Revealed on March twenty second, 2022 by Aristofanis Papadatos

As inflation has surged to a 40-year excessive this yr, income-oriented traders are struggling to guard the true worth of their portfolios from eroding. Many traders have resorted to high-yield shares in an try to offset inflation.

You may obtain your free full checklist of all excessive dividend shares with 5%+ yields (together with necessary monetary metrics corresponding to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Xerox (XRX) has grow to be a high-yield inventory in current months and it’s at the moment providing an almost 10-year excessive dividend yield of 5.4%.

Nevertheless, traders ought to carry out their due diligence earlier than buying a high-yield inventory. On this article, we’ll analyze whether or not income-oriented traders can buy Xerox for its attractive yield.

Enterprise Overview

Xerox traces its roots again to 1906, when The Haloid Photographic Firm started manufacturing photographic paper and tools. Since then, the corporate has gone by means of a collection of mergers and spinoffs. In 2017, Xerox spun off its enterprise processing unit and now focuses on design, growth, and gross sales of doc administration programs.

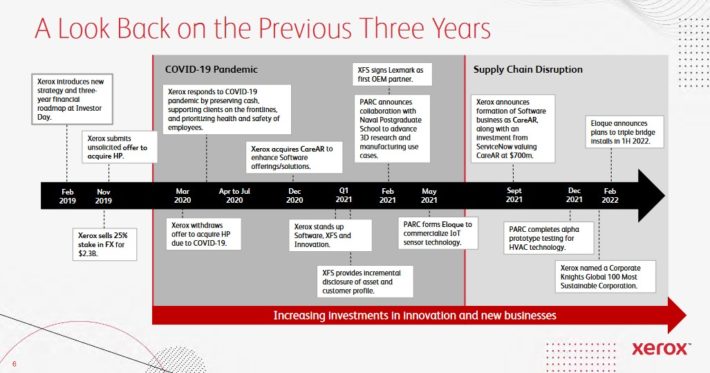

The previous three years have seen many modifications for Xerox.

Supply: Investor Presentation

Xerox has been severely damage by the coronavirus disaster, which has led many firms to undertake a work-from-home mannequin or a hybrid work mannequin. Because of this shift, demand for doc administration programs has considerably decreased.

Within the fourth quarter, Xerox noticed its revenues decline 8% and its adjusted earnings per share plunge 41% over the prior yr’s quarter.

Even worse, the plunge in earnings per share materialized regardless of a 20% discount within the share depend of the inventory. In different phrases, Xerox repurchased its shares at an excessive fee to masks its poor enterprise efficiency but it surely didn’t handle to stop a 41% lower in its earnings per share.

It’s exceptional that the corporate returned $1 billion to its shareholders by way of dividends and share repurchases in 2021. As this quantity is 30% of the market capitalization of the inventory, it’s evident that administration is doing its finest to masks its poor efficiency by way of monetary engineering.

Administration attributed a part of the disappointing outcomes to disruptions of its provide chain as a result of pandemic however the poor outcomes and the main focus of administration on excessive buybacks increase a crimson flag for traders.

Furthermore, administration offered steerage totally free money move of no less than $400 million (~$2.50 per share on the present share depend) in 2022. Such a excessive free money move could appear attractive on the floor, because it in all probability indicators that the aggressive share buybacks will stay in place for no less than one other yr.

However, we would like to see administration spend money on the enterprise and make efforts to turnaround the corporate as an alternative of specializing in monetary engineering.

Development Prospects

Xerox has exhibited a frightening efficiency report over the past decade. Throughout this era, the corporate has diminished its share depend by practically 50% however its earnings per share have plunged 60%. In different phrases, its underlying earnings have plunged roughly 80% over the past decade.

The pandemic has begun to subside in current months however Xerox has failed to indicate any indicators of a promising restoration. Most firms that had been damage by the pandemic have totally recovered or have begun to get well no less than. Sadly, this isn’t the case for Xerox.

The pandemic has led many firms to undertake a hybrid work mannequin, which has considerably diminished the demand for the merchandise of Xerox. As this secular development will not be more likely to fade anytime quickly, there’s nice uncertainty over the long run progress prospects of Xerox.

As well as, we don’t count on margins to enhance considerably, given the shrinking finish market of this enterprise. Share repurchases shall be a serious progress driver for the underside line however they don’t seem to be ample to render the inventory enticing, as its enterprise mannequin is below strain.

Aggressive Benefits

The first aggressive benefit of Xerox lies in its pure-play give attention to doc administration programs and its very lengthy historical past within the trade. As well as, the corporate has a extremely diversified, world buyer base.

However, its finish market is constantly shrinking, as many firms shift to a hybrid work mannequin. Given additionally the disappointing efficiency report of the corporate and the secular decline of its enterprise, it’s evident that the aggressive benefits of Xerox are of little significance to the shareholders within the present enterprise surroundings.

Dividend Evaluation

Xerox is providing an almost 10-year excessive dividend yield of 5.4%. Nevertheless, it has paid the identical dividend for 5 consecutive years. As well as, Xerox has an elevated payout ratio of 63% whereas its enterprise mannequin is below strain as a result of secular shift of firms in the direction of a extra digital work mannequin.

Furthermore, Xerox has enormously leveraged its stability sheet these days with a view to execute its aggressive share repurchases. Curiosity expense consumes 23% of working earnings whereas internet debt at the moment stands at $5.8 billion. As this quantity is almost double the market capitalization of the inventory, it’s undoubtedly excessive.

Moreover, Xerox is more likely to proceed shopping for again its shares aggressively this yr however its stability sheet won’t strengthen anytime quickly. Total, the 5.4% dividend of Xerox will not be protected, notably in a recession.

As a substitute, it’s more likely to come below strain every time the corporate faces a headwind, corresponding to a recession. Subsequently, traders shouldn’t buy Xerox for its above-average dividend yield.

Closing Ideas

Xerox is providing an almost 10-year excessive dividend yield of 5.4% and is buying and selling at a ahead price-to-earnings ratio of 11.2. Sadly, there are good causes behind these seemingly enticing metrics of the inventory. The corporate is dealing with a powerful secular headwind, specifically the shift of firms in the direction of a extra digital enterprise mannequin. Given the shrinking finish market of Xerox and the extraordinary competitors in its enterprise, it is just pure that the inventory is buying and selling at a low price-to-earnings ratio.

Furthermore, as an alternative of doing its finest to spend money on the enterprise and switch the corporate round, administration appears to be centered totally on shopping for again shares aggressively with a view to enhance earnings per share artificially. Consequently, we don’t count on Xerox to enter a sustained progress trajectory anytime quickly.

Over the past decade, the inventory has shed 37% whereas the S&P 500 has greater than tripled. Total, the 5.4% dividend of Xerox is inadequate to compensate traders for the excessive threat of the inventory.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].