Printed on March 27, 2022, by Felix Martinez

Prudential Monetary Inc. (PRU) is a excessive dividend yield firm. The corporate is a dividend contender, a U.S. inventory that has grown its dividends for 10-24 consecutive years. On this case, Prudential has raised its dividend for fourteen straight years.

We additionally cowl lots of different totally different high-yield shares in our database.

We have now created a spreadsheet of shares (and intently associated REITs and MLPs, and so forth.) with dividend yields of 5% or extra…

You possibly can obtain your free full listing of all securities with 5%+ yields (together with essential monetary metrics comparable to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Thus, we’ll assessment Prudential Monetary Inc. (PRU) for the next high-yield shares on this sequence, with a dividend yield of 4.0%.

Enterprise Overview

Prudential Monetary Inc. has operations in the US, Asia, Europe, and Latin America. The corporate gives clients with numerous services, together with life insurance coverage, annuities, retirement-related companies, mutual funds, and funding administration. Prudential Monetary has now been in enterprise for over 140 years with $1.7 trillion in belongings beneath administration (AUM).

Prudential operates in 4 divisions: PGIM (previously Prudential Funding Administration), U.S. Companies, Worldwide Companies, and Company & Different. The corporate trades with a $45.4 billion market capitalization.

Supply: Investor Presentation

On February 3, 2022, the corporate reported fourth-quarter and full-year outcomes for Fiscal 12 months (FY)2021. The corporate had robust monetary outcomes for the expansion quarter and full 12 months. On this interval, the corporate made important progress in changing into the next development, much less market delicate, and extra agile firm.

For the quarter, Prudential reported a internet earnings of $1.208 billion or $3.13 per share in comparison with $819 million or $2.03 per share in 4Q2020. This is a rise of 54.2% year-over-year. After-tax working earnings equaled $1.227 billion or $3.18 per share in comparison with $1.13 billion or $2.80 per share in 4Q2020, or a rise of 13.6%. On a guide worth per frequent share, the corporate reported $161.26 versus $167.81 per share for the 12 months in the past. AUM grew barely for the quarter by 1.2% in comparison with 4Q2020.

The corporate reported a complete working earnings of $7.3 billion for all the 12 months in comparison with the $4.95 billion the corporate made in FY2020. This is a rise of 47.5% 12 months over 12 months. The PGIM section noticed development of 30.2%, whereas the U.S. companies section noticed development of 43.4%.

For the 12 months, Prudential generated a internet earnings of $7.724 billion or $19.51 per share in comparison with a lack of $374 million

or a lack of $1.00 per share in 2020. Nonetheless, 2020 included important funding losses. Adjusted after-tax working earnings

equaled $5.772 billion or $14.58 per share in comparison with $3.913 billion or $9.72 per share for 2020.

The corporate additionally entered into agreements to divest decrease development and extra market-sensitive companies all through final 12 months. The divestments will assist the corporate carry out significantly better for the subsequent recession.

General, the corporate earned $14.58 per share for all the 12 months, which is a rise of 43% in comparison with FY2021. We anticipate the corporate to earn $12.50 per share for FY2021. It will denote a lower of 14.3%. This will likely be largely pushed by the slowdown of the market.

Progress Prospects

Prudential development prospects will come from programmatic acquisitions and investments in asset administration and rising markets. For instance, the corporate acquired Montana Capital Companions, Inexperienced Harvest Asset Administration, and ICEA LION Holdings. Whereas these are glorious acquisitions, Prudential can be divesting closely market-sensitive belongings. These divestments will assist stabilize the corporate through the subsequent recession. Thus, making the dividend safer.

One other development driver for the corporate could be outdoors the U.S. As you’ll be able to see beneath, AUM from European purchasers grew 13% CAGR during the last 5 years. Chian can be a major alternative for the corporate.

Supply: Investor Presentation

Aggressive Benefits & Recession Efficiency

Prudential Monetary doesn’t essentially have aggressive benefits. Life insurers don’t profit from favorable aggressive positions. The trade competitors is fierce, and the merchandise are commoditized in lots of circumstances. Moreover, insurers have no idea the price of items bought for a number of years, permitting them to underprice insurance policies with out understanding it.

In the course of the Nice Recession, the corporate took onerous earnings hit in 2008, with an earnings decline of 65%. The corporate additionally needed to minimize the dividend due to the quick lower in earnings that 12 months. Prudential minimize its dividend from $1.15 per share to $0.58 per share for a discount of 49.6%. Nonetheless, it rebounded very effectively within the following years after 2008.

PRU’s earnings-per-share all through the Nice Recession:

- 2007 earnings-per-share of $7.58

- 2008 earnings-per-share of $2.69 (65% lower)

- 2009 earnings-per-share of $5.58 (107% enhance)

- 2010 earnings-per-share of $6.27 (12% enhance)

As you see, the corporate okay through the 2008-2009 Nice Recession. Each the earnings and dividend took excessive reductions in 2008 however got here to their earlier ranges in nearly three years.

Dividend Evaluation

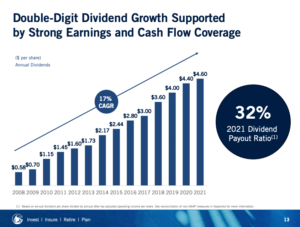

As talked about above, the corporate has a dividend development historical past of fourteen consecutive years. The one purpose why it’s not longer than fourteen years is due to the Nice Recessions in 2008. Apart from that, the corporate has a ten-year dividend development fee of 12.2%. Over the previous 5 years, PRU has had a dividend development fee of 10.4%.

The mix of a excessive dividend yield with a excessive dividend development fee makes Prudential Monetary a fascinating funding for dividend and income-driven traders. The newest dividend enhance was on February 3, 2022, when Prudential declared a $1.20 quarterly dividend, marking a 4.3% enhance.

The corporate additionally pays a excessive dividend which may be very protected. Up to now ten years, the best dividend payout ratio was 43% in 2020. Based mostly on our anticipated incomes of $12.50 per share for FY2021, it will give us a dividend payout ratio of 38%. Thus, the dividend may be very protected and can proceed to develop within the foreseeable future.

Supply: Investor Presentation

The corporate additionally has an excellent stability sheet. The corporate has a 0.3 debt-to-equity ratio, which is superb. Additionally, PRU has an S&P Credit score Ranking of “A.” The “A” credit standing is an investment-grade score.

Thus, the stability sheet is superb and will assist the corporate face up to a recession with out a dividend minimize. Due to this fact, we predict the dividend may be very protected.

Closing Ideas

General, Prudential Monetary has been a strong enterprise through the years with quite a lot of optimistic attributes. The dividend may be very protected and safe. The excessive dividend yield and the excessive dividend development make PRU a gorgeous funding for dividend and income-driven traders.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].