[ad_1]

Abstract Aerial Art

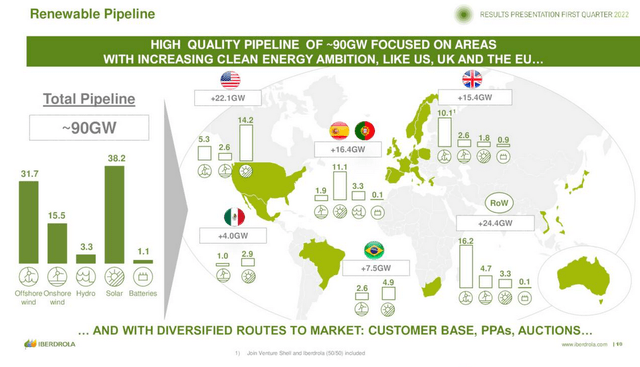

If you want to quickly judge the future of an electric utility, one of the first things you would want to look at is its renewable energy pipeline. There lies its future as the world starts to seriously de-carbonize for climate change and energy security reasons. In that respect Iberdrola (OTCPK:IBDRY) has a bright future with its massive ~90GW of renewable energy projects pipeline. It is also a very well diversified pipeline, with projects ranging from offshore wind and onshore wind, to hydroelectric, solar, and batteries. What’s more, Iberdrola is executing on this pipeline, putting in operation ~3.5GW of new renewable energy in just the last twelve months. There are other ~7.5GW currently under construction, with solar power and offshore wind taking the biggest percentages.

Iberdrola Investor Presentation

Electricity generation is only about half of Iberdrola’s business, with roughly the other half being distribution networks. This is an important business that brings stability and diversification, and in which Iberdrola is also continuing to invest. In Q1 2022 Iberdrola invested ~800 million in its networks business, mostly distributed among the US, UK, Brazil, and Spain.

Financials

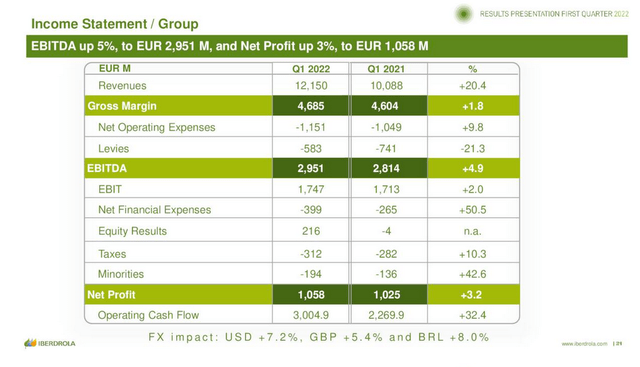

Iberdrola has a resilient business model with significant geographic diversification. About 32% of its EBITDA comes from Spain, 20% from the UK, 19% from the US, 18% from Brazil, 5% from Mexico, and 5% from the rest of the world. Approximately 50% of its operating margin is protected from inflation, and ~80% of its debt is fixed-rate. Results have been strong, with Q1 2022 delivering 1.05 billion Euros in net profit, a 3.2% increase year over year from the corresponding quarter in 2021. Revenues were up an impressive 20.4%, but margins suffered from the current inflationary environment.

Iberdrola Investor Presentation

Balance Sheet

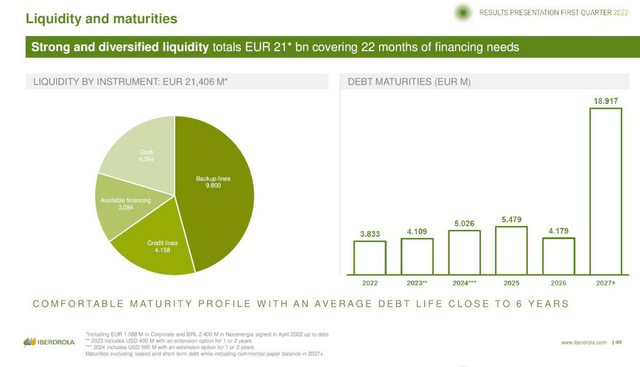

One thing investors should be aware of before investing in Iberdrola is the significant amount of debt it carries on its balance sheet. Fortunately, most of this debt comes with a relatively low interest rate, and Iberdrola benefits from green financing. In fact, Iberdrola is the world’s leading Group in Green Bonds issued. Iberdrola also has liquidity of ~21 billion Euros, enough to cover its financing needs for about 22 months.

Its adjusted net debt totals about 40 billion Euros, and its adjusted net debt/EBITDA ratio stands at ~3.3x currently. For a utility this is a normal amount of leverage, although we wish the average debt duration was a little bit longer than the current average of 6 years. And there are peers, such as Orsted (OTCPK:DNNGY) that have a much lower debt/EBITDA ratio, closer to a 2x multiple in Orsted’s case. On the positive side the debt maturity is well distributed among different years.

Iberdrola Investor Presentation

ESG

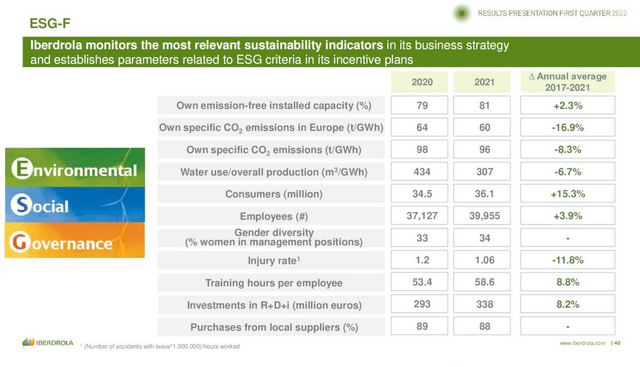

Iberdrola is considered one of the most sustainable corporations in the planet, making it to the top 100 of the prestigious Corporate Knights. Iberdrola can be found at position #25 of the 2022 ranking. Iberdrola is also part of the Dow Jones Sustainability Index, FTSE4Good, and the Bloomberg Gender Equality Index.

The company also shares multiple indicators, of which one of the most important in our opinion is the percentage of emission-free installed capacity. Thanks to the continuous build-out of renewable assets this percentage reached 81% in 2021, and hopefully it will continue increasing towards 100%.

Iberdrola Investor Presentation

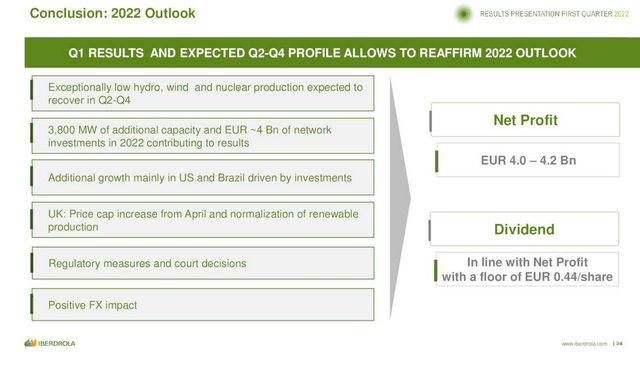

2022 Guidance

For 2022 Iberdrola is guiding to a net profit of between 4 billion Euros and 4.2 billion Euros, for comparison its market cap is currently ~64 billion Euros, placing the forward price/earnings ratio at about 15x. The company is also guiding to a dividend dependent on net profit, but at least EUR 0.44/share, which would equate to a ~4.5% dividend yield at current prices.

Iberdrola is well on its way to meeting this profit target having already made more than a billion Euros in Q1 022. It expects exceptionally low hydro, wind, and nuclear energy production to recover in Q2-Q4. Other tailwinds include 3.8GW of new capacity and ~4 billion Euros of network investments to contribute to 2022 results.

Iberdrola Investor Presentation

Valuation

As we saw, at current prices shares should yield at least ~4.5% given the dividend floor of 0.44 Euros per share. That compares favorably to the ~4% ten-year dividend year average, and indicating that shares are currently slightly undervalued.

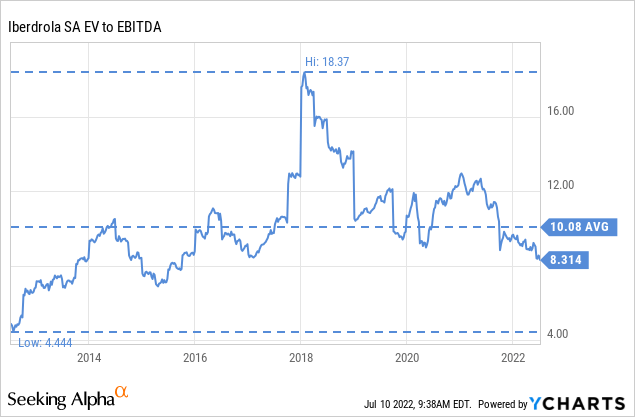

The EV/EBITDA ratio is almost 20% below its ten-year average of ~10x, another sign shares are undervalued.

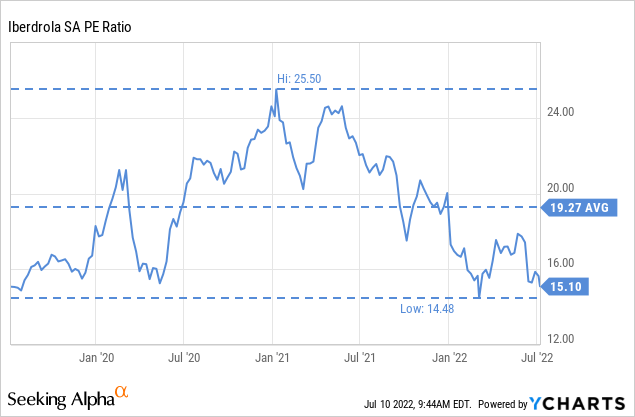

Looking more recently at the last 3 years, shares are trading at a similar price/earnings ratio to that of the worse of the Covid crisis. In the last 3 years the p/e ratio has averaged around 19x, and shares are currently trading with about a 20% discount to this average at about 15x.

We estimate a net present value for the shares of $12.05, which is about 20% above the current prices at around $10. Note that this is for the shares trading as Iberdrola (OTCPK:IBDSF), and would be equal to $48.2 for the ADRs trading as Iberdrola (OTCPK:IBDRY) that represent 4 ordinary shares.

| EPS | Discounted @ 9% | |

| FY 22E | 0.68 | 0.62 |

| FY 23E | 0.76 | 0.64 |

| FY 24E | 0.80 | 0.62 |

| FY 25E | 0.84 | 0.59 |

| FY 26E | 0.88 | 0.57 |

| FY 27E | 0.92 | 0.55 |

| FY 28E | 0.97 | 0.53 |

| FY 29E | 1.02 | 0.51 |

| FY 30E | 1.07 | 0.49 |

| FY 31E | 1.12 | 0.47 |

| FY 32 E | 1.18 | 0.46 |

| Terminal Value @ 3% terminal growth | 16.84 | 5.99 |

| NPV | $12.05 |

Risks

There are two important risks that we see with an investment in Iberdrola. One is regulatory risk, with countries making modifications to regulations sometimes in favor of companies like Iberdrola, sometimes not, e.g., price capping regulations, reducing incentives to green energy. In the Q1 results presentation, you can see in slides 13-15 a summary of regulatory impacts that Iberdrola lists for different countries and regions, some expected to have a positive impact and others a negative impact.

The other important risk we see is that renewable energy is attracting a lot of capital, which might reduce the expected returns for all participants. We see this risk as somewhat mitigated by Iberdrola’s scale and competitive advantages, but it is a risk to consider, nonetheless.

Conclusion

Iberdrola has an impressive renewable energy projects pipeline, which investors are not giving enough credit to in our opinion. We estimate shares to be about 20% undervalued, and trading at very low multiples of EBITDA and earnings. There are a few risks to consider, including regulatory risks and increased competitive pressures in the renewable space. That said, we believe shares are a ‘Strong Buy’ at current prices.

[ad_2]

Source link