Printed on March twenty fourth, 2022 by Prakash Kolli

Excessive yield shares with dividend yields above 5% are interesting for revenue buyers. Nevertheless, not all excessive dividend shares are created equal. Some have safe dividend payouts. Nevertheless, others are in questionable monetary situation, leaving shareholders weak to a dividend reduce in a downturn.

With this in thoughts, we created a full listing of excessive dividend shares.

You’ll be able to obtain your free full listing of all excessive dividend shares with 5%+ yields (together with vital monetary metrics resembling dividend yield and payout ratio) by clicking on the hyperlink beneath:

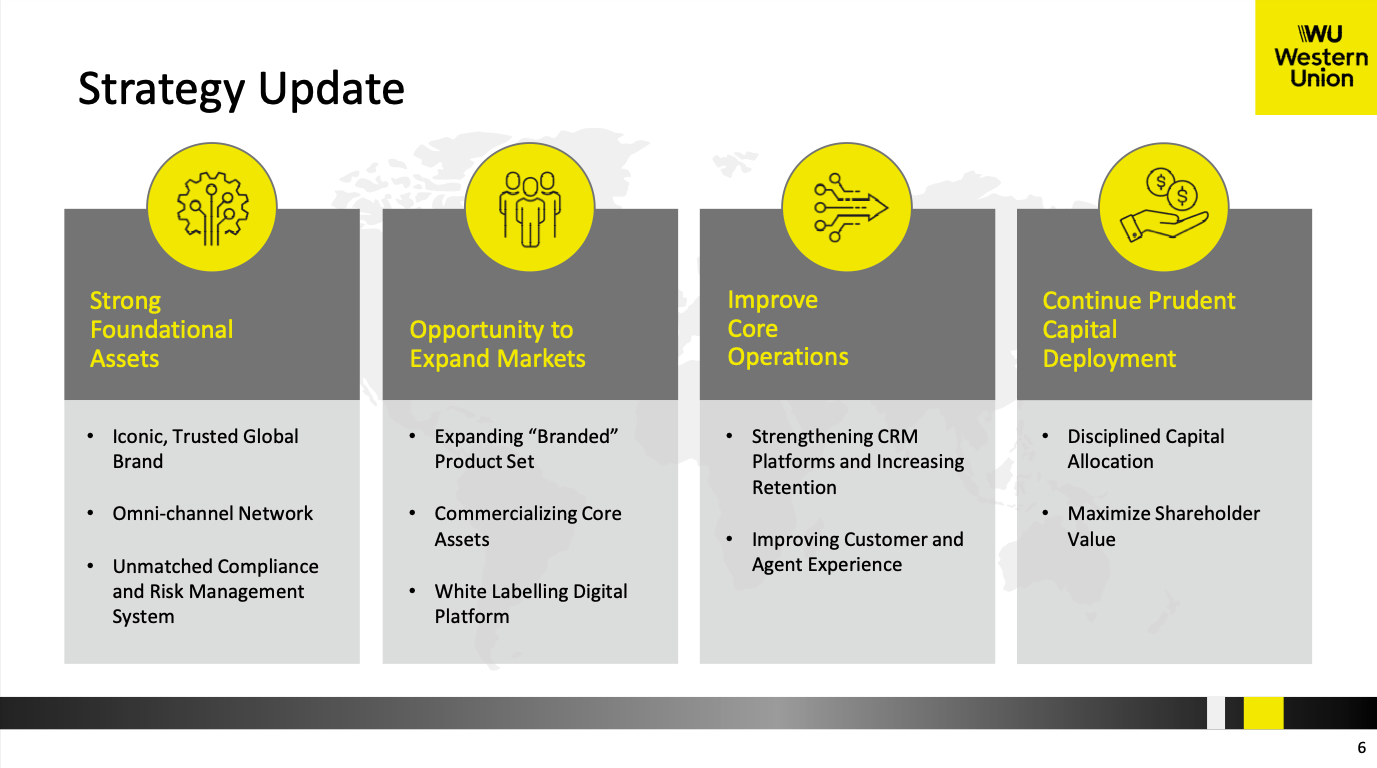

Western Union has been a excessive dividend yield inventory for a number of years. The corporate has struggled with development in a mature enterprise, however it’s worthwhile. Administration has more and more returned money to shareholders, and the yield is now over 5%, supported by a fairly conservative payout ratio. Regardless of rising competitors, the dividend yield is secure within the close to time period.

Enterprise Overview

The Western Union Firm (WU) is the world chief in home and worldwide cash transfers. The corporate operates in three segments Shopper-to-Shopper (C2C), Enterprise Options, and Different. The corporate was based in 1851.

The C2C enterprise consists of cash transfers between shoppers utilizing the agency’s international community of brokers, the web site, and the app. Western Union has almost 600,000 third-party brokers globally and operates in additional than 200 nations. As well as, the app and web site enable digital cash transfers between shoppers. The corporate serves about 150 million shoppers.

The Enterprise Options section permits funds and cross-border funds for companies. The Different section is especially invoice funds within the US and Argentina and cash orders. As well as, the corporate offered the Speedpay (US invoice funds) and Paymap (mortgage funds) companies in 2019. The Enterprise Options section can be offered for $910 million, with closing anticipated in 2022.

Complete income was $5,070.9 million in 2021 and $5,070.8 million previously 12 months.

Supply: Investor Relations

Development Prospects

Western Union’s primary C2C enterprise is mature however very worthwhile. As well as, the corporate is by far the chief in agent cash transfers. It’s a number of occasions bigger based mostly on income than the quantity two competitor. The corporate makes cash by transferring cash and taking a small price it shares with brokers. Nevertheless, each volumes and income development are flat-to-declining on account of rising competitors from digital cash transfers and new gamers in that house.

Theoretically, including brokers and extra geographies ought to result in incremental development. Due to this fact, the corporate actively provides companions to construct its community and preserve its scale. As an illustration, Western Union is partnered with Walmart. Nevertheless, with almost 600,000 brokers and operations in 200 nations, there’s in all probability little in the best way of future development within the conventional C2C enterprise.

Then again, digital cash switch operations are rising. The corporate centered on this enterprise just a few years in the past and now has an app and the WU dot.com web site. Consequently, digital cash switch volumes and income are rising. As well as, the COVID-19 pandemic boosted volumes and income as shoppers transitioned from retail to digital channels. Consequently, roughly 24% of C2C income is thru the digital cash switch channel. Nevertheless, stable development on this enviornment has not translated into an total improve within the C2C enterprise.

Supply: Investor Relations

The primary problem for development is stiff competitors in digital cash transfers. The corporate faces competitors from well-funded and bigger rivals. Firms resembling Xoom, Sq., Zelle, Stripe, and plenty of others supply digital cash transfers domestically. More and more, they’re providing the identical service internationally.

Western Union has a brand new CEO who’s seemingly specializing in digital channels and methods to leverage the in depth community for development. Nevertheless, he has been in place only some months.

Aggressive Benefits

Western Union has a number of aggressive benefits. First, the identify and model are well-known worldwide for cash transfers. Second, the corporate is the market chief. Third, the corporate in all probability has the very best identify recognition within the cash switch enterprise.

Subsequent, Western Union is probably the most vital participant within the C2C cash switch enterprise. This truth confers a bonus in working and value efficiencies. The in depth community means including extra brokers or shoppers solely ends in incremental value will increase. Therefore, Western Union’s working margins of roughly 21% are increased than its primary competitor.

Lastly, Western Union’s enterprise mannequin requires the usage of third-party brokers. This level means prices are low, and little capital is required for funding. Moreover, the in depth community and broad geographic presence imply the corporate can supply cash transfers virtually wherever. In much less developed nations, having an in depth agent community is a major benefit since an agent is required to ship cash and obtain cash.

Dividend Evaluation

Western Union pays a wholesome dividend yield. The corporate has delivered an rising dividend for seven years, making the inventory a Dividend Challenger. The ahead dividend fee is $0.94 per share, giving a wonderful ahead dividend yield of about 5.6%. This worth is bigger than the 5-year common of 4.10%. Additionally it is greater than thrice the common dividend yield of the S&P 500 Index.

Though Western Union seemingly prioritizes share repurchases, it has continued to extend the dividend fee. The corporate’s dividend development fee is round 11.73% previously decade and roughly 7.99% within the trailing 5-years. Nevertheless, the newest improve was solely 4.4%, decrease than the long-term averages.

The corporate’s dividend is secure from the attitude of earnings and free money movement (FCF). The payout ratio is about 48% based mostly on the ahead dividend fee and estimated 2022 earnings per share of $1.96. As well as, Western Union generated an FCF of roughly $1,007.6 million in 2021, and the dividend required solely $381.6 million. Due to this fact, the dividend-to-FCF ratio is conservative at ~38%.

Western Union’s steadiness sheet is in a superb place from the attitude of dividend security. On the finish of This autumn, 2021, long-term debt was about $3,008.4 million, offset by $ 1208.3 million in money and equivalents. The leverage ratio is conservative at roughly 1.5X, and the curiosity protection is greater than 10.5X. The present credit standing is BBB / Baa2, a decrease medium investment-grade credit standing by S&P International and Moody’s.

Last Ideas

Excessive-yield shares are interesting for buyers looking for revenue. The issue is many have deteriorating companies and weakening dividend security metrics. Usually, what was as soon as a wonderful dividend yield is not one due to a dividend reduce or omission. Nevertheless, Western Union’s dividend security metrics are stable, and the yield is excessive.

Western Union is the market chief in shopper cash transfers with its in depth agent community. The corporate is rising its digital cash switch enterprise and may preserve its scale and management.

Western Union is an effective inventory for buyers looking for a excessive dividend yield and revenue.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].