[ad_1]

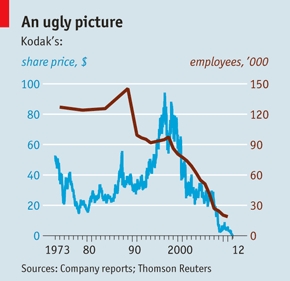

Kodak’s story is acquainted as one of many company world’s nice ironies: Kodak went bankrupt in 2012 because of the rise of digital pictures after pioneering the expertise years earlier than opponents. In keeping with legend, Kodak worker Steven Sasson invented the self-contained digital digital camera in 1975, just for administration to inform him “That’s cute — however don’t inform anybody about it.” But the story of Kodak’s failure is about a lot a couple of shortsighted expertise determination. It’s extra about Kodak’s not understanding that worth evolution would require its enterprise mannequin to evolve accordingly.

To make use of phrases from my latest report, Development Requires New Recipes, Not New Substances, Kodak failed at each worth seize (rising by extending present markets) and worth creation (rising by increasing to adjoining markets). In flip, this meant Kodak failed at worth conversion (transitioning from seize to creation as circumstances and alternatives demanded and being productive between natural and inorganic progress).

- By way of worth seize, Kodak failed to increase its core market of pictures, the place losses began slowly then accelerated quickly. In 1976, Kodak had 90% market share within the US movie market. Within the Nineteen Eighties, Kodak misplaced floor to its Japanese competitor Fujifilm, which aggressively slashed costs, had a advertising coup by sponsoring the Los Angeles Olympics, and opened a US-based film-production plant. Between 1980 and 2000, Fujifilm tripled its US market share to twenty%. Though Kodak had an preliminary lead within the digital pictures market, poor pricing fashions and extra opponents reminiscent of Canon and Nikon introduced Kodak from 27% US market share in 1999 to fifteen% in 2003 and seven% in 2010. Kodak shed its client pictures enterprise within the chapter two years later.

(Supply: The Wall Avenue Journal, “Kodak Is Dropping Share In U.S. Market to Fuji”)

- By way of worth creation, Kodak didn’t broaden to adjoining markets. Within the 2000s, Fujifilm responded to declining pictures revenues by producing Astalift, a line of skin-care merchandise that used the identical antioxidant expertise it had developed for its photographic movie. In the meantime, Kodak spun off its subsidiary Eastman Chemical right into a separate enterprise in 1994. Right now, Eastman Chemical has 10 occasions the annual income of Kodak. Kodak’s one vital diversification play, the acquisition of Sterling Drug for $5.1 billion in 1988, ended six years later with the piecemeal sale of Sterling’s enterprise models.

(Supply: The Economist, “The final Kodak second?”)

In flip, Kodak didn’t convert worth between seize and creation as circumstances and alternatives demanded. In different phrases, think about a world the place Kodak had opportunely moved from movie to digital pictures, utilizing its expertise to widen its market aperture to its well being and business imaging companies — and, on the similar time, used its photographic and normal chemical substances experience to develop prescription drugs and wonder merchandise.

That world didn’t come to cross, however maybe some glimpse of it’s nonetheless to return. Possibly we’re in for a brand new “Kodak second.” In July of 2022, Kodak introduced an funding in Wildcat Discovery Applied sciences to assist develop batteries for electrical automobiles. In keeping with its press launch, Kodak will “present coating and engineering companies in collaboration with Wildcat to develop and scale movie coating applied sciences that are important for the protection and reliability of the subsequent technology of EV battery expertise. … [This] represents [Kodak’s] continued enlargement of our Superior Supplies & Chemical compounds group as we capitalize on our experience in coating expertise, developed over many years of movie manufacturing … ”

Higher late than by no means.

This analysis falls underneath Forrester’s tech insights and econometric analysis (TIER).

[ad_2]

Source link