning a number of months earlier than the primary charge minimize in a Fed easing cycle and persevering with for six to 9 months after the minimize.

I think about this a key cause for my BUY score on this ETF. Macroeconomic components considerably affect dividend development methods, as decrease rates of interest enable corporations to borrow extra cheaply, decreasing the chance of dividend cuts. Moreover, with an inverted yield curve, the chance of a recession will increase, which in flip raises the likelihood of additional charge cuts.

Why Worldwide Dividends

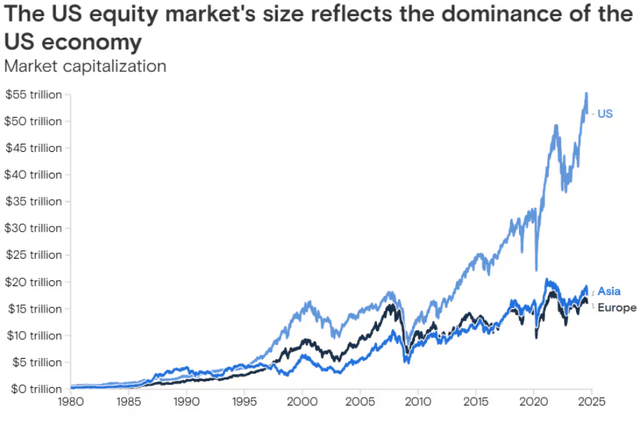

As illustrated within the graph beneath, the US inventory market has expanded considerably in comparison with different fairness markets because the 2008 monetary disaster.

US Fairness Market Dimension (Goldman Sachs)

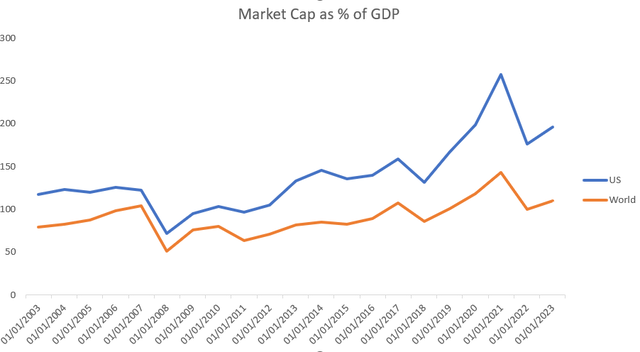

Though the US has lengthy had the most important inventory market and financial system, the hole between it and different markets has widened because the monetary disaster. This disparity is as a result of US experiencing a extra strong restoration in comparison with the remainder of the world. Moreover, the full market capitalization within the US has grown relative to GDP, indicating that the inventory market’s worth has elevated in comparison with the nation’s financial development. In distinction, this ratio has remained comparatively steady in the remainder of the world. The US market cap elevated by 70% whereas the world market cap solely elevated by 39% since 2003

Market Cap % of GDP (Bloomberg)

This pattern isn’t a surprise, as US corporations, notably within the know-how sector, have skilled a lot higher revenue development in comparison with their world counterparts. Nevertheless, this has additionally led to inflated market valuations relative to corporations exterior the US. Due to this fact, I imagine this underscores the significance of geographical diversification as an funding technique.

I’ve all the time been a robust advocate of receiving dividends from corporations exterior the U.S., as a number of the longest-running dividend payers are based mostly exterior of the U.S. This, together with the truth that European markets have lagged behind U.S. efficiency, reinforces my perception in looking for returns past the U.S. market.

Peer Comparisons

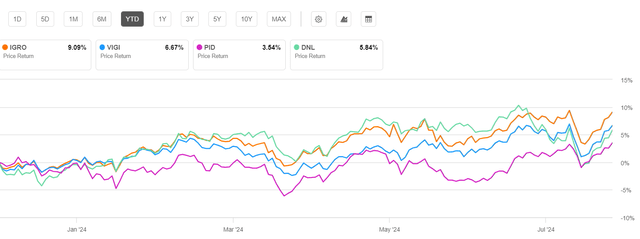

I’ve in contrast a number of ETFs much like IGRO, and IGRO persistently outperforms the others whereas sustaining the bottom charges. IGRO’s year-to-date efficiency is 9%, notably increased than its friends, whose returns vary from 3% to six%. Over the previous yr, IGRO has additionally led the group with a efficiency of 15.74%, with the subsequent closest being VIGI at 14%.

Peer Comparability (Looking for Alpha)

As well as, IGRO turnover (a measure of how a lot the ETF trades) is on the low finish relative to its friends at 38%. Much less buying and selling means decrease transaction prices, which contribute to efficiency over an extended interval. Moreover, IGRO’s 3- and 5-year beta values are 0.92 and 0.98, respectively, carefully aligning with the class common of 1, indicating minimal market volatility. That is essential for buyers looking for a steady dividend yield with minimal threat.

Dangers

As with every funding, there may be all the time a threat of being flawed. A big concern right here is that the portfolio is considerably concentrated. With solely 399 constituents, it is comparatively small and due to this fact uncovered to single-stock threat. Because of this disappointing earnings from just some corporations might negatively influence the ETF’s value. Moreover, as a result of this ETF excludes U.S. shares, notably U.S. tech, it might miss out on short-term sector positive aspects. Whereas I’ve famous that this sector and the broader U.S. market could also be overvalued, there’s all the time an opportunity that the markets might proceed to rise within the quick to mid-term.

Conclusion

General, this text explains why investing in a diversified worldwide dividend development ETF is a great technique, particularly when contemplating the macroeconomic atmosphere, rate of interest cuts, and peer comparisons.