[ad_1]

Gold, XAU/USD, Silver, XAG/USD – Outlook:

- Subsequent help for gold: 1805, 1785, 1720.

- Bearish head and shoulders sample triggers in silver.

- What’s the outlook and the important thing ranges to observe?

For an in depth dialogue on the elemental and technical outlook on treasured metals obtain DailyFX’s fourth quarter buying and selling information. It is free!

Beneficial by Manish Jaradi

Get Your Free Gold Forecast

Gold and silver have under their respective multi-week vary, pointing to additional losses within the close to time period amid rising US Treasury yields.

US Treasury 10-year yield hit a 16-year excessive final week on the rising conviction of higher-for-longer rates of interest, weighing on the zero-yielding treasured metals. On technical charts, the US Treasury 10-year yield’s break above the 2018 excessive of three.26% has opened the best way towards the pre-Nice Monetary Disaster excessive of 5.33%.

Rising nominal rates of interest coupled with easing value pressures/inflation expectations have pushed up actual charges, elevating the chance price of holding the zero-yielding yellow metallic. See “Excessive Actual Yields Beginning to Chunk Gold? XAU/USD Value Setup Forward of US CPI,” printed August 10.

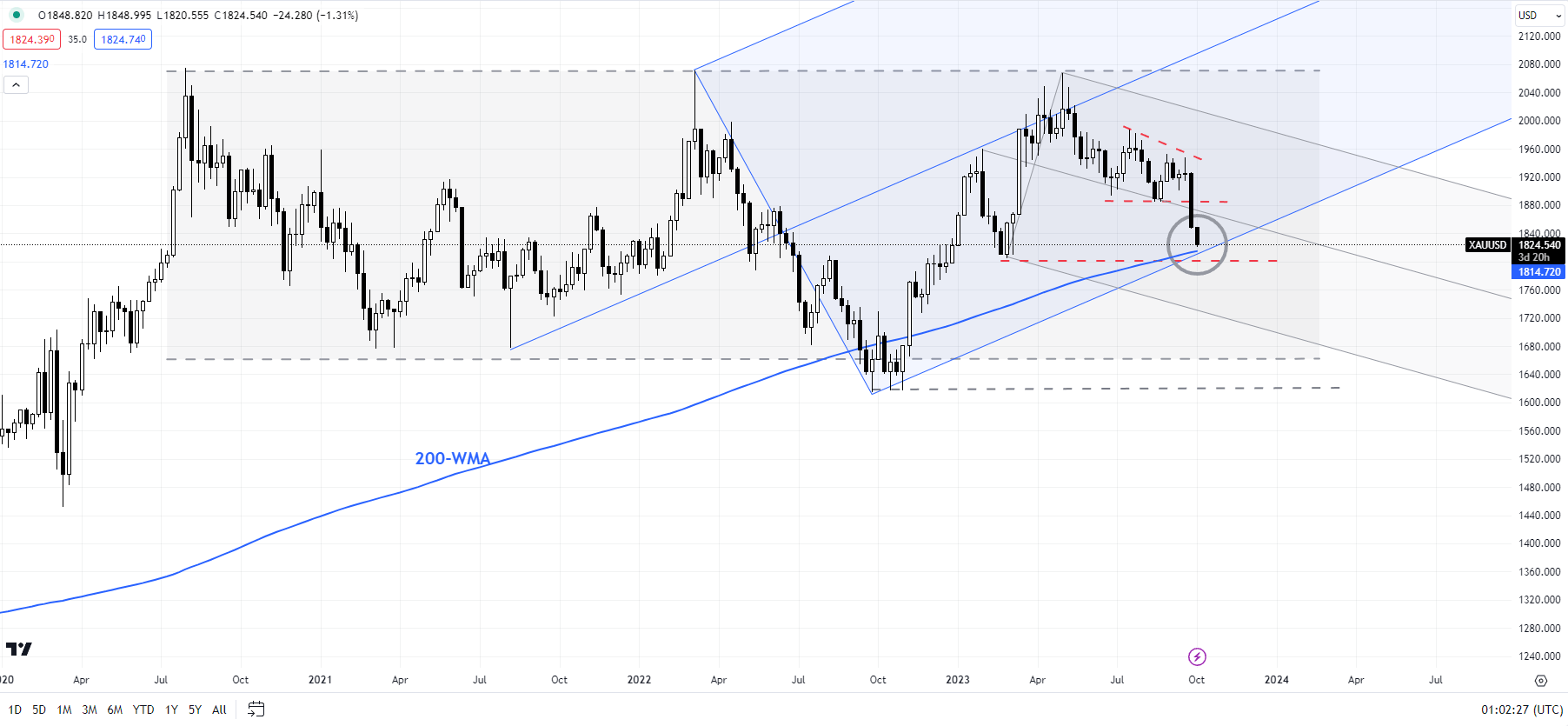

XAU/USD Day by day Chart

Chart Created Utilizing TradingView

Fed Governor Michelle Bowman bolstered the hawkish view on Monday saying she stays prepared to help one other improve within the central financial institution’s coverage charge at a future assembly if incoming information reveals progress on inflation has stalled or is simply too gradual. Moreover, the short-term decision to avert a US authorities shutdown eliminated the prospect of safe-haven bids in gold.

Gold: Bearish triangle triggers

On technical charts, XAU/USD has fallen under very important help on the 200-day transferring common, across the June/August low of 1885-1890. The significance of this help was highlighted in “Gold, Silver Forecast: It’s Now or By no means for XAU/USD, XAG/USD,” printed on August 13. The break under has paved the best way towards the February low of 1805, close to sturdy help on the 200-week transferring common. Subsequent help is at 1785 adopted by 1720 (the 76.4% retracement of the 2022-2023 rally).

XAU/USD Weekly Chart

Chart Created Utilizing TradingView

Gold is trying deeply oversold on the each day charts with the 14-day Relative Energy Index now under 20 – a stage that was related to a rebound in mid-2022. Nonetheless, it wasn’t sufficient to finish the slide. The implication is that deeply oversold circumstances elevate the chances of a corrective bounce however might not essentially terminate the downtrend.

A decisive break under 1805 would seal the chance that the spectacular one-year rally since early 2022 was corrective and never the beginning of a brand new uptrend – a degree highlighted in current months. See “Gold May Discover It Powerful to Crack $2000”,printed March 28, and “Gold Weekly Forecast: Is it Time to Flip Cautious on XAU/USD?” printed April 16.

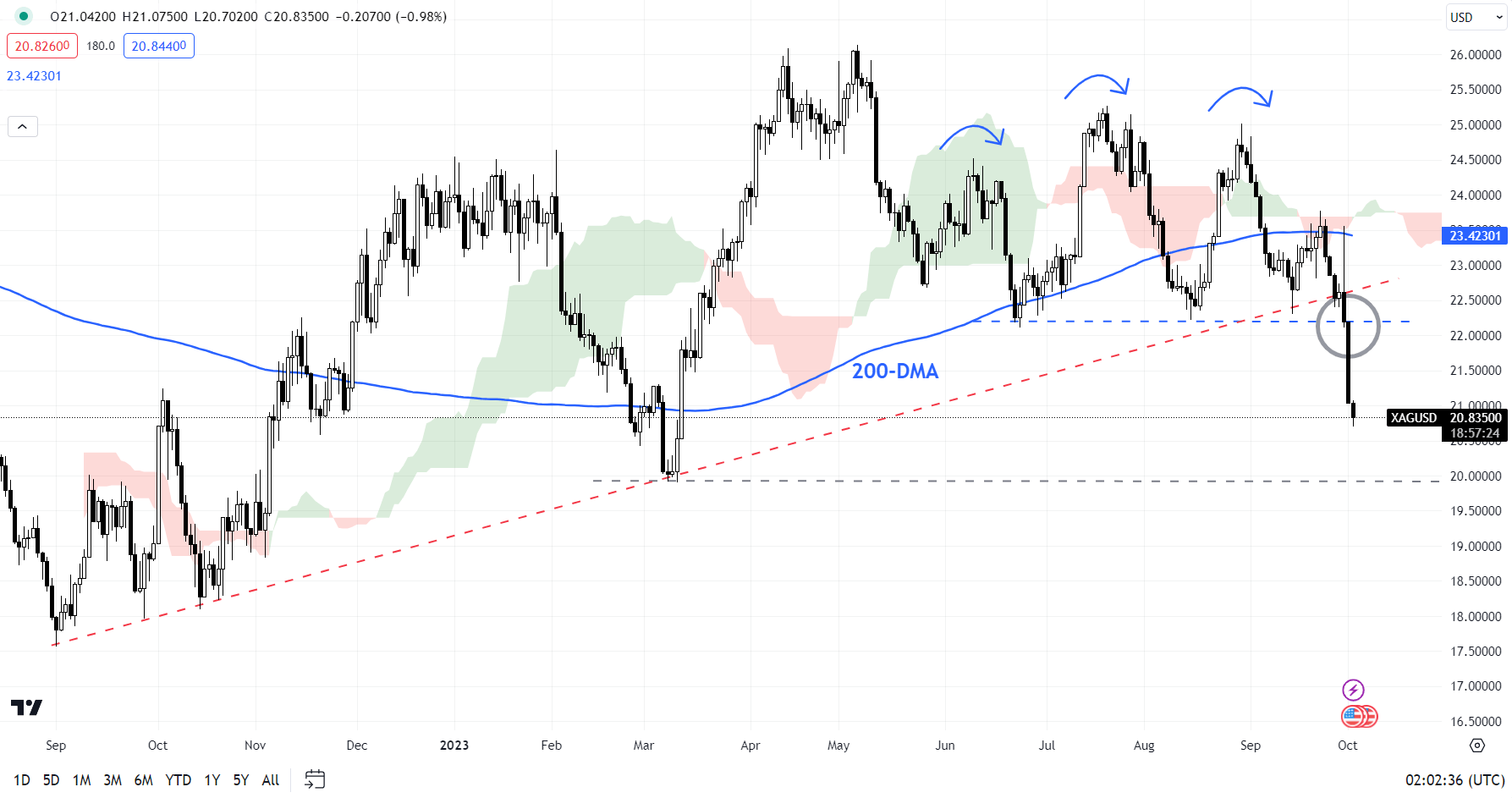

XAG/USD Day by day Chart

Chart Created Utilizing TradingView

Silver: Head & shoulders sample triggers

XAG/USD has damaged under key converged help, together with an uptrend line from late 2022, coinciding with a horizontal trendline from June that got here at about 22.00. The break has triggered a bearish head & shoulders sample – the left shoulder is on the June excessive, the top is on the July excessive, and the fitting shoulder is on the August excessive – opening the best way towards the March low of 19.85. The bearish transfer can be related to a fall under the 200-day transferring common, suggesting the uptrend from late 2022 has reversed.

Beneficial by Manish Jaradi

Get Your Free Prime Buying and selling Alternatives Forecast

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and observe Jaradi on Twitter: @JaradiManish

[ad_2]

Source link