[ad_1]

The next is a visitor put up by web3 strategist Toby Fan, and Aly Madhavji, Managing Companion at Blockchain Founders Fund.

Social media has eternally modified how we view and handle monetary crises. Banks want a option to tactfully deal with what’s now being coined “social media threat.” Viral video games of the phone performed at an exponential scale permit little or no time for nuanced investigation or considerate response. By incorporating social media into general threat frameworks, banks can assist form the narrative and public notion by pre-emptive and clear buyer engagement. Aggregation and monitoring instruments have gotten more and more essential to observe for early indicators of hassle and navigate this panorama of speedy info ingestion and uncontainable unfold.

Latest collapses of a number of the largest crypto-associated banks ($SIVB, $SI, $SBNY) have despatched jitters by tech, crypto, and banking sectors. Many startups have been left questioning whether or not they might meet payroll obligations, whereas regional banks caught whiffs of a financial institution run for the primary time for the reason that subprime mortgage disaster.

Crowd-sourced interpretations of data relating to $SIVB’s monetary well being gave depositors a crash course (no pun meant) in Recreation Principle 101 — placing many startups and tech firms within the sneakers of a prisoner on a textbook payoff matrix: withdraw deposits now or threat holding the bag.

How It All Went Incorrect

On Mar 8, Moody’s downgraded $SIVB financial institution deposit and issuer rankings. On the identical day, $SIVB introduced a proposed sale of $2.25bn in inventory, together with a stability sheet repositioning exhibiting a $1.8bn realized loss from promoting fixed-income property that had misplaced important market worth with the current hike in Fed charges.

Like many financial institution runs earlier than this one, depositors, a lot of them VC-funded and crypto firms, wasted no time enjoying a sport of hen. Inside a day or two, $SIVB stability sheets have been drying up and the inventory was, tumbling — by Mar 10, regulators had closed $SIVB and brought management of its deposits. A slew of regional banks adopted swimsuit, taking large drawdowns in market worth ($FRC, $WAL, $CMA, $ZION) earlier than recovering on the information of an FDIC backstop in deposit insurance coverage. And whereas there have been comparable situations of financial institution runs in monetary historical past, what made this one so distinctive was the velocity at which it occurred and the medium by which the contagion unfold.

Monetary contagion went viral over social media. Social media platforms like Twitter dominate the crypto and startup house. The rate of data unfold (in addition to completely different interpretations) is an order of magnitude larger than conventional information or linear media. Even regulators have acknowledged the affect of social media on the latest disaster. Home Monetary Companies Committee chairman Patrick Henry admitted “this was the primary Twitter fueled financial institution run”.

Some could bear in mind Washington Mutual, which skilled comparable deposit outflows through the 2007-2008 monetary disaster. Like $SIVB, WaMu held over $188bn in deposits however started to write down down important losses as a result of defaulted mortgages. When Lehman Brothers collapsed on Sept 15, 2008, WaMu depositors started withdrawing in droves – taking out $16.7bn from checking and financial savings accounts (~11% of complete deposits) over ten days. The velocity of the outflows was unprecedented on the time, finally resulting in WaMu’s chapter. Distinction this with $SIVB – the place depositors tried to withdraw $42bn in a single day, equal to 25% of complete deposits.

This time round, it wasn’t simply the speed of data that was unprecedented however the proximity of social distance (between Twitter followers, pals, and subreddits) that helped the information unfold like wildfire. Whereas earlier than in conventional media, information was unfold from centralized events to the plenty (a one-to-many transaction) — social media is a many-to-many transaction, and the social distance between sources is way nearer, lending these property a stage of social proof that hasn’t at all times been current in conventional media. And as soon as the data reaches crucial mass, it turns into fact because the inertia of the unfold causes the story to change into ubiquitous. As they are saying, an individual’s notion is their actuality.

The Energy Of Viral Narratives

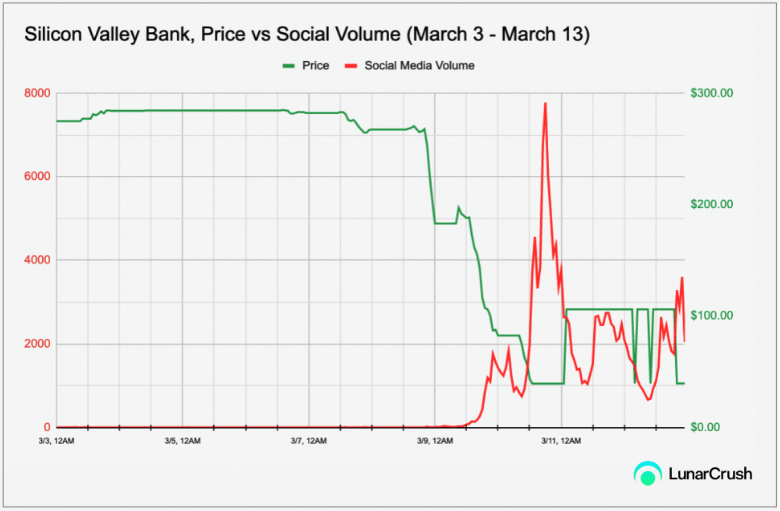

By monitoring mixture social media knowledge, you may see examples of this speedy unfold, even early indicators of it. Take, for example, Silicon Valley Financial institution:

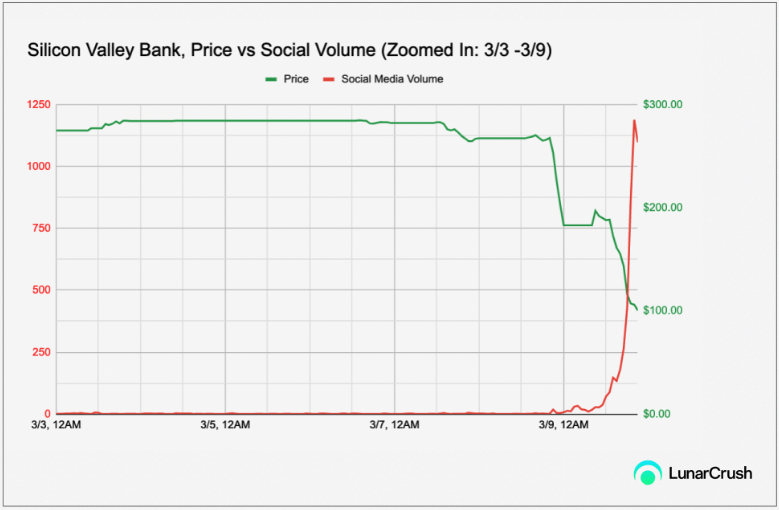

In crimson, we’ve social media quantity (particular person tweets/posts/information articles throughout Twitter, Reddit, and 1000+ information sources) and the $SIVB inventory value in inexperienced. You’ll be able to see an after-the-fact spike in social media quantity. Nevertheless, zooming in additional, you can begin to see development in chatter earlier than the parabolic spike in social media quantity (signaling the highly effective velocity of social media attain):

Zooming in even additional into the times main as much as $SIVB’s important drawdown, you may see the whispers of trade insiders and analysts earlier than a big relative spike proper when the inventory begins to drop. By doing a little bit of further investigating across the time the social media exercise began to select up, an analyst could have been capable of glean hidden gems like this by Matt Harney:

Decrease fundraising

+

Money circulate detrimental companies (on common)

=

Liquidity draining:

🆘detrimental $57b in Complete Consumer Funds in 2022 from startups banking at Silicon Valley Financial institution

– supply = newest MS “Enterprise Imaginative and prescient” pic.twitter.com/ZMD7miBuyE

— Matt Harney (@SaaSletter) March 7, 2023

or this one by Rusil Sarka which will have raised early crimson flags for any get together concerned with the financial institution:

When there may be uncommon outflow of deposits, the financial institution must promote their property to fulfill the withdrawals that’s when bonds must be marked-to-market.

Similar occurred to Silicon Valley Financial institution in 2021, when charges have been low. It took $91 billion of that cash and invested it in mortgage— Rusil (@rusilsarkar) March 6, 2023

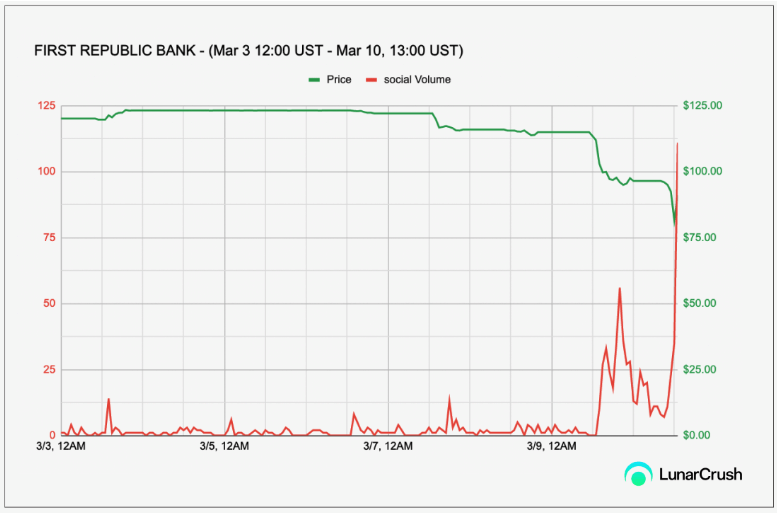

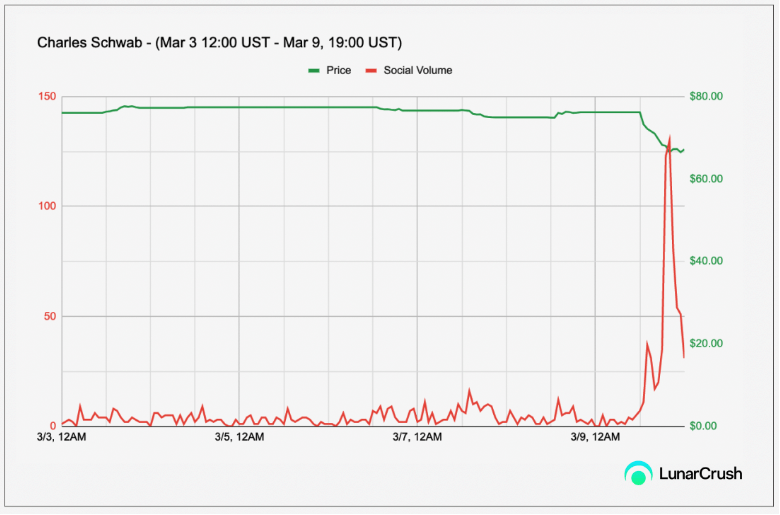

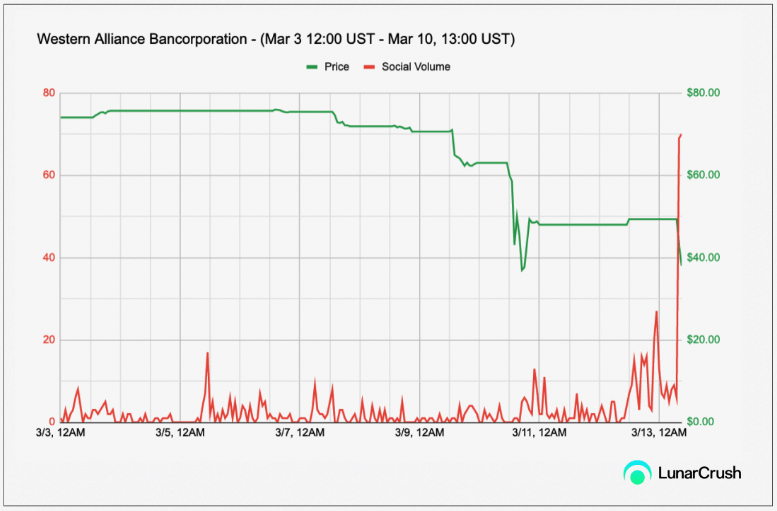

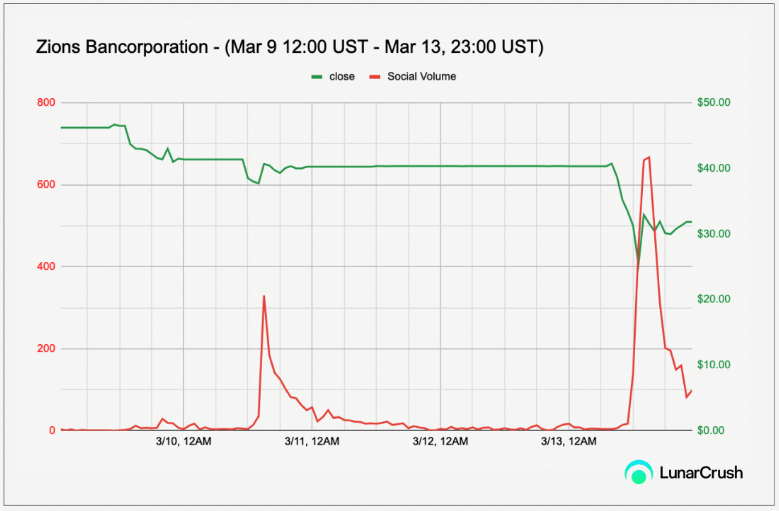

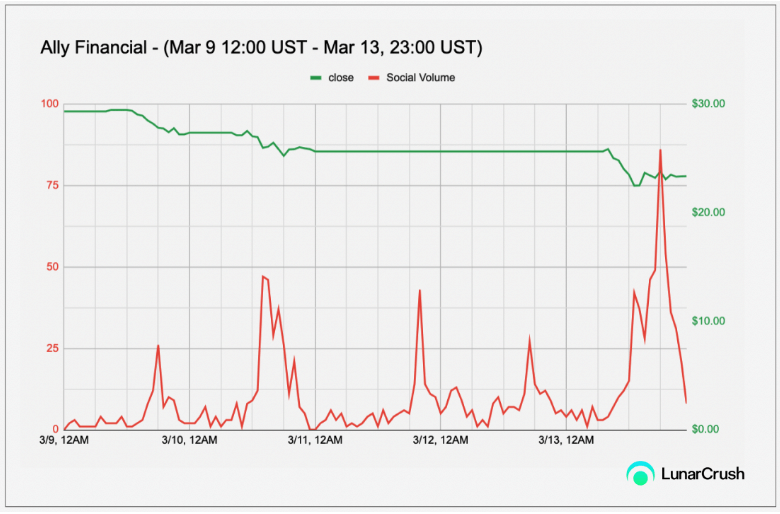

Related patterns will be discovered with the shares of regional banks affected by the fallout of $SIVB, specifically banks like First Republic, Western Alliance, Comerica, Zions, and PacWest — who skilled as much as 65% drawdowns in a day. All of those massive drawdowns have been preceded by parabolic rises or sudden upticks in social quantity, demonstrating the velocity and conviction of social media contagion:

Social Media Is A Actual Monetary Danger

Monitoring for outsized or irregular will increase in social chatter can assist catch early whiffs of quiet (however quickly to be not quiet) developments. These massive deviations in social exercise typically carry with them self-fulfilling tidbits of alpha. By capturing mass consideration and spurring motion in a brief time frame — a sport theoretic dynamic is commonly generated the place the primary individual to behave often has probably the most to achieve (or the least to lose) and makes motion or participation extra enticing for the next get together.

“Social media has accelerated the unfold of monetary info, and with it, the potential for market contagions. Banks want to acknowledge and handle ‘social media threat’ as a part of their general threat frameworks. Instruments like Moonrise by LunarCrush can assist monitor and monitor early warning indicators, enabling monetary establishments to form narratives and have interaction with clients extra successfully,” stated Joe Vezzani, CEO of LunarCrush.

One factor is obvious the mud settles on a tough week within the banking sector. Banks want to fulfill clients the place they’re and handle narratives and crises shortly of their most well-liked medium. communication technique could have helped stem the fallout, however the important thing would have been first to catch these narratives early of their growth. By utilizing clever aggregation instruments and sustaining a powerful, clear social media presence, trade members can hopefully be faster and higher ready to react and handle these crises sooner or later.

The information right here is courtesy of the LunarCrush API, a social media monitoring engine that gives entry to correct, high-latency knowledge on over 4000+ crypto property, 300+ NFT collections, and 700 shares.

Creator(s):

Toby Fan, Web3 Strategist Twitter | LinkedIn:

Toby Fan, Web3 Strategist Twitter | LinkedIn:

Toby Fan is the Head Web3 Strategist at LunarCrush, which gives aggregated real-time social media knowledge on crypto, NFT, and conventional equities. He’s a graduate of UC Santa Cruz, the place he double majored in Econometrics and Info Methods and helped lead departmental analysis on commodity market dynamics in China and the US. Toby can also be an lively contributor for CoinMonks (https://medium.com/@tobyornottoby) and a member of the BlockBros DAO. Aly Madhavji, Managing Companion at Blockchain Founders Fund and LP at Loyal VC & Draper Goren Holm Twitter | LinkedIn

Aly Madhavji, Managing Companion at Blockchain Founders Fund and LP at Loyal VC & Draper Goren Holm Twitter | LinkedIn

Aly Madhavji is the Managing Companion at Blockchain Founders Fund, which invests in, and enterprise builds top-tier startups. He’s a Restricted Companion on Loyal VC and Draper Goren Holm. Aly consults organizations on rising applied sciences, akin to INSEAD and the UN, on options to assist alleviate poverty. He’s a Senior Blockchain Fellow at INSEAD and was acknowledged as a “Blockchain 100” World Chief by Lattice80.

Disclosure: Blockchain Founders Fund is an early-stage investor in LunarCrush. Not one of the info right here is supposed to be construed as monetary recommendation.

[ad_2]

Source link