[ad_1]

Revealed on January eighth, 2023 by Josh Arnold

Utility shares are typically nice sources of dividends for shareholders. Their predictable income and margins usually produce secure earnings over time, regardless of financial situations, and capital expenditure wants are sometimes met a number of occasions over by earnings. That leaves ample room for top dividend yields, and one such inventory that meets these standards is lesser-known cell phone service supplier Phone & Knowledge Techniques (TDS).

TDS has boosted its dividend for a staggering 48 consecutive years, placing it in elite firm on the measure of dividend longevity. As well as, the inventory is down greater than 40% prior to now yr, so its present dividend yield is healthier than 6%. Meaning TDS is on our listing of high-yield shares.

This listing comprises about 200 shares with yields of not less than 5%, that means that all of them yield not less than thrice that of the S&P 500.

You’ll be able to obtain your free full listing of all securities with 5%+ yields (together with vital monetary metrics similar to dividend yield and payout ratio) by clicking on the hyperlink under:

Under, we’ll check out one of many smaller wi-fi and broadband suppliers, together with its development prospects and dividend outlook.

Enterprise Overview

TDS is a telecommunications firm that’s based mostly and operates within the US. It operates two segments: UScellular and TDS Telecom. The corporate presents all kinds of wi-fi options to customers, companies, and authorities purchasers, together with software program, automation, communication, fleet administration, non-public networks, wi-fi providers, {hardware}, and extra. The corporate has about 5 million wi-fi retail connections by means of its UScellular enterprise, and about 1.2 million wireline and cable connections.

TDS was based in 1968, generates about $5.5 billion in yearly income, and trades with a market cap of $1.3 billion. For comparability, each AT&T (T) and Verizon (VZ), which operates comparable companies, each commerce with market caps of not less than $140 billion, so TDS is sort of small.

TDS posted third quarter earnings on November third, and outcomes had been very weak. Earnings-per-share missed estimates badly, coming in at a lack of 15 cents in opposition to expectations of a revenue of a nickel. Income was up virtually 7% year-over-year to $1.08 billion, however missed estimates by $270 million.

Whole working bills weighed on profitability, rising 5% year-over-year to $1.392 billion. Earnings fell from a revenue of $28 million a yr in the past to a lack of $25 million as bills exceeded income.

Increased postpaid common income per person at UScellular drove service income development as prospects traded as much as higher-priced plans. Postpaid common income per person was up 4% to only over $50. Whole broadband connections had been up 4% to 506,500, and residential income per connection grew 4.5% to only over $60. The corporate is investing in fiber infrastructure to assist develop the broadband enterprise within the years to come back.

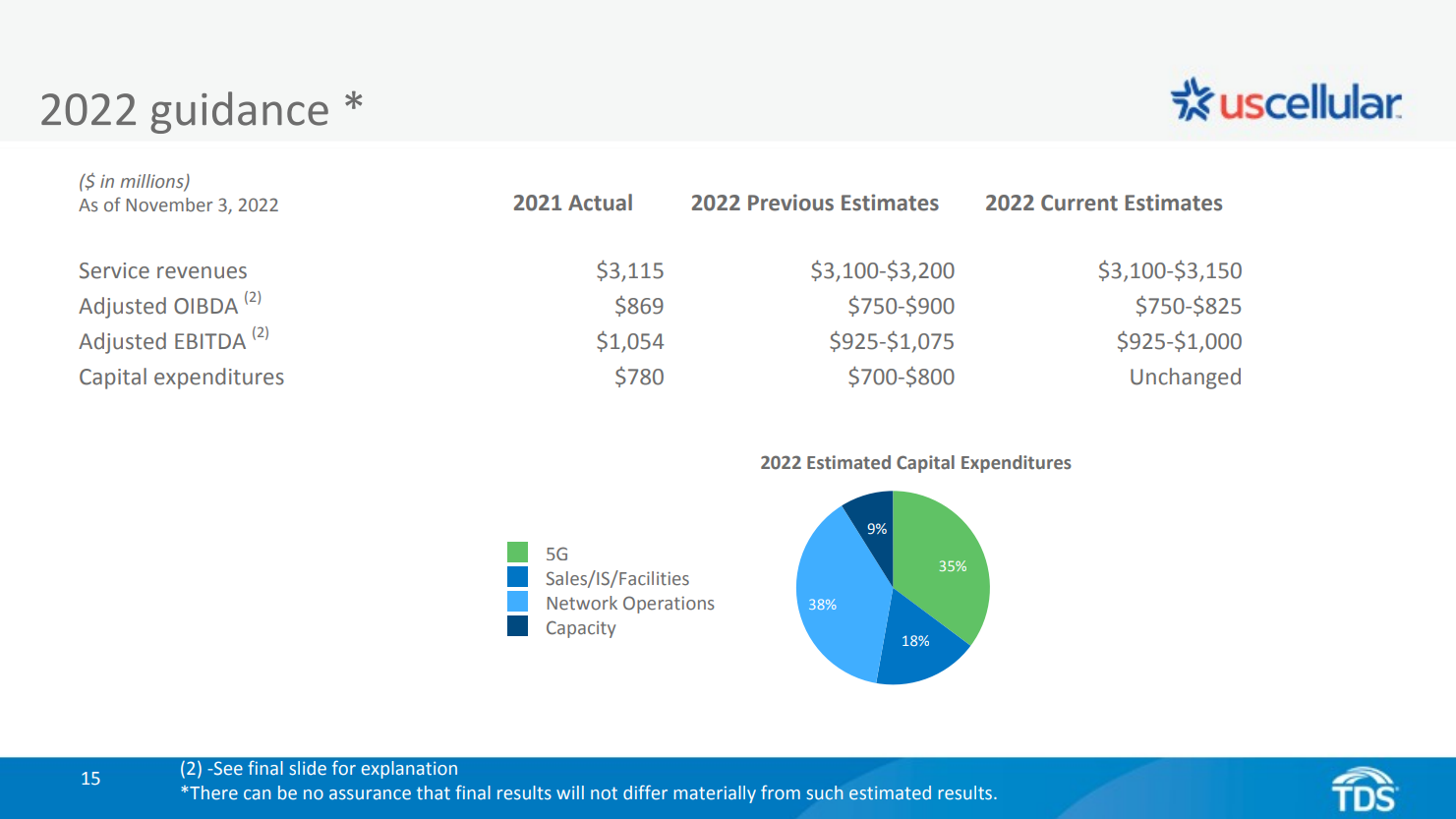

Supply: Investor presentation, web page 15

The corporate lowered steerage for the complete yr, with service income estimates being narrowed to a barely decrease midpoint of $3.125 billion, and adjusted earnings coming down extra sharply because of deleveraging of the highest line. Capital expenditures are actually anticipated to be practically the entire firm’s adjusted EBITDA for 2022. Following a weak third quarter report, we count on earnings to be simply three cents per share for fiscal 2022.

Progress Prospects

TDS operates a really low-growth enterprise, as it’s a very small participant in a extremely aggressive trade that’s dominated by Verizon and AT&T. That has led to repeated years of adverse earnings development, similar to 2022, and we predict the corporate will battle to develop within the years to come back at simply 0.5% yearly. TDS’ technique is extremely dependent upon the UScellular enterprise, and to its credit score, the variety of customers and the common income per person are regularly drifting greater.

Nevertheless, hovering working bills are taking a few of that benefit away over time, as we noticed with Q3 2022 outcomes. Along with that, the corporate is making an attempt to construct out its choices in broadband service by means of its fiber infrastructure, which helps ship quicker and extra dependable web to residences in its service space.

Supply: Investor presentation, web page 11

We are able to see that working income has been roughly flat for a while, and we count on it should stay as such for the foreseeable future. The corporate’s retail service income is probably the most worthwhile, so whereas the highest line can present development, buyers should keep watch over the place it’s coming from.

Gear gross sales, as an example, can see peaks round new product launches, however that income is lower-margin and tends to be extra unstable than service income. Whereas TDS is making an attempt to take a position for development, we imagine the corporate is going through an uphill battle relating to rising earnings within the years to come back.

Aggressive Benefits

TDS’ aggressive benefit, if it has one, is that it has a captive viewers of types in its service areas. Broadband operators are likely to have service areas analogous to energy utilities in that selection for customers is often restricted. That may assist shield TDS’ internet-based income over time, however we see much less of a price proposition for customers on wi-fi income.

Customers have far more selection relating to wi-fi income, and whereas TDS hasn’t confronted a person exodus, development is low and we attribute that to the extraordinary competitors within the wi-fi service area. The very fact is that Verizon and AT&T have scale benefits that TDS doesn’t, and we predict that its aggressive place is probably in danger in consequence.

To its credit score, TDS has weathered recession after recession prior to now 5 many years, elevating its dividend by means of all of them. Thus, even when we get a recession in 2023, we don’t assume that alone would put the dividend in danger as the corporate’s income and earnings aren’t essentially beholden to financial situations. Slightly, TDS is extra inclined to different components, as mentioned above.

Dividend Evaluation

TDS’ dividend streak is excellent by any measure, however we imagine that the dividend is below extra menace of being reduce than it has been at maybe every other time prior to now 48 years. The corporate is slated to provide primarily no earnings for 2022, which implies the whole lot of the 72 cents per share in frequent share dividends should be paid from sources aside from earnings. That’s a totally unsustainable scenario, though we do see earnings rebounding in 5 years’ time to 95 cents per share yearly.

We additionally see the dividend round 83 cents per share in 5 years, so it should stay tight by way of the payout ratio for TDS. In different phrases, we aren’t essentially certain TDS will have the ability to proceed its dividend enhance streak indefinitely given its weak earnings scenario.

Remaining Ideas

Whereas we like TDS’ spectacular streak of dividend will increase, in addition to its ample 6.1% present yield, we’ve considerations about its capability to proceed to pay the dividend, not to mention elevate it, within the years to come back. The corporate will want a pointy rebound in earnings to make that occur, and we’re cautious in consequence.

The inventory is down over 40% prior to now yr, and the yield is extraordinarily excessive in consequence, however TDS is just too speculative in the mean time, in our view, to warrant it as a sensible choice for these searching for dividend security.

In case you are interested by discovering high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases might be helpful:

The key home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them commonly:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link