[ad_1]

Revealed January seventeenth, 2023 by Jonathan Weber

The Williams Firms, Inc. (WMB) is an American vitality midstream firm that gives a excessive dividend yield of greater than 5% at present costs. Shares aren’t ultra-cheap, however the recession resilience of Williams’ enterprise mannequin makes the corporate appropriate for buyers searching for a lower-risk selection.

It is likely one of the high-yield shares in our database.

We’ve got created a spreadsheet of shares (and carefully associated REITs and MLPs, and many others.) with dividend yields of 5% or extra.

You’ll be able to obtain your free full listing of all securities with 5%+ yields (together with necessary monetary metrics comparable to dividend yield and payout ratio) by clicking on the hyperlink beneath:

On this article, we are going to analyze the prospects of The Williams Firms, Inc.

Enterprise Overview

The Williams Firms, Inc. was based greater than 100 years in the past, in 1908. The vitality midstream firm is headquartered in Tulsa, Oklahoma.

Williams is a pure fuel pipeline-focused vitality infrastructure firm that owns and operates greater than 30,000 miles of pipelines. On prime of that, Williams additionally owns adjoining belongings, comparable to pure fuel processing services, fractionation services, pure fuel liquid storage services, and so forth.

Pure fuel demand shouldn’t be very cyclical, because the commodity is primarily used for heating properties, cooking, electrical energy era, and a few industrial use circumstances comparable to fertilizer manufacturing. Since heating and cooking aren’t depending on the energy of the financial system, and since electrical energy demand can also be not shifting up and down rather a lot depending on financial circumstances, annual pure fuel demand is comparatively resilient versus macro shocks.

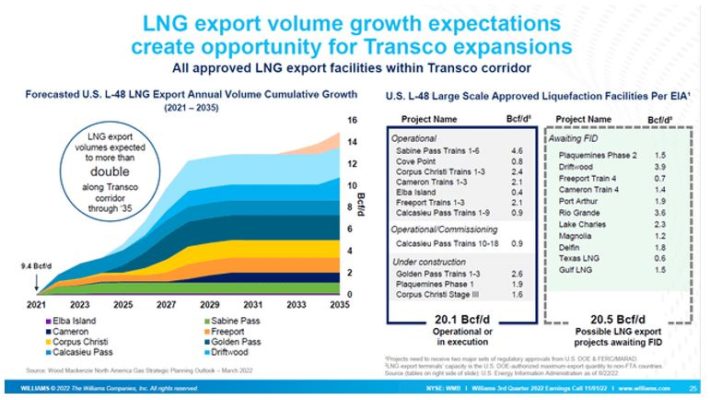

In North America, pure fuel demand is in a longer-term development development. Whereas the expansion price isn’t particularly excessive, coal-to-gas shifting in electrical energy era offers long-term development potential for pure fuel demand. Pure fuel demand in North America can also be pushed by rising LNG (liquified pure fuel) export volumes:

Supply: Investor Presentation

Nations in Asia and Europe enhance their LNG imports, particularly because the warfare in Ukraine began, which made European nations scale back their pure fuel imports from Russia. LNG suppliers such because the US shall be assembly this extra LNG demand, leading to larger manufacturing volumes in North America. Since this fuel needs to be exported to the coasts the place LNG terminals are situated, Williams ought to have the ability to fill its pipes with pure fuel for a very long time.

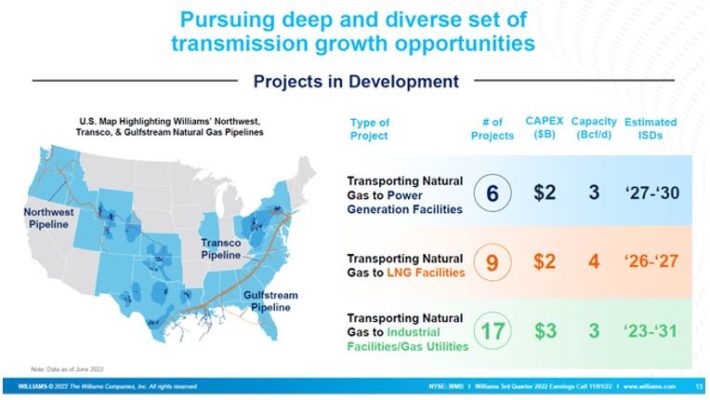

Williams has a big asset footprint in the USA, proudly owning main pipeline belongings such because the Gulfstream Pipeline and the Transco Pipeline:

Supply: Investor Presentation

The corporate additionally owns pipelines connecting the Pacific Northwest to different markets. Not too long ago, Williams expanded its asset footprint additional by buying MountainWest Pure Gasoline Transmission from Southwest Gasoline Holdings in a deal that values the asset at $1.1 billion. This deal, which was introduced in December, will broaden Williams’ footprint within the Rockies by connecting to Salt Lake Metropolis and different markets in that area.

Development Prospects

The vitality midstream business isn’t rising in a short time. However vitality infrastructure corporations comparable to Williams will nonetheless have the ability to generate some development going ahead, by way of a number of measures.

First, Williams can create money circulate development by investing in new belongings. Constructing out new main pipelines isn’t simple on account of robust laws, however the firm is increasing its pure fuel gathering and processing footprint, the place laws aren’t as difficult and the place approval processes aren’t as time-consuming, relative to (interstate) pipelines.

Williams continues to put money into new gathering services within the Haynesville shale play, for instance, which is situated in Texas and Louisiana. All through 2023, Williams’ gathering capability within the space will develop by round 20%, relative to 2022, which ought to end in a significant income uptick this 12 months.

Different funding areas embody the Marcellus play within the Appalachia area and a few deepwater growth tasks within the Gulf of Mexico the place Williams is working for main vitality corporations comparable to Chevron.

Williams can also be investing in adjoining companies comparable to CO2 capturing and pure fuel storage services. Through these development investments and common tuck-in acquisitions such because the aforementioned MountainWest takeover, Williams ought to have the ability to generate a stable mid-single digits revenue and money flow-per-share development price going ahead, we imagine.

Aggressive Benefits

Vitality midstream corporations with present asset footprints profit from the very harsh regulatory setting at present. Getting approvals for brand spanking new pipelines is a extremely difficult and really time-consuming process, which makes these endeavors dangerous. New main pipeline tasks which can be corresponding to Williams’ Transco Pipeline, for instance, are thus probably not pursued any longer these days. That makes present pipelines very worthwhile and laborious (and even unimaginable) to switch. There’s thus little or no disruption threat for Williams’ pipeline phase.

The gathering and processing enterprise isn’t fairly as insulated by regulation, however on account of Williams’ established enterprise relationships with prospects and on account of Williams’ dimension and scale, it’s in an advantaged place versus smaller and newer gamers nonetheless. General, enterprise disruption dangers are thus small.

Dividend Evaluation

The Williams Firms elevated its dividend for the final 5 years in a row, after reducing the payout in 2016, when a spread of vitality midstream corporations did in order they moved in direction of a self-funded mannequin.

Williams is presently paying out $1.70 per share, which implies that its shares provide a dividend yield of 5.2% at present costs. That’s not among the many highest dividend yields within the vitality midstream area, however this nonetheless represents a excessive dividend yield in absolute phrases.

On prime of that, Williams has delivered compelling dividend development in recent times. Between 2017 and 2022, Williams elevated its payout by 42%, which equates to an annual dividend development price of slightly greater than 7%. Together with a dividend yield of greater than 5%, that’s engaging.

Ultimately, dividend development ought to decelerate to the mid-single digits to be extra consistent with our estimate for Williams’ future earnings and money circulate development. However even that might nonetheless be removed from dangerous, as a 5.2%-yielding dividend that grows by 4% to five% per 12 months is engaging for dividend development buyers.

On the present degree, the dividend is well-covered by Williams’ money flows. The money circulate payout ratio, based mostly on the anticipated money flow-per-share of $3.95 for 2022 (This autumn outcomes haven’t but been launched), is fairly low, at 43%. Williams might thus proceed to develop its dividend at a price that’s larger than its enterprise development for some time.

On prime of that, Williams’ dividend seems sufficiently protected for the foreseeable future, based mostly on the not-at-all elevated money circulate payout ratio.

Last Ideas

The Williams Firms is likely one of the largest pure gas-focused vitality infrastructure gamers in the USA. It owns some massive and kind of irreplaceable pipelines and a steadily rising pure fuel gathering and processing enterprise on prime of that.

Due to a mix of hedges and fee-based contracts, Williams’ outcomes are resilient versus macro shocks, and the corporate was in a position to develop its dividend in the course of the pandemic years, regardless of weak vitality markets. The dividend yield is compelling, at slightly greater than 5%, and future dividend development could be anticipated.

Alternatively, Williams has seen its shares climb meaningfully over the past 12 months, in contrast to another midstream names, which is why its shares have grow to be dearer. At round 11x 2022’s money flows, Williams shouldn’t be actually costly, however not a discount, both.

In case you are enthusiastic about discovering extra high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases shall be helpful:

The most important home inventory market indices are one other stable useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them repeatedly:

[ad_2]

Source link