[ad_1]

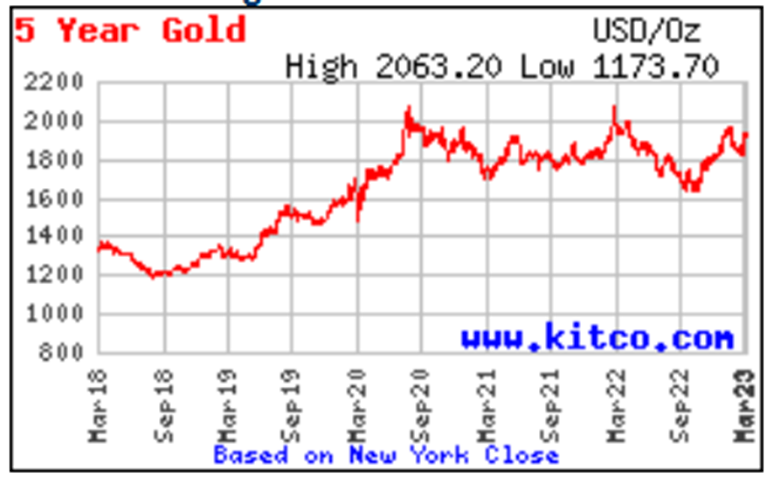

Gold is again in favor this week as a banking disaster that began with the failure of Silicon Valley Financial institution (SVB), had buyers flocking to safe-haven belongings together with the US greenback, Treasuries and bullion.

Spot gold Wednesday hit an intra-day excessive of $1,933/oz, as European financial institution shares fell. Credit score Suisse shares got here below intense promoting strain, after its largest investor stated it couldn’t present the Swiss financial institution with extra monetary help. Nonetheless, they surged on Thursday after the nation’s central financial institution agreed to lend it as much as $54 billion, following the collapse of three US banks — SVB, Silvergate and Signature Financial institution.

Supply: Kitco

However the actual driver of gold costs at present is the Federal Reserve’s decision-making over how a lot it’ll proceed to lift rates of interest, pause them and even decrease them because the central financial institution pores over financial knowledge and weighs the banking disaster forward of its common coverage assembly subsequent week.

Members of the Federal Open Market Committee will resolve on March 22 whether or not to hike the federal funds price by 25 or 50 foundation factors, or depart it at between 4.5 and 4.75%.

Officers have raised charges at every of their final eight coverage conferences spanning 12 months, as they attempt to decrease inflation to their 2% goal. Nonetheless, the financial institution collapses and ensuing market turbulence have added a complicating issue for the Fed because it debates its subsequent transfer on inflation. (Wall Avenue Journal, March 15, 2023)

Right here we take a look at what all of it means for treasured metals going ahead.

Banks bailed out

Silicon Valley Financial institution and Signature Financial institution are among the many largest banks in america, valued at $209 billion and $110.4 billion, respectively. (JP Morgan Chase, Financial institution of America and Citibank are the three largest, valued at between $1.7 and $3.2 trillion).

When Silicon Valley Financial institution collapsed final Friday, it turned the second-largest financial institution failure in US historical past, behind primary Washington Mutual Financial institution in September, 2008.

How did it go down?

As USA Right now explains,

Because the financial institution grew to be the sixteenth largest in America, SVB invested their funds in long-term bonds when charges have been close to zero.

This may increasingly have appeared like a good suggestion on the time, however when rates of interest rose, these long-term bond costs fell, cratering their investments.

On Wednesday, SVB introduced that it suffered a $1.8 billion after-tax loss and urgently wanted to lift extra capital to deal with depositor issues.

The market reacted sharply and SVB misplaced over 160 billion {dollars} in worth in 24 hours.

What occurred subsequent is acquainted to most Individuals, particularly those that protested towards the financial institution bailouts in the course of the monetary disaster.

So the Federal Deposit Insurance coverage Company took over SVB on Friday to get depositors entry to their cash by Monday, and since the financial institution’s troubles posed a significant danger to the monetary system…

Earlier than the FDIC stepped in, depositors might solely entry as much as $250,000…

The Federal Reserve, the Treasury Division and the FDIC stated regulators took the weird step of guaranteeing the deposits as a result of SVB offered a significant danger for the U.S. economic system.

Signature Financial institution in New York was additionally closed on Sunday after its prospects started withdrawing money too rapidly. State regulators stated they took over the financial institution to stabilize monetary techniques. Federal regulators stated depositors from each banks will get their cash.

Wall Avenue then ordered a number of regional banks to stop buying and selling Monday, as their shares plummeted. Shares of First Republic Financial institution, for instance, have been stopped after falling 65%.

The Economist notes that rising rates of interest have left banks uncovered.

The crux of the problem is what occurs when a financial institution is pressured to promote bonds, and beforehand unrecognized losses develop into actual.

As talked about, at SVB, when rates of interest have been low and asset costs excessive, the California financial institution loaded up on long-term bonds. When the Fed raised rates of interest on the quickest tempo in 4 many years, bond costs plunged and the financial institution was left with big losses.

Unrecognized losses throughout America’s banking system totaled $620 billion on the finish of 2022. Submit-financial disaster rules sought to restrict credit score danger by making certain that banks maintain belongings that may simply be bought. None matches the invoice higher than US authorities bonds.

However as The Economist explains:

A few years of low inflation and rates of interest meant that few thought-about how the banks would endure if the world modified and longer-term bonds fell in worth. This vulnerability solely worsened in the course of the pandemic, as deposits flooded into banks and the Fed’s stimulus pumped money into the system. Many banks used the deposits to purchase long-term bonds and government-guaranteed mortgage-backed securities.

[Note this is exactly what happened in 2008. After introducing quantitative easing, the Fed expected the smaller banks to lend more to individuals and businesses to kickstart the economy. Instead, they bought bonds and MBS’s, inflating their profits and handing out obscene CEO bonuses — Rick]

You may suppose that unrealized losses don’t matter. One downside is that the financial institution has purchased the bond with another person’s cash, often a deposit. Holding a bond to maturity requires matching it with deposits and as charges rise, competitors for deposits will increase. On the largest banks, like JPMorgan Chase or Financial institution of America, prospects are sticky so rising charges have a tendency to spice up their earnings, due to floating-rate loans. Against this, the roughly 4,700 small and mid-sized banks with complete belongings of $10.5trn need to pay depositors extra to cease them taking out their cash. That squeezes their margins — which helps clarify why some banks’ inventory costs have plunged.

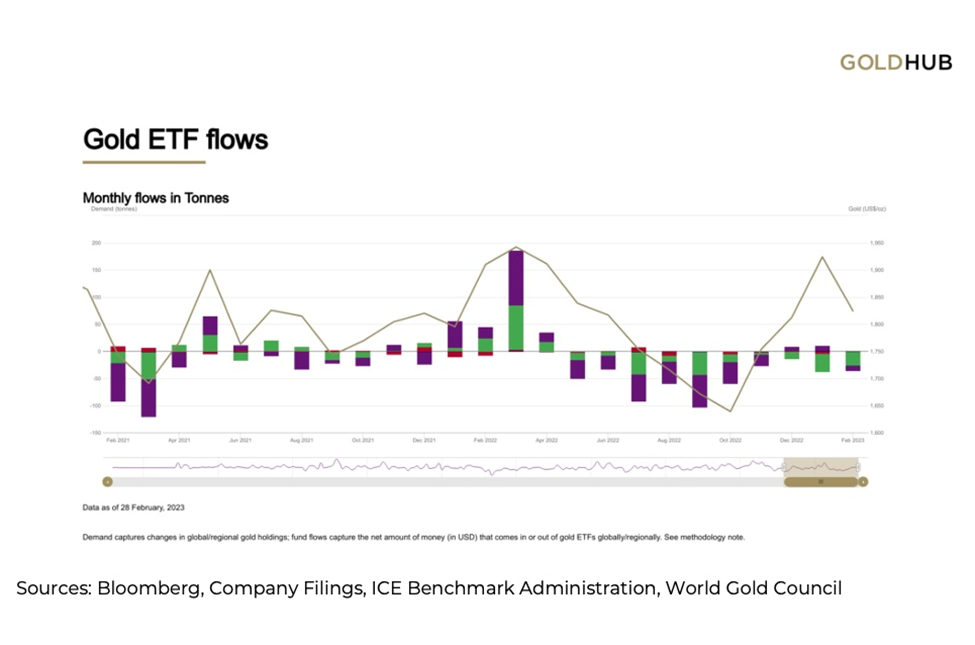

Gold ETF promoting

Regardless of gold rising to inside $100 of an all-time excessive of $2,034 set within the fall of 2020, some buyers are dumping the yellow metallic.

A stronger greenback and rising bond yields (keep in mind, gold pays neither a dividend not a yield, making the chance value of holding gold larger in periods of excessive rates of interest) led to a 5% decline within the gold worth in February.

Final month, many buyers of gold-backed ETFs determined to liquidate. In response to the World Gold Council, gold ETFs misplaced $1.7 billion in February, marking a 10-month shedding streak, the longest since January 2014.

Gold ETF belongings below administration (AUM) declined by 1% to $200 billion, WGC knowledge confirmed. In tonnage phrases, February’s decline noticed international ETF holdings fall by 34 tonnes to three,412t.

European funds drove outflows because the area’s central banks continued to ship outsized price hikes, whereas North American gold ETFs misplaced simply over half a billion {dollars}, the primary month-to-month outflow in 2023 after two consecutive months of inflows, the WGS stated.

Nonetheless as we noticed in a earlier article, the gold worth continues to remain lofty, regardless of a excessive US greenback and elevated authorities bond yields (the latter noticed some volatility this week and final). The greenback and gold usually transfer in reverse instructions.

The hyperlink between commodities and inflation

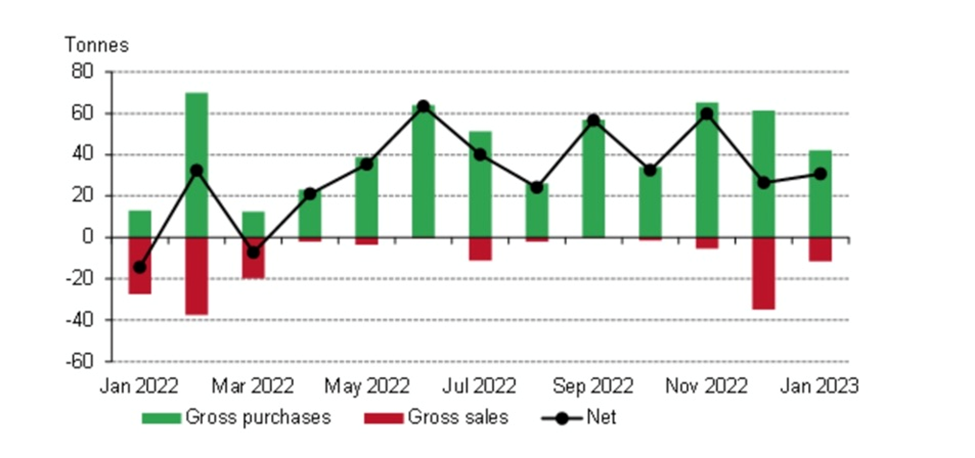

Central financial institution shopping for

Central financial institution shopping for is one purpose why gold has held its personal over the previous few months.

Central financial institution gold demand has reportedly seen a continuation from 2022’s document 12 months of purchases, with CBs including 31 tonnes to international gold reserves in January, the World Council stated earlier this month.

Supply: World Gold Council

Supply: World Gold Council

The most important purchaser was the Central Financial institution of Turkey, adopted by the Folks’s Financial institution of China and Kazakhstan’s nationwide financial institution.

January’s central financial institution gold haul was 16% larger than December. The WGC sees the pattern persevering with all through this 12 months.

“We see little purpose to doubt that central banks will stay optimistic in direction of gold and proceed to be web purchasers in 2023,” the report stated. “The wholesome January knowledge we now have up to now offers us little purpose, right now at the very least, to deviate from this outlook.”

Final 12 months, central banks bought 1,136 tonnes — probably the most on document and a greater than 150% enhance from 2021. (Kitco Information, March 2, 2023)

When will the Fed pivot?

The Fed’s high-interest price coverage has damaged the banks, and there are indicators of a cooling US economic system — February’s financial knowledge confirmed a decline in retail gross sales and easing worth pressures. Is every little thing damaged sufficient for the Fed to cease elevating charges, the so-called Fed pivot?

I’m sticking to my earlier (appropriate) prediction, that we’d see price will increase fall from 75 foundation factors to 50bp, after which charges could be held at +0.25% will increase for awhile, earlier than a pause and a return to decreasing by the top of this 12 months.

The banking disaster doesn’t change my mind-set. In response to Reuters, the markets have put a 57% likelihood on the Fed holding its benchmark price at present ranges at its March 22 assembly. I personally don’t suppose a pause is merited this quickly; with inflation nonetheless method above the Fed’s focused 2%, I see one other 0.25% elevate in March and doubtlessly a couple of extra. There are six FOMC conferences left in 2023 after March’s gathering.

Clearly I’m not alone on this prediction. “A pause now would ship the improper sign concerning the seriousness of the Fed’s inflation resolve,” the Wall Avenue Journal quoted Michael Feroli, chief US economist at JPMorgan Chase, the nation’s largest financial institution.

And the way about this for backing my forecast of a price lower by year-end? In response to WSJ, The uncertainty over the Fed’s price path led buying and selling in futures markets to indicate expectations that the central financial institution might begin decreasing charges by July. On Wednesday, markets noticed an almost 70% likelihood that by 12 months’s finish, the Fed would lower charges to under 4%.

Ratio favors silver

As for what this implies for gold and silver, let’s check out what we all know. The banking disaster together with different regular gold worth drivers, like central financial institution shopping for, and tight provide because of an absence of recent discoveries, pushed gold to inside 100 {dollars} of its all-time excessive this week.

At round $21, silver has but to interrupt out.

Gold ETFs have been massively promoting off, understandably because of the extra enticing returns from excessive bond yields, but central banks proceed to hoard gold, particularly within the East, like China and Turkey.

If gold is nice sufficient for central banks, even @ $1,900, why are retail buyers promoting it?

Properly, the economic system is inflating concurrently central financial institution banks are elevating rates of interest. Gold’s worth appreciation is subsequently restricted by larger charges and bond yields. Why put money into gold, with affords neither curiosity nor a dividend, when you will get a good return on a authorities bond, or simply by stuffing a bunch of money right into a financial savings account that these days pays round 3%?

Personally I wouldn’t be shopping for bodily gold proper now as a result of it’s costly, particularly in Canadian {dollars}, however I definitely wouldn’t be promoting it both. I’m shopping for shares in gold and silver centered Juniors, there are bargains galore on the market. Contemplate that gold jumped to inside spitting distance of $2,000 with the failure of three banks. What’s going to occur to gold if we get a recession? Or if one in every of 4 scorching spots in 2023 — the struggle in Ukraine, Iran protests, US-China commerce relations, and North Korea — flares up? Traditionally treasured metallic centered juniors provide the most effective leverage to rising gold and silver costs.

By the top of the 12 months, as I’ve stated, I see rates of interest coming down and the greenback weakening, principally due to a softer job market and a slowdown in client spending. So for me good transfer is to hold onto my gold, and gold shares, at the very least till the top of the 12 months. So much has nonetheless to be determined and it’s only March.

The data sector shed 25,000 jobs in February, factories laid off 4,000 staff and the transportation and warehousing business lower 22,000 positions. The month-to-month unemployment price elevated from 3.4% to three.6%. It’s in all probability nonetheless too low to alter the Fed’s thoughts on price hikes, however give it time.

Commodities inflation will get handed by to manufactured items, leading to larger costs for items and companies, that should be borne by customers. How lengthy can this historic anomaly of excessive inflation and excessive borrowing prices be tolerated by customers, a lot of whom are already extremely leveraged with mortgages, loans, strains of credit score and bank card debt?

US customers are getting crushed by high-interest debt and inflation

Shopper spending, which makes up two-thirds of world GDP, goes to sluggish, drastically.

When economies all over the world go smooth, and the Fed decides they’ve finished sufficient to “kill the patron” and the job market with excessive rates of interest, the US greenback will plunge and treasured metals, gold and silver, will, imo, soar.

Within the meantime I additionally shopping for silver.

We use the gold-silver ratio to learn the way silver costs examine to gold. The ratio is the quantity of silver one can purchase with an oz. of gold. Merely divide the present gold worth by the worth of silver.

Present indications present that silver is method undervalued. Proper now, Friday morning on the 17th of March the gold-silver ratio is 88:1, which means it takes 88 oz of silver to purchase one ounce of gold.

See the chart under and linked commentary displaying that Traditionally, when the unfold will get [above 80], silver doesn’t simply outperform gold, it goes on a large run in a brief time frame. Since January 2000, this has occurred 4 occasions. As this chart reveals, the snapback is swift and powerful.

Supply: Schiffgold.com

Supply: Schiffgold.com

Conclusion

It’s actually fairly easy.

When treasured metals rallied in 2020, on the again of lockdowns, rates of interest slashed to zero, QE, and basic market worry, silver’s achieve was double that of gold. The worth ran up 43% from January to December, 2020, in comparison with gold’s mere 20.8% rise. Earlier within the 12 months, as gold punched above $2,000 an oz., a 39% achieve, silver rallied to just about $30 an oz., a 147% enhance.

In the meantime, the silver-gold ratio fell from over 100:1 to simply over 64:1.

It might simply occur once more.

Richard (Rick) Mills

aheadoftheherd.com

Authorized Discover / Disclaimer

Forward of the Herd publication, aheadoftheherd.com, hereafter generally known as AOTH.

Please learn the whole Disclaimer fastidiously earlier than you employ this web site or learn the publication. If you don’t conform to all of the AOTH/Richard Mills Disclaimer, don’t entry/learn this web site/publication/article, or any of its pages. By studying/utilizing this AOTH/Richard Mills web site/publication/article, and whether or not you really learn this Disclaimer, you might be deemed to have accepted it.

Any AOTH/Richard Mills doc is just not, and shouldn’t be, construed as a proposal to promote or the solicitation of a proposal to buy or subscribe for any funding.

AOTH/Richard Mills has primarily based this doc on data obtained from sources he believes to be dependable, however which has not been independently verified.

AOTH/Richard Mills makes no assure, illustration or guarantee and accepts no duty or legal responsibility as to its accuracy or completeness.

Expressions of opinion are these of AOTH/Richard Mills solely and are topic to alter with out discover.

AOTH/Richard Mills assumes no guarantee, legal responsibility or assure for the present relevance, correctness or completeness of any data supplied inside this Report and won’t be held answerable for the consequence of reliance upon any opinion or assertion contained herein or any omission.

Moreover, AOTH/Richard Mills assumes no legal responsibility for any direct or oblique loss or injury for misplaced revenue, which you will incur because of the use and existence of the knowledge supplied inside this AOTH/Richard Mills Report.

You agree that by studying AOTH/Richard Mills articles, you might be appearing at your OWN RISK. In no occasion ought to AOTH/Richard Mills answerable for any direct or oblique buying and selling losses brought on by any data contained in AOTH/Richard Mills articles. Data in AOTH/Richard Mills articles is just not a proposal to promote or a solicitation of a proposal to purchase any safety. AOTH/Richard Mills is just not suggesting the transacting of any monetary devices.

Our publications will not be a advice to purchase or promote a safety – no data posted on this web site is to be thought-about funding recommendation or a advice to do something involving finance or cash except for performing your individual due diligence and consulting together with your private registered dealer/monetary advisor.

AOTH/Richard Mills recommends that earlier than investing in any securities, you seek the advice of with an expert monetary planner or advisor, and that it’s best to conduct an entire and impartial investigation earlier than investing in any safety after prudent consideration of all pertinent dangers. Forward of the Herd is just not a registered dealer, supplier, analyst, or advisor. We maintain no funding licenses and should not promote, provide to promote, or provide to purchase any safety.

[ad_2]

Source link