[ad_1]

Up to date on December twenty sixth, 2023

If you begin investing, you already know the least about investing that you’ll ever know.

This may result in poor preliminary outcomes, and finally ‘quitting’ investing with out ever benefiting from the prosperity creating results of compound curiosity.

If you’re ranging from scratch, it pays to start your funding journey with the information essential to succeed. This text is your information on learn how to make investments nicely, from the beginning.

Investing can appear extraordinarily sophisticated. There’s a staggering quantity of industry-specific information in investing. Happily, you don’t must know all of it to do nicely.

Actually, learn how to do nicely as an investor might be boiled down into the next sentence:

Spend money on nice companies with robust aggressive benefits and shareholder pleasant managements buying and selling at honest or higher costs.

You are able to do this by investing in high quality dividend progress shares such because the Dividend Aristocrats, an elite group of 68 shares within the S&P 500 with 25+ consecutive years of dividend will increase.

You possibly can obtain a full record of all 68 Dividend Aristocrats by clicking on the hyperlink beneath:

Shopping for top quality companies has traditionally been a successful technique. The bolded assertion above covers all there may be to find out about profitable dividend progress investing. Nevertheless, it’s lacking some element.

The remainder of this text discusses intimately learn how to construct a dividend progress portfolio, beginning with $5,000 or much less. You may also watch an in depth evaluation on the subject beneath:

Selecting a Inventory Dealer and Funding Your Account

The way in which that we buy shares has modified dramatically over the a long time.

It was once very costly to buy shares – a ‘dealer’ was a person, not a web based platform. Shopping for shares concerned calling your inventory dealer and seeing if he knew anybody who was promoting your required safety.

At the moment, there are a plethora of on-line inventory brokers with easy-to-use buying and selling platforms. The largest think about choosing a web based dealer was once charges, however lately many brokers have gone to $0 buying and selling commissions, making investing extra accessible than ever.

As a self-directed investor, your price to purchase or promote a safety could possibly be $0. Nevertheless, there are a number of causes that it might nonetheless pay to concentrate on long-term investing.

Apart from merely shopping for and promoting securities, brokers will cost for issues like buying and selling on margin, choices and particular circumstances.

Some buyers will elect to commerce on margin as a solution to enhance returns (with a proportionate enhance in threat). Which means an investor will borrow cash from their inventory dealer to buy extra shares, utilizing present investments as a collateral.

Totally different brokers will cost completely different rates of interest on borrowed margin. Sometimes, the rate of interest will lower as portfolio dimension will increase.

For big portfolios that commerce on margin, margin rates of interest can be a bigger issue than fee charges when figuring out which dealer to make use of.

An extra consideration is a dealer’s built-in analysis capabilities. For buyers which might be new to the markets, some brokers can have devoted in-house inventory screeners and funding seminars that can assist flatten the training curve as you construct your dividend progress portfolio.

All of those components ought to come into play when deciding which inventory dealer to make use of.

After getting chosen a inventory dealer, you will need to then ‘fund’ your account. There are numerous completely different mechanisms by way of which you’ll be able to fund your funding account. Some brokers will settle for checks delivered through mail. Others settle for funds through a invoice fee out of your monetary establishments. Preparations can usually be made to have cash routinely withdrawn out of your checking account on a periodic foundation (which is right for the systematic investor).

Directions for funding your first funding account can be accessible in your dealer’s web site.

Ought to You Construct Your Portfolio With Shares or ETFs?

Up to now, the one solution to achieve publicity to the monetary markets was by investing in particular person securities. Traders would purchase stakes in firms like Walmart (WMT), Exxon Mobil (XOM), or Johnson & Johnson (JNJ) straight.

That modified with the introduction of the mutual fund and later the exchange-traded fund (ETF). These choices are monetary merchandise the place retail buyers such as you and I buy a fund and our cash is professionally managed by an funding supervisor.

Whereas we usually oppose mutual funds due to their excessive charges, ETFs are a low-cost manner for buyers to achieve diversification and entry to the monetary markets.

ETFs are traded by way of the identical mechanism as shares on the inventory change (which isn’t the case with mutual funds). You should buy ETFs in your brokerage account and maintain them for as lengthy (or as brief) as you want, simply as with shares.

There’s a lot back-and-forth within the investing {industry} about what is healthier: ETFs or particular person shares.

The reality is that each choices have professionals and cons.

Associated: The Professionals and Cons of Dividend Investing.

Listed here are some professionals and cons of ETFs versus particular person shares.

Associated: The Full Record Of Dividend Change-Traded Funds.

Professional: Investing in dividend ETFs supplies broad diversification.

That is useful for buyers with small portfolios as they will get the required diversification from proudly owning a number of shares rapidly.

Proof reveals that a lot of the good thing about a diversified portfolio comes from proudly owning ~20 shares. ETFs usually maintain a whole lot of positions, in order that they is perhaps overdoing it a bit.

With that being stated, ETFs are a easy manner for buyers to achieve diversified market publicity.

Professional: Investing in dividend ETFs has a low time dedication.

As soon as bought, buyers can “overlook” about their ETF. No extra analysis is required.

This low time dedication is a profit to people who find themselves not considering choosing particular person shares.

Professional: Dividend ETFs nearly all the time have decrease expense ratios than their mutual fund counterparts.

There are a number of dividend ETFs which have annual expense ratios beneath 0.1%. Many dividend mutual funds have a price of 1% or extra (which quantities to $1,000 in annual charges on a $100,000 portfolio).

Con: Dividend ETFs are all the time costlier than proudly owning particular person shares.

After the preliminary buy is made, particular person shares don’t have an expense ratio; checked out one other manner, they are going to all the time have an expense ratio of 0.00%. There isn’t a price to carry a inventory, whatever the holding interval.

Con: You can not hand-select which companies you personal with a dividend ETF.

Dividend ETFs provide you with no management over your portfolio. You can not purchase or promote particular person shares, which implies you can’t fine-tune your technique to match your particular wants.

There are numerous circumstances the place you’ll wish to tweak your portfolio to fulfill sure wants. For instance:

- Solely shares with 4%+ dividend yields (the Positive Retirement criterion)

- When you dislike a specific sector

- Maintain solely shares with excessive ranges of insider possession

The limitless customization potentialities are one of many main benefits of shopping for particular person shares over ETFs.

Conclusion: There’s nothing essentially incorrect with dividend ETFs.

For buyers with minimal time or curiosity in investing, ETFs are a superb various to high-fee mutual funds.

With that being stated, Positive Dividend prefers to put money into particular person companies. The remainder of this text will discover this avenue.

Associated: Do Particular person Shares or Index Funds Make The Higher Funding?

The place to Discover Nice Companies

To put money into nice companies, you must discover them first.

Positive Dividend usually recommends two databases of shares as a supply of high-quality dividend-paying companies. Each of them are based mostly on consecutive streaks of dividend will increase.

Consecutive dividend will increase are necessary as a result of they reveal two issues:

- The enterprise is doing nicely

- The administration is shareholder-friendly

With reference to the primary level, an organization can not elevate its dividend over the long-term if earnings are usually not additionally rising.

Whereas dividends could outpace earnings within the short-term, that is unattainable over the long-term. A really lengthy streak of regularly rising dividends signifies that an organization has grown dividends (and earnings) by way of all the things the market has thrown at it.

Secondly, shareholder-friendly administration groups are a telltale signal of a fantastic enterprise. Distinctive folks create distinctive firms, plain and easy.

The primary supply of nice companies we advocate is the Dividend Aristocrats Index. In an effort to be a Dividend Aristocrat, an organization should:

- Be within the S&P 500

- Have 25+ consecutive years of dividend will increase

- Meet sure minimal dimension & liquidity necessities

The Dividend Aristocrats have traditionally outperformed the general inventory market as measured by the S&P 500 Index.

One other excellent place to search for high-quality companies is the Dividend Kings.

Just like the Dividend Aristocrats, the Dividend Kings record is predicated on historic dividend will increase – besides it’s much more unique. To be a Dividend King, an organization will need to have 50+ years of consecutive dividend will increase.

You possibly can see the record of all 54 Dividend Kings right here.

The Positive Evaluation Analysis Database covers 150 companies with 25+ years of regular or rising dividend funds. (Together with many firms past the Dividend Aristocrats and Dividend Kings).

How To Know If A Nice Enterprise Is Buying and selling At Honest Or Higher Costs

Discovering nice companies with shareholder-friendly administration is step one.

The second is to find out if these nice companies are buying and selling at honest or higher costs. Even the most effective firm turns into a poor funding if an investor pays too excessive a value.

“For the investor, a too-high buy value for the inventory of a superb firm can undo the consequences of a subsequent decade of favorable enterprise developments.”

– Warren Buffett

A really quick-and-easy rule of thumb is to search for nice companies buying and selling at or beneath the S&P 500’s price-to-earnings ratio. If a enterprise is higher-than-average high quality, you’ll assume it could command a better price-to-earnings ratio than the market common (as measured by the S&P 500).

Nice companies that commerce beneath the S&P 500’s price-to-earnings ratio are a very good place to look into worth with extra element. The S&P 500’s price-to-earnings ratio is at the moment 26.36.

Past evaluating shares to the general market, buyers ought to evaluate a enterprise’ price-to-earnings ratio to each:

- Its 10-year historic common price-to-earnings ratio

- Its rivals’ price-to-earnings ratio

It is very important keep in mind to make use of adjusted earnings when evaluating price-to-earnings multiples.

GAAP earnings might be decreased by one time results equivalent to acquisition prices or depreciation prices. Equally, GAAP earnings might be artificially inflated if the corporate sells property.

These prices are accounting based mostly, not actuality based mostly, and should not actually talk the long-term earnings energy of a enterprise.

One other inventory record of curiosity is the excessive dividend shares record: 5%+ yielding shares.

Shopping for Your First Inventory

After getting recognized a high-quality enterprise buying and selling at a beautiful valuation, it’s time to purchase.

Shopping for shares can appear simply as sophisticated as analyzing shares. It’s not so simple as simply pushing ‘purchase’ – there are a variety of various order sorts that buyers can use, relying on the circumstances.

For simplicity’s sake, the start investor ought to solely be involved with two kinds of orders:

A market order is if you talk to your dealer ‘purchase this inventory at prevailing market costs’. Market orders are all the time the quickest solution to execute a commerce.

Market orders have downsides. If the inventory value strikes rapidly after you place your order, chances are you’ll find yourself shopping for the inventory at a better value than you needed.

Restrict orders are the answer to this downside. A restrict order is if you talk to your dealer ‘purchase this inventory, however solely at a value of X or beneath‘.

For instance, if Goal (TGT) was buying and selling at $150 and also you needed to purchase at $130, you can place a restrict order for $130 and the order would possibly by no means be crammed until Goal inventory dropped to $130 (or beneath).

There are numerous different kinds of purchase orders and likewise equal promote orders.

Nevertheless, restrict orders are usually one of the simplest ways to make sure that you’re getting a good or higher value on a commerce.

Extra subtle buyers may also benefit from choices to purchase and promote shares to extend earnings.

Associated: Money-Secured Places: The Step-By-Step Information

Nevertheless, these methods are extra superior in nature and shouldn’t be pursued till buyers have a agency grasp of the opposite investing fundamentals and fundamentals which might be described on this article.

How Many Shares Ought to You Maintain?

There’s a tradeoff with diversification.

The extra inventory you maintain, the safer you might be if any one among them does poorly. Then again, you have got much less to achieve from the shares you maintain that do nicely.

Skilled buyers additionally expertise this divide. Warren Buffett, the CEO and Chairman of Berkshire Hathaway, manages a ~$300 billion frequent inventory portfolio the place his prime 4 holdings make up over 70% of his portfolio.

You possibly can see Warren Buffett’s prime 20 shares right here.

Buffett doesn’t have a really diversified portfolio.

Peter Lynch, then again, most actually did (he’s now retired). Because the supervisor of the Magellan Fund at Constancy Investments between 1977 and 1990, Lynch’s portfolio averaged a 29.2% annual return – making him the best-performing mutual fund supervisor on the earth.

Though managing a lot lower than Buffett – round $14 billion at his peak – Lynch was recognized to carry greater than 1,000 particular person inventory positions. Lynch had a really diversified portfolio.

Who is correct? The empirical information suggests {that a} 1,000-position inventory portfolio is pointless. In accordance with research cited by Morningstar:

“About 90% of the utmost good thing about diversification was derived from portfolios of 12 to 18 shares.“

Holding a portfolio of ~20 shares offers 90% of the advantages of holding 100+ shares. There are additionally quite a few benefits to holding round 20 shares.

To start with, holding 20 shares means you get to put money into your greatest concepts. You possibly can personal the companies you might be most comfy holding – those that you simply consider have the best complete return potential.

Associated: How To Calculate Anticipated Whole Return For Any Inventory

Holding a big portfolio of 100 or 200 shares additionally requires a big time dedication and is just about unattainable to maintain up with. It’s onerous to actually know 100+ companies. Maintaining with the quarterly earnings stories of this many companies could be an enormous endeavor – a lot much less so for 20 companies.

So investing in round 20 companies is the ‘candy spot’ between investing in solely your greatest concepts whereas nonetheless benefiting from diversification.

You possibly can’t simply personal any 20 shares and be diversified, nonetheless.

For instance, when you owned 20 upstream oil companies, you wouldn’t be nicely diversified. Equally, proudly owning 20 biotech firms doesn’t a diversified portfolio make.

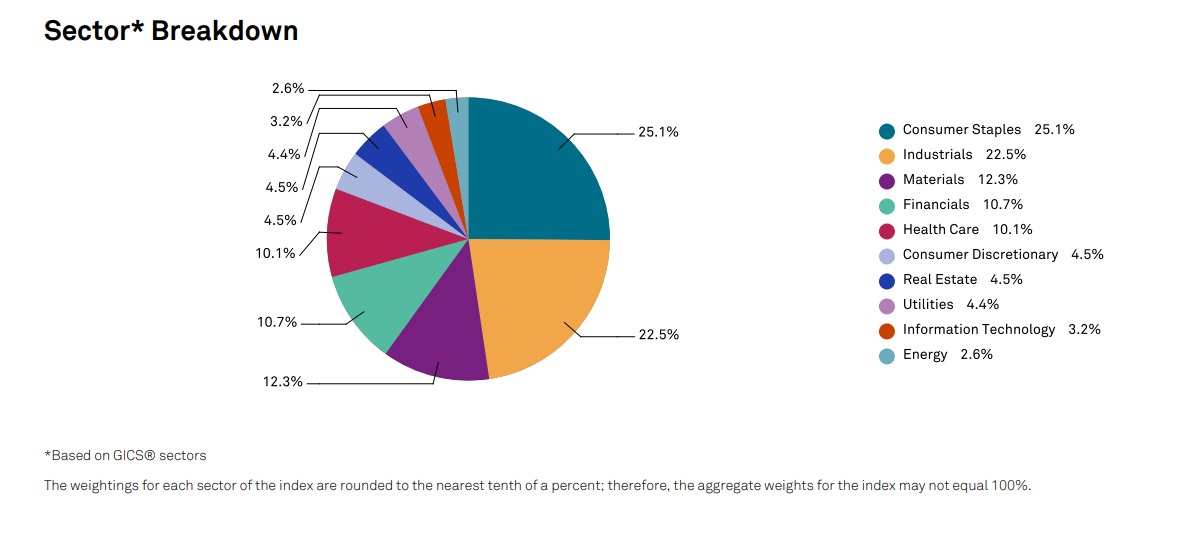

Dividend progress buyers ought to look to put money into completely different sectors to achieve publicity to various kinds of nice companies.

The record of Dividend Aristocrats is balanced throughout market sectors.

Supply: Truth Sheet

Clearly, there exist high-quality enterprise in mainly each sector.

The subsequent part discusses completely different portfolio constructing methods.

Dividend Development Portfolio Constructing Technique

There are two kinds of ‘new’ dividend progress buyers:

- These which might be ranging from scratch

- These with sizeable portfolios trying to switch over to dividend progress investing

This text is about ranging from scratch. That’s what can be coated on this part.

Constructing a high-quality dividend progress portfolio is a course of. Diversified dividend earnings is not going to be created in a single day. The method will take time, identical to most necessary issues in life. The webinar replay beneath covers learn how to construct a dividend progress portfolio for rising passive earnings intimately.

I like to recommend shopping for the very best ranked inventory you personal the least each month based mostly in your particular standards. Every criterion needs to be chosen to both enhance returns or scale back threat.

Additional, every criterion needs to be supported by empirical proof with logical underpinnings (not clearly unrelated relationships like ‘firms with CEOs named Jim have outperformed over the previous X years’).

The longer you make investments, the extra money you must make investments, and the extra diversified your portfolio will turn into.

Regardless of how selective you might be when buying shares to your dividend progress portfolio, you’ll ultimately need to trim the ‘lifeless weight’. The composition of your portfolio will undoubtedly change over time.

The perfect investments are long-term in nature. As soon as a inventory is bought, buyers ought to want to let it compound their wealth indefinitely.

A protracted-term orientation additionally supplies particular person buyers with a aggressive benefit over institutional buyers like pension plans and mutual funds, whose efficiency is judged on a quarter-over-quarter foundation.

“The only best edge an investor can have is a long run orientation”

– Seth Klarman

With that being stated, holding a inventory for the long-term is just not all the time doable. Issues occur. Companies that have been nice at one time lose their aggressive benefit.

This may occur by administration shedding its manner, expertise adjustments, or by rivals discovering a solution to destroy or copy the corporate’s aggressive benefit.

When a enterprise loses its skill to compound your wealth by way of rising dividend funds, it’s time to promote.

The first promote standards based on the final technique at Positive Dividend is to promote when a enterprise cuts or eliminates its dividend. It is a very clear signal from administration that both:

- The dividend is just not necessary (shareholders don’t matter)

- The enterprise can not maintain its dividend (enterprise is in decline)

In both case, that isn’t the kind of funding prone to generate long-term wealth. In fact, there are exceptions.

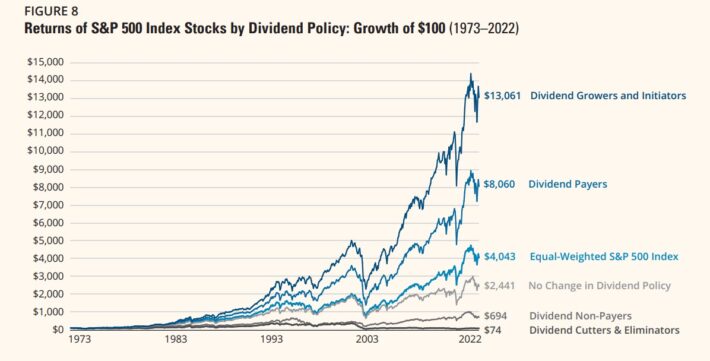

Generally companies rebound after dividend cuts. Nevertheless, the historic file reveals that dividend cutters make poor investments, on common.

Extra particularly, dividend cutters have had a decrease return and a better commonplace deviation than all different courses of shares, leading to horrible efficiency on a risk-adjusted foundation.

Supply: Hartford Funds – The Energy Of Dividends

Happily, there are sometimes many extra dividend growers & initiators than dividend cutters/eliminators at any given time.

This makes it simpler (and fewer dangerous) for dividend progress buyers to execute their funding technique.

There’s one different good cause to promote a dividend progress inventory – if it turns into wildly and absurdly overvalued.

It’s higher to revenue from this overconfidence by promoting than to take part in it. Earnings might be reinvested into dividend progress shares with sane valuations.

This advantages buyers in a lot of methods. Shares with decrease valuations have higher complete return potential, all else being equal.

Equally, two firms which have the identical earnings and payout ratios however with completely different valuations may even have completely different dividend yields – the lower-valued firm will generate extra dividend earnings for shareholders.

Self-discipline Is The Key

What units aside those that will retire rich from the remaining is the quantity of self-discipline you must keep on with the plan you lay out.

In case your funding technique is sound, and also you observe it diligently, you might be prone to do nicely out there over time.

The inventory market doesn’t go up in a straight line.

You possibly can expertise losses of fifty% or extra investing solely in shares. When you have the fortitude to persevere by way of market downturns, you possibly can profit from the compounding impact of proudly owning improbable companies over lengthy intervals of time.

Then again, when you promote when issues look their worst – like March, 2009 – you’ll possible underperform the market by a large margin.

Staying absolutely invested all through market cycles seems to be the most effective technique. Lacking a number of key days over the long term can have a profound impact on funding efficiency.

Sadly, most particular person buyers have a tendency to purchase and promote far too usually.

The research The Behaviour of Particular person Traders by Brad Barber and Terrance Odean revealed the unlucky fact about particular person buyers.

The authors analyzed information from 78,000 particular person buyers. They discovered that when particular person buyers promote a inventory to purchase one other, the inventory they offered outperforms the inventory they bought (on common).

This implies we have a tendency to purchase and promote on the incorrect occasions… What’s the answer?

Apply ‘do nothing’ investing. Don’t promote shares with no excellent cause. Value declines are not a very good cause until the underlying enterprise has deteriorated.

For a second, evaluate investing to grocery procuring. When you purchased steak for $10 and it went on sale for $8, would you return and return the steak you had already bought? No! You’ll purchase extra.

When a inventory’s value declines, you should purchase extra for a greater deal (assuming the underlying enterprise has not considerably modified). This makes inventory declines the fitting time to add to your positions, not promote them.

Last Ideas: Why Investing Issues

Why is investing necessary?

As a result of making a passive earnings stream permits for monetary flexibility in your life. You possibly can take management of your time if you don’t have to fret about having a job to fund your wants. With each step alongside the best way, with every dividend examine that is available in, you might be nearer and nearer to the purpose of economic independence. It’s not a fast course of, however it’s actually worthwhile.

The nationwide GDP has marched upward over time, but individuals are usually not capable of retire when they need or on their very own phrases.

Dividend progress investing will assist you construct a retirement portfolio that pays rising dividend earnings. This may result in retirement on time – and even early retirement.

If you’re considering discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases can be helpful:

The main home inventory market indices are one other strong useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link