Revealed on October twenty eighth, 2025 by Felix Martinez

Excessive-yield shares pay out dividends which might be considerably larger than the market common. For instance, the S&P 500’s present yield is simply ~1.2%.

Excessive-yield shares may be notably helpful in supplementing earnings after retirement. A $120,000 funding in shares with a mean dividend yield of 5% creates a mean of $500 a month in dividends.

Timbercreek Monetary Corp. (TBCRF) is a part of our ‘Excessive Dividend 50’ collection, which covers the 50 highest-yielding shares within the Positive Evaluation Analysis Database.

We now have created a spreadsheet of shares (and intently associated REITs, MLPs, and so on.) with dividend yields of 5% or extra.

You’ll be able to obtain your free full listing of all securities with 5%+ yields (together with essential monetary metrics akin to dividend yield and payout ratio) by clicking on the hyperlink under:

Subsequent on our listing of high-dividend shares to assessment is Timbercreek Monetary Corp. (TBCRF).

Enterprise Overview

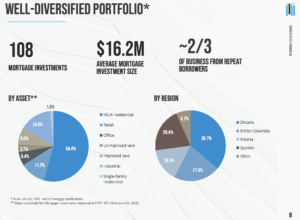

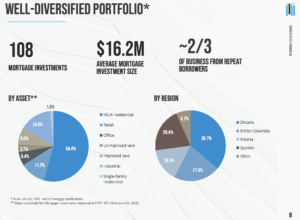

Timbercreek Monetary is a Canadian non-bank lender specializing in short-term, structured financing for business actual property. The corporate primarily offers first-mortgage loans for income-producing properties, together with multi-residential, retail, industrial, and workplace belongings. Its loans assist acquisitions, redevelopment, or transitional financing and are sometimes repaid by means of long-term financing or property gross sales. The agency’s portfolio is absolutely targeted on business actual property, with round 92% of capital deployed in Ontario, British Columbia, Quebec, and Alberta.

Timbercreek emphasizes conservative danger administration, sustaining a 63.3% loan-to-value ratio (year-end 2024) and floating-rate loans with charge flooring to guard in opposition to market volatility whereas benefiting from rate of interest actions. The corporate pays month-to-month dividends, interesting to income-focused traders, and has a market capitalization of CAD 460.8 million. Its disciplined lending mannequin and urban-focused portfolio present secure, high-quality publicity to Canada’s main actual property markets.

Supply: Investor Relations

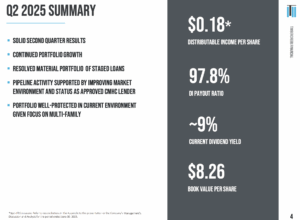

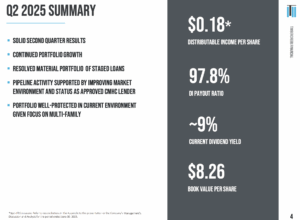

Timbercreek Monetary reported Q2 2025 internet earnings of $12.4 million, or $0.15 per share, barely under expectations. Internet funding earnings was $25.2 million, and distributable earnings totaled $14.6 million ($0.18 per share). The corporate declared $14.3 million in dividends ($0.17 per share), yielding 9.5% on the present share value.

The online mortgage portfolio grew to $1.114 billion, up 11% year-over-year, with new loans weighted towards the tip of the quarter. Stage 2 and three loans totaling $80 million have been resolved, releasing capital for higher-yield investments. Variable-rate loans with rate of interest flooring made up 87.4% of the portfolio, defending in opposition to rate of interest swings, whereas multi-family residential belongings stay resilient.

The portfolio’s weighted-average LTV was 66%, with first mortgages accounting for 91.6% and cash-flowing properties accounting for 76.3%. Weighted common rates of interest have been 8.6%. Timbercreek’s disciplined underwriting, energetic mortgage administration, and concentrate on high-quality city belongings proceed to generate secure earnings and engaging risk-adjusted returns for shareholders.

Supply: Investor Relations

Development Prospects

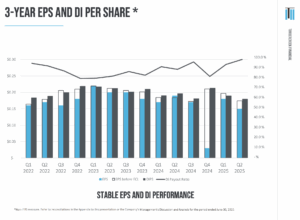

Timbercreek Monetary grows by lending to new clients at engaging charges, primarily in opposition to income-producing properties. Nevertheless, EPS has proven little progress over the previous seven years, and U.S. traders face added danger from CAD/USD fluctuations. Even accounting for forex results, Timbercreek’s backside line has been principally flat, and EPS is anticipated to stay secure over the following 5 years.

Over the previous decade, EPS ranged from $0.36–$0.43 by means of 2017, fell to $0.23 in 2020 because of low charges and pandemic-related accounting changes, and rebounded to $0.43 by 2023. EPS declined to $0.28 in 2024 from higher-risk mortgage provisions and a few portfolio runoff.

Distributable earnings per share is anticipated to remain round $0.36, and the month-to-month dividend has been secure at roughly $0.042 USD since 2017. Timbercreek stays a low-growth, income-focused funding with predictable dividends.

Supply: Investor Relations

Aggressive Benefits & Recession Efficiency

Timbercreek Monetary’s aggressive benefit lies in its concentrate on short-term, structured lending to business actual property traders, permitting quicker execution and extra versatile phrases than conventional Canadian banks. Its disciplined underwriting, conservative loan-to-value ratios, and excessive share of first mortgages (over 90% of the portfolio) present draw back safety, whereas variable-rate loans with rate of interest flooring assist the corporate profit from rising charges and mitigate rate of interest danger. Moreover, Timbercreek’s urban-focused, income-producing property portfolio ensures predictable money circulation and secure distributable earnings for shareholders.

Throughout financial downturns, Timbercreek has demonstrated relative resilience. Its emphasis on cash-flowing properties, primarily multi-family residential belongings, and conservative lending practices helps keep mortgage efficiency even in softer markets.

Whereas EPS may be unstable because of accounting changes or forex fluctuations, precise defaults have traditionally been restricted, and the corporate has continued to generate regular distributable earnings. This defensive positioning makes Timbercreek a extra secure selection in contrast with broader business actual property lenders throughout recessions.

Dividend Evaluation

Timbercreek Monetary’s annual dividend is $0.50 per share. At its latest share value, the inventory has a excessive yield of 9.5%.

Given the corporate’s 2025 earnings outlook, EPS is anticipated to be $0.50 per share. Because of this, the corporate is anticipated to pay out 100% of its EPS to shareholders in dividends.

Last Ideas

Timbercreek Monetary offers publicity to high-yield, short-term business actual property lending, benefiting from rate of interest sensitivity and energetic portfolio administration. The corporate provides engaging month-to-month dividends, however traders ought to train warning, as the present payout degree might not be absolutely sustainable.

Its returns are tied to market circumstances and the efficiency of income-producing properties, making it a higher-risk funding relative to extra diversified or low-volatility choices.

Given its present valuation and restricted potential for dividend progress, we anticipate modest whole returns, forecasting roughly 4.3% annualized by means of 2030. Contemplating the mix of elevated danger, stagnant earnings, and capped dividend upside, the inventory is rated a promote, as its whole return potential seems restricted relative to various income-focused investments.

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].