[ad_1]

- US 10-year bonds have reached the very best ranges since 2007

- PMIs for the US financial system proceed to point out a damaging pattern

- In the meantime, a bearish session for the Nasdaq 100 signifies a excessive threat of additional declines

Earlier this week, US reached 4.36%, the very best level in over a decade. This comes as a part of a medium-term upward pattern that started in April of this 12 months, fueled by each basic and technical components.

The market’s concern about rising pressures and their influence on financial coverage is the first driver behind the bonds’ rally. Presently, the of one other hike is rising and is already above 40% for the Fed’s November assembly.

Supply: www.cmegroup.com

Consequently, US inventory indexes are having a difficult week, and yesterday’s weak buying and selling session may doubtlessly additional reinforce the downward pattern — regardless of the extremely constructive shock in Nvidia’s (NASDAQ:) .

Nonetheless, the ultimate verdict for the weeks forward stays unsure till the fruits of the later immediately and Federal Reserve Chair Jerome Powell’s .

The place Will US 10-12 months Bonds Cease?

The U.S. bond market is sending a transparent sign that the battle in opposition to inflation could also be way more difficult than beforehand anticipated. Though the 10-year has rebounded decrease in latest periods, the upward pattern remains to be in impact.

US 10-12 months 5-Hour Chart

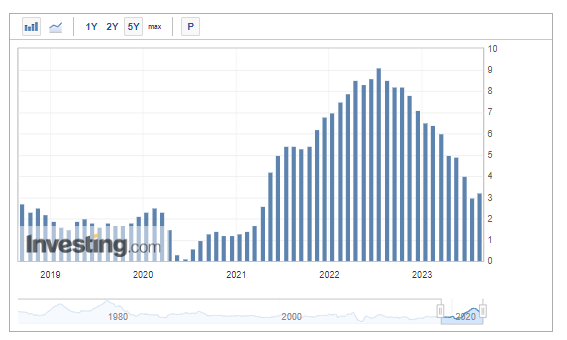

The newest CPI readings have been barely higher than forecast however confirmed the primary month-to-month y/y enhance since final July.

US CPI YoY

This means that though there was strong development within the first half of the 12 months, attaining the two% goal might be akin to climbing an 8,000-meter peak. As you ascend, gaining further meters—right here, share factors—turns into progressively tougher. If upcoming readings affirm the pattern reversal, it’d lean in direction of one other rate of interest hike.

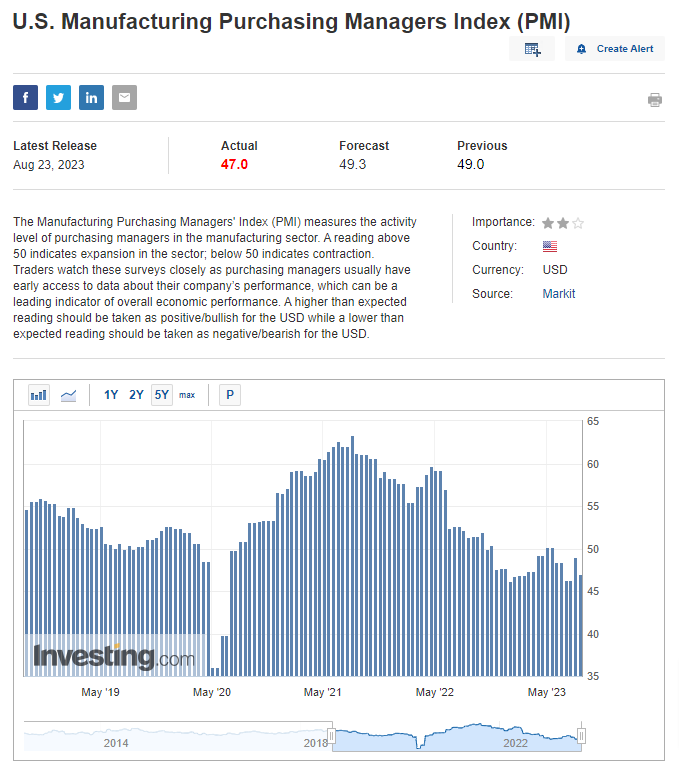

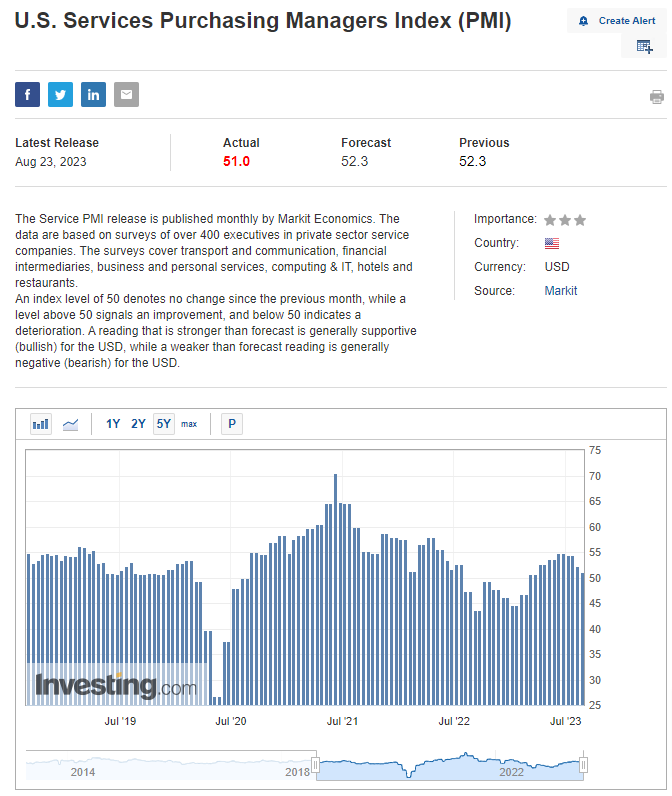

US Providers PMIs Strategy 50-Level Mark

Other than GDP, the principle components that point out the well-being of an financial system, specifically the and PMIs, are nonetheless giving us no cause to really feel upbeat. The figures launched this week for July have been notably decrease than predicted, particularly regarding companies. This facet may play a pivotal position in sustaining inflation dynamics above the goal.

The companies sector is displaying extra resilience in comparison with the manufacturing sector and stays above the essential 50-point threshold that distinguishes progress from slowdown. In relation to tackling inflation, it could be helpful to see a string of damaging readings persist, as this may point out slowing financial exercise and abating inflationary pressures.

Nasdaq 100: Bears Stay in Management

Earlier within the week, there appeared to be a possibility to wrap up the correction because the tempo of declines eased and the had a rebound. Nonetheless, yesterday’s buying and selling session, the place greater than half of the upward restoration was worn out, indicated that the bears nonetheless maintain sway.

This implies the opportunity of additional declines from this level. The bears have a reasonably vast margin for downward motion, on condition that the closest help stage lies just under 14,000 factors inside a major help zone.

Nasdaq 100 Each day Chart

If the bearish scenario unfolds, paying shut consideration to the supply-side dynamics could be prudent. In case of a correction to the upside, a transfer towards earlier help areas could be good sign to contemplate lengthy positions.

***

Discover All of the Data you Want on InvestingPro!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counseling or advice to take a position as such it isn’t supposed to incentivize the acquisition of belongings in any means. I wish to remind you that any kind of belongings, is evaluated from a number of factors of view and is very dangerous and subsequently, any funding resolution and the related threat stays with the investor.

[ad_2]

Source link