Dismissing asset allocation as ineffective has develop into widespread in some circles lately, however the cost is demonstrably false.

The proof on the contrary is particularly conspicuous in 2022, which is on monitor to dispense an unusually big selection of returns for the calendar 12 months that just about run out of highway. The implication: alternative has been unusually excessive throughout the realm of asset allocation.

Contemplate how the foremost asset lessons stack up on a year-to-date foundation primarily based on a set of proxy ETFs.

The unfold between the most effective and the worst funds is a hefty 49 share factors! If variation in outcomes equates with alternative, the 12 months that’s coming to an in depth has been ripe with potential.

Main Asset Lessons: Whole Returns

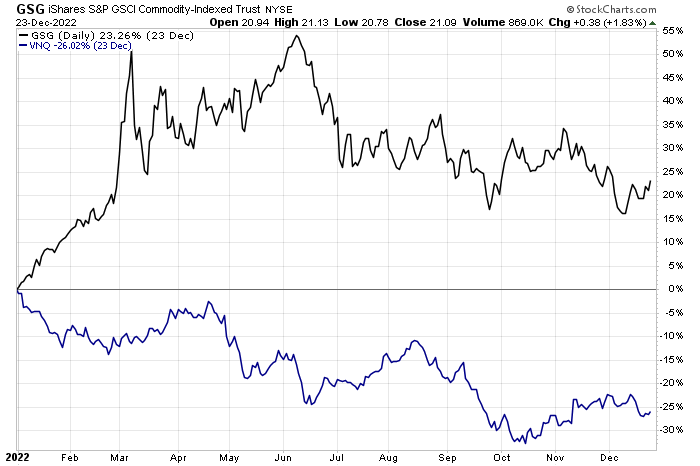

Commodities are set to submit the strongest achieve in 2022 by far for the foremost asset lessons. The iShares S&P GSCI Commodity-Listed Belief (NYSE:) surged greater than 23% this 12 months by means of Friday’s shut (Dec. 23).

Spectacular, however let’s not neglect that this 12 months’s sizzling efficiency follows a good stronger achieve final 12 months for uncooked supplies write giant.

The important thing takeaway: the choice to allocate into commodities or not most likely explains quite a bit concerning the efficiency of multi-asset-class portfolios this 12 months.

On the alternative excessive: US actual property funding trusts (REITs), which have taken a beating in 2022 and are set to submit the deepest loss for the foremost asset lessons within the fast-fading calendar 12 months.

Vanguard Actual Property Index Fund ETF (NYSE:) is underwater by 26% by means of the shut of final week’s buying and selling.

The desk above reminds us that many of the world’s markets are nursing losses this 12 months. Aside from commodities, solely money (iShares Brief Treasury Bond ETF (NASDAQ:)) cheated the bears in 2022, albeit modestly.

Will these outcomes affect the 12 months forward? Nice query. Sadly, the long run’s no much less opaque at December’s shut vs. January’s debut. However that’s no excuse to disregard asset allocation.

Historical past isn’t a crystal ball, nevertheless it’s nonetheless helpful, particularly when mixed with different metrics, resembling valuation, momentum, and varied flavors of macro evaluation.

Within the remaining days of the 12 months, I’ll assessment 2022 outcomes so far on a extra granular stage. Tomorrow’s focus: US equity-factor returns.